The pillar 3A as a frontalier : is it a good or bad thing?

Updated on January, 19th 2024.

If you work in Switzerland, you have probably heard of the pillar 3A also called private retirement planning or private pension.

In this article, we will do everything in our power for you to get a precise idea of what a pillar 3A is, its goal, its advantages as well as its disadvantages and finally, for you to be able to, with full knowledge of the facts, decide whether to use or not this tax-deductible saving.

The pillar 3A: what is its goal and how does it work?

In the articles explaining how second pillar (LPP) and first pillar pensions are calculated, you probably notice that through the OASI / AHV and the LPP, the Swiss system hard to ensure its population and income equivalent to 60% of its last incomes.

In reality, the said 60% are almost never reached for various reasons and therefore Switzerland created a last tool to ensure a more comfortable retirement: the pillar 3A also called private retirement planning or private pension.

It is the only free component of your retirement. You decide whether yes or no and when you want to start saving it.

The pillar 3: a powerful fiscal tool

To make it easier let’s say the third pillar is a savings account which can be opened either with a bank or an insurance.

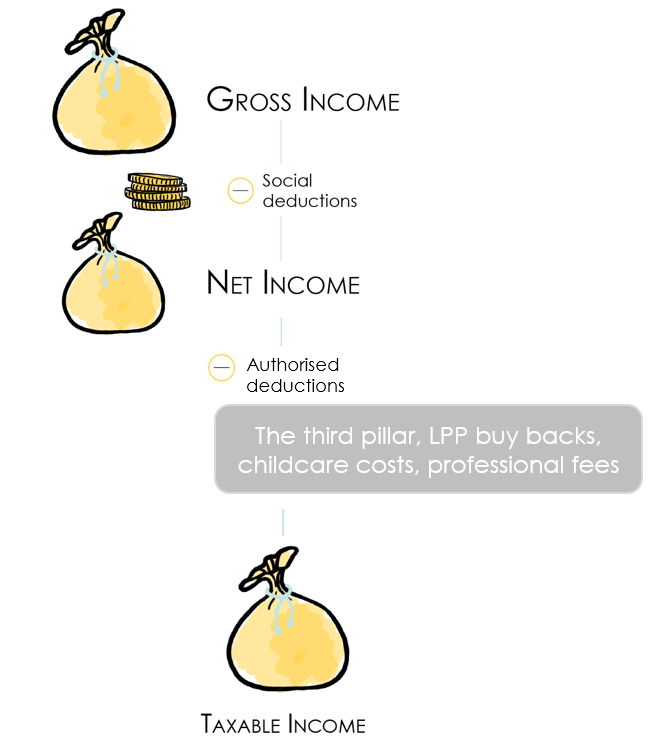

All of the payments made can be deducted from your taxable income and thereby reduce your taxes (please read the following carefully to ensure that your contributions are deductible, particularly in the section entitled 3rd pillar: is it always a good solution?).

Be careful: until 2021, everyone taxed at source whether they lived in Switzerland or abroad could, if their income was taxed in Switzerland, ask for a simple rectification of their taxation at source of the previous year in order to deduct, amongst others, pillar 3A contributions.

If you wish to continue to deduct your contributions and every other deduction previously accepted, you must go through a subsequent standard taxation.

The third pillar: how much can I deduct from my pillar 3?

Now that you understood that the goal of the pillar 3 was to save money for your old days, it is worth having a look at the amounts you can save while taking advantage of the deductibility of your 3A account.

What is the minimum I can deduct from my 3A?

The law does not impose a rule concerning the minimum deductible. You can, if you wish to, never contributes to the third pillar.

However, some insurances may require a monthly minimum before accepting that you open an account with their institution

What is the maximum I can deduct from my 3A?

While there is no minimum, there is a maximum allowed. You can deduct a maximum of 7,056 CHF (in 2023 and 2024) per civil year from your income if you are an employed person and a maximum of 35,280 CHF if you are self-employed, or 20% of your income.

The third pillar: is it always a good solution?

Until 2021, we would have always told you YES, it is a good thing to save on this kind of product, why? For two reasons:

- saving is always a good idea;

- everything you put in your pillar 3 is no longer text.

