Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 16th 2024.

Frontalier CMU: calculate your premium precisely

At FBKConseils, we have devoted an entire section of our website to helping cross-border workers settle in Switzerland. In addition to information on tax and pensions, we have published several articles dedicated to your first important decision, often underestimated but essential from the start of your career in Switzerland: the choice of your health insurance system.

In principle, the default system in Switzerland is Swiss health insurance, with the famous LAMal. However, thanks to an agreement between the Swiss and French governments, cross-border workers can opt out of this rule and remain affiliated to the French social security system, the CMU.

This article will not go into detail about how the CMU system works, but will focus mainly on calculating your annual premium. We invite you to take the time to read our other articles on the Swiss system so that you can (hopefully) make an informed choice.

The line-up:

The CMU: A premium proportional to your income

By the time you get to this page, you’ve probably always worked in France and may soon be considering whether working across the border might be more advantageous. If so, you’re probably not used to comparing the cost of your health insurance, because in France the rules are the same for everyone: the state sets the prices. These are set unanimously and are based exclusively on your reference tax income (RFR); the more you earn, the higher the cost of your health insurance cover. By choosing to remain voluntarily affiliated to the French system, you retain this logic.

CMU – How can I calculate my annual premium in 2024?

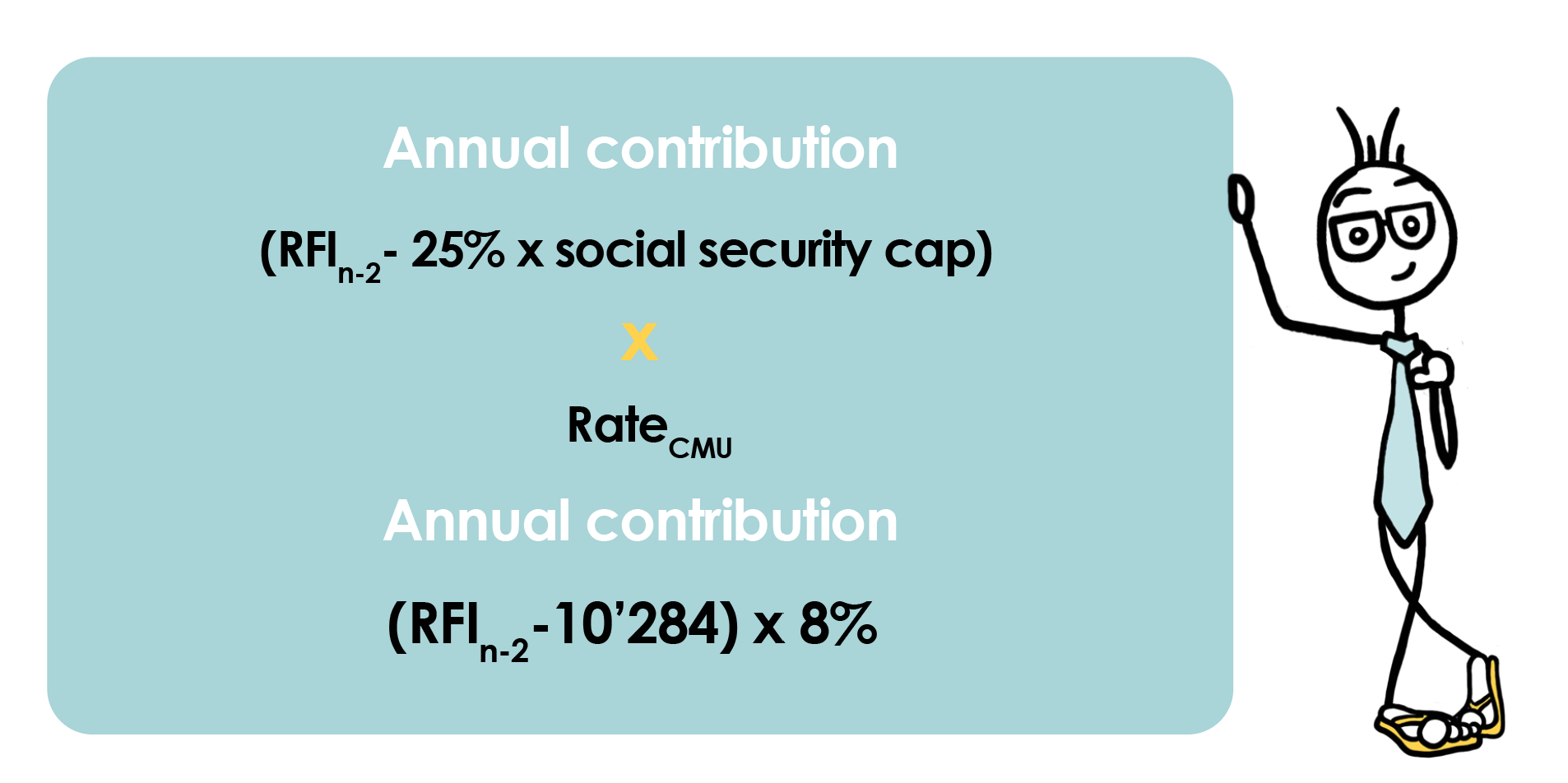

I suggest presenting this little calculation directly and then taking the time to go through it step by step:

It is made up of 3 easy-to-find numbers:

- The reference tax income for the year N -2 (in other words, for 2024 we need to look at the figure for 2022).

- The social security cap for the year in question, i.e. 10,284 in 2024.

- The CMU contribution rate (which may vary from one year to the next).

Follow the guide.

Stage 1: Find your Reference Fiscal Income

Your is indicated on your tax declaration.

The little “-2” on the formula simply specifies that it is your income of the penultimate year.

Which is logical. Are you calculating for the year 2024? In this case you look at your tax declaration of 2023, which reflects what you made in 2022.

So it is the Reference Fiscal Income of 2022 which is taken into accounts to calculate your contributions for the year 2024.

Got it? Very well, then you can move to stage 2 without reading the rest of this first stage.

