Written by Yanis Kharchafi

Written by Yanis KharchafiSubsequent Ordinary Taxation (TOU) in Switzerland for individuals subject to withholding tax

Welcome to this article dedicated to Swiss residents subject to withholding tax or those who have not yet obtained a long-term residence permit (Permit C).

Today, we’ll dive into a fascinating fiscal topic: Subsequent Ordinary Taxation (TOU). This mechanism can, in certain circumstances, require some taxpayers to declare their taxes through the ordinary system, despite having taxes automatically withheld at source. In other cases, TOU can be voluntarily requested, offering an opportunity to recover part of the tax already paid.

Sounds interesting, doesn’t it? Yes, but be cautious: while TOU offers advantages for some, it can quickly become complex and lead to costly mistakes. So, stay focused as we break down this topic step by step.

P.S.: This article might also be of interest to cross-border workers taxed at source, such as those working in Geneva. To avoid mixing situations, we’ve written a specific article on the status of quasi-residents.

The line-up:

What is subsequent standard taxation (TOU)?

Let’s start at the beginning: Subsequent Ordinary Taxation (TOU). Let’s break down its name for better understanding:

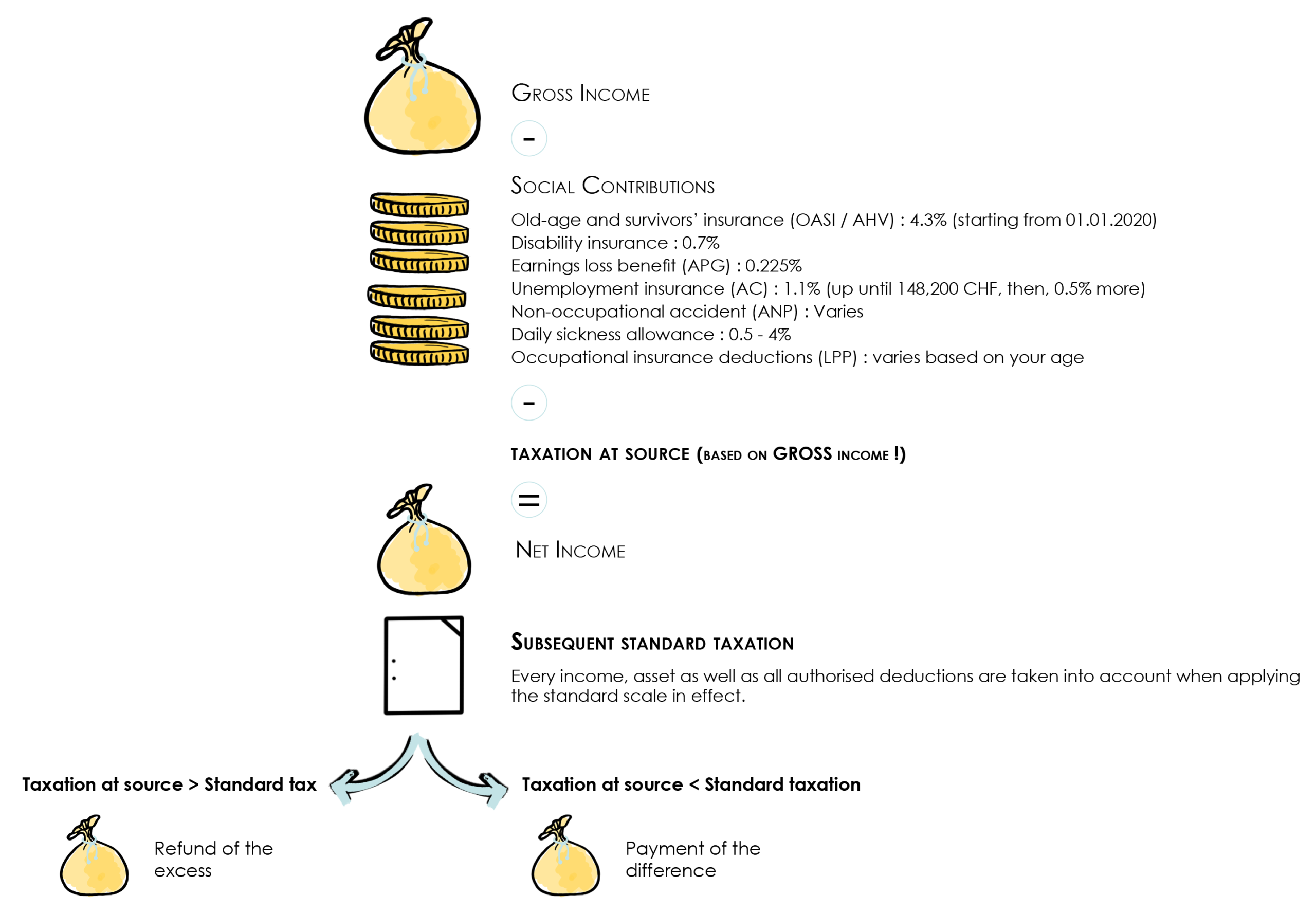

- Ordinary Taxation: This means your taxes will be calculated under the standard system of tax declaration, similar to Swiss residents or holders of a Permit C.

- Subsequent: This indicates that the taxation occurs retroactively, after an initial withholding at the source.

In simple terms, even if you are already taxed monthly through withholding directly from your salary, TOU allows (or in some cases requires) your taxes to be recalculated under the rules of ordinary taxation. This approach adjusts the tax amount withheld at source to reflect your actual personal and family circumstances.

In other words, TOU is a standard Swiss tax declaration process, applicable to certain individuals already subject to withholding tax. Its purpose is to fine-tune your tax obligations to accurately account for your income, deductions, and any specific circumstances.

What is the purpose of Subsequent Ordinary Taxation (TOU)?

Subsequent Ordinary Taxation serves two main purposes:

- To ensure that the Swiss government does not lose tax revenue.

- To guarantee equal treatment between taxpayers subject to withholding tax and those filing an ordinary tax declaration (Swiss residents or Permit C holders).

Purpose 1: Preventing tax revenue loss

You might think that withholding tax covers all your tax obligations, and that once deductions are made from your salary, your fiscal responsibilities are settled. Plot twist—nope, not always!

Withholding tax applies only to income from employment (and certain pension or compensation payments). However, other taxable elements, such as:

