Written by Yanis Kharchafi

Written by Yanis KharchafiPension Scheme – How does the 2nd pilar (LPP) work in Switzerland ?

Introduction

While the first pillar is a pension plan administered by the state, the second pillar is an occupational pension (LPP). It complements the first pillar to provide you with a retirement pension that “should” amount to approximately 50-60% of your last salary. At least, that was the original idea when the three-pillar system was introduced. However, as we approach 2025, I can assure you that this goal is, unfortunately, far too often unattainable.

Rather than simply stating that the system isn’t working, I propose a series of articles on the 2nd pillar. These articles aim to help you better understand how it operates and, more importantly, make you aware of what to expect when you reach retirement age.

The line-up:

What is occupational pension provision?

The occupational pension (LPP), or to give its full name Federal Act on Occupational Old Age, Survivors’ and Invalidity Pension Provision, is based on individual savings. Half of it is financed by the employer and the other half is financed by the employee at variable rates depending on the employee’s age.

What about self-employed persons? Lonesome creators? Commercial adventurers?

For them, joining an occupational pension scheme is not mandatory

In fact, we have all heard someone say something similar to “I really have to quit this job. I will withdraw my 2nd pillar and start a business!”. Or something like “in two years, I’m withdrawing all my second pillar and leaving Switzerland”.

What is actually possible and under which conditions?

Before answering this question, quick history moment. Indeed, to make the best use of your LPP, it is important to understand why it exists…

On the day the second pillar was introduced, the sun blazed all day long on the Federal Palace on this radiant day of 25 June. It was the year 1982 and the population was driven by an unprecedented exuberance at the idea that at its retirement age, it would be able to unwind more happily.

Ok, truth is, I am unsure whether it was actually sunny in Bern in that day. To tell you the truth, I’ve never seen Bern on a sunny day.

Thought the LPP was signed in June 1982, it was not until 1 January 1985 that it entered into force.

This second pillar of the Swiss retirement scheme explicitly aims to allow the elderly, but also surviving family members and incapacitated persons, in addition to the OASI, to maintain an appropriate standard of living when carrying out an old age,death or invalidity insurance case.

When do you start contributing to the 2nd pillar?

Unlike AVS, which covers everyone—whether you’re a student, job seeker, self-employed, or an employee—the LPP exclusively ensures salaried employees or, optionally, self-employed individuals who are also registered with the AVS. Contributions are split evenly: half by employees and half by employers.

To simplify, here’s the basic rule: “Employers must contribute at least as much as employees.”

Another key difference with AVS: when a percentage of my salary is taken for AVS, that contribution is not personally earmarked for me. It goes to current retirees, who benefit from the redistribution of my contributions. In contrast, the portion of my salary allocated to the LPP will come back to me at retirement age. Unlike the AVS, this is a capitalization system.

Those who do not pay into the LPP are therefore inactive individuals (retirees, people without gainful employment, students) and certain self-employed individuals who have chosen not to affiliate.

When do you start contributing to the 2nd pillar?

Just like the 1st pillar, the 2nd pillar is divided into two distinct components, each with its own entry age:

Risk contributions (Illness, Accident, and Death)

You contribute to the LPP risk component starting January 1 of the year after you turn 17 if:

- You earn an annual salary exceeding CHF 22,680 in 2025 (CHF 22,050 in 2024), equivalent to CHF 1,890 per month (the Swiss Confederation loves precision!).

- This income comes from the same employer.

Note that at this age (ah, 17—what a great time of life!), you only contribute to cover risks like death and disability.

Savings contributions in the 2nd pillar

You begin saving to build a retirement capital starting January 1 of the year after you turn 24, provided the above two conditions are also met. Otherwise, you’ll start contributing to the 2nd pillar as soon as these conditions are fulfilled.

Important Note: There’s nothing stopping an employer from starting to contribute to your 2nd pillar before the age of 25. While it’s not an obligation, it’s a right.

