Written by Yanis Kharchafi

Written by Yanis KharchafiWhat will be your second pillar contribution (LPP)?

Introduction

At FBKConseils, we have noticed that the vast majority of our clients underestimate the importance of their second pillar (2e pilier). And this isn’t just an isolated observation: in Switzerland as a whole, this subject is far too often overlooked. Without realizing it, many people sign employment contracts without even questioning whether the pension provisions offered to them are favorable or not.

This article aims to wake you up and make you realize that the second pillar is a crucial component of your personal finances. Before diving into the details of the contributions, let’s take a brief detour through the three pillars of our retirement system:

- The first pillar: AVS (Old Age and Survivors Insurance)

- The second pillar: Occupational pension provision

- The third pillar: Private pension provision

While the first and third pillars are relatively straightforward to understand, the second pillar is a true maze. It may seem accessible at first, but as soon as you want to deepen your knowledge, you’re faced with numerous nuances and complex details. This is precisely why we decided to create a series of articles dedicated to occupational pensions in Switzerland. Each article will focus on a specific aspect to guide you step by step.

And today, we start with the basics: contributions to the second pillar.

The line-up:

Professional pension in two parts: The mandatory part and the supplementary part.

Contributions as a legal obligation

The first very important thing to keep in mind is that for all employees, regardless of the company, salary, age, etc., the minimum rules are the same. This means that everyone from a certain age (25 years for what is known as the ‘old-age bonus’, i.e. savings, and 17 years to cover risks) and a certain income level must contribute proportionally to their income. This legal obligation is based on the Federal Law on Occupational Pensions, article 2 (LPP).

Contributions with at least equal sharing

One of the first specificities to know is that your employer is required to contribute at least as much as you do for yourself. In other words, part of the contributions is deducted from the employee’s salary, while another part is directly paid by the employer.

Legally mandated minimum rates

The second important specificity is to understand the basis on which BVG contributions are calculated. The law sets out a fairly clear legal framework. All the legal minimums are set (insured salary, contribution rate, interest paid, etc.). It is these legal minimums that will create what is known as the mandatory part.

The Mandatory part

- This first component of your 2nd pillar is and always will be the same, regardless of who you work for or the conditions under which you are paid. Employers are required by law to comply with certain rules:

- Minimum age-related savings contributions: Essentially, the minimum total contribution rate required for an employee in your age group (Article 16 of the LPP).

- Annual interest rates applied to the insured’s savings: 1.25% in 2026 (Article 15).

- Conversion rates (6.8%): Still applicable in 2026 but expected to decrease in the future due to an upcoming LPP reform, although all reform attempts have been rejected so far.

The Supplementary part

- The law always determines minimum requirements but does not preclude them from being more generous. They can decide freely on how to insure their employees, as long as their situation remains at least as good as what the law prescribes.

- Retirement credits greater than the minimal requirements per age range.

- The portion paid by the employer can be higher than the portion paid by the employee.

- Employers have the option to insure a salary higher than the legal minimum by adjusting what is known as the coordination deduction. Since the first pillar (AVS) already covers part of your income, the second pillar only accounts for the remaining portion after deducting a fixed amount called the coordination deduction. Starting in 2025, this amount will be capped at CHF 26,460 (don’t worry if this concept seems a bit unclear—we’ll explain it further in a moment).

Whew, I know what you are thinking: “why do you keep adding new complicated words Noé? There are enough already!”

What’s important to remember? When you look at your BVG certificate, there’s a good chance you’ll see a line marked “BVG portion” or “compulsory portion”. You now know that this is the legal minimum to which you are entitled. Then, if your employer has decided to be more generous, you will see a second line or column labeled “Non-mandatory part.” The third will indicate your total balance, including both the mandatory and non-mandatory portions.

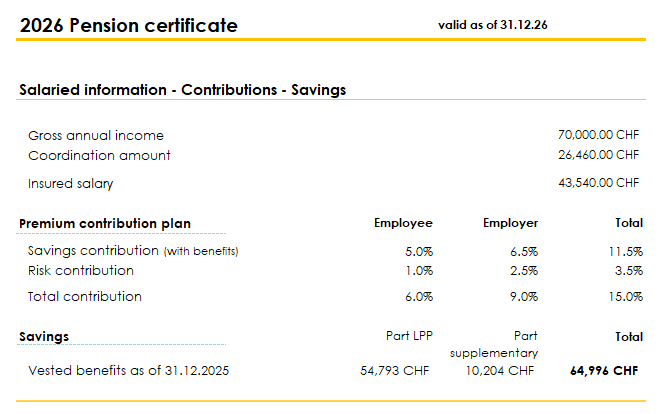

Let me give you a quick example. Here’s a part of my LPP certificate, as I’ll receive it at the end of December 2025—or, to be more realistic, in March 2026.

