Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on September, 18th 2025.

Starting a Business in Switzerland: The 3 key steps to get started

Introduction

I’m delighted to have you back for this new article, which is part of our ongoing commitment to provide you with clear, practical, and in-depth content on the fascinating world of entrepreneurship in Switzerland. Whether you’re considering starting out as a sole proprietor or creating a legal entity, our goal is to guide you through every stage of your journey.

This time, it’s not about comparing the benefits of being self-employed with those of running a small company. Instead, let’s start from a clear assumption: you’ve already thought it through, run the simulations, and made your decision. You’re ready to take the plunge and set up a Public Limited Company (SA) or a Limited Liability Company (Sàrl).

In the next few minutes, we’ll walk through the entire process of setting up a company in Switzerland, step by step. At each stage, we’ll explain the procedures to follow, the expected timelines, and the associated costs, so that you know exactly what to expect.

And here’s a little bonus: if you’re still hesitating between an SA and an Sàrl, you’ll find a clear comparison of the differences, pros, and cons of each at the end of this article. But for now, let’s focus on what remains the same, whichever legal structure you choose.

So, without further ado, let’s dive into this exciting entrepreneurial journey together. Let’s go!

Step 1: Understanding what it means to create an SA or an Sàrl in Switzerland

Before diving into the concrete steps, it’s important to set a few foundations regarding the functioning of capital companies in Switzerland. Without this context, you might not fully grasp the meaning of the steps we’ll cover next. Don’t worry—this is not a full lecture on SME accounting or taxation (we have other articles for that). The idea here is simply to summarize the key points in two minutes.

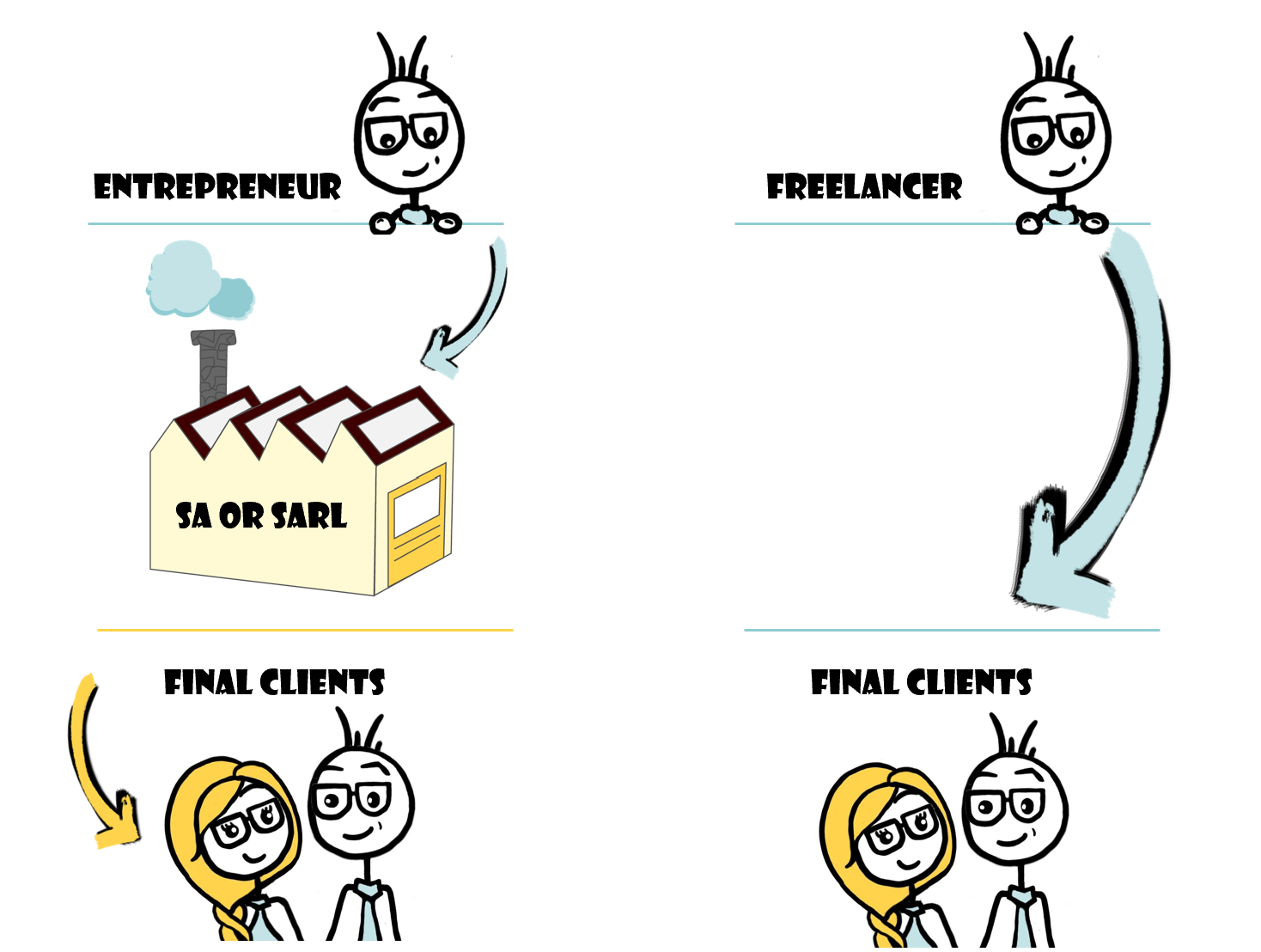

When you decide not to operate as a sole proprietor but instead to create a legal entity whether an SA or an Sàrl you’re choosing to build a legal wall between yourself and your business. This means that you, as a natural person, and your company, as a legal entity, are two separate entities in the eyes of the law, particularly when it comes to:

