Written by Yanis Kharchafi

Written by Yanis KharchafiThe tax on 2nd and 3rd pillars withdrawals to move to France

Introduction

Are you leaving Switzerland for France? How much will you pay in taxes on the withdrawal of your second and third pillars? Noé will give you an answer!

Are you planning to go back to France after a working experience in Switzerland? Or do you wish to start a new experience in France after having worked in Switzerland for years or simply enjoy retirement at home?

Two life paths, one same question how much will you pay in taxes on the withdrawal of your second and third pillars?

Quick disclaimer: if you are not thinking of France as a final destination then you should read my more general article on this topic. And if you are unsure about whether you can benefit from your LPP savings, I invite you to read withdrawal conditions of your second pillar (LPP).

Otherwise… let’s go!

The line-up:

Who, when, and what can you withdraw from your 2nd pillar savings when moving to France?

Before discussing taxes, we offer a brief introduction to help you understand the general situation: who can withdraw their savings? When can you request your savings, and which savings are we talking about?

Who and when can you request a withdrawal from your 2nd pillar savings?

Although we have other articles that go into more detail on this issue, here’s a quick summary: Whether you are Swiss, French, a cross-border worker, or a resident, the rules governing the 2nd pillar are the same for everyone. No difference. Here are the key rules:

Home Ownership Encouragement (EPL) – Purchasing a Primary Residence

Swiss law allows anyone to request a withdrawal of their 2nd pillar savings to finance all or part of the purchase price of their primary residence. When we talk about purchasing, this also includes paying off a mortgage or financing home improvement works, as long as the property is your primary residence. Regarding the amount, the rule is fairly straightforward: you cannot withdraw more than the purchase price. For example, if your home costs CHF 100,000, you cannot withdraw CHF 200,000 from your 2nd pillar.

Leaving Switzerland or ceasing work in Switzerland

If you were a resident and have decided to move to France, or if you were a cross-border worker and your work permit is expiring, these two reasons allow you to request a partial withdrawal of your 2nd pillar savings: the non-mandatory portion. In other words, it’s everything that exceeds the legal framework, the part not strictly governed by the law. For some, this portion will be significant, while for others it might be nearly nonexistent—but that’s life. To get a precise idea, you’ll need to request your LPP certificate and check the fine print to see how your 2nd pillar savings are structured.

What about withdrawing your 3rd pillar savings when moving to France?

No lengthy paragraphs this time, just a simple rule: ending your career in Switzerland gives you the possibility to withdraw your 3rd pillar savings. The 3rd pillar is generally not restrictive.

However, be careful: 3rd pillar accounts that are linked to insurance might cause issues when withdrawing. If your contract has not been in place for at least 10 years and the value of the policy has not reached the sum of your contributions, withdrawing too early could result in a loss of money. So, remember: having the right to withdraw your 3rd pillar is different from actually wanting to do it.

A three stage taxation system

The Helvetic Confederation signed two double imposition agreements with more than 80 countries precisely in order to avoid paying taxes on your savings twice.

With France, just like with most European countries, the taxation system is in three phases.

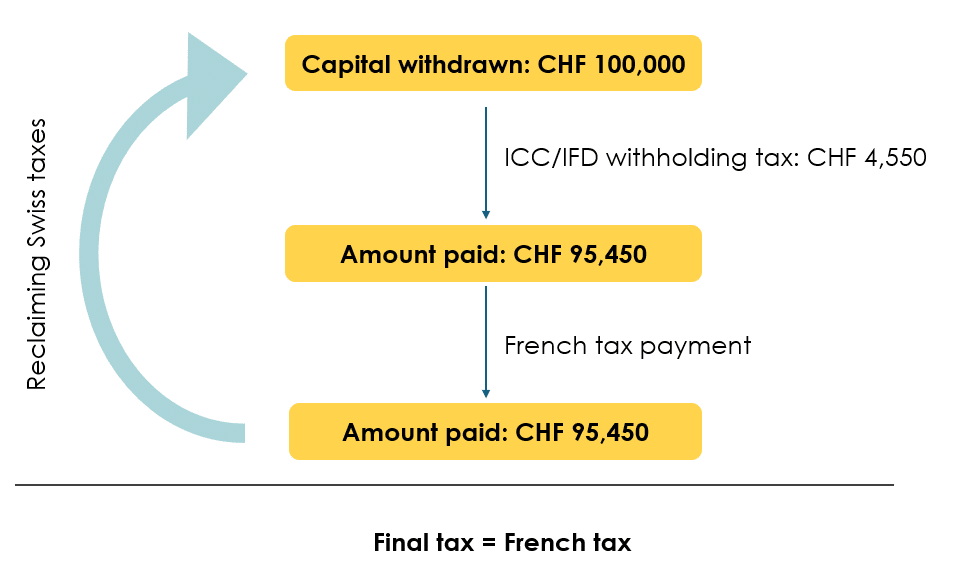

Stage 1: Withholding tax in Switzerland

Switzerland first withholds at source a tax which varies depending on the relevant amount, your marital status and the relevant canton. When you leave Switzerland, it’s not your place of residence that counts, but the place from which the money leaves.

