Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 10th 2024.

What are the arguments for investing in real estate?

Investing in real estate, what does that even mean? This definition is easier than then other two: it simply means accessing property.

It involves two sources of income:

- Rents. If you rent the place out, it is the money you make each month from it. If you live in the property, you are making serious savings in comparison to a rental of the same standing.

- The rise of the sales price.

Plus, investing in real estate is also fiscally attractive.

A good real estate investment, which must combine an advantageous purchase price and a desirable geographical situation, can provide you a return of 10% to 20%.

The line-up:

How does a real estate investment work?

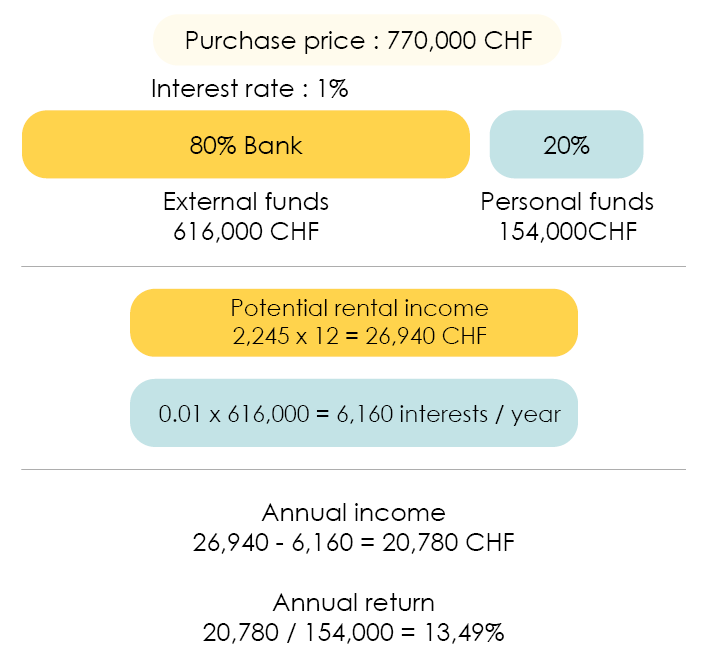

I will give you a quick example. I find a real gem in the heights of Lausanne: an apartment valued at 770,000 CHF.

After a thorough study of the rental prices in the region and the purchase price per m2, I tell myself I can rent out this property for 2,245 CHF per month. I get in touch with the team at FBK Conseils and ask them to find me the best mortgage.

Bingo! My advisor gets me a mortgage loan at 1% on 616,000 CHF (since I need 154,000 CHF, which represents 20% of the total value, of personal funds, the legal minimum).

I would thus potentially have a rental income of 26,940 CHF per year, minus the 6,160 CHF interest rates.

In comparison with the 154,000 CHF invested, it represents a 13.5% return (before taxes), which is really not bad.

There are some easily calculable indicators to get an idea of the quality of a real estate investment.

- The GROSS return: (rents collected / price of the property)

A GROSS return will give you, depending on the region, the correspondence between the rents to collect and the price of the property. In bigger cities (Geneva, Lausanne, etc…) you can expect the gross return to range from 3.8% and 4.3% for the project to be viable. However, the further away the town or village is from the urban centres, the higher the GROSS return must be to make up for the risk of not being able to rent out the property. These returns can be more than 5.5% in the most remote locations.

- The NET return of the investor: Rent collected – administrative fees – management costs – mortgage loan – taxes/ personal funds invested.

The value of some buildings or apartments, because of either their age, construction or location might be very expensive to maintain and cost you a pretty penny each year.

It is crucial that you have a precise overview of the expenses that your real estate purchase will generate before taking the plunge!

Buying a real estate property through a company or in your own name?

Very good question! It is important to think about this BEFORE purchasing a real estate property because your decision will greatly impact your fiscal situation and, therefore, the returns of your property.

But let’s have a look at both options in more detail together:

Buying a real estate property through a company

Everyone that goes down this road for their real estate projects either go through:

- A public limited company (Ltd.)

- A real estate company (SI)

- A limited liability company (LLC)

Each one of these companies have advantages and disadvantages but unfortunately, it would be too lengthy to go into all this detail.

But why would you do it anyway?

It is actually really simple, a company will become a legal entity, a different person from you who has income, expenses and, a fortiori, your own taxes. This model allows a people not to add to their own income that of their real estate property and therefore, helps keep the marginal tax rate reasonable. Plus, companies do not have the same taxation rates nor fiscal rules as individuals: they have the advantage of having a much more interesting tax scale and even sometimes a fixed one.

On the other hand, there are also big disadvantages. If you want to benefit from your money, you will have to either:

- Pay yourself a salary.

- Pay yourself dividends (given that you are a shareholder in your company).

Each solution comes with its own set of problems. Salaries will fully be subject to taxes and social contributions AVS / OASI, IV, APG, etc.), which represents a huge amount. And dividends are not tax deductible for the company plus, they are taxed to the individual.

Other problems car surface when selling a property. You are no longer selling a property but shares of a company.

Buying a real estate property in one’s own name?

Phewwww, you can take a deep breath, the hardest part is over. Now, let’s have a look at how to purchase a property in your name?

This is a lot simpler and does not require the creation of a company, which will allow you to say goodbye to the associated additional costs! All you will have to do is have the necessary personal funds as well as a bank’s approval.

Even though this possibility is easier than the previous one, if your other sources of income are important a big part of your rental income will be taken away in taxes. You would thus be losing return on your real estate investment.