To delve deeper into the 2nd pillar and enhance your understanding, the following articles might be of interest:

Now that we’ve explored what the 2nd pillar is and when you start contributing, let’s take a quick look at what the 2nd pillar can offer you. With that, I believe this introductory article will be complete!

What can you expect from the 2nd pillar for your retirement?

Let’s take the most common scenario: you reach the age of 64 or 65 (or more accurately, 65 or 65 given the latest referendum changes), having contributed for 40 years. The accumulated capital (which can vary significantly depending on the terms of your pension fund) is charmingly called your “retirement assets.”

Let’s call it a cake—pumpkin-flavored, as it’s meant to be enjoyed in the autumn of your life.

Each month, you’ll savor a slice of your pumpkin cake. However, in most cases, you won’t be able to eat it all at once. Pension funds are there to protect you from a severe case of indigestion. Thank you, pension funds!

That said, under Art. 37 LPP, it is currently legal to withdraw a quarter of your retirement assets (25%) as a lump sum, while the remaining 75% must be taken as an annuity.

Happily, under certain conditions and at the discretion of specific pension funds, this rule may not always apply. Some pension funds allow insured members to withdraw more than a quarter of their retirement assets as a lump sum, and in some cases, even the entirety.

CAUTION: The higher the percentage of the amount withdrawn as a lump sum, the lower the annuities you will receive!

How to calculate your 2nd pillar pension?

Everything starts with your retirement assets: what you contributed to the 2nd pillar during your working life. To determine your annual pension, simply multiply your accumulated capital by the applicable conversion rate.

How to calculate your 2nd pillar pension for the mandatory portion?

Let’s start with the basics. To calculate your pension when you retire, the simplest step is to request your LPP pension certificate. This document provides an overview of all the contributions made during your career, provided you successfully transferred your funds after changing employers. From this, you’ll know the amount of your retirement assets that will be converted into a pension from the first month of your retirement.

In this part of the article, we’ll assume your LPP capital is composed solely of the mandatory portion. To calculate the pension, you simply multiply your capital by the conversion rate.

As of 2025, the conversion rate remains at 6.8%—it could have dropped to 6% under the reform rejected in September 2024. Regardless, your pension will equal your capital multiplied by the conversion rate. No more, no less.

For example:

If you have a capital of CHF 200,000, your lifetime pension will be calculated as:

How to calculate the pension for my 2nd pillar on the non-mandatory portion?

If you:

- Earn more than CHF 90,720 per year (starting in 2025)

- Your employer does not apply or only partially applies the coordination deduction

- You earn interest on your assets that far exceed the legal minimums

- Etc…

Then you fall under the non-mandatory scheme we discussed earlier. The conversion rate is no longer regulated by law. It is set by your pension fund. In other words, each pension fund can decide how much it will pay you based on your capital. Typically, conversion rates are much lower for the non-mandatory portion (6%, 5.5%, or even much lower). This can lead to significant variations in future pensions, even with the same amount of capital.

How to calculate the pension for my 2nd pillar if my capital includes both mandatory and non-mandatory portions?

If you’ve understood the previous two sections, then calculating the pension is quite simple… It’s a mix of both portions. You will need 4 precise numbers, all available on your LPP pension certificate:

- Capital from your mandatory portion (LPP)

- Capital from your non-mandatory portion

- Conversion rate for the mandatory portion: 6.8% (in 2025, may be adjusted downward in the future)

- Conversion rate for the non-mandatory portion

(However, it’s possible that your pension fund may only provide a single “blended” rate for the total capital, combining both mandatory and non-mandatory portions. This rate will at least comply with the legal requirements for the mandatory portion. As for the non-mandatory portion, it’s at their discretion.)