- Income from renting out real estate,

- Income from self-employment,

- Or taxable assets,

are not included in the withholding tax and therefore remain untaxed.

This means that if you have additional sources of income or a specific financial situation, withholding tax might not fully cover your tax liability. TOU addresses this by allowing the tax authorities to incorporate these elements into the overall calculation, ensuring no revenue is lost for the government.

Purpose 2: Ensuring equal treatment between taxpayers

Unlike the first objective, this one aims to protect the rights of taxpayers. Indeed, when you are taxed at source, no specific deductions are taken into account. The rate applied is fixed, regardless of your actual expenses. This means you cannot deduct costs such as:

- Transportation expenses,

- Contributions to a 3rd pillar pension plan,

- Childcare costs,

- Or significant medical expenses.

In contrast, a Swiss taxpayer or a Permit C holder who is subject to the ordinary tax declaration can benefit from these deductions to reduce their taxable income and, consequently, their tax liability.

The result? An obvious inequality between those taxed at source and those subject to ordinary taxation. For example, someone with many deductions could end up paying much less tax under the ordinary system than if they remain under withholding tax.

The Solution?

To restore this balance, subsequent ordinary taxation (TOU) allows individuals subject to withholding tax to voluntarily file an ordinary tax return to reflect their true situation. This gives them the opportunity to correct any overpayment of tax by including all possible deductions.

In summary, TOU ensures that all taxpayers, whether taxed at source or not, have the same fiscal rights, provided they follow the necessary procedures.

Small clarification: The subsequent ordinary taxation (TOU) will never allow you to avoid the withholding tax but will instead help determine whether there is a difference between the ordinary tax assessment and the amount withheld at source.

If a difference is found, your tax liability will be adjusted to match the ordinary tax amount.

- If the withholding tax is too low, you will need to pay the difference.

- If the withholding tax paid is too high, you will be refunded the difference.

First piece of advice: If you are not required to do so, do not request subsequent ordinary taxation unless you have first simulated the outcome. It is not uncommon for the withholding tax to be preferable to the ordinary tax assessment (despite what some may say).nd a Swiss person or a person with a type C residence permit, taxed according to the standard procedure.

Swiss resident : when am I concerned with the subsequent standard taxation (TOU)?

