Written by Yanis Kharchafi

Written by Yanis KharchafiHow does the first pillar work and who finances it?

Introduction

In Switzerland, retirement is based on the well-known three-pillar system. The first pillar, called AVS (Old-Age and Survivors Insurance), forms the foundation of the country’s retirement provision. It guarantees a basic pension to the entire population, ensuring that fundamental needs are covered when you reach retirement age.

At FBKConseils, we understand that grasping how the first pillar works is not always straightforward. Who must contribute? How is it financed? And most importantly, what role will it actually play in your future retirement?

In this article, we provide a detailed explanation of the AVS first pillar, covering its principles, financing, and contribution obligations for the various categories of people in Switzerland.

The line-up:

AVS (AHV), a pay-as-you-go social system

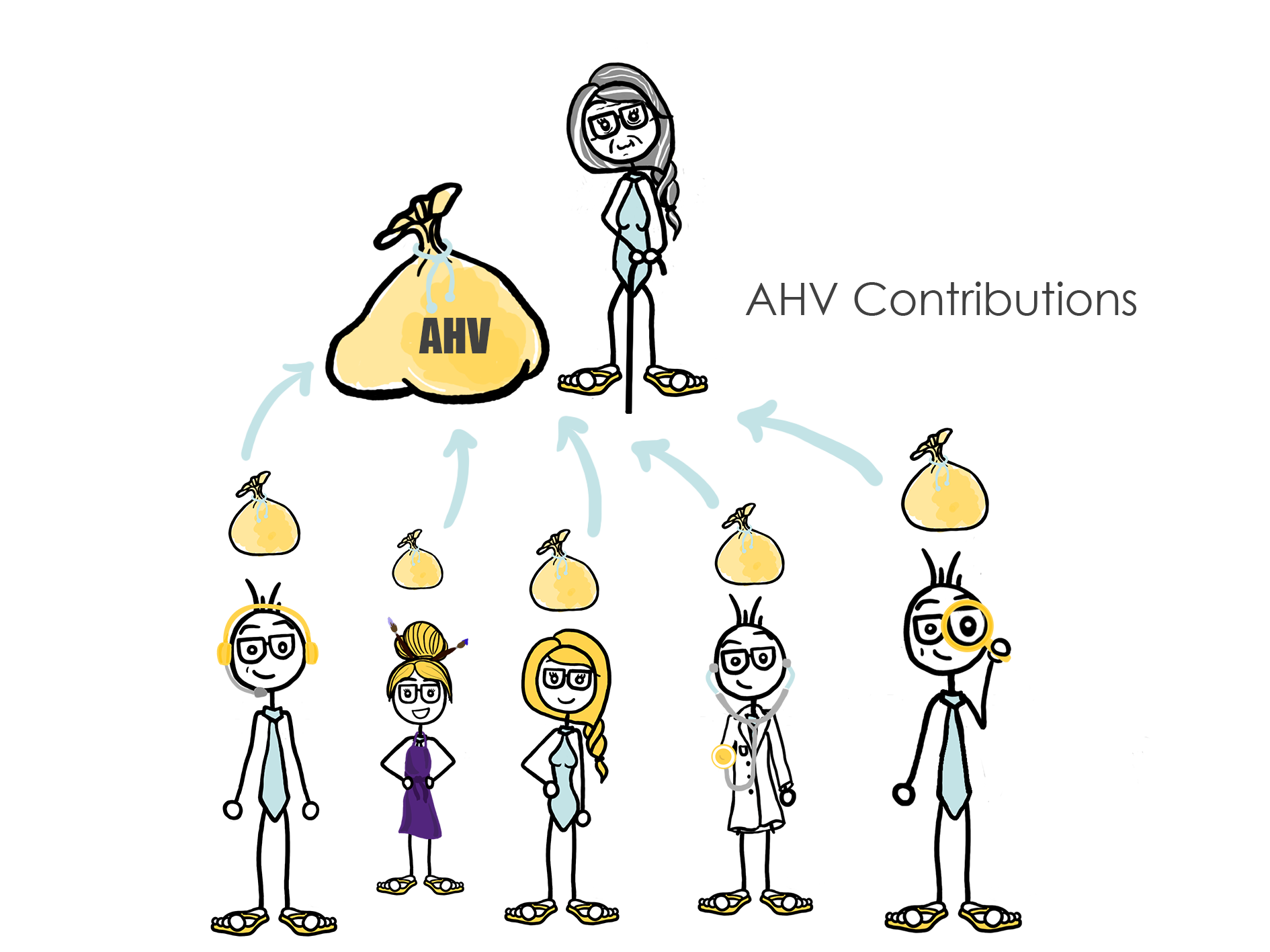

Contrary to popular belief, your AVS contributions do not directly fund your own retirement. The system operates on a pay-as-you-go basis: today’s active workers finance the pensions of current retirees.

In other words, you are contributing for your parents and grandparents today, and tomorrow, it will be the future generations who fund your pension.

This principle illustrates intergenerational solidarity: everyone contributes so that no one is left behind.

One key point to remember is that the first pillar is not personal savings. It is a collective system, managed by the state, that ensures a minimum income for retirees, widows, widowers, and orphans.

Who must pay AVS contributions in Switzerland?

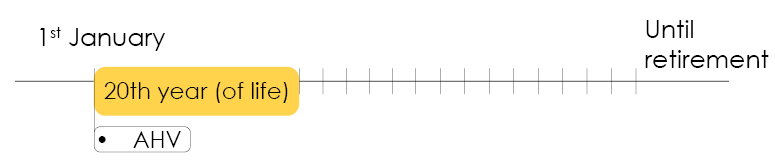

In principle, anyone residing in or working in Switzerland is subject to AVS contributions, from age 21 until retirement (65 for men, 64 for women — evolving under the AVS 21 reform).

Let’s take a closer look at the different cases:

Active Individuals — Employees

If you are employed in Switzerland, your AVS contributions are deducted directly from your salary.

- Rate: 5.3% of your gross salary is withheld each month.

- The employer contributes an equal share, bringing the total contribution to 10.6% of your salary (employer + employee).

This contribution is clearly shown on your payslip under the line “AVS/AI/APG”.

Active Individuals — Self-Employed

Self-employed individuals must also contribute to the first pillar. The difference is that they cover the full amount themselves, as they do not have an employer to pay half.

However, for annual incomes below CHF 58,000 (2025 scale), a progressive scale reduces the minimum contribution.

In most cases, the contribution rate is 10% of net profit before deducting the AVS charge.

Individuals Without Gainful Employment

This is less well-known. Even without an income, you are generally required to contribute to AVS if you are over 21 and have not yet reached retirement age.

This applies, for example, to:

- Students

- Homemakers (who are not married to an employed AVS contributor)

- Early retirees

- Individuals living off their personal assets

In these cases, contributions are calculated based on wealth and any potential pensions. This particular category of non-working individuals is discussed in more detail in another article here.

How FBKConseils can assist you?

At FBKConseils, we support many clients with retirement planning and all matters related to the first pillar.

- Introductory Meeting: we offer a free 20-minute consultation to answer your basic questions.

- Advisory Meeting: for more complex situations (pension calculations, tax optimization, coordination with the 2nd and 3rd pillars).

- Comprehensive Retirement Planning: we conduct budget and tax simulations to provide a clear overview of your future pensions and capital.