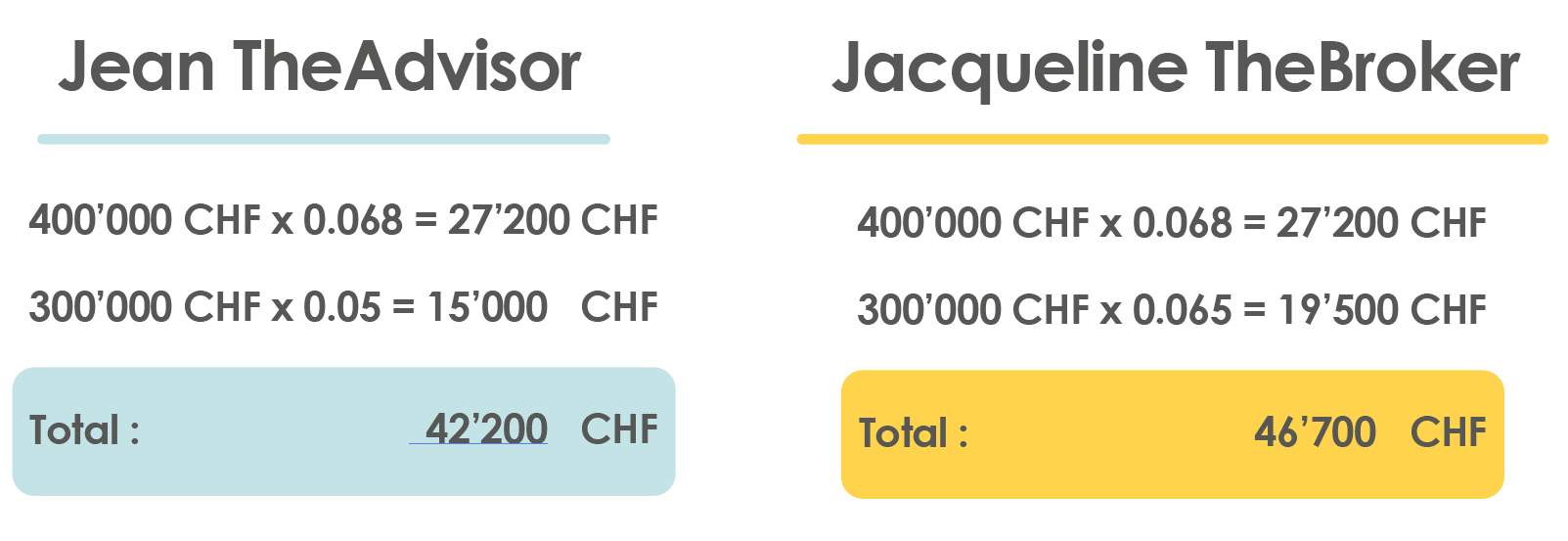

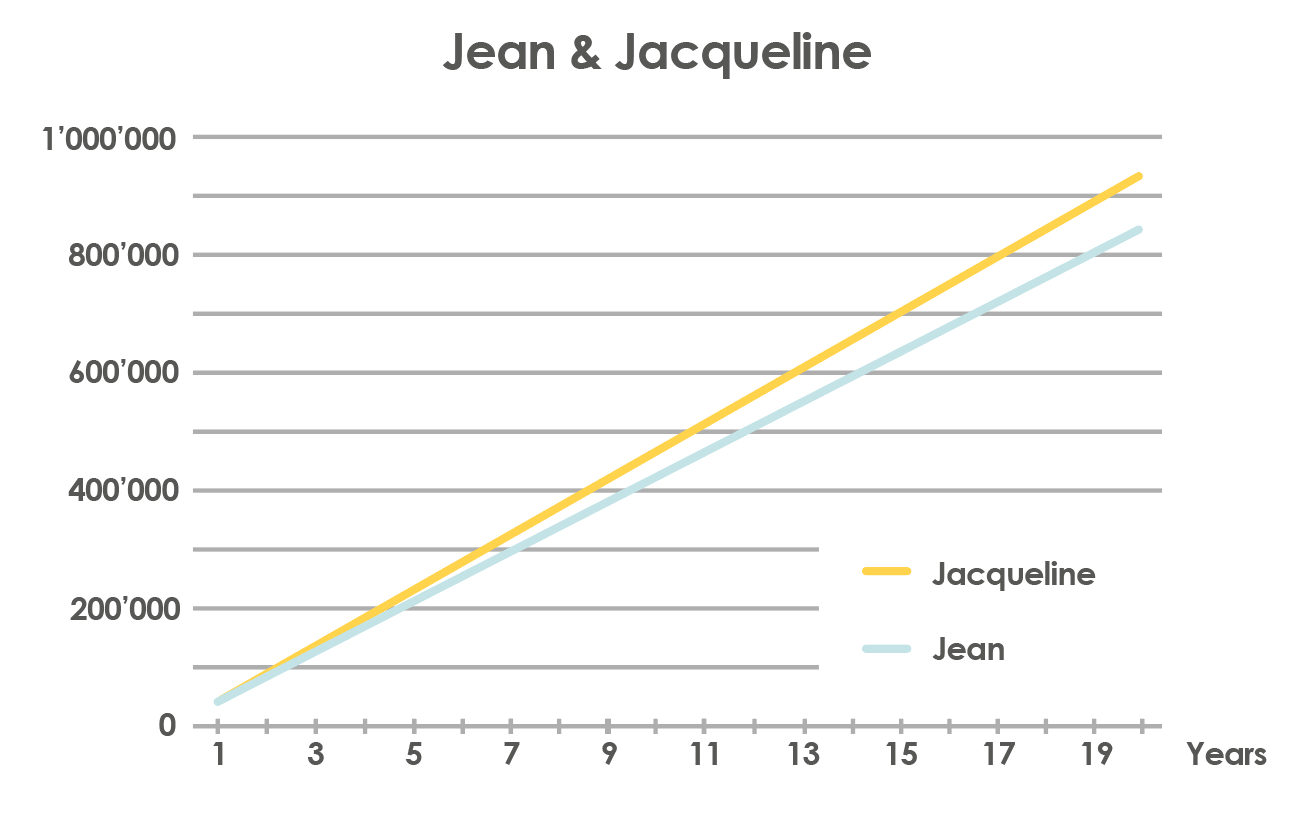

Let’s take an example with my father Jean LeConseiller and my mother Jacqueline LaCourtière, who both had good pension funds throughout their careers and were able to save a modest sum of CHF 700,000 each in their 2nd pillar. When they retired, they were told that out of the CHF 700,000, CHF 400,000 came from the mandatory portion, and the remaining CHF 300,000 was from the non-mandatory portion.

Since they had different employers, they did not have the same conversion rates for their non-mandatory portions. My mother was fortunate enough to have a conversion rate of 6.5%, while my father’s rate was 5%. Here’s what that means:

This represents a difference of CHF 90,000 over 20 years.

Your 2nd pillar pension will make up a significant portion of your retirement income, so it’s important not to overlook these details.

How can FBKConseils help you?

A first free appointment

The 2nd pillar is undoubtedly the most complex part of the Swiss retirement system. It is full of nuances and can take many different forms depending on your employer’s choices and the evolution of your professional career.

At FBKConseils, we offer a first free consultation of 15 to 30 minutes to answer as many of your questions as possible and clarify the essential aspects of your situation.

Retirement Planning

At FBKConseils, we are always by your side to help you plan your retirement optimally. We guide you in analyzing the different options available to you and answer all of your essential questions, such as:

- Pension or Capital? Which option is the most advantageous for your personal situation?

- Tax Impact: What taxes will you need to pay based on your choices?

- Maintaining Your Standard of Living: Will your pension be enough to maintain your current lifestyle?

- Moving Abroad: How can you effectively prepare for retirement if you plan to live abroad?

Trust our expertise to build a retirement strategy tailored to your needs and goals.