Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 16th 2024.

Frontalier CMU: Functioning, Cover and Cost

I’m willing to bet that you’re about to change your life (or at least radically change your job). Going from a working life in France to a new job in Switzerland means asking yourself a few questions, and one of them is: should you join the Swiss health insurance scheme – LAMal – or opt for the French social security scheme – CMU.

In this article, we’ll take the time to give you as much information as possible about French social security – CMU.

Once you have considered this first option, take the time to learn more about Swiss health insurance.

The line-up:

What is the CMU?

CMU Is the abbreviation for universal healthcare. It is the French health insurance system to which you can subscribe as a frontalier to benefit from a certain level of care in Switzerland and in France.

Choice of insurance system: What is a right of option?

This right of option is not always well explained (or at least understood). To put it simply, as soon as you start working in Switzerland, you must choose Swiss health insurance from among the dozens of recognised insurers within 90 days. However, for cross-border workers, Switzerland has signed agreements with these countries that allow cross-border workers not to take out insurance in Switzerland and to remain affiliated to their previous insurance system.

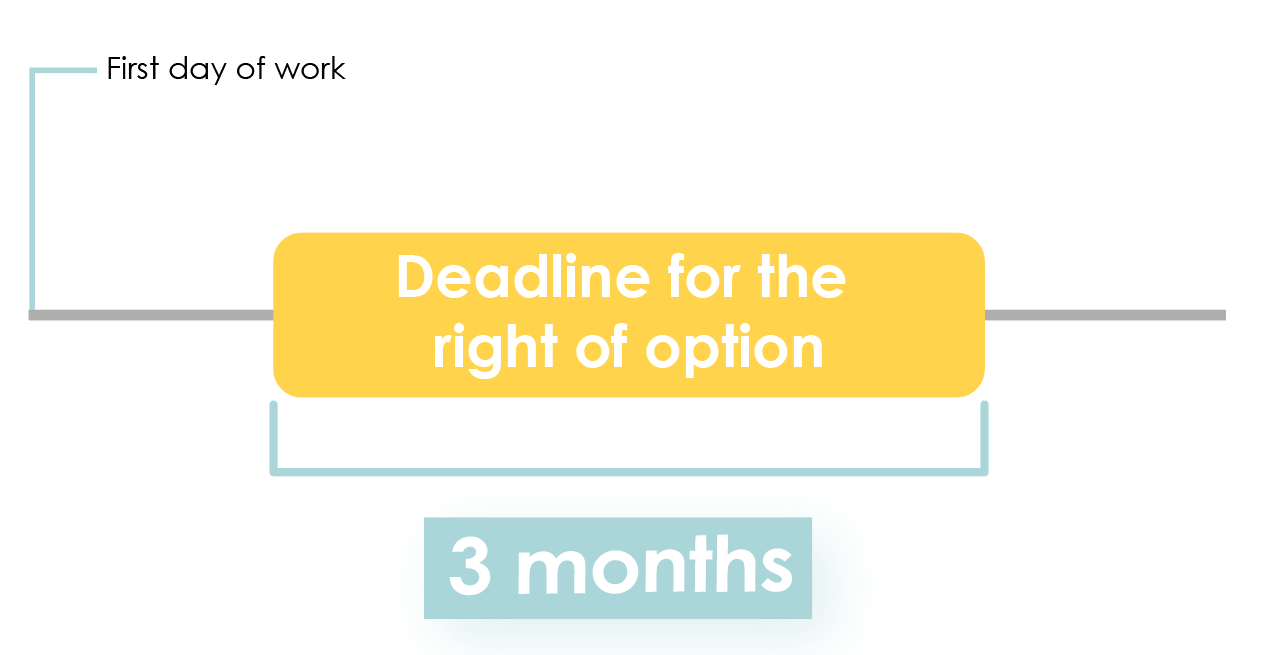

The right of option refers to the period of 3 months from your 1st day of work during which you have the option of not joining the Swiss health insurance scheme and opting for the CMU.

If, like many of our French and cross-border workers clients, you wish to remain affiliated to the French social security system, you will find here the form to fill in.

You can choose but you have to choose quickly.

What happens if I miss the option deadline?

If the deadline has passed, Switzerland will automatically register with a Swiss health insurance company, selecting an insurer according to its own criteria. It is important to note that the choice of insurer will not necessarily take account of the competitiveness of the insurance premiums.

