Written by Yanis Kharchafi

Written by Yanis KharchafiReal estate: How much can I borrow in 2026 to purchase my permanent residence in Switzerland?

Introduction

Buy or rent?

Let’s be honest: it’s a question that comes up all the time — during lunch breaks, at after-work drinks, at Christmas dinner… and for some of you, it even keeps you up at night.

But how do you actually know what the right choice is?

I get it — and to answer that, you first need to ask yourself a few real questions:

- Is it financially more advantageous to become a homeowner?

- How much equity do I need to finance a property purchase?

- What will be the tax impact if I switch from renting to owning?

But before all that, you need to determine one essential point: how much is the bank actually willing to lend you?

In other words: what is the maximum debt your income allows you to take on?

In this article, we’ll focus exclusively on primary residences located in Switzerland.

We’ll voluntarily leave aside secondary homes or rental properties, because the rules can be very different for those.

And let’s set the stage clearly right from the start: in Switzerland, banks don’t look only at your gross income — they mainly look at the theoretical annual cost of the property you want to buy.

This cost is made up of three key components:

- Mortgage interest: the cost of the money you borrow from the bank.

- Amortization: the mandatory repayment of the second mortgage tier over 15 years or until retirement age.

- Maintenance costs for the property (calculated as a fixed percentage).

Once these three elements are added together, you get the theoretical annual cost of your purchase — and therefore, by extension, the maximum amount you’ll be able to finance.

If you’re ready, let’s dive right in — as always — with clear and concrete examples!

The line-up:

Part 1 : Calculation of the mortgage burden

Banks like to play it safe. That’s why they don’t use the actual market interest rate (which is between 1.2% and 2% at the end of 2025 / beginning of 2026). Instead, they apply a technical, fictitious rate that usually ranges between 4% and 5%, depending on the financial institution.

Why do they choose rates that are so much higher than reality?

It’s simple: they want to make sure that if the real estate market ever goes south and interest rates skyrocket, you’d still be financially capable of handling your mortgage.

To sum up this first part:

Take the amount you want to borrow (between 0% and 80% of the purchase price) and multiply that amount by 5%, which is this famous theoretical rate.

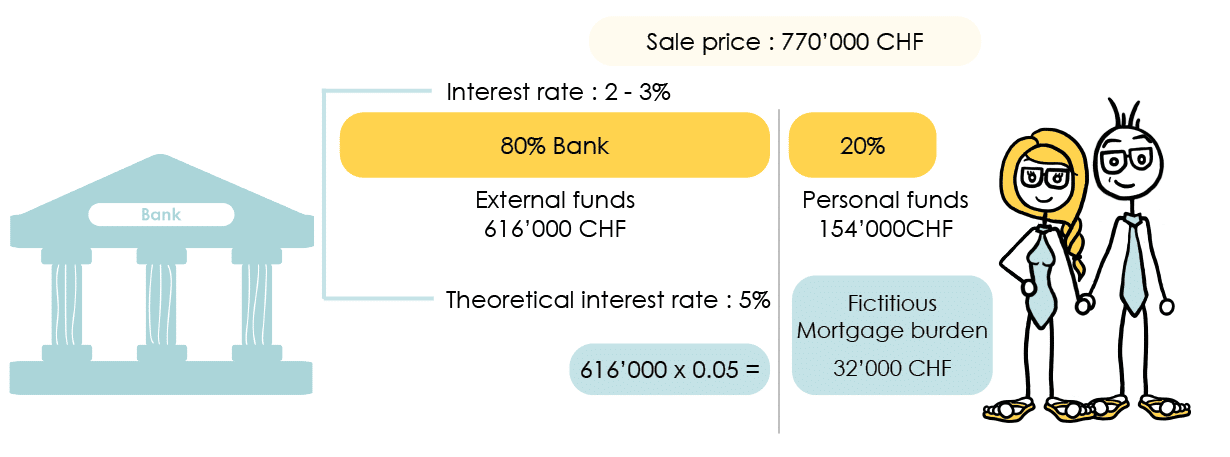

Example of fictitious interest charges

If my apartment is worth 770,000 CHF and that we subtract the personal funds (20%, 154,000 CHF), the bank should loan me 616,000 CHF (80%).

And let’s take a fairly strict bank that will base its rate on 5%. With a mortgage debt of 616,000 CHF at a 5% interest, it gives us 32,000 CHF per year.

Write this number down, put it aside and let’s move on to the costs related to the amortisation.