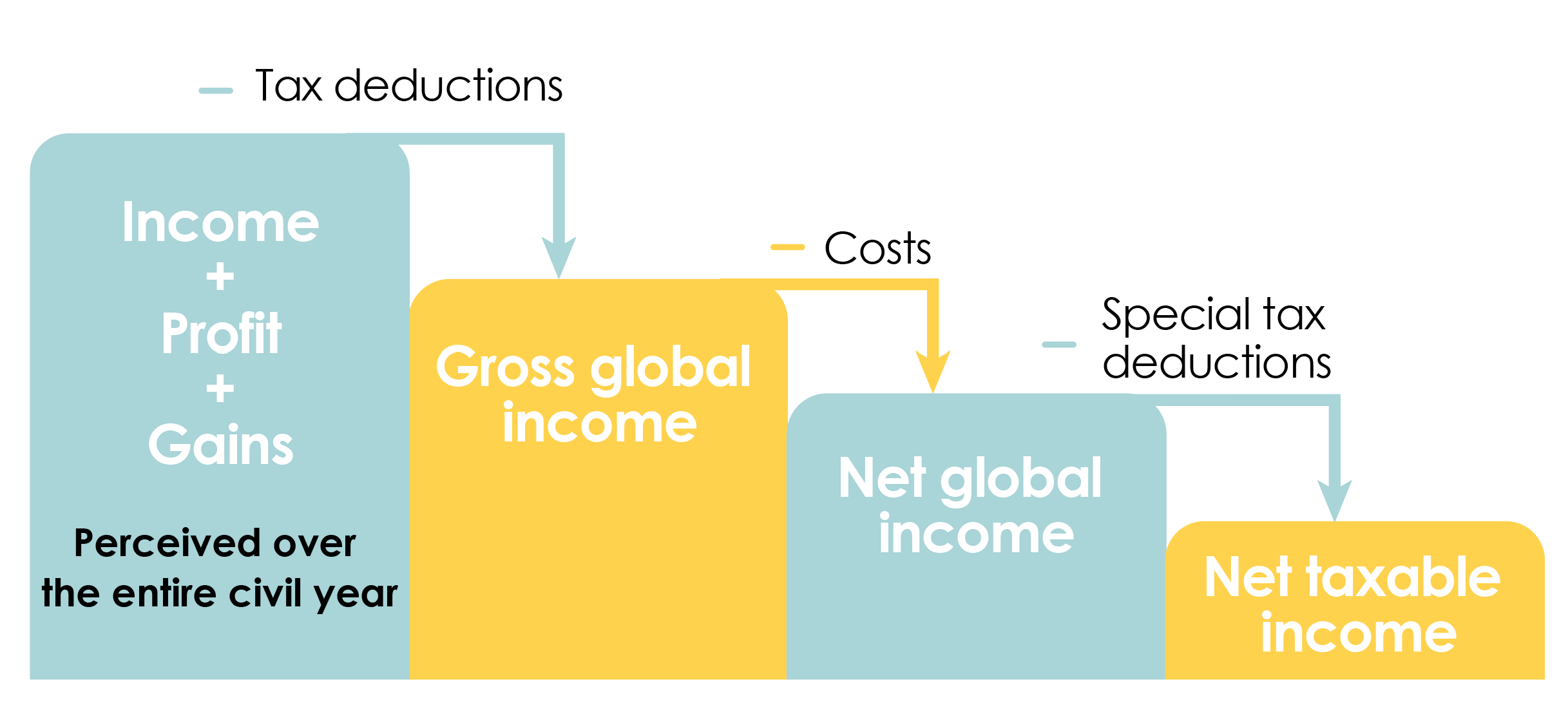

If you still do not grasp how this functions, you can calculate your Reference Fiscal Income based on your taxable next net income.

- Tax deductions: fixed (10% of your income) or actual professional costs;

- Costs: retirement planning or alimonies paid;

- Special tax deductions: regarding elder people or people with disabilities.

