Accounting and Tax services for SMEs and Freelancers

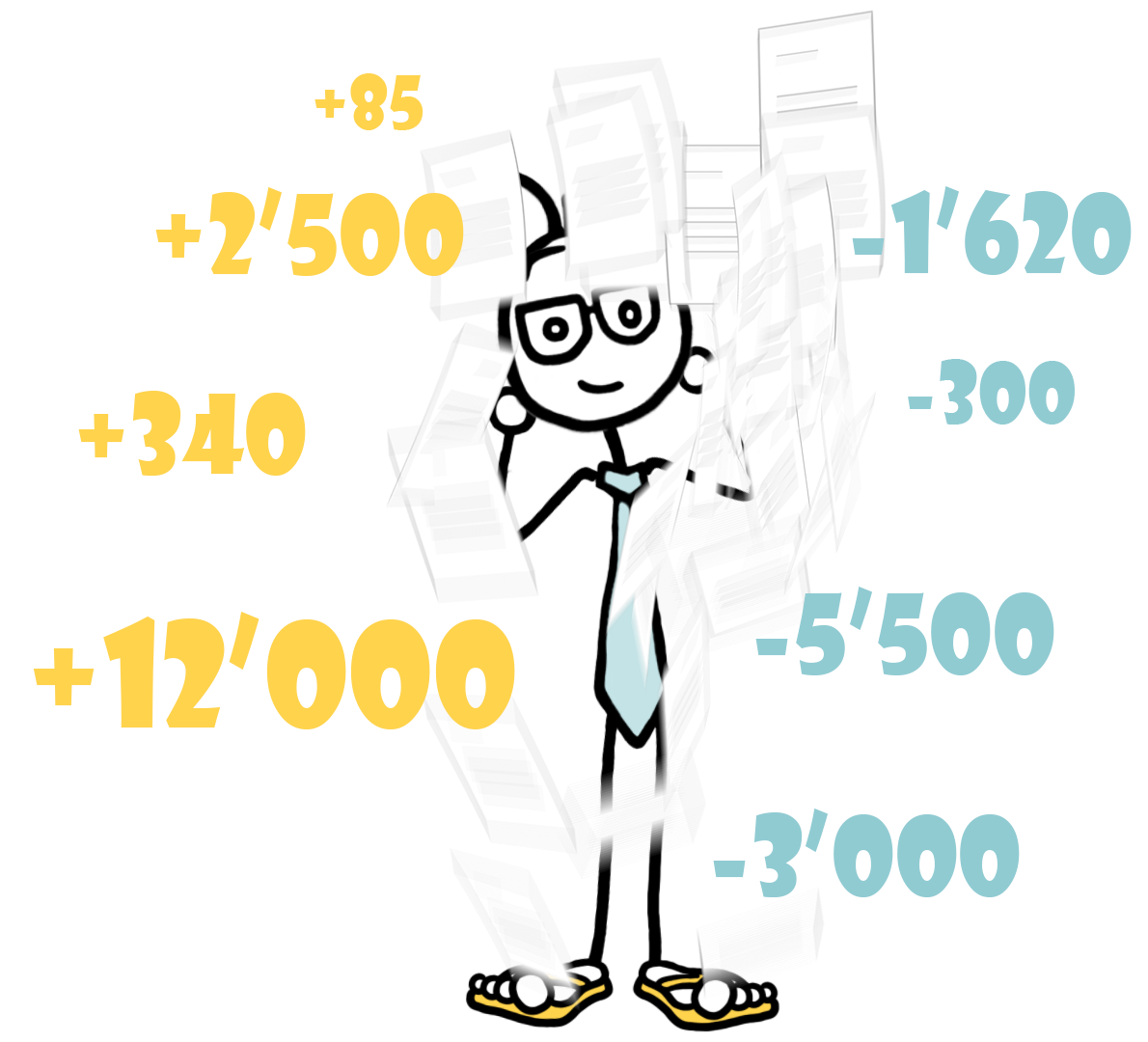

Being an entrepreneur means juggling growth, team management, quality… and accounting and tax obligations. Essential, but time-consuming tasks.

At FBKConseils, we offer to outsource these aspects so you can save time, reduce errors, and focus on growing your business. We handle your monthly accounting, payroll, VAT returns, and all year-end closing procedures.