Part 2 : Calculation of the amortisation

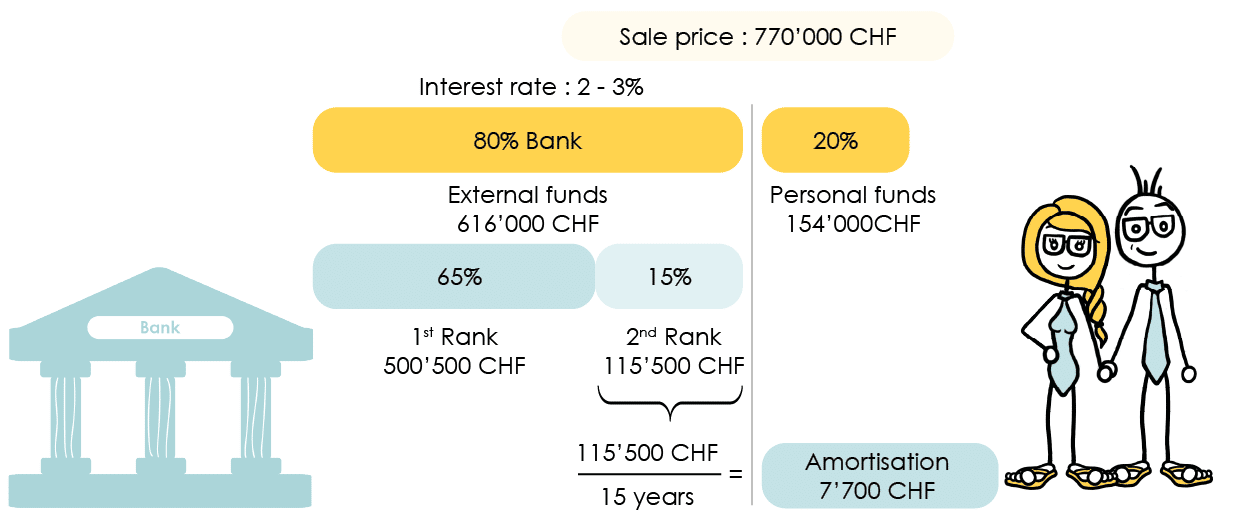

The mortgage loan is, in most cases, divided in two ranks. The first represents 65% of the total value of the property. The second, 15%.

The second rank (so 15% of the real estate price) must be reimbursed in 15 years or up until the day you retire, this is called the amortisation. it can be either direct or indirect.

When calculating solvency, the value of the 2nd rank is simply :

- divided by 15 years if you are younger than 50 years old

- divided by the amount of years you have left until you retire, if you’re older than 50 years old.

In our example, the sale price is CHF 770,000 and 15% of this amount gives us CHF 115,500. This CHF 115,500 represents the part to be amortised. If, in our example, we have 35 years, then we will have to amortise this sum over 15 years, i.e. 115,500 / 15 = CHF 7,700 / year.

So, for the moment, we have CHF 32,000 in theoretical interest costs (part 1) + CHF 7,700 in depreciation costs (part 2). Put these two figures to one side, stay focused, it’s nearly over.

All we have left to calculate in order to determine the total costs that the bank considers for your future purchase, is the maintenance costs.

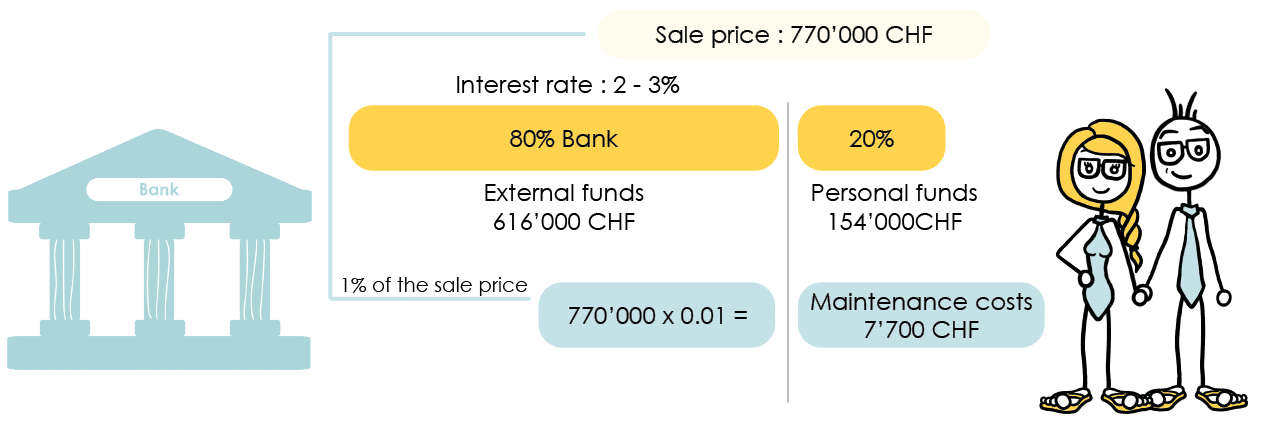

Part 3 : Calculation of your home maintenance costs

The maintenance costs quickly accumulate and end up weighing in the final amount. Generally, we (or should I say, the banks) consider that they yearly amount to 1% of the total price of the property.

1% of 770’000 CHF, is 7’700 CHF.

Phew… Now, all we have left to do is finding out the price of the property the bank will accept to finance thanks to our income.

