Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 16th 2024.

LAMal for frontaliers : functioning, cover and costs

Taking the plunge as a cross-border commuter in Switzerland involves a number of crucial decisions, and one of them may well surprise you by its impact: your choice of health insurance. Will you stick with the French Couverture Maladie Universelle (CMU), or will you switch to Swiss LAMal insurance? This dilemma, which might seem minor at first glance when you’re changing your life and career, turns out to be a major issue for several reasons:

- Health is priceless: Choosing how to protect your well-being is a decision of the utmost importance.

- A choice set in stone: Once you’ve made your decision (or worse, not made it), there’s no going back, even in the face of major life changes.

At FBKConseils, we know how daunting these decisions can seem. That’s why we invite you to take your time and explore this article and our other resources dedicated to this crucial topic for any future frontier worker:

The line-up:

What is health insurance in Switzerland – LAMal?

In Switzerland, the health insurance system, also known by the acronym LAMal for “Loi sur l’Assurance Maladie” (Health Insurance Act), is essential to understanding the healthcare framework for residents and cross-border commuters alike. Although the health insurance scheme for cross-border commuters shares many similarities with that of Swiss residents, it does have some notable specificities. Here are the basic principles governing health insurance for cross-border commuters.

Choosing your health insurance

Unlike the French system, where the state plays a central role in health insurance, the Swiss landscape is quite different. In Switzerland, workers have access to a variety of insurance companies, with around ten major players offering their services. This diversity translates into competition in terms of insurance premiums, which vary considerably from one company to another. However, despite these differences in cost, the cover offered remains identical in essence – what changes is the amount of the premium and, potentially, the quality of customer service.