The question is not whether you can file a request, as all Swiss residents subject to withholding tax can, but rather whether you are required to do so or if it is simply an option.

Mandatory Subsequent Ordinary Taxation (TOU)

- Always remember that Switzerland is a federal country where each canton has some fiscal autonomy. This means that rules can vary slightly from one canton to another, which can sometimes cause confusion, especially if you live or work in areas with different tax practices.

- Income: Your individual income, whether you are married or not, exceeds CHF 120,000 gross per year.

- Fortune: You have taxable wealth in your canton of residence.

- Vaud: CHF 58,000 for a single person, and CHF 116,000 for a married couple or registered partnership (in 2024).

- Geneva: CHF 86,833 for a single person, double for a married couple or registered partnership (CHF 173,666), plus CHF 43,417 per child (in 2024).

- Valais: CHF 30,000 for a single person without children and double (CHF 60,000) for a married couple, registered partnership, or single-parent families.

- Income not subject to withholding tax: If you have income that is not subject to withholding tax, such as: widowed pensions, income from self-employment, rental income, etc.

In some cases, the complete absence of income may also require you to file a tax return.

Furthermore, for married couples, if one of the two needs to undergo subsequent ordinary taxation (TOU), then the entire household will have to comply with this rule, and this will apply for life (or at least until a definitive departure from Switzerland).

Since we’re talking about marriage, let’s also address the issue of divorce: if your future ex-spouse eventually requests a divorce, the law will require both ex-spouses to continue undergoing TOU.

Optional or Voluntary Subsequent Ordinary Taxation (TOU)

If you do not meet any of the four conditions outlined above, good news: the Swiss Confederation allows you to voluntarily request subsequent ordinary taxation (TOU). This gives you the opportunity to recalculate your taxes based on your actual situation and potentially recover a portion of the taxes paid at the source.

Is a subsequent standard taxation (TOU) necessarily better than being taxed at source?

This is a legitimate question, but there is no universal answer. Although many advisors seem to believe that TOU (subsequent ordinary taxation) is always the ideal solution for taxpayers subject to source taxation, this is far from being true!

Here’s what you need to understand:

The source tax rates are not applied randomly. They have been carefully designed to reflect a standard situation, incorporating average deductions that an “average” person would be entitled to (e.g., transport costs, meals, social security contributions, etc.). Therefore, in many cases, taxpayers subject to source taxation are not necessarily at a disadvantage compared to those filing an ordinary tax return.

Believing that TOU is always advantageous because you contribute to a third pillar or have pursued further education could lead to unpleasant surprises.

How can you avoid these surprises? Here are the factors you need to consider:

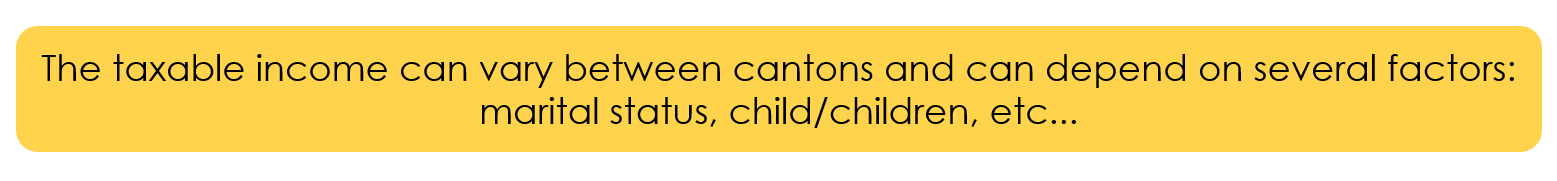

Your commune of residence

As you probably already know, in Switzerland, cantons and communes have a fair amount of freedom when it comes to taxation. They determine scales and deductions authorised for themselves.

This freedom will have a direct impact on the amount of taxes you will have to pay.

Your deductions

This is undoubtedly the most important point. Deductions are the kryptonites of taxes.

Depending on your expenses and your lifestyle, you will be able make a number of deductions, which will significantly affect your tax burden.

