Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on October, 27th 2025.

How did becoming an owner make you save money? What about in 2026 ?

Introduction

“Oooh, you don’t know, Noé, I heard again this morning that becoming a homeowner would save us taxes… Is that really true?”

To answer this question, let me start from the beginning. Back then, my wife Zoé and I lived in an 80m2 apartment in the center of Lausanne. Our rent was 2,200 CHF. The building wasn’t anything special, in fact, it was quite old. But, in the property market, the apartment was worth the modest sum of 800,000 CHF.

Starting from this information, it’s quite simple to determine the yield that our property owner achieves: the annual yield is calculated as (2,200 CHF×12)/800,000 CHF×100=3.3%!

We thought that if we could rent such a valuable property, we must be solvent enough to buy one of the same value. Except we wanted something new. After some research, we found a rare gem at the edge of the city, in the charming commune of Chalet-à-Gobet.

Without hesitation, we gathered the usual paperwork and presented it to our banker. He quickly confirmed that the bank agreed to lend us the necessary amount, with a fixed interest rate of 1.2%.

(A small aside for our loyal readers: as every year, we update our articles to provide you with up-to-date information suited to the changes in the real estate market. Interest rates have fluctuated significantly in recent years: They were extremely low during the COVID period, surged in 2022–2023, then started a significant decline at the end of 2024. In 2025, they continue to decrease and are expected to remain low through the first half of 2026. Today, 10-year rates are once again near their historical lows, around 1%–1.2%.

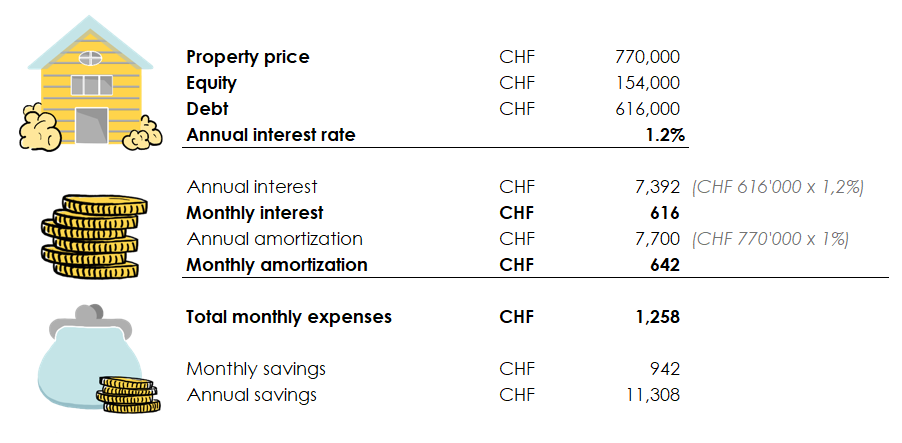

End of this aside, now back to our story: This little gem of an apartment at the foot of a brand-new building cost us 770,000 CHF, including a parking space. Our personal contribution, representing the 20% of own funds required, amounted to 154,000 CHF. The mortgage was 616,000 CHF, divided into two tranches.

The line-up:

Buying your primary residence to save on rent

In this chapter, we will analyze the economic expenses of a tenant and compare them with the costs that an owner would have to pay monthly.

Monthly expenses for a tenant

This point is relatively simple: the rent is usually the only fixed monthly expense for a tenant. In our example, the rent amounts to CHF 2,200 per month, a sum that covers the use of the property but generates no equity for the tenant.

Monthly expenses for an owner

Things become more complex when it comes to an owner. For this first analysis, we will focus solely on the “equivalent rent” for an owner, which mainly consists of interest paid on the mortgage debt and amortization.

In our example:

- The owner borrows CHF 616,000.

- The annual interest rate is 1.2%, which amounts to CHF 7,392 per year, or about CHF 616 per month in interest.

Additionally:

- Amortization: the portion of the capital repayment (usually on the first rank). This amount gradually reduces the debt and increases the owner’s equity in the property.

In summary, an owner pays more complex monthly payments, but these include a forced savings component, unlike a tenant’s rent.

Buying your primary residence to save on taxes

Before concluding that purchasing a primary residence is advantageous, it is essential to consider the tax impacts. In Switzerland, buying real estate brings significant changes to your tax declaration, both in terms of income and wealth.

Tax impacts of purchasing a primary residence on income

In Switzerland, we still have—and will continue to have until 2028—a unique and often debated tax mechanism: the imputed rental value.

Of course, we will take the time to explain it in the lines that follow, but it is important to note that in September 2025, the Swiss voted to abolish this system, along with all related mechanisms. In other words, everything you read here will remain valid for about two more years. After that, the regime will change significantly. But don’t worry: our articles are regularly updated, so you can always come back to see the new rules in effect.

What is the imputed rental value?

The imputed rental value is a notional income added to the taxable income of the owner for each property that is “owner-occupied.”