Part 4 : Determine the salary needed to buy your principal residence

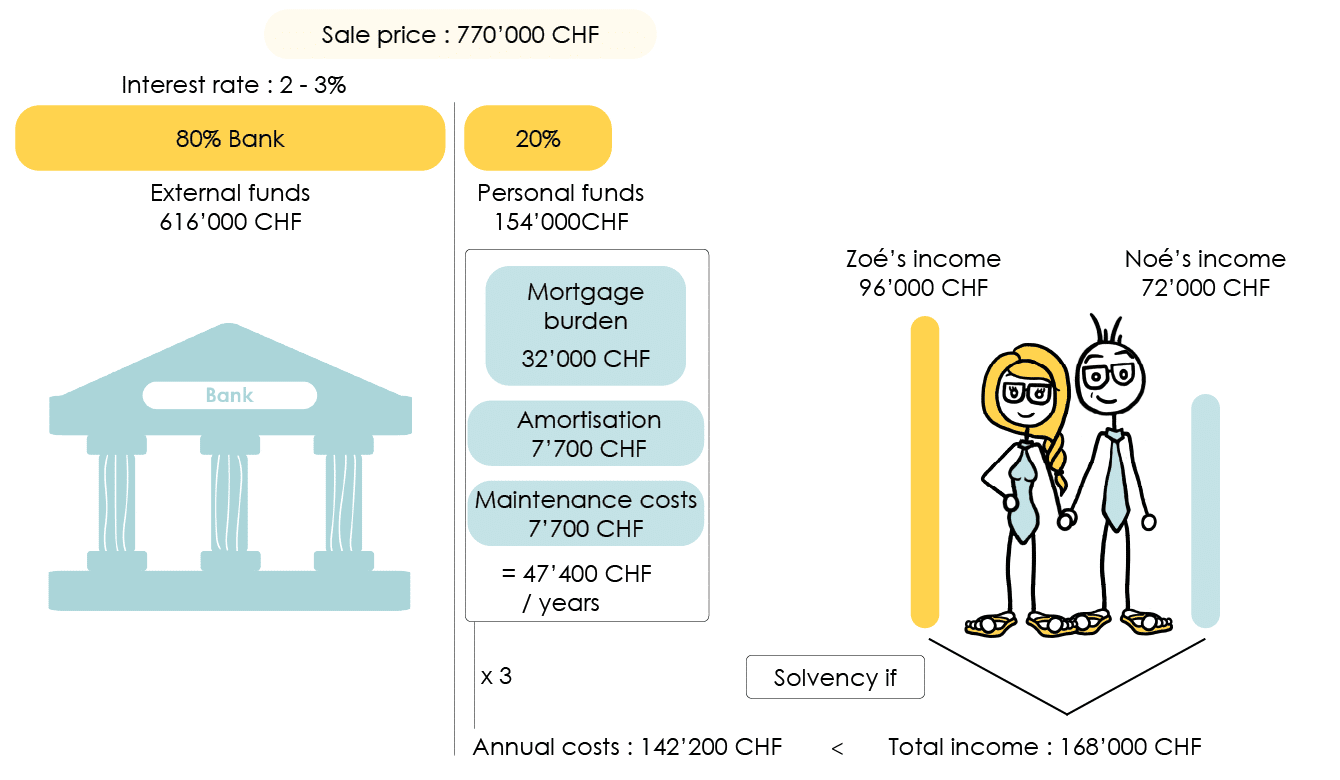

To sum up: we have, per year:

· Mortgage burden 32’000 CHF

· Amortisation 7’700CHF

· Maintenance costs 7’700 CHF

When we add everything up, it gives us a total of 47’400 CHF.

The rule is simple: take this figure, multiply it by 3 and you’ll get the minimum income needed to buy the property.

47’400 x 3 = 142’200 CHF per year.

We therefore have to make 142’200 CHF per year for banks to agree to loan us the 616’000 CHF we need to buy our property.

Since I make 72’000 CHF per year, I was very far from the mark! My wife Zoé, makes 96’000 CHF for a year.

Even though her monthly salary is above national average, she also would not have been able to take out a loan on her own.

But together, we make 168’000 CHF per year, which is plenty enough to reassure our banker!

In short, once the personal funds are gathered and the solvency test is passed, all you have left to do is to put your file together in order to present it to different institutions and find the best rate with the best terms.

Be careful: in our example, our favourite couple does not have any debts or existing expenses. Every expense such as leasing, consumer credit, etc… will be taken into account in the calculation of your income and will thus drastically decrease your purchasing ability, even if she managed to find a very good mortgage rate!

How can FBKConseils help you with your real estate project?

Knowing how much money you have available to purchase a primary residence is often the easy part. However, precisely calculating the maximum debt a bank would be willing to grant you can be far more challenging.

At FBKConseils, we guide you through every step with tailored services:

Introductory meeting

The first step is a complimentary introductory meeting, offered by FBKConseils, to address your main questions and clear any lingering doubts. This session will give you a clearer understanding of your project.

In-Depth advisory meeting

If the 20 minutes of the introductory meeting aren’t enough, we also provide a comprehensive advisory session. During this meeting, we perform the necessary calculations and simulations, giving you a complete understanding of your borrowing capacity and the financial impact of your real estate purchase.