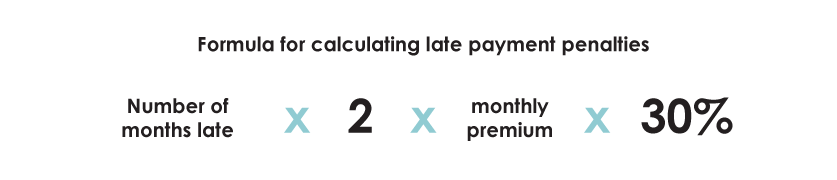

What’s more, if the delay is significant, the insurance company may have no qualms about imposing substantial late payment penalties. Here’s how the penalty might be calculated:

- Step 1: Take the number of months overdue and multiply by 2.

- Step 2: Take the monthly premium from the insurer with whom you were affiliated.

- Step 3: Then multiply the first two steps by 30%.

Can I go back on my choice and change health systems?

Between the CMU and the LAMal, you not only have to choose quickly, but you also have to choose well. Your decision is final. Non revokable. No turning back possible.

Well… there are however two exceptions:

Moving to Switzerland

You live in France and move to Switzerland. If you are affiliated to the CMU, the law requires that you subscribe to the LAMal. The opposite is not possible.

Unemployment benefit

You receive unemployment benefits. You have 90 days, starting from your first day of unemployment, to choose between the CMU and the LAMal, regardless of your previous affiliation.

Is my partner covered by my CMU insurance?

If you subscribe to the CMU, your partner is considered as a beneficiary. They enjoy the same protection as you do.

If your partner also works in Switzerland, they can however subscribe to the LAMal if they want to.

Are my children covered by my CMU insurance?

If one of the parents is covered by the CMU, the children are also covered by the CMU without any additional contribution.

However, if both parents are covered by the LAMal, then your children will also have to take out Swiss health insurance. The Swiss insurance will require an additional premium per child (less costly than that of the adults).

When I am covered by the CMU, what happens in case I require care?

You can choose between getting treated in France or in Switzerland. In each case, to get the maximal refund, you will have to choose a general practitioner to serve as first contact person.

Is it best to get treated in Switzerland or in France? The answer depends on the situation.

In non urgent medical situations

France determined a fixed rate for each type of medical service. The full list is available on the website Ameli :

Your right to reimbursement is based on this price list.

Imagine that your visit to the doctor costs you €25. If the fixed price mentioned on the website Ameli.fr is €25, you are entitled to the maximum reimbursement: 70% of the bill.

Be careful: the CMU does not take into account the price differences between France and Switzerland. The bill from a medical visit in Switzerland will greatly exceed the 25€. But you will be reimbursed 70% of the 25 euros fixed by the French authorities.

The rest will come out of your pocket.

The CMU cover is shorts in case of non-urgent health problems.

If your condition requires specific medical knowledge or equipment that is not available in Switzerland yet, you can ask for a derogation in order to get treated at the Primary Sickness Insurance Fund (CPAM).

Urgent medical situation

In case you have an urgent health problem, it is simpler: the CMU covers the costs, whether you are in Switzerland or in France. Phew!

What happens in case of unemployment if I am affiliated to the CMU?

If you lose your job, you are no longer covered by the CMU or by the LAMal, but rather by the French social security system.

What happens in case of termination of employment contracts?

In this case as well, if you live in France but no longer work in Switzerland, you will not be covered by the CMU or the LAMal anymore.

Compared to those of the LAMal, what are the advantages of the CMU?