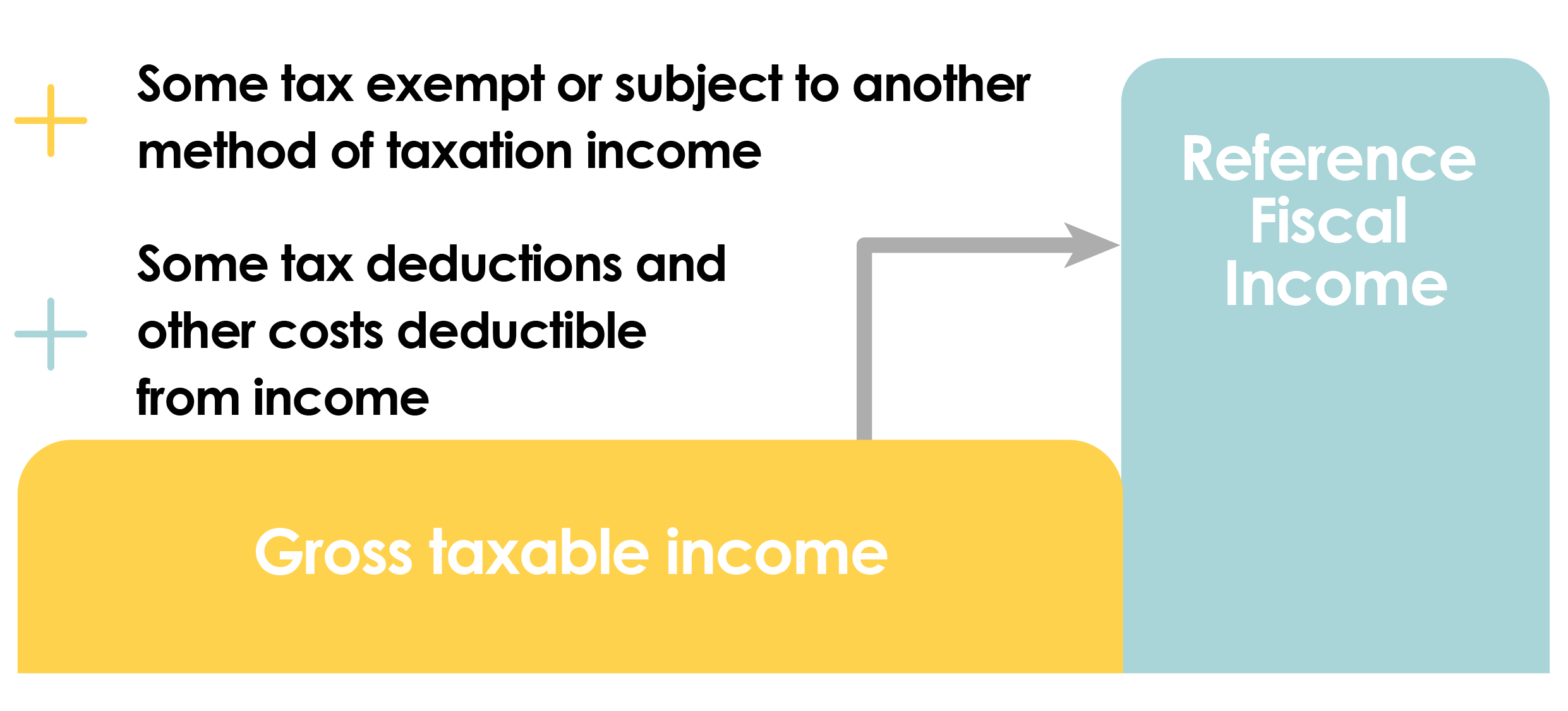

To go from the taxable net income to the Reference Fiscal Income, you must add to the former…

- Tax exempt income or subject to another method of taxation: income from movable capital, capital of Swiss retirement planning second and third pillars;

- Special tax deductions such as dividends.

Stage 2: calculate the 25% current cap of Social Security

The annual cap of Social Security is determined each year on 1 January by the French relevant authorities.

The number is easy to find by looking it up on Google

In 2022, it was :41,136 euros.

In 2023, it was 43,992 euros.

In 2024 it is: 46,368 euros.

25% of this cap, is 1/4, which means you have to divide the cap by 4. Which gives us 10,284 € for 2022.

Be careful: make sure to take the most recent number. Most broker websites wrote their articles a long time ago and did not take the time to update the information. Here is a link to the article published and updated by the French government.

Stage 3: Take the CMU contribution rate

the CMU contribution rate is also fixed by French authorities. Currently it is of 8% for 2024.

Here too, before calculating make sure the rate is up to date.

All you have left to do is to calculate.