1 – Deductions taken directly off your salary (mandatory)

- Social deductions (AHV / OASI, LPP, accident insurance, etc…)

2 – Authorised deductions (optional)

- Professional deductions : Professional expenses, dual activity of the spouse, etc…

- Private provisions (pillar 3A)

- Mortgage rates

- Health insurances (sometimes, they are capped)

- LPP repurchases

- Transportations costs

- Meal expenses

- Etc…

Once your taxable income is determined, you will have a clear and precise view of the impact that ordinary taxation would have on your tax burden. The more deductions you can claim, the more advantageous TOU could become.

However, be cautious: once you have filed for TOU, it will be required every year. If your deductions decrease over time, the tax benefit could disappear.

Your arrival date in Switzerland

It may come as a surprise, but your arrival date in Switzerland can significantly influence the outcome of your subsequent ordinary taxation (TOU). This phenomenon, known as the “annualization of income and expenses,” plays a crucial role in calculating your tax burden.

Annualization: What is it?

In Switzerland, when your tax period is shorter than a full year (for example, if you arrive mid-year), the tax authorities must establish two things:

- Which income is taxable in Switzerland?

This generally includes income earned from your date of arrival in Switzerland. - What would your theoretical annual income have been?

To determine the tax rate applicable to your taxable income in Switzerland, the tax authorities “annualize” your income. This means they calculate what you would have theoretically earned if you had worked the entire year at the same rate. This rate is then applied to the actual income you earned in Switzerland.

Concrete Example:

Let’s say you arrived in Switzerland on December 1st and earned CHF 5,000 between December 1st and 31st.

- Your taxable income in Switzerland will be CHF 5,000.

- However, to determine the applicable tax rate, the authorities assume you would have earned CHF 5,000 x 12 = CHF 60,000 over the course of a full year. This rate is then applied to your actual CHF 5,000 income.

In principle, this same annualization principle should apply to the calculation of withholding tax, but based on our experience, the result is almost always more favorable when it comes to withholding tax.

An example is worth a thousand words : must Zoé really do a subsequent standard taxation?

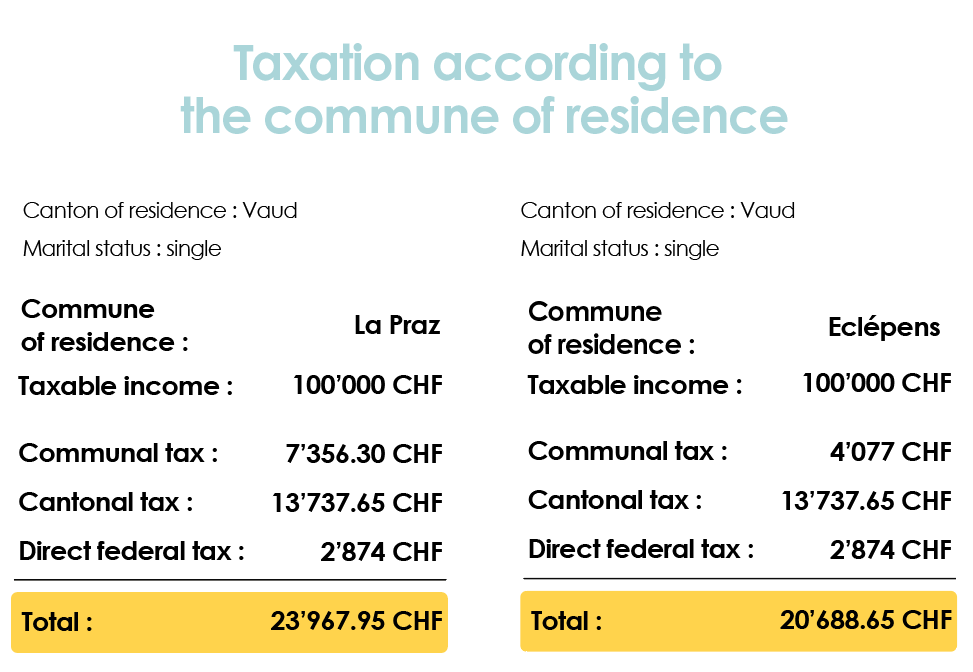

Case 1 : Zoé with a pillar 3A + travel expenses + meal expenses

In the following example, we will look at the case of Zoé when she arrived to Lausanne on 1st January 2024.

Those were the good old days, she was 27 years old, had a great job paid 60,000 CHF per year and, opened a pillar 3A account, on which she had saved 4,000 CHF.