I admit, the term “owner-occupied” can be confusing: it simply refers to properties that are not rented out and therefore do not generate actual rental income. This includes primary residences, secondary homes, or even properties made available to a relative, such as a child or parent.

This notional income is calculated by the cantonal tax authorities according to rules specific to each canton, and as often in Switzerland, these rules can vary significantly from one canton to another.

In principle, the main factor used to determine the imputed rental value is the size of the property (living area), to which a series of adjustments are added based on location, property condition, or comfort. At FBKConseils, we dislike approximations, but to give you a rough idea, the imputed rental value can be around 3% of the purchase price. In other words, for a property bought for CHF 1,000,000, the imputed rental value could be about CHF 30,000.

However, caution: this figure is highly indicative. In some cantons, such as Valais, the actual value could be around CHF 15,000 only.

If you wish to get a precise estimate according to your situation and canton, don’t hesitate to book a free initial consultation with our firm.

What you should remember so far is that when you become an owner of an owner-occupied property, you must add to your taxable income an amount you do not actually receive.

This notional income, the imputed rental value, therefore mechanically increases your tax burden. In return, and this until 2028, the current system allows for several tax deductions designed to partially offset this taxation.

Possible tax deductions for owners

In return for this fictitious income, several deductions are allowed:

- Property tax (or land tax): A fixed annual tax paid by the owner, which is almost always a percentage (%) of the tax-assessed value of your property (defined a few lines below).

- Maintenance costs: Expenses for maintaining the property can be deducted. If no expenses have been incurred, most cantons allow a flat-rate annual deduction.

- Condominium fees: Expenses related to the maintenance of common areas in a co-owned building are also deductible.

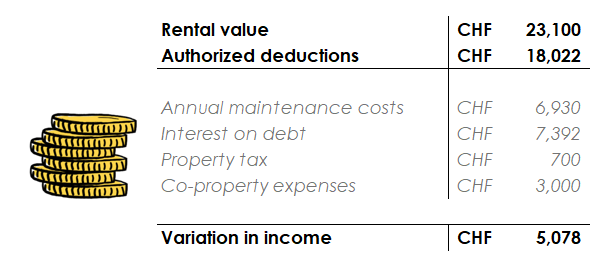

- Mortgage interest: In our example, the 1.2% annual interest on a debt of CHF 616,000 is deductible, or CHF 7’392.

To determine whether buying a primary residence will lower or increase your annual taxes, you need to compare:

- Imputed rental value vs allowable deductions.

Here are the two possible scenarios:

- If the imputed rental value is higher than the deductions, your annual taxes will increase.

- If the imputed rental value is lower than the deductions, your annual taxes will decrease.

It’s that simple! Let’s now explore this concept with concrete numbers.

With the assumptions made, this purchase would increase our taxable income by nearly CHF 5,000 each year, thereby leading to a proportional increase in our taxes.

Example showing the increase in tax burden linked to the purchase of a primary residence

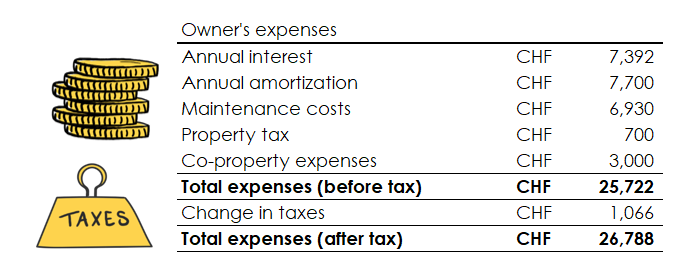

As you know, income tax rates in Switzerland vary significantly depending on your income, ranging from 0% to 42%. This makes it impossible to provide a precise estimate without knowing your situation. However, here is a concrete example:

- Annual income: CHF 90,000.

- Applicable tax rate: 21% (CHF 19,200 in annual taxes).

- Increase in taxable income: CHF 5,000.

- Tax savings: 21% x CHF 5,000 = CHF 1,050.

This purchase will therefore mathematically lead to an annual increase of over CHF 1,000 in taxes.

Before drawing final conclusions, it is essential to examine the impact of this purchase on wealth tax. Once this analysis is completed, we will have a comprehensive view to assess whether this real estate purchase is truly advantageous in all aspects.

Tax impacts of purchasing a primary residence on your wealth

The impact of wealth tax when purchasing real estate is generally much easier to understand than that on income. As a general rule, purchasing real estate leads to a decrease in your taxable wealth, and therefore a reduction in your wealth taxes.

Why does your taxable wealth decrease?

The tax authorities do not use the actual purchase price to assess your property, but a fiscal value, which is often much lower than the price paid.

- Geneva: The fiscal value may be close to the purchase price in the first few years.

- Valais: The fiscal value is generally estimated to be 40% less than the purchase price.