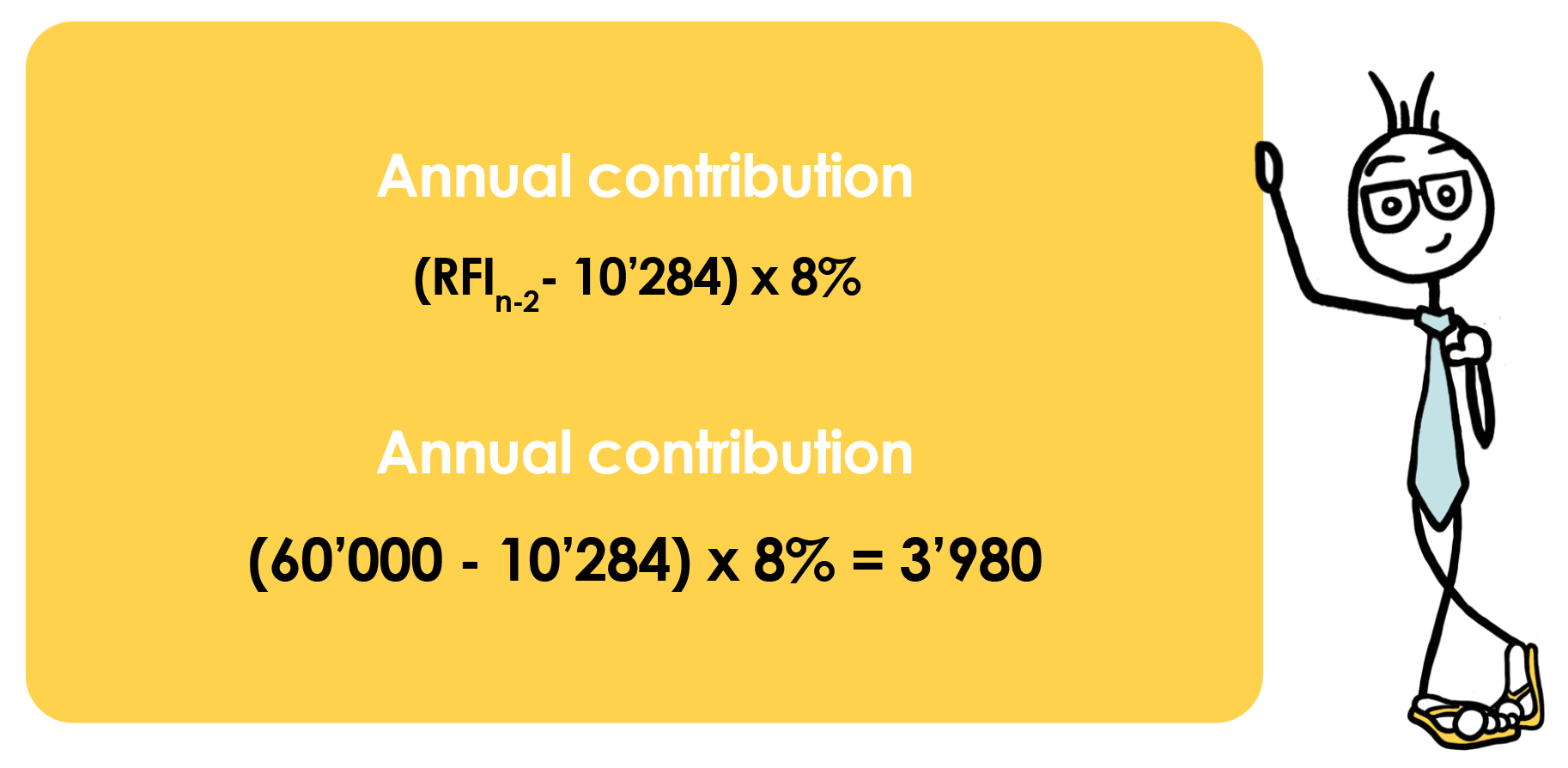

Let’s take the formula from the start.

Annual contribution = (RFI -2 –25% x social security cap) x 8% (CMU rate)

Let’s imagine your reference fiscal income is 60,000 € for 2022 (which is n-2).

In this case, to calculate your annual CMU frontaliers premium, just proceed as follows….

(60,000 – 10,284) x 8% = 3,977,30€.

Which amounts to 331,45 € per month.

CMU – A choice with far-reaching consequences

If you have taken the time to read our article on the CMU and how it works, you now know that this choice is ‘almost’ definitive. No matter how your life, your career or your needs change, you will remain affiliated to the CMU and you will have to pay these premiums.

Tips and advice for cross-border workers and their choice between CMU and LAMal

Tip no. 1: Knowledge is power

At FBKConseils, our permanent recommendation, whatever the financial decision to be made, is: take your time, there’s no rush!The more you try to rush things, the more you risk making the wrong decisions. This is particularly true of your choice of health insurance, which could have irreversible consequences. Although the deadline for exercising your right of option is relatively short – only 3 months – there’s nothing to stop you from finding out all you can before you start the process. Document yourself, plan a meeting with an expert and, above all, ask your questions to other frontier workers who have already gone through this process.

Tip no. 2: Be aware of other income affecting your reference tax revenue

Beware of other income affecting your reference tax income: Our experience with cross-border workers has shown us that few people take into account the factors influencing their reference tax income. As a result, most people think only of their salary. However, other forms of income, known as ‘exceptional’ income, such as pension withdrawals, bonuses or premiums, can also increase your RTI and, by extension, your contributions.