Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 16th 2024.

How much exactly does the Health Insurance Act of Switzerland (LAMal) cost?

You are about to become what is known in Switzerland as a “cross-border commuter” and start work on Swiss soil. This major change involves a number of important decisions. At FBKConseils, we’ve created a dedicated section to help you. We cover most financial essentials, including health insurance. When you arrive in Switzerland, you will quickly be faced with a compulsory choice between two insurance systems:

- The Swiss health insurance system, commonly known as LAMal.

- The French social security system, often referred to as CMU.

In this article, we will focus specifically on the Swiss health insurance system, and more specifically on the method used to calculate insurance premiums. For more details on how the LAMal scheme works, please see our second article on the subject.

The line-up:

Calculation of the LAMal health insurance premium for cross-border workers

Unlike the French system, where health insurance premiums are calculated on the basis of your income, the Swiss system takes a different approach. In Switzerland, premiums do not depend on your income but are based exclusively on three factors:

- Your choice of health insurance company.

- Your age, or more precisely, your date of birth.

- The inclusion or exclusion of accident cover.

This method may seem unusual to those who have only known the French system. In Switzerland, the health sector is made up of numerous insurance companies which, depending on their financial situation, can offer different rates to their customers.

LAMal insurance premiums by company

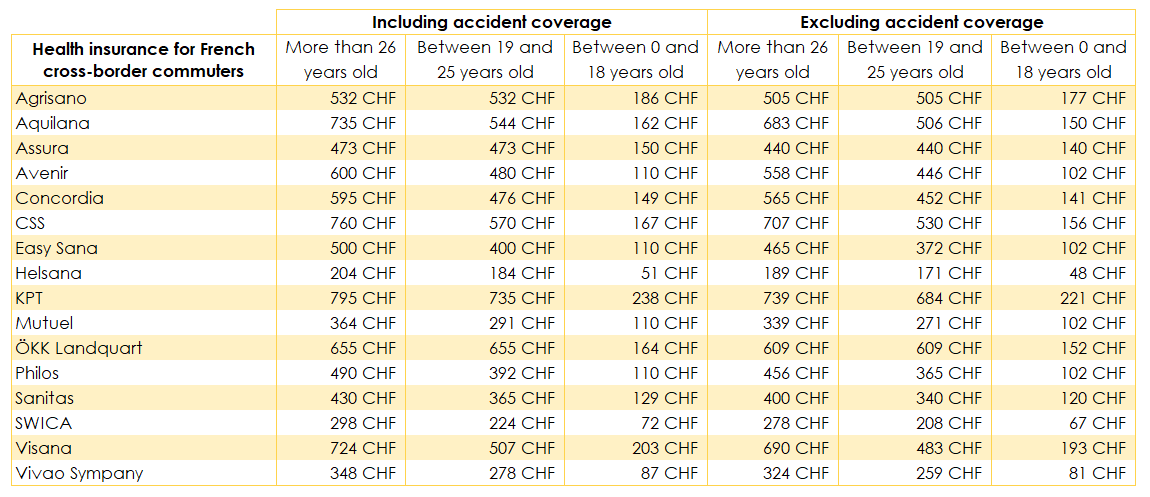

If you decide to opt for the Swiss health system, you will have to choose which health insurer will cover your health. In 2024, there are 16 possible insurances.

Another thing that may seem counter-intuitive at first glance is that in Switzerland, although several health insurers can offer you their services, they will not all offer the same prices, as you can see from the table above. However, all Swiss health insurers offer the same cover!

Your age range

In Switzerland, each insurance company adjusts its rates according to its costs and income, which can lead to significant price variations from one year to the next. However, there is another determining factor in setting the price of your insurance premium: your age. The older you are, the higher the premium.

For frontaliers there are three price categories per insurance. They exclusively depend on your age:

- Range 1 : Children until 18 years old

- Range 2 : From 19 to 25 years old

- Range 3 : From 25 years old onwards

As you probably understood the higher your age range, the higher your contributions will be.

The only question remaining is how to make a decision.

Inclusion or exclusion of accident insurance

Medical cover in Switzerland is unique in that there are two types of medical expenses:

- Those related to illness (all expenses not related to an accident).

- Those related to an accident.

When you choose your insurance, you have the option of covering illness only, or illness and accident.

How do I decide whether to include accident insurance in my health insurance?

The answer is quite simple. If you work full-time (more than 8 hours a week), your employer already covers accident insurance. You will therefore only need to take out sickness insurance. However, if you are a student or have dependent children who are also covered by Swiss health insurance (LAMal), they will have to take out insurance that includes accident cover. Sounds simple, doesn’t it?

How to make the right decision

You probably understood that in terms of care and reimbursements, you cannot go wrong. Unlike the French social system, the Swiss health system makes it mandatory for every insurer to offer the same level of service.

However, prices being different, as a general rule, the best choice is the insurance offering the best rates…

Well yes, of course… But how do we know which one is the best rate?

You have to compare prices!

And remember, taking out an insurance does not mean you have to stay there for life! Each year you will have the option to start over with the process and choose a new health insurance company.

be careful, do not mix things up.

Choosing a new insurer does not mean changing health systems. Once you are affiliated to the LAMal, you will not be allowed to go to the CMU as you please.