Written by Yanis Kharchafi

Written by Yanis KharchafiIn case of disability, what will happen to my second pillar?

The line-up:

Introduction

The occupations insurance exists to support the first pillar in order to meet your needs once you retire but not only. Your pension fund also exists to back you in case life plays tricks on you. If, by misfortune, you are no longer able to work, it will bridge your revenue shortfall.

Should a tragedy occur, you will have to inform the central office of the OASI who will be in charge of confirming the earning incapacity and in particular, its extent. It takes on average two years for the DI (Disability Insurance) to deliver a decision.

There is however a difference if the disability is the result of an illness or of an accident. In both cases, pensions are paid out, amounting to between 50% and 90% of your last salary. However, as we will demonstrate in this rather detailed article, the higher your salary, the greater the potential shortfall.

The second pillar in the event of disability due to an illness

In Switzerland, 80% of work interruptions are due to an illness. The remaining 20% concern work interruptions following an accident, a congenital problem, etc…

The fact that falling ill occurs a lot more frequently than other disability cases makes this coverage very costly to insure. Two important stages take place after an earning incapacity case:

The first two years of incapacity

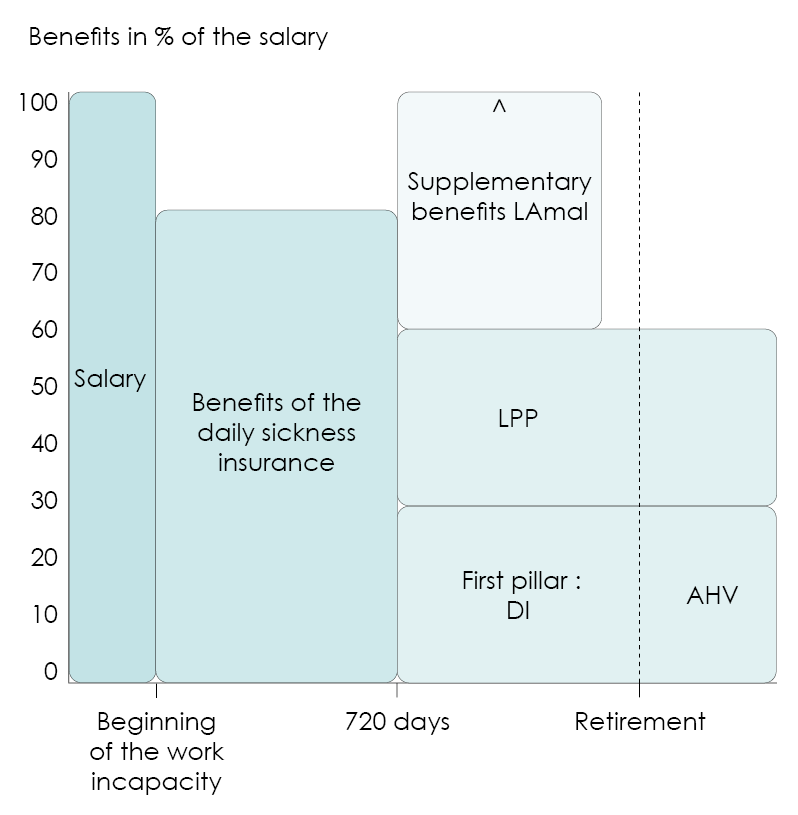

1) From the first day of disability until the decision of the DI (3rd day – 720th day)

during this period, your income will no longer come from your employment but rather from the obligation every employer has towards its employees. This obligation, outlined in the Swiss Code of Obligations under Article 324a, specifies that the salary must continue to be paid for a certain period but does not define the exact duration.

The time limit depends exclusively on your seniority in the company, your employer’s generosity and the canton.

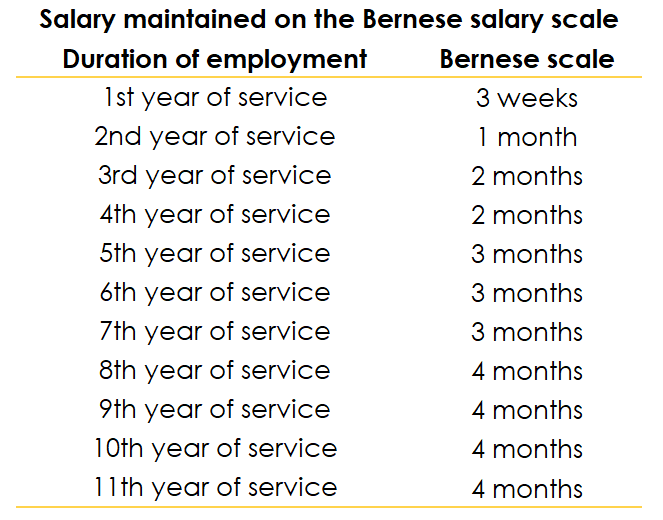

The law (and more specifically the Code of Obligations), requires all employers to cover all their employees in the event of incapacity for work, as long as they have had an employment contract for more than 3 months or have worked for more than 3 months. Since the Swiss Code of Obligations (CO) does not specify a duration, the cantons can choose to follow a table to determine the period. This is what the table looks like.