Of course, some products are more interesting than others: better returns, more security, less costs, etc.

But as a general rule it is unlikely for it to be a bad idea.

In 2021, everything changes! You will no longer be able to use a simple rectification in order to deduct your pillar 3. You now have to use a subsequent standard taxation.

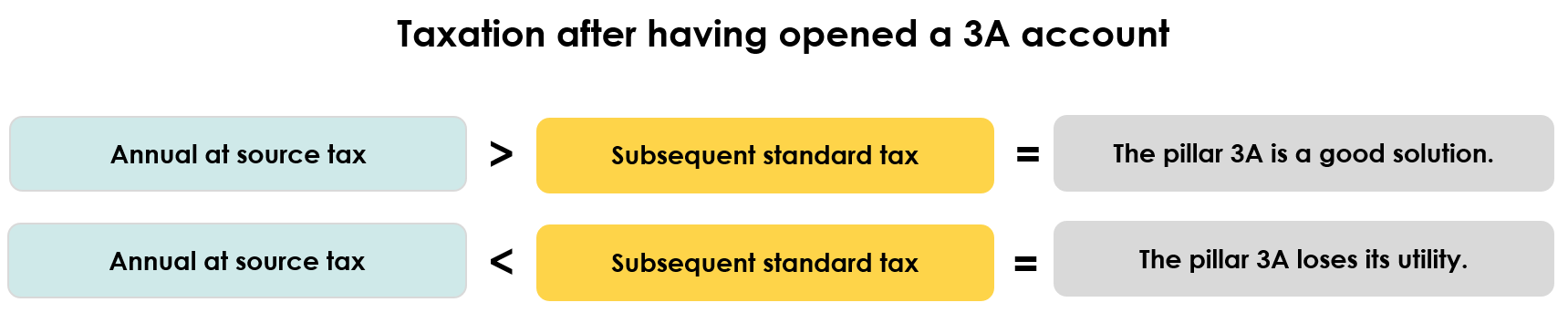

How is this different? You will no longer be subject to the rules and scales of taxation at source but rather to the Swiss scales, which are not always more generous

Before jumping in head first, you should simulate the taxes you would pay without this subsequent standard taxation. Then, do the same exercise with the subsequent standard taxation. If the taxation at source is lower than the Swiss taxes, then opening a pillar 3 becomes pointless.

What you need to understand is that as long as you are taxed at source without going through the regular tax system at a later date, no deductions will be accepted. Withholding tax already includes the main deductions. The only way to claim deductions is to file a Swiss tax return.

The pillar 3A: where can a frontalier open a 3A account?

Most brokerage agencies and their brokers offer pillar three solutions at insurances to their clients. They even claim that few insurances still offer this option and that if you do not rush to open an account today, you may not be able to do it tomorrow. But is this really the case?

The pillar 3A at an insurance

It is true that today, only a few insurances still accept to offer their pillar 3A products to frontalier clients. But does this mean that opening an account with them is a good idea? This question is more complicated and must be answered on a case-by-case basis. As each product is very different from one another.

In order to understand whether and insurance product is a good solution, one should take the time to breakdown the offer:

- What part of my investments goes to savings?

- How much are the risks I am insuring costing me?

- What returns were made during the previous years?

- What are the repurchasing values?

- Can I keep my pillar 3 if I leave Switzerland?

All these questions and terminologies were addressed in another article: “Pillar 3A at the bank or an insurance, what is the best choice?”

The pillar 3A at a bank?

Interestingly, this simple solution appears to be less common than the one offered by insurance is. Yet, it does come with significant advantages.

A pillar 3A at a bank is a bank account, nothing more nothing less. It works exactly the same as a savings account. Once opened, you can invest your money as you please without needing to pay the same amount each month, you can leave Switzerland with your investments whenever you want, without risking to lose the repurchasing values.

In conclusion, a pillar 3A at a bank is a savings account blocked until the end of your activity in Switzerland or, at the earliest, until one of the five scenarios occur.

Discover our new online platform to entrust us with your tax return!

Complete your 2023 tax return online!

In the blink of an eye!