Written by Yanis Kharchafi

Written by Yanis KharchafiIn case of death, what will happen to my second pillar (LPP)?

The line-up:

Introduction

Let’s not sugarcoat it—writing an article about death, even in a field we deeply care about, is never a pleasant task, neither for the writer nor the reader. Unfortunately, it’s a reality that everyone may face, and its financial consequences can be significant.

In this series of articles dedicated to retirement and, more specifically, the 2nd pillar, we will examine the impacts of such circumstances on the insured person and their loved ones from the perspective of occupational benefits.

Occupational pension plan: What can I expect from the 2nd pillar in case of death while being affiliated with a pension fund?

Have you ever ask yourself : “What would happen to my second pillar if I died suddenly?”

In this article on death, we will deal only with annuities and lump sums payable to survivors. If you are looking for more information on 2nd pillar cover following disability, we have devoted a special article to this subject.

How much will go to my spouse?

Once the marriage is registered, and without having to do anything, the 2nd pillar will cover you against invalidity, as well as your spouse against the risk of death. If, by some misfortune, you have to leave this world before your soul mate, he or she will continue to receive a monthly pension for life. The question is, how do you calculate the amount?

How much is the widow’s/widower’s pension under the 2nd pillar?

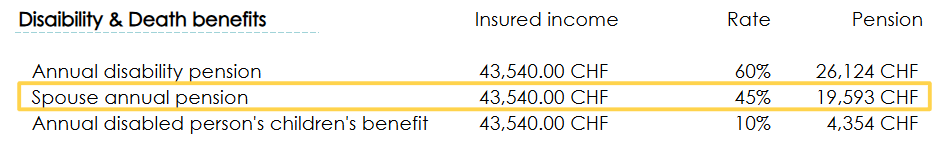

Rather than give you figures that are not accurate, I suggest you take your BVG certificate and look carefully for the widow’s/widower’s pension line.

Depending on your pension fund, pensions and capital can vary greatly.

In addition to pensions, some pension funds may also offer full or partial repayment of vested benefits. In addition to the BVG certificate, take the time to read your pension fund’s regulations.

What will go to my partner if we are not married?

You haven’t taken the plunge yet, or you’ve opted for a life without marriage, but you’re still wondering what will happen to your 2nd pillar pension in the event of your death? The answer is not so simple. The 2nd pillar sets out very specific rules for inheritance. If you have legal heirs, your capital will go to them (your child, for example). No heirs, but you’ve been a couple for some time? Then, depending on the rules of your pension fund, it is highly likely that you will be able to request that all or part of this capital be transferred to your spouse.

A word of advice: if you’re in this situation, make sure you mention your partner’s name to your employer. To do this, simply ask HR for the form and take the time to fill in the details of your partner. A word of warning: in principle, you need to be able to prove that you’ve been living together for a certain length of time (usually 5 years).

What will go to my children?

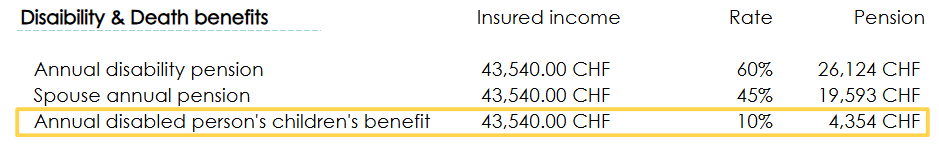

In addition to the AVS, which will pay your children (depending on their age) an orphan’s pension, the 2nd pillar also has this type of pension. They will also depend on the age and status of your children. To find out the precise details of your situation, we advise you to read the internal regulations of your pension fund.

As a general rule, orphans’ pensions are proportional to widows’/widowers’ pensions. You can also find the amounts directly on your BVG certificate.

We can’t stress this enough at FBKConseils: negotiating a gross salary is all well and good, but being aware that the biggest risks in life are also borne by your employer should also be part of your thinking before accepting a job. We advise you to take the time to think about :

- What will my pension/capital be when I retire?

- If I were no longer able to work (disability), what income could I count on?

Occupational pension: What can I expect from the 2nd pillar in case of death if you are no longer affiliated with a pension fund?

Before addressing this question, it’s helpful to clarify what it means to be affiliated with a pension fund. In Switzerland, as soon as you are employed, your employer is required to contribute to your occupational pension, which includes the 1st pillar (AHV/AVS) and the 2nd pillar, via a pension fund.

However, certain situations might lead you to leave your pension fund, such as:

- Divorce;

- Unemployment;

- Leaving Switzerland;

- And other circumstances.

In such cases, your 2nd pillar assets are transferred to a vested benefits institution, where they are held until you are legally entitled to use them. But what happens if, unfortunately, you pass away before accessing these funds?

Without a clear legal framework, this could quickly become chaotic. Fortunately, Swiss law (the Vested Benefits Ordinance) clearly defines the rules for the distribution of these assets. Here is the order of beneficiaries as stipulated by the legislation:

- Spouse and children: They are the first to claim your assets.

- Individuals who were significantly supported by you: This could include a partner or someone responsible for shared children.

- Independent children (over 25 years old), parents, or siblings: They are the last in the order of succession.

How can FBKConseils assist you?

An introductory appointment

At FBKConseils, we offer all our new clients a complimentary 20-minute introductory meeting. The primary goal of this session is to answer your questions and provide you with clear initial guidance tailored to your situation.

A personalized consultation

If the introductory session doesn’t fully address your needs, we offer personalized consultations with flexible durations based on your requirements. These sessions allow for in-depth research and simulations tailored to your case, helping you make well-informed decisions.

Assistance with administrative processes

Advice is valuable, but sometimes it’s not enough. At FBKConseils, we also support you with all the administrative tasks related to your retirement planning, particularly concerning your 2nd pillar. We’re here to simplify your processes and save you time.