Written by Yanis Kharchafi

Written by Yanis KharchafiHow much will you contribute to AVS (AHV) as a person without gainful activity?

Introduction

In principle, everyone must contribute to the AVS (AHV), even persons considered to be without gainful employment, that is, those who do not engage in an activity which generates income. I know what you are thinking: “thank you, Captain Obvious”.

Sounds crazy, doesn’t it? You don’t work, you don’t earn a salary, and yet if you’re between 21 and 65, you’ll probably have to pay AHV contributions in order to secure a maximum AHV pension.

Don’t worry, our pension system is based on 3 pillars. The 2nd and 3rd pillars don’t require any contributions when you’re not working – in fact, it’s forbidden.

In this article, we’ll look at how much you’ll have to pay in AHV contributions if, for example, you decide to retire before the reference retirement age: 65 for both men and women from 01.01.2024.

The line-up:

Who has to pay contributions without even being gainfully employed?

That’s a very good question — there are so many situations in life where one might find themselves without any income that it’s hard to know where to begin…

If I had to define a general rule, I would say that as long as you haven’t reached the age of 65, are over 21, and don’t pay AVS contributions as an employee or a self-employed person, there’s a very good chance you fall into a category that requires you to contribute.

To make this clearer, here are a few examples:

- People who have taken early retirement

- Individuals with passive income (rental income, foreign pensions, inheritances, investment income, etc.)

- Beneficiaries of a disability pension (AI)

- Students

- People registered as unemployed but whose benefits have expired

- Insured persons engaged in a low-income activity, whose total annual contributions (including the employer’s share) do not reach CHF 530 per year, which corresponds to an annual gross income of approximately CHF 4,702

- etc.

This list is unfortunately not exhaustive, but keep in mind the rule we’ve just established — it should help you quickly determine whether you fall into this category.

If you’re ever in doubt, never hesitate to contact your AVS compensation office; they can clarify your situation.

Now that we’ve identified who is considered non-active but still subject to AVS contributions, let’s move on to the next question:

How are these contributions calculated? And how much does a person without gainful employment have to pay each year?

How do you calculate contributions for people with no gainful activity?

Let’s put it this way — just like with taxes, the AVS system isn’t naïve. If you don’t have any salary or self-employment income, it’s quite likely that you have some assets or receive certain pensions or annuities that allow you to cover your living expenses.

That’s precisely why a specific calculation method has been designed for you — it’s a combination of your wealth and your income from pensions.

Your wealth includes:

- Bank accounts

- Investments

- Taxable value of real estate properties

- Surrender value of life insurance policies

Your income includes:

- Pensions

- Annuities

- Alimony or maintenance payments received from third parties

- Etc.

To determine your annual AVS contribution, you simply multiply your annual pension or annuity income by 20, then add your total assets.

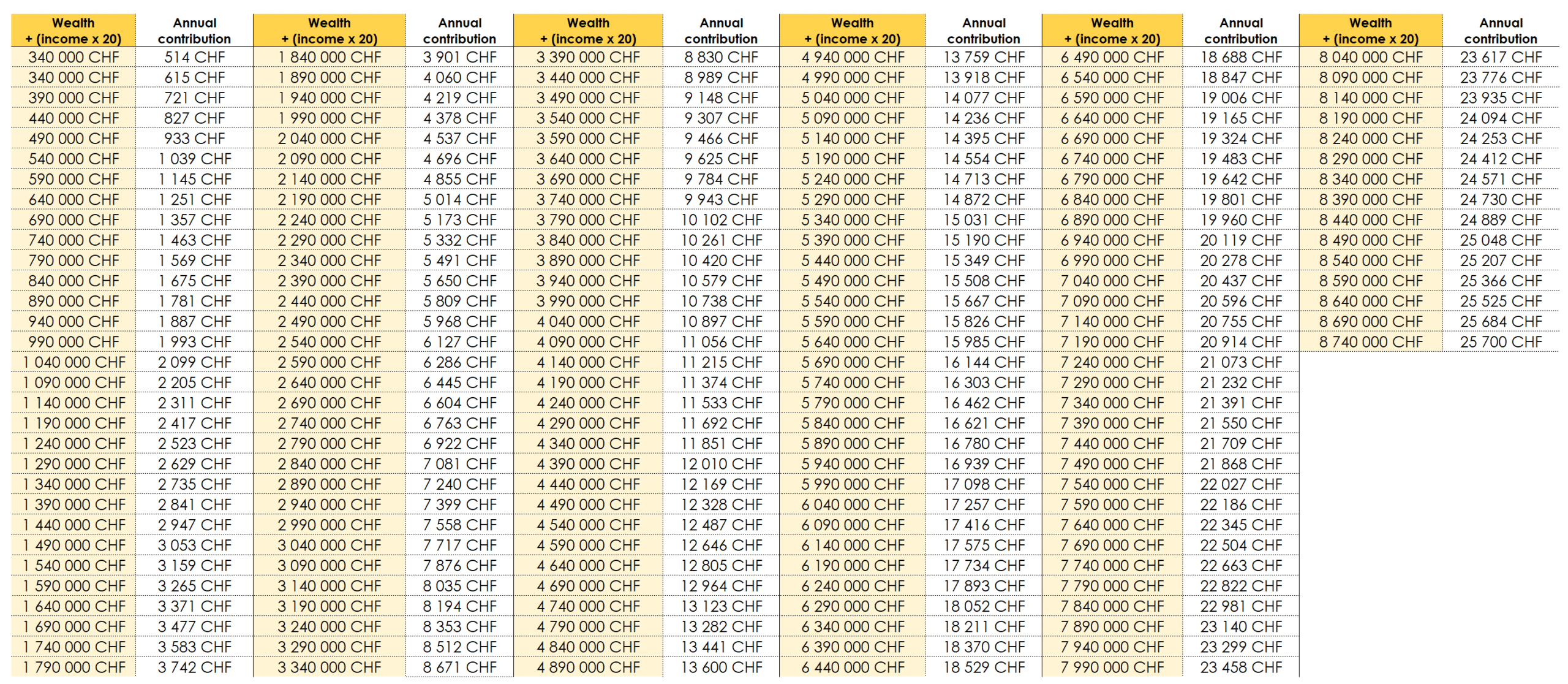

Once you have this total, you can refer to the table below to find out your exact annual AVS contribution.

Before meeting Zoé, I was married to someone else who — for reasons unknown — still pays me a monthly pension of CHF 1,500. On top of that “annuity,” I managed to save about CHF 460,000 from my YouTube channel earnings.

If we follow the calculation step by step:

- Income component: CHF 1,500 × 12 × 20 = CHF 360,000

- Wealth component: CHF 460,000

- Total amount: CHF 360,000 + CHF 460,000 = CHF 820,000

Now, all that’s left to do is check the big table below to find out the corresponding annual AVS contribution.

In my case, my annual AVS contribution would be CHF 1,675.

And you — which range do you fall into?

Not so bad after all, right? Now you know how to calculate your AVS contribution if you don’t have any gainful activity!

And what if you do have one?