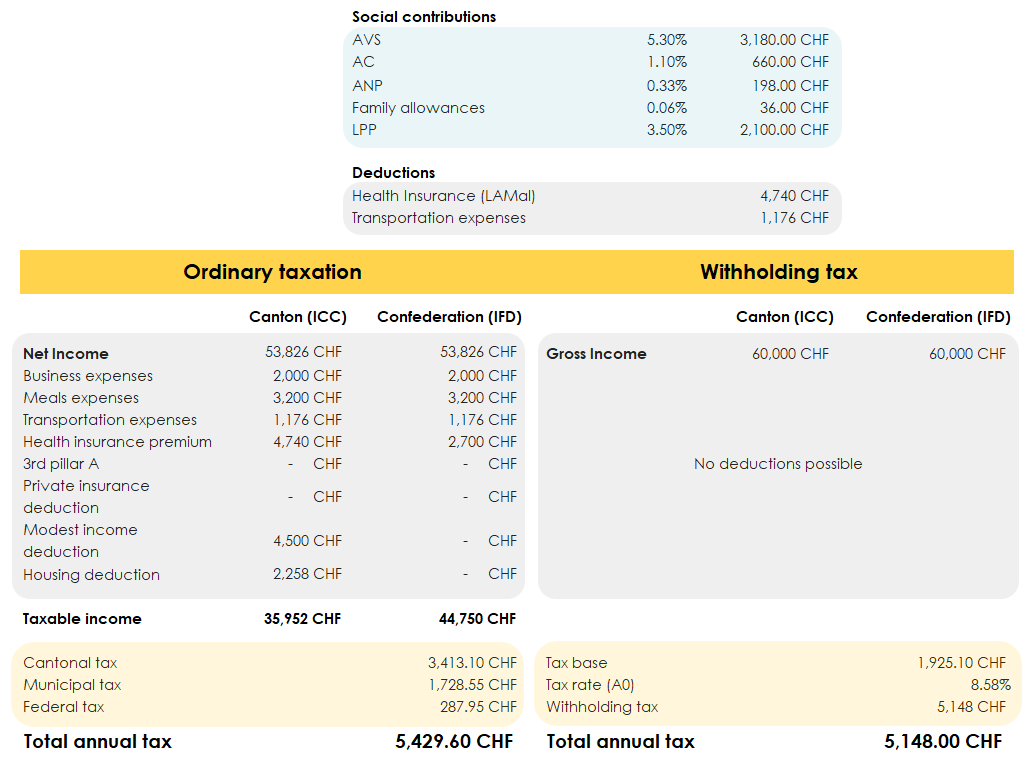

In this example, it is clear that Zoé has a strong incentive to apply for ordinary taxation (TOU). Through this process, she could save more than CHF 2,050 on her tax liability. However, it is crucial to keep in mind that every situation is unique, and this example cannot be generalized.

What this example shows us:

Zoé, who resides in Lausanne, was able to maximize her tax deductions thanks to mechanisms specific to her canton, including social deductions for housing or for low-income taxpayers. These benefits are not necessarily available in other French-speaking cantons.