Your health insurance deductible

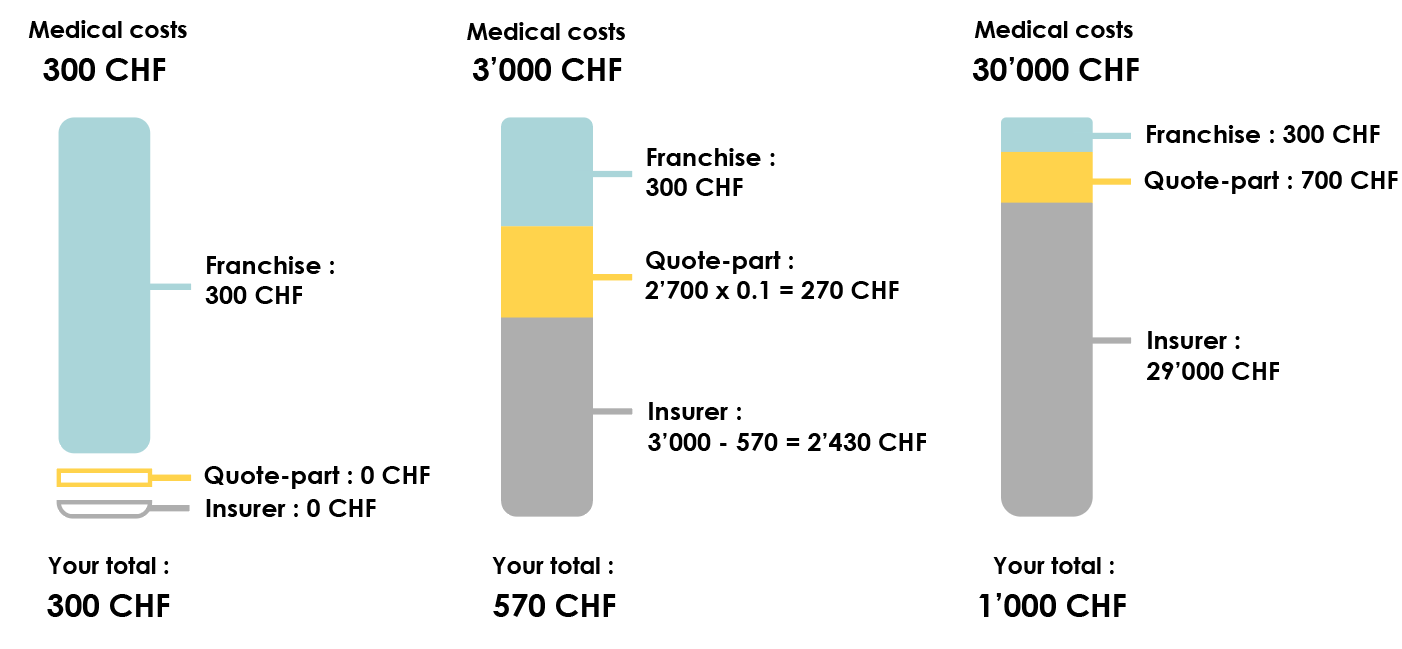

In Switzerland, whether you are a resident or a cross-border commuter, your health insurance includes what is known as a deductible. This deductible requires you to cover initial health costs up to a certain amount before you can be reimbursed. For cross-border commuters, there is no flexibility in this area: the franchise is set at CHF 300 per calendar year. In practice, this means that you have to pay up to CHF 300 of medical expenses each year out of your own pocket before the insurance starts to reimburse additional costs.

Your health insurance co-payment

In Switzerland, in addition to the deductible, policyholders must also manage what is known as the co-payment, a sort of second deductible. Once your initial franchise has been used up, you will be responsible for paying 10% of additional medical costs. To make this concept more understandable, imagine this: after paying your CHF 300 deductible, you continue to pay 10% of all subsequent medical expenses, until you reach an annual limit of CHF 700 for this co-payment. So, even after you have paid your excess, you will still have to pay part of the costs until you reach this maximum.

What is the right of option?

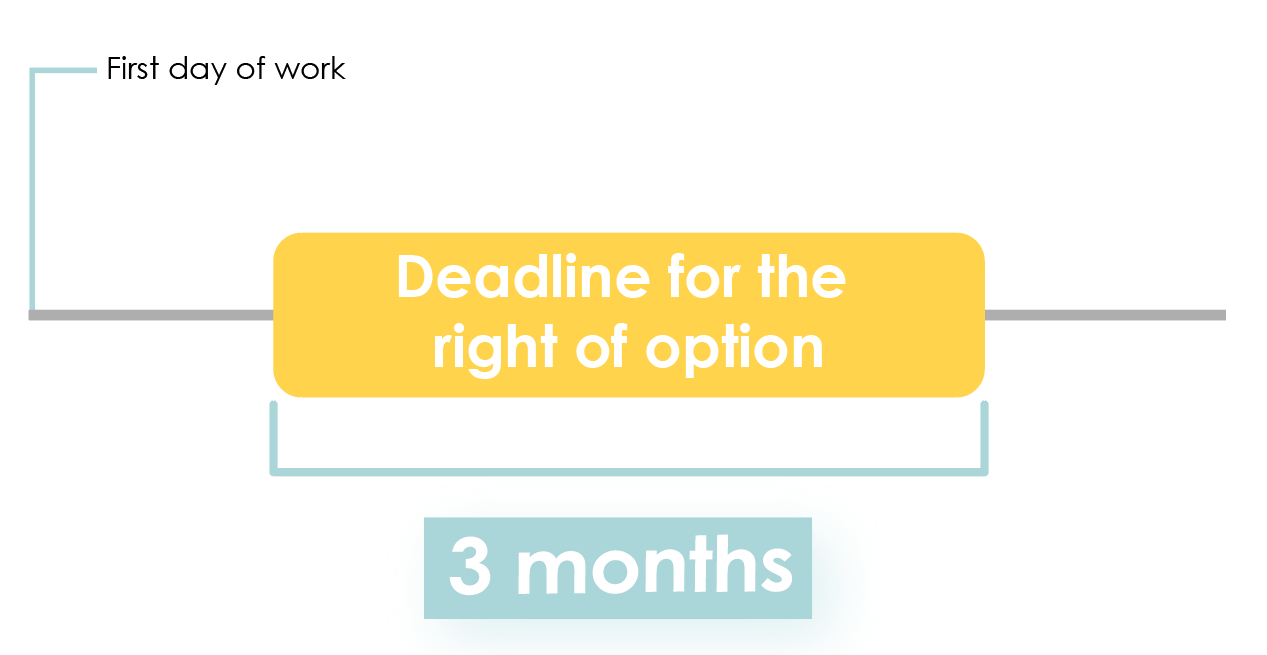

We call “right of option” the 90-day period during which you may choose between the LAMal and the CMU.