We can see that my total vested benefits amount to CHF 64,996, with the mandatory LPP portion accounting for CHF 54,793. The extra-mandatory portion, which corresponds to funds accumulated beyond the legal minimum, amounts to CHF 10,204, or 15.7% of the total!

LPP certificates are not standardized across institutions. Therefore, yours might not be as explicit, and you may need to perform some additions and subtractions to reach a conclusion. However, this is basic information that you should have access to.

If in doubt or if you need assistance, do not hesitate to contact us.

What are the annual 2nd pillar contributions?

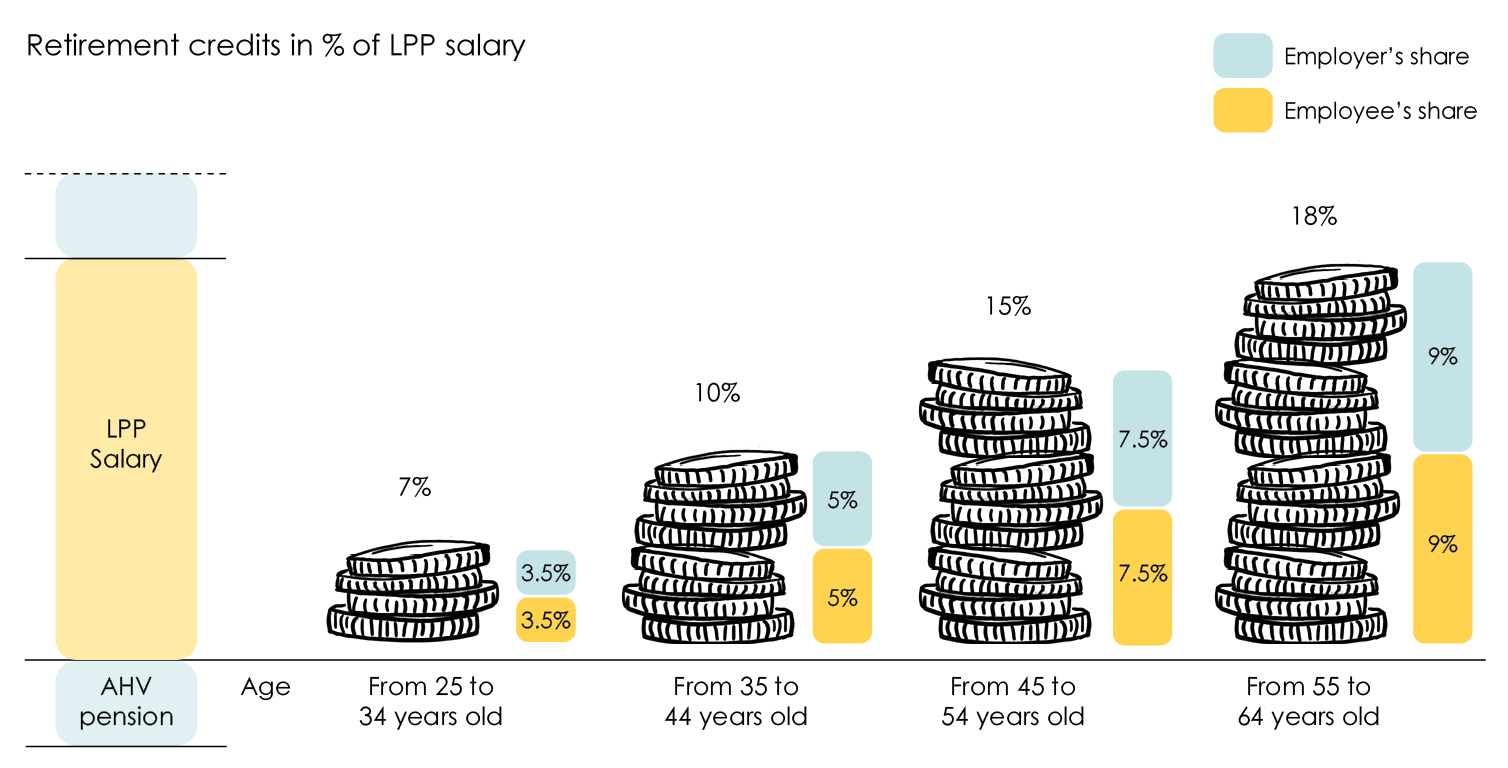

As noted in the first part of this article, part of the contributions (the compulsory part) is set by law. Nobody can contribute less than that. Here are the contribution rates in force until the end of 2023:

Minimum BVG/LPP contributions (Old-age credits)

- From 25 to 34 years old: 7% of the annual salary (3.5% on you, 3.5% on your employer). On a monthly income of 5,000 CHF at 27 years old, a 350 CHF contribution will be required in total. 175 CHF will be deducted from your salary and your employer will be in charge of the other 175 CHF.

- From 35 to 44 years old: 10% of the annual salary (5% on you, 5% on your employer). On a monthly income of 6,000 CHF at 39 years old, a 600 CHF contribution will be required in total. 300 CHF will be deducted from your salary and your employer will be in charge of the other 300 CHF.

- From 45 to 54 years old: 15% of the annual salary (7.5% on you, 7.5% on your employer). On a monthly income of 7,000 CHF at 52 years old, a 1,050 CHF contribution will be required in total. 525CHF will be deducted from your salary and your employer will be in charge of the other 525 CHF.