Why choose FBKConseils?

At FBKConseils, all our account managers are trained according to Swiss fiduciary standards. Our team is not only professional but also passionate about what we do.

A Fiduciary dedicated to SMEs and Freelancers

Unlike many Swiss fiduciaries that mainly focus on large corporations, we chose to dedicate our expertise to small and medium-sized businesses. Our clients are self-employed professionals and SMEs in French-speaking Switzerland, often made up of a dozen employees. We speak their language and understand their daily challenges.

Tailored accounting solutions

Every business has its own way of operating. Whether you already have an internal accountant, use a specific software, or prefer to simply drop your documents at our office, we adapt to your workflow.

We can take care of your entire accounting, from bookkeeping to year-end closing statements, or simply review and validate your work if you prefer to keep part of it in-house.

Transparent and fair pricing

Transparency is at the heart of our approach. That’s why we offer an online quote tool, giving you an instant personalized estimate based on objective criteria: turnover, number of employees, type of activity.

At FBKConseils, we reject vague or arbitrary fees. Our prices reflect the actual workload, nothing more.

A human and responsive service

Behind the numbers are people and projects. We take the time to explain accounting and tax issues so you can understand every step.

By choosing FBKConseils, you work with a dedicated, passionate, and approachable team that combines professional rigor with clear explanations.

Our accounting and tax services for SMEs and Freelancers

Choose the package that best fits your needs and book a free appointment, online or at our offices, to get started.

- The price is based on your turnover, industry, VAT status, and the number of employees in your company.

- The price is based on the same criteria as full outsourcing, as well as your accounting skill level.

- To lower costs, we can also provide accounting training.

They already trust us.

Unlike in France, Swiss law does not require you to use a certified accountant. You can legally keep your own books or entrust them to a trusted person, provided your accounting complies with the Swiss Code of Obligations and tax rules. If you are comfortable with numbers and your business is simple, this is entirely possible. At FBKConseils, we know many entrepreneurs prefer to start on their own. That’s why we also offer a review service, where we check your accounts and correct errors, especially useful in the early years.

In theory, this isn’t ideal: anyone who has ever taken over existing accounts knows how difficult it can be to correct or continue someone else’s work. That said, at FBKConseils, we always stay flexible. If your needs change mid-year, we’ll discuss it and find the best solution. Our priority is to make your life easier, not harder.

It depends on the type of error. If a bank or investor finds an inconsistency, your credibility may suffer and jeopardize financing or partnerships. If the tax authorities discover it, consequences can be serious: tax reassessments, interest, or even fines in cases of suspected fraud. Either way, “not knowing the law” is not a valid excuse.

Many small businesses start with Excel or Numbers. Legally, no specific software is required. However, Swiss law distinguishes between:

In theory, Excel works. In practice, it lacks integrated charts of accounts, automations, and increases the risk of errors. What saves time at first often becomes costly later.

In Switzerland, the offer is broad and prices vary. At FBKConseils, we use Odoo, Bexio, and Banana:

The right choice depends on your budget, needs, and level of autonomy.

Swiss law requires accounts to be kept “accurately and continuously.” In practice:

This makes monthly bookkeeping essential in most cases. For some self-employed individuals without VAT or employees, annual bookkeeping may be possible, but it’s risky and error-prone.

Not necessarily. Many fiduciaries simply take your documents and declare them “as is.” Accounting itself leaves little room for interpretation. At FBKConseils, we believe real tax optimization happens before year-end, through strategic decisions: salary vs. dividends, employee vs. freelancer status, VAT regime, asset depreciation, etc. That’s why we guide and inform our clients early, so they can make the right choices at the right time.

When you entrust us with your accounting, we take full professional responsibility. This means we ensure the accuracy of your reports and handle communication with authorities if audited. However, by law, the final responsibility always remains with the client. Working with a serious fiduciary like FBKConseils greatly reduces risks of errors or disputes.

Yes, and fortunately. Today, accounting can be managed entirely paperless with scanned or electronic documents. This saves time and improves efficiency. At FBKConseils, we adapt to each client: some prefer physical document drop-off, others want full digitalization. The key is that all accounting records must be kept for at least 10 years, regardless of format.