The three months begin from your first day of work.

If you did not inform the Swiss authorities of your decision within the given time period, they will decide for you.

You will be affiliated to the LAMal as a default insurance. Furthermore the said insurance will charge delay penalties.

Ouch.

In other words, you can decide, but you must decide quickly.

Here’s the direct link to make this choice.

Exceptions allowing for a change of health insurance regime

As I said above, the decision is final.

Unless…

- You live in France and move to Switzerland. If you are affiliated with the CMU, it is mandatory by law to get an LAMal insurance. The opposite is not possible.

- You benefit from unemployment benefits after a cross border employment. You then get a new right of option if you find a job in Switzerland again. You have 90 days starting from the first day of unemployment to choose between the CMU and the LAMal. Regardless of your previous affiliation.

Is my partner covered by the LAMal?

No. In Switzerland, the health system is individual. Each member of the family must take out independent insurance, which means that each person must also pay an insurance premium.

Are my children covered by the LAMal?

Your health insurance will not automatically cover your children’s care.

- If both parents are affiliated with the CMU, the children are covered by the French system.

- If one parent is affiliated with the CMU, the children are also covered by the French system.

- But if both parents are affiliated with the LAMal, the insurance will ask you for an additional contribution for each child. This is also the case if the couple is divorced or separated and the custodial parent is affiliated with the LAMal.

Where can I receive care if I am covered by the LAMal?

Everywhere. The base health insurance of the LAMAL allows you to choose where you would rather receive care and bears the costs of the country chosen.

What happens in case of unemployment or termination of the employment contract?

If you lose your job, you will no longer be insured at the age I. While you are unemployed, you lose your frontalier status and are insured with the social security of your country of residence again.

Compared to those of the CMU, what are the advantages of the LAMal?