What you need to understand about this table is that it gives you the minimum that is tolerated by law. If you have worked for a company for 3 years and fall ill, you will be entitled to two months’ salary at 100% and then nothing until the AI has given its verdict.

However, most companies today offer another system that is also accepted by law: offering loss-of-earnings insurance to their employees. The company for which you work will, for a period of 720 days (730 in certain cases), cover your salary not at 100% but at 80%. This cover can be financed up to a maximum of 50% by the employee and 50% by the employer.

Even if 80% isn’t as good as 100%, 720 days is still a lot better than 2 months, isn’t it? That’s it for this first part, and now we need to take stock of what will happen after this 2-year period.

2) From the recognised disability until the first day of your retirement

This second stage falls within the competence of your occupational insurance (the disability LPP). Once the pensions fund receives confirmation of a case of disability, it starts paying pensions, in addition to the first pillar (AHV which is the

Old-age and survivors’ insurance).

To find out the amount of the pensions paid, you must check your LPP certificate.

In most cases, the amount of the pension is expressed in % of the insured salary. These pensions, which include the first pillar, range from 50% to 60% of the last salary.

The second pillar in the event of disability due to an accident

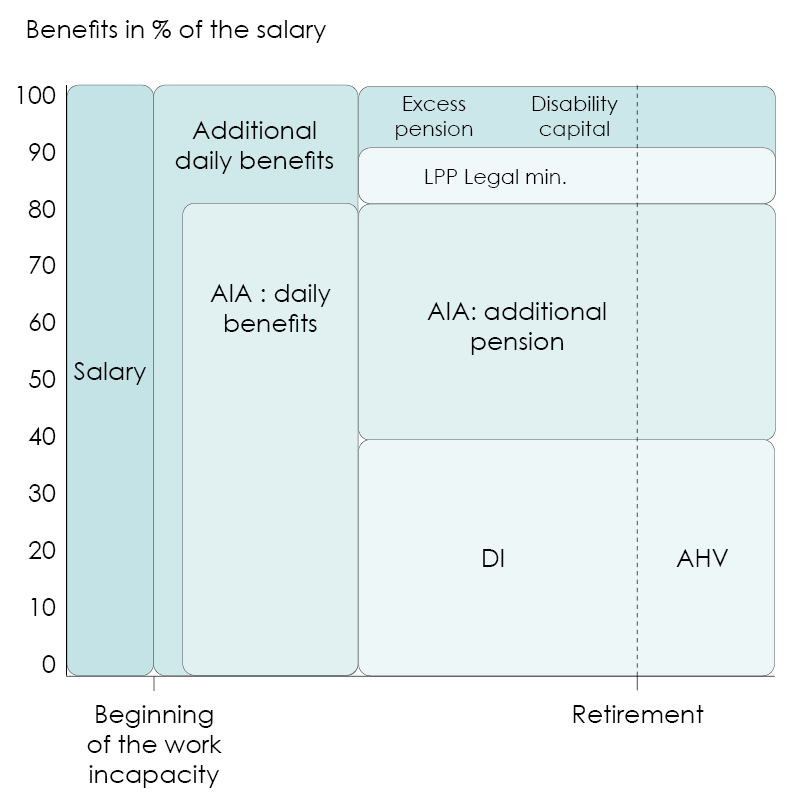

In this case, the same two stages as in the case of illness also exist but the actors and amounts are entirely different. Due to the fact that disabilities following an accident are rare, the coverages offered go beyond those for illnesses.

1) From the first day of disability until the decision of the DI (3rd day – 720th day): During this time, the Federal Act on Accident Insurance offers good protection to employees. It allows for a coverage of 80% of the last salary in every case.

2) From the recognised disability until the first day of your retirement:

Here, pensions will no longer be paid by the LPP but rather by the second component of the occupational insurance, the AIA. This insurance does not take into account the conditions of the pension fund, on average, the income maintenance varies around 90% of the last income.

How can FBKConseils help you ?

A free introductory meeting

Even in 2025, FBKConseils continues to offer all new clients a free introductory meeting. This meeting is the perfect opportunity to fill in any information you may not have found on our website or YouTube channel, while also providing you with answers tailored to your personal situation.

A personalized consultation

Whether due to illness, an accident, or preparing for retirement, looking into your 2nd pillar is always a wise move. Understanding the pension system, its mechanisms, contributions, and the insurances that make it up allows you to make informed decisions that will ensure your financial security, both now and in the future.

Our personalized consultation appointments give you the opportunity to:

- Conduct in-depth research tailored to your situation;

- Run detailed economic and tax simulations;

- Get precise answers to all your questions, enabling you to act with confidence.