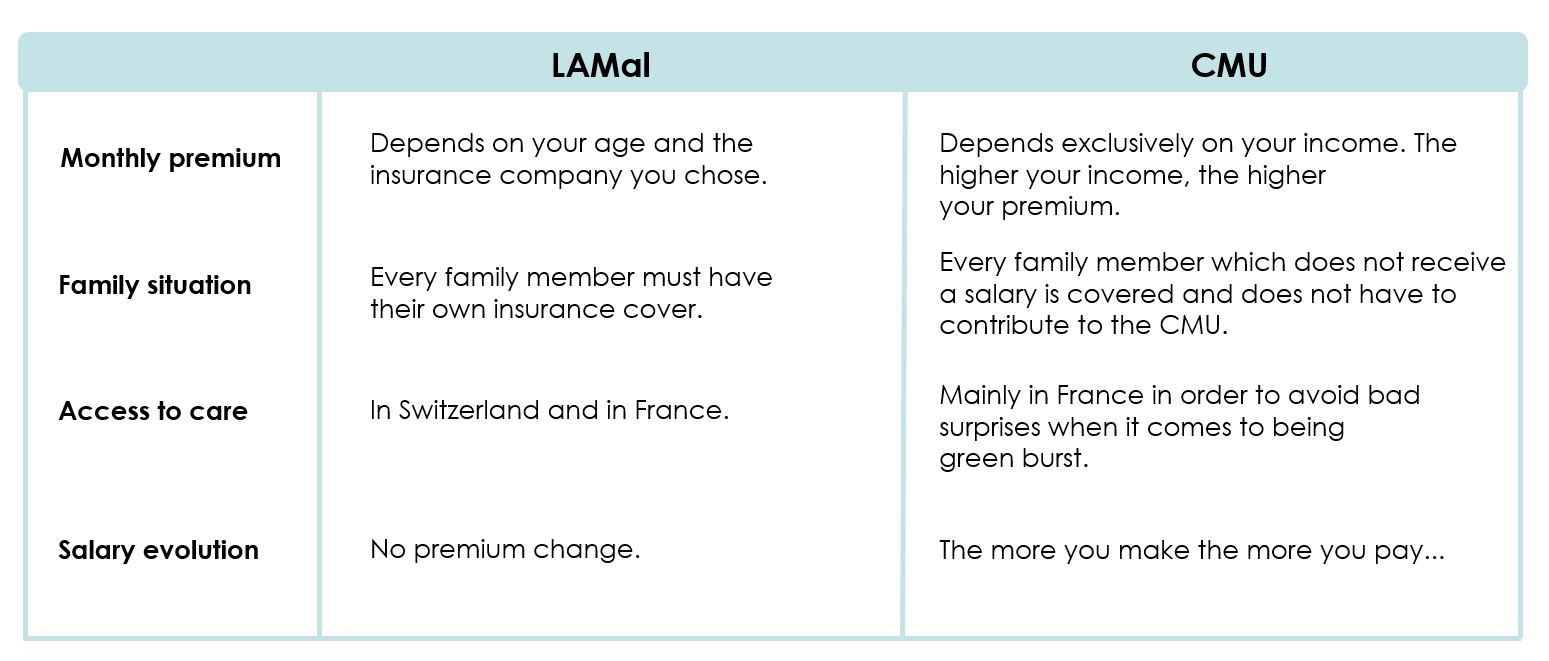

Here is a comparative table which sums up the main characteristics of being insured with the LAMal on the left and with the CMU on the right:

In short, being affiliated to the CMU is advantageous in case of a modest salary and if you intend to keep receiving care in France.

Pay attention, the calculation of your CMU contributions is based on an 8% rate, which might increase in the coming years. In Switzerland, contributions are not based on a rate. They are stable and even tend to decrease.

How much does the CMU cost?

Unlike the Swiss system, which sets a fixed annual premium, the CMU is just like taxes: the more you make, the more you pay.

If you want to know the exact amount of your (potential) future CMU premiums, I prepared an article explaining in a simple and easy way how to calculate it.

Tips and advice on the French security system: The CMU

Tip no. 1: As quickly as possible, as slowly as necessary

Here’s a motto to keep in mind when thinking about the CMU and the Swiss system. Even if the 90-day deadline seems relatively short, there’s nothing to stop you thinking about it before the entitlement starts to run. In principle, people compare the premiums for the two systems and opt for the cheaper one. Which is logical. But what people don’t take into account is changes in their situation: higher salaries, a growing family, and so on. These days, there are a number of sites like ours, experts and even a government department that can help you understand this choice better and make it with full knowledge of the facts. Be patient and get informed.

Tip no. 2: Hidden contributions

In principle, the CMU is calculated on your income, so most of our customers have taken their salary and made a quick comparison between the LAMal and the CMU. However, what some people may not be aware of is that other income, known as “exceptional” income, could be added to this salary and cause your contributions to skyrocket (annuities and pensions, withdrawal of capital from the 2nd pillar, withdrawal of capital from the 2nd pillar, etc.). It’s important to look ahead and consider all the income that could later come into CMU contributions.