- From 55 to 64 or 65 years old: 18% of the annual salary (9% on you, 9% on your employer). On a monthly income of 8,000 CHF at 61 years old, a 1,440 CHF contribution will be required in total. 720 CHF will be deducted from your salary and your employer will be in charge of the other 720 CHF.

That is what is called a sharp increase! But since salaries tend to increase as we grow older. The fact that LPP contributions increase should not be an issue, turns out, the whole thing is rather well thought through.

As a reminder, if your employer wishes, they can completely relieve you of this burden and contribute the full amount owed to the pension fund.

There’s more to come. So far, our aim has been to explain to you in a fairly simple way how contributions to your 2nd pillar work. To do this, we’ve had to simplify things a little… For the more adventurous, I suggest you hang on a little longer, because there are some small subtleties that can make a big difference if they’re not properly understood.

What is your real insured salary under your 2nd pillar?

The 2nd pillar was created in another era… Salaries were not the same, nor was the cost of living, and life in general was very different. Yes, the 2nd pillar is trying to adapt, but it is only partially successful. The first example is your insured salary.

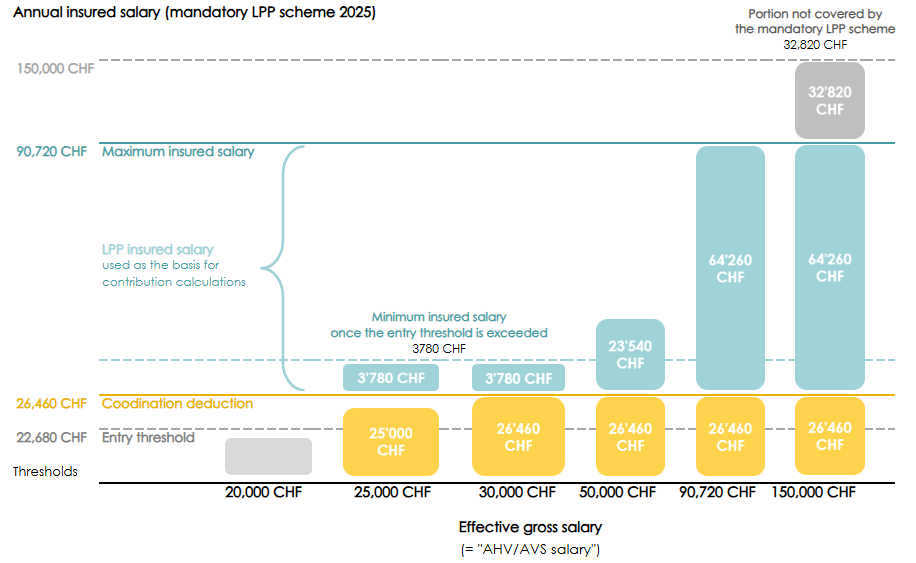

The LPP (the law) obliges employers to deduct contributions from a salary… but unfortunately not necessarily from yours… The law allows employers to do some very important things:

- Insure a maximum of CHF 90,720 per year in 2026 (same as 2025). In other words, if you earn CHF 100,000, your employer can insure “only” CHF 90,720, without asking you, and therefore only contribute on that salary. The problem? When you reach retirement age, your standard of living is based on CHF 100,000, but your contributions have been calculated on CHF 90,720… And wait, that’s not all.