- Vaud: On average, Vaud’s fiscal assessments range between 60% and 75% of the purchase price.

Moreover, since the mortgage debt often represents around 80% of the purchase price, and the fiscal value of the property is usually lower than this proportion, your taxable wealth is automatically reduced.

Let’s take our example: if you buy a property for CHF 770,000 in the canton of Vaud, and the authorities assess its fiscal value at 70% of this price, i.e., CHF 539,000, your situation will be as follows:

- Purchase price: CHF 770,000

- Mortgage: CHF 616,000

- Fiscal value: CHF 539,000

In this case, your net taxable wealth will be CHF 539,000 – CHF 616,000 = CHF –77,000. In other words, you will report negative wealth, which will have the effect of reducing your overall tax burden.

Conclusion on wealth tax

Buying a primary residence almost always lowers your taxable wealth, and by extension, your wealth taxes. However, it is important to note that this tax remains relatively low in Switzerland, except for holders of very large estates.

Tax and budgetary savings of a real estate purchase

We are now at the end of this article. To conclude, let’s summarize the key points for a clear synthesis:

- Tenant: Their only fixed expense is the rent.

- Owner: In addition to the mortgage payments, they benefit from significant tax variations, both on income and wealth.

Here is a concrete example for 2026:

- Property: Primary residence at Chalet-à-Gobet.

- Purchase price: CHF 700,000.

- Monthly expenses for the owner: Mortgage interest (1.2%), amortization, charges, and tax variations.

In conclusion, a real estate purchase represents an investment with favorable tax impacts, notably a reduction in wealth taxes and, potentially, savings on income taxes.

We can see that, in this example, the annual budget for a property owner would amount to CHF 26,788, compared to CHF 26,400 for a tenant (CHF 2,200 x 12 months). This means that, on paper, a property owner in 2025–2026 with a similar situation would face almost the same expenses.

Before moving on to how FBKConseils can support you in your real estate project, it is important to remind you that this article is based on several assumptions. The conclusions drawn here could vary significantly depending on market conditions or your personal situation. If this article is updated next year, the results might be radically different.

The rise in interest rates

The period at the end of 2025 and the beginning of 2026 seems to start on a positive note for borrowers: banks are once again offering rates close to 1% for 10-year loans, making real estate purchases very attractive.

However, if the economic situation were to change and interest rates were to rise, the loss incurred by a property owner could be significantly worsened. Caution is therefore still warranted when evaluating a real estate project.

Flat-rate maintenance costs

In this example, we used a flat-rate equivalent of 30% of the imputed rental value, in accordance with what some tax authorities accept. However, the reality can be quite different:

- New property: Maintenance costs could be much lower.

- Old property: Maintenance costs can increase significantly, or even skyrocket in the case of major renovations.

These fluctuations must be taken into account in your calculations, and it is very important to remember that from 2028 onwards, no maintenance costs will be deductible: no more imputed income (good!) but also no more deductions (not so good!).

Notary fees and transfer taxes

In our example, we assumed that the purchase price included all fees. However, in reality, a real estate transaction in Switzerland involves specific taxes, notably:

- Notary fees and transfer taxes, which vary by canton.

- These costs typically represent 4% to 5% of the property price (can vary greatly depending on the canton).

For a property priced at CHF 700,000, this could reach up to CHF 35,000, an amount that must be included in your calculations.

Other factors to consider

Finally, there are many other elements that can influence the profitability or interest of a real estate purchase:

- Appreciation or depreciation of the property: Your property could gain or lose value over the years.

- Capital gains tax: Payable upon sale, this tax can significantly reduce your profit.

- Mortgage penalties: In the case of early sale, fees may apply if the mortgage contract is not honored.

- And much more.

Conclusion

Every real estate project is unique and depends on many personal and financial factors. Therefore, it is impossible to answer universally the question: Is investing in a primary residence a good idea?

The purpose of this article is to provide you with the maximum information to better understand the issues and simulate the impacts. A thorough analysis of your situation remains the key to making an informed decision.

How can FBKConseils assist with your real estate project?

An initial introduction meeting

At FBKConseils, we always offer a free initial meeting in 2026. In twenty minutes, we take the time to discover your project, understand your needs, and answer your main questions. Book your slot now, either via video conference or in our Lausanne office.

A consultation meeting

Sometimes, twenty minutes isn’t enough to cover everything. At FBKConseils, we offer longer meetings to explore your real estate project in detail, conduct thorough research, and provide you with precise simulations.

Fiscal and budget simulations

Don’t have time for calculations? FBKConseils handles your fiscal and budget simulations. We provide you with a comprehensive, detailed analysis to help you negotiate and finalize your project with peace of mind.

Administrative procedures

A real estate purchase doesn’t stop at calculations. At FBKConseils, we support you through all the administrative steps, from project analysis to final signing and organizing your move.