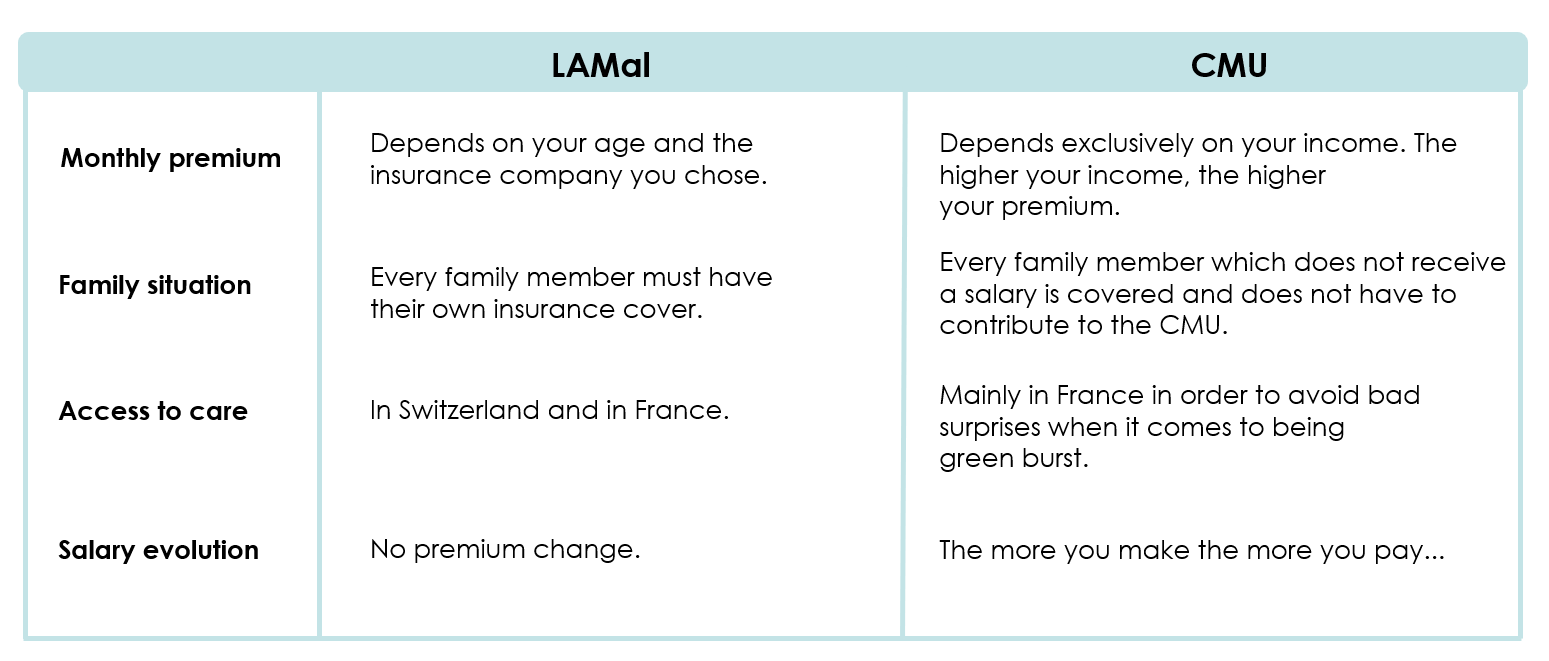

Here is a comparative table which sums up the main characteristics of being insured with the LAMAL on the left and with the CMU on the right:

Unlike that of the CMU, the cost of membership to the LAMal is a fixed rate. Premiums are not good German spy your immediate or future income.

This is a significant advantage if your salary is high or if you are expecting a career evolution.

However, you should keep in mind that the CMU covers the care of your partner and your children and that the LAMal is individual.

In the end, the best way is to compare, is to count…

How much does the LAMal for frontaliers cost?

If you want to know the exact amount of your (potential) future LAMal premiums, I prepared a little article for you which will explain clearly an easily how to calculate: How to calculate precisely the cost of the LAMal insurance for frontaliers?

Increase in LAMal premiums for cross-border commuters from 2025

Important information for all cross-border commuters wishing to start working in Switzerland from 2025: be aware that the State of Geneva has decided to reduce the difference in premiums between Geneva residents and cross-border commuters. Until 2024, a cross-border commuter will pay an average of between CHF 160 and 180 a month to be insured under the LAMal. From 2025, premiums are likely to skyrocket (by up to 65%) to reach levels approaching CHF 340.

Tips and advice for cross-border commuters choosing their health insurance in Switzerland

Tip no. 1: Take into account potential career and life changes

One of the great advantages of Swiss health insurance is the stability of its premiums. They are set annually and depend mainly on your age and choice of insurer, without being influenced by your income. Whether your income increases or you receive other sources of income, such as capital or retirement pensions, your insurance premiums remain unchanged. So with Swiss health insurance, you can be sure of knowing how much you’ll be paying each year, so you can plan your budget without any surprises.

Tip no. 2: Don’t pay pointless premiums

- Since coverage is the same regardless of the insurance company you choose, there’s no point in choosing an expensive company. You won’t be better insured, and you’ll be paying higher premiums for no reason.

- Remember not to include accident insurance if you are employed. In Switzerland, it’s your employer’s job to insure you against the risk of accident. You need to exclude this cover as soon as you have a job. Only children and people not in work need include accident cover in their policy.

Voir les 2 commentaires

11h06

I understand I have maximum 3 months to take out LAMal health insurance. But what happens when I need medical care before I take LAMal insurance? Is this then covered retrospectively?

16h57

Exactly, you have 3 months to choose your insurance. Of course, if you have a medical issue before you made that choice, you will be taking care of, and covered retrospectively. If you haven’t chose an insurance after the 3 months, an insurance compagny will automatically be chosen for you, and the doctors or specialists you have seen during this time will send the bill there.

Comments are closed.