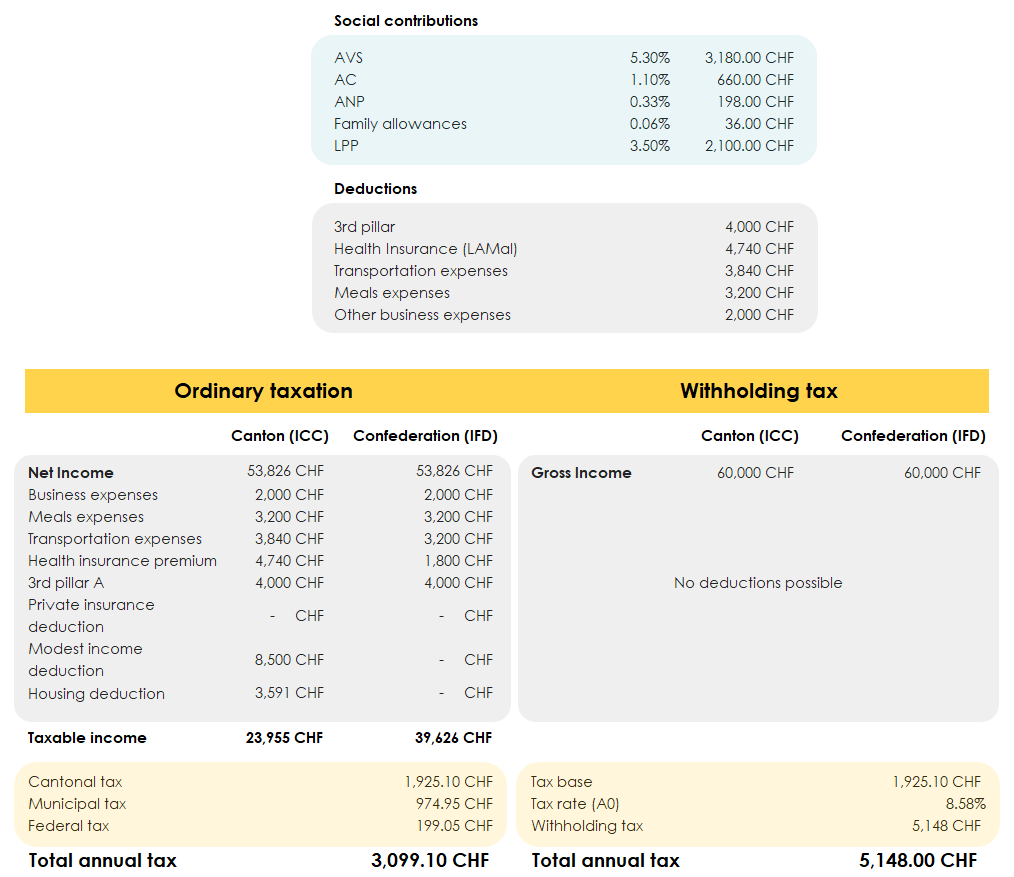

Case 2 : Zoé without a single deduction except for those granted off the bat because she worked remotely because of Covid!

In this second scenario, Zoé would be well advised to think twice before requesting an ordinary subsequent taxation (TOU). Not only would she waste time with this process, but she could also risk seeing her tax burden increase.

Yet, in this example, Zoé still benefits from certain social deductions, although they are reduced compared to the first case. If her income had been higher, these deductions could have disappeared entirely, widening the gap between the withholding tax system and ordinary taxation. In that case, the loss would have been even greater.

Documents and Legal Sources

Before we conclude this article and present our services, let’s take a moment to provide you with the essential links that will help you put everything you’ve learned here into practice. These resources will allow you to tailor the information to your specific situation.

We have divided these documents and sources into three subsections based on your canton of residence. Choose the one that applies to you to access the necessary information and forms.

- Ordinary taxation for residents of Vaud:

- For the Canton of Geneva:

- Explanations from the canton and useful links: Link

- For our dear residents of Valais:

How FBKConseils Can Assist You with Your Ordinary Taxation (TOU)?

At FBKConseils, we understand that the ordinary taxation (TOU) process can sometimes be a tax headache. Our mission is to make this process as simple and beneficial as possible for you. Here’s how we can assist you:

A Free Consultation Appointment

We believe that everyone deserves clear answers to their tax questions. That’s why, in 2025, we continue to offer a first consultation free of charge, lasting 15 to 30 minutes.

- This appointment is an opportunity to discuss your specific situation.

- You’ll get to know who we are, how we work, and how we can assist you with your tax procedures.

TOU Simulation

If you’re unsure whether to request an ordinary taxation (TOU), we can perform an accurate simulation of its impact on your tax situation.

- This simulation will help you know in advance if a TOU request could be beneficial.

- In the case of an optional request, we ensure that the TOU is genuinely advantageous and potentially results in a tax refund.

Our goal is to help you avoid any unpleasant surprises and guide you in making the best decision.

Preparing Your Tax Return

Whether TOU is a requirement or a voluntary choice, we can help you prepare and submit your tax return:

- Step-by-step assistance:

- We work hand-in-hand with you to teach you how to fill out your tax return.

- This option is ideal if you want to become more independent while still receiving professional support.

- Full-service handling:

- You send us your documents, and we take care of everything: data entry, calculations, and submission to the tax authorities.

- We also respond to any requests for supporting documents or questions from the tax administration, and we assist you in case of disputes or appeals.