Stage 2: Pay taxes in your country of residence

When your assets are released you must declare them in your new country of residence, here France.

It is now the turn of French taxation authorities to require taxes from you. at this point, two scenarios are possible, which I will detail right below.

Stage 3: Reclaiming withholding tax paid in Switzerland

Once you paid the amounts, your taxes at source can be reimbursed. These little fiscal gymnastics will allow you to pay, in the end, only one tax, the French one.

Two taxation scenarios on the French side

France considers your LPP and third pillar assets as forming parts of a withholding tax, that is an extraordinary income.

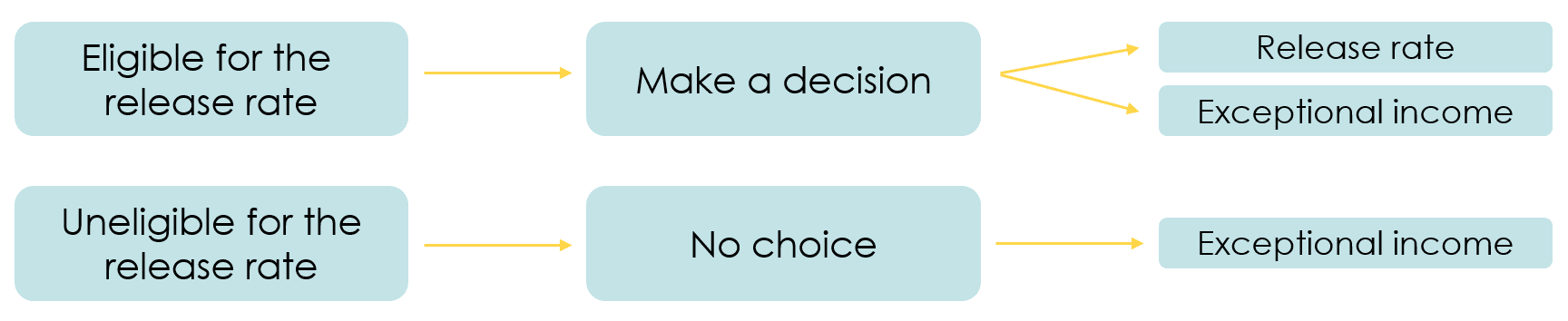

In the first case, a fixed rate is applicable. Which is generally advantageous when the relevant amount is substantial. in the second case, the tax is proportional to the amount received, which can be advantageous when the amount is smaller

The withholding tax: under which conditions?

The withholding tax is taxed at a fixed rate of 7,5% minus 10% meaning 6,75%, regardless of the amount of your assets

To qualify the withdrawal must meet one of the two following conditions:

- be used to purchase a primary residence

- be withdrawn as capital in a single operation (another part can be withdrawn as pensions).

The purchasing of a primary residence

The condition is rather clear: if you wish to finance the purchasing of a property which will serve as a primary residence, then you will be taxed at a fixed rate of the withholding tax.

Be careful: depending on your pension fund and the bank, you will not be able to finance all of the costs related to your purchase with your LPP assets (notary fees, bank guarantee, administrative fees).

The withdrawal of the capital at once

The other condition to benefit from a fixed rate is to withdraw the capital at once. for example, you cannot decide to withdraw the supplementary part when you are 45 years old or before that and demand the mandatory part later on.

That being said, you can decide to withdraw a part of your capital and the remaining part will be paid out to you as pensions. The first part will be taxed at a fixed rate of 6,75% and the other will be taxed as usual – as an income.

Taxation of the exceptional income

What does “exceptional” mean? It is mostly a negative definition. In other words, when your withdrawal does not meet the characteristics of a withholding tax as discussed right above, it is considered to be “exceptional”.

This option is mostly interesting for smaller amounts, since the taxation is based on a progressive scale: the scale of the income tax.

The tax burden can quickly become significant.

In any case, it is a good idea to call a professional that will be able to calculate and compare different amounts.

Can I decide the taxation method?

If your withdrawal is considered as a withholding tax, you can decide between a fixed rate or a progressive rate.

Otherwise, the conditions of the exceptional income apply.

In conclusion, no matter the French tax that you must pay, once it is paid, remember to ask to be reimbursed of the amount withheld by the Swiss authorities.

How can FBKConseils help you withdraw your 2nd pillar to move to France?

An Introductory meeting

At FBKConseils, we offer all new clients a free 20-minute introductory session. This meeting is designed to complement the information available on our website or YouTube channel while addressing your specific questions.

Support with administrative procedures

While the process of withdrawing your 2nd pillar may seem complex at first glance, it is often more time-consuming than truly complicated. That being said, FBKConseils is here to make your life easier. We handle all administrative steps related to the withdrawal of your 2nd pillar and subsequently assist with the request for reimbursement of withholding tax.