- Coordination deduction: It’s a complicated word and not necessarily good for your contributions. As well as not being obliged to insure what exceeds the LPP salary (CHF 90,720), your employer is also entitled to deduct CHF 26,640 in 2026 (same as 2025) from your salary, which is supposedly already covered by the 1st pillar (AVS).

What does all this mean? If you earn a salary of CHF 100,000, are 40 years old and your employer wishes to keep to the legal minimum, then he is entitled to insure a salary of CHF 90,720 and deduct CHF 26,640. Your insured salary will fall from CHF 150,000 to CHF 64,260. In our example, you are 40 years old, so the contribution rate is 10%. You will contribute 10% x 64,260 = CHF 6,426 per year.

What is the maximum insurable salary for your 2nd pillar?

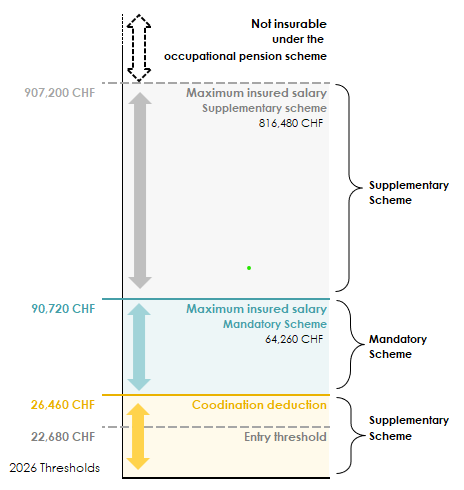

Fortunately, there are as many “stingy” employers as there are generous ones, and so much the better, because the law sets minimum amounts but also allows them to be exceeded by a considerable margin.

Among other things, employers can decide not to apply the coordination deduction in order to guarantee your real AVS/AHV salary – Your effective salary, the gross salary you negotiated with your employer. They can also decide to apply higher contribution rates than those in force for your age bracket.

Isn’t that nice?

Here’s another table to help you understand the minimum and maximum amounts authorised for your 2nd pillar.

Phew… here we are…

We hope that by now you’ve understood that the 2nd pillar is a precious source of savings which, at one point or another in your life, will be crucial. It could be the means by which you buy your principal residence one day, become independent or simply enjoy a comfortable retirement. And that’s why it is crucial to look beyond the gross salary offered by your employer – in Switzerland, a significant portion of your compensation is determined by your pension plan conditions.

2nd pillar withdrawals: Many other questions remain unanswered

In this article, we’ve taken the time to explain how the 2nd pillar works in terms of contributions. However, to truly master the subject, there are still several areas you’ll need to dive deeper into:

- Will you receive an annuity or rather a lump sum? Do you have a choice?

- When can you withdraw or start living off your 2nd pillar?

- Taxes are inevitable with annuities or lump sums – it’s crucial not to forget them.

- Is it possible to optimize your 2nd pillar while reducing your taxes?

On our blog, you should find answers to these questions, and if that’s not enough, you can always get in touch with us.

How FBKConseils can help you?

A first free appointment

Since our inception, we’ve been offering a first, free consultation of around twenty minutes. This meeting aims to answer all your questions and, if necessary, present our services tailored to your situation.

Personalized advisory appointment

Certain life events require a more in-depth reflection on how to use your 2nd pillar: buying a property, starting a business, or retiring in Switzerland or abroad. At FBKConseils, we offer to schedule an appointment to carry out all the necessary simulations and calculations. Our goal? To save you from any unpleasant surprises and help you save precious time.

Requesting a 2nd pillar withdrawal

The administrative steps related to withdrawing from the 2nd pillar can be complex and time-consuming. Whether due to a lack of time or the fear of making a mistake, FBKConseils is here to support you every step of the way. We guarantee you full, personalized assistance throughout the process.