- Social security contributions

- Legal liability

- Taxes

In other words, your company has its own legal identity, which means that it can enter into contracts, own property, be sued, or pay its own expenses. And like any autonomous entity, it must be managed by clearly defined individuals who are responsible for ensuring its proper functioning in accordance with Swiss law.

Who are the key people in a Swiss SME?

When creating a company and throughout its existence a business in Switzerland relies on several governing bodies, each with a specific role and defined responsibilities. In smaller structures, these functions can sometimes be combined by the same person, but they must never be confused.

In the case of an SA (Corporation) or an Sàrl (Limited Liability Company), here are the main groups of people involved:

- Shareholders (SA) or Partners (Sàrl): the owners of the company, holding the share capital.

- Board Members (SA) or Managers (Sàrl): those responsible for the day-to-day management of the company and for making strategic and operational decisions.

- The Auditor (Revisory body): the individual or firm appointed to review and audit the accounts, unless an opt-out is possible and formally decided.

- Employees: not part of the governing bodies, but they play an essential operational role in the company’s activities.

To avoid getting lost in legal details, keep this simple rule in mind:

No matter the type or size of the company, two governing bodies must be defined from the very beginning:

- The ownership body (shareholder or partner)

- The management body (board member or manager)

The owners of an SME in Switzerland: Shareholders or Partners

To put it simply, the owners of a company called shareholders in an SA or partners in an Sàrl are the people who invest money upfront in exchange for shares or equity that grant them ownership rights in the business. These titles can gain value (capital gains), be resold, or entitle the holder to a share of the profits if the company performs well. In this case, we talk about dividends, not salary important distinction!

The compensation of owners is neither fixed nor guaranteed: it depends entirely on the company’s results and on the collective decision of the other partners or shareholders.

What is the role of Shareholders or Partners?

The role of the owners, defined in Articles 998 and following of the Swiss Code of Obligations, is first and foremost to finance the company and assume its economic risk. In return, they hold the highest authority within the company through the general meeting. This body is responsible for:

- Electing the people in charge of management (directors or managers),

- Approving the annual accounts,

- Deciding how to allocate profits (reinvestment or distribution),

- And, in times of difficulty, making major decisions, such as restructuring or liquidation.

Who can become the owner of a company in Switzerland?

The answer is simple: absolutely anyone. Shares or equity can be held either by:

- Individuals (like you or me),

- Or other companies (legal entities such as FBKConseils).

There is no requirement to be Swiss or even to reside in Switzerland. Foreigners can fully own a Swiss company, with no restrictions on nationality or place of residence.

Directors or Managers of an SME in Switzerland

Let’s now move on to the second category of key people in a company: the executives. These are the individuals elected by the general meeting, appointed to manage the company’s day-to-day operations and implement the strategy defined by the owners. In a corporation (SA), they are called directors and form the board of directors; in a limited liability company (Sàrl), they are referred to as managers.

What is the role of Directors?

As their name suggests, the role of executives is to direct, administer, and represent the company. This includes:

- Signing contracts,

- Managing teams,

- Handling relationships with banks and insurance providers,

- More broadly, all legal and administrative tasks,

- Implementing the vision of the owners.

In larger organizations, management can be delegated to a Chief Executive Officer (CEO). However, in most small businesses, the board of directors and management are often embodied by the same person.

What are the responsibilities of Directors?

In principle, directors or managers have an executive role: they implement the decisions made by the owners. But this mission comes with significant legal responsibilities. In the event of financial difficulties, it is their duty to act quickly, notify the relevant authorities, and even initiate liquidation proceedings if necessary.

And be careful: even if they are not owners, executives can be held personally liable, especially if the company fails to pay its social security contributions (AVS, LPP, etc.). This is why taking on a management role in Switzerland is a serious commitment.

In return, executives may be compensated in different ways:

- Profit shares: a portion of the profit, often allocated to members of the board of directors,

- Attendance fees: remuneration for participating in strategic meetings,

- A salary: in cases where the person is also actively involved in day-to-day management.

Who can become a Director or Manager?

Only natural persons can hold these positions companies cannot manage other companies. In addition, Swiss law imposes an important rule: every Swiss company must have at least one executive with signing authority who is domiciled in Switzerland.

If you are a cross-border worker or live abroad, you will therefore need to appoint a trusted person residing in Switzerland to take on this role; otherwise, the creation of your company will not be authorized.

The audit body: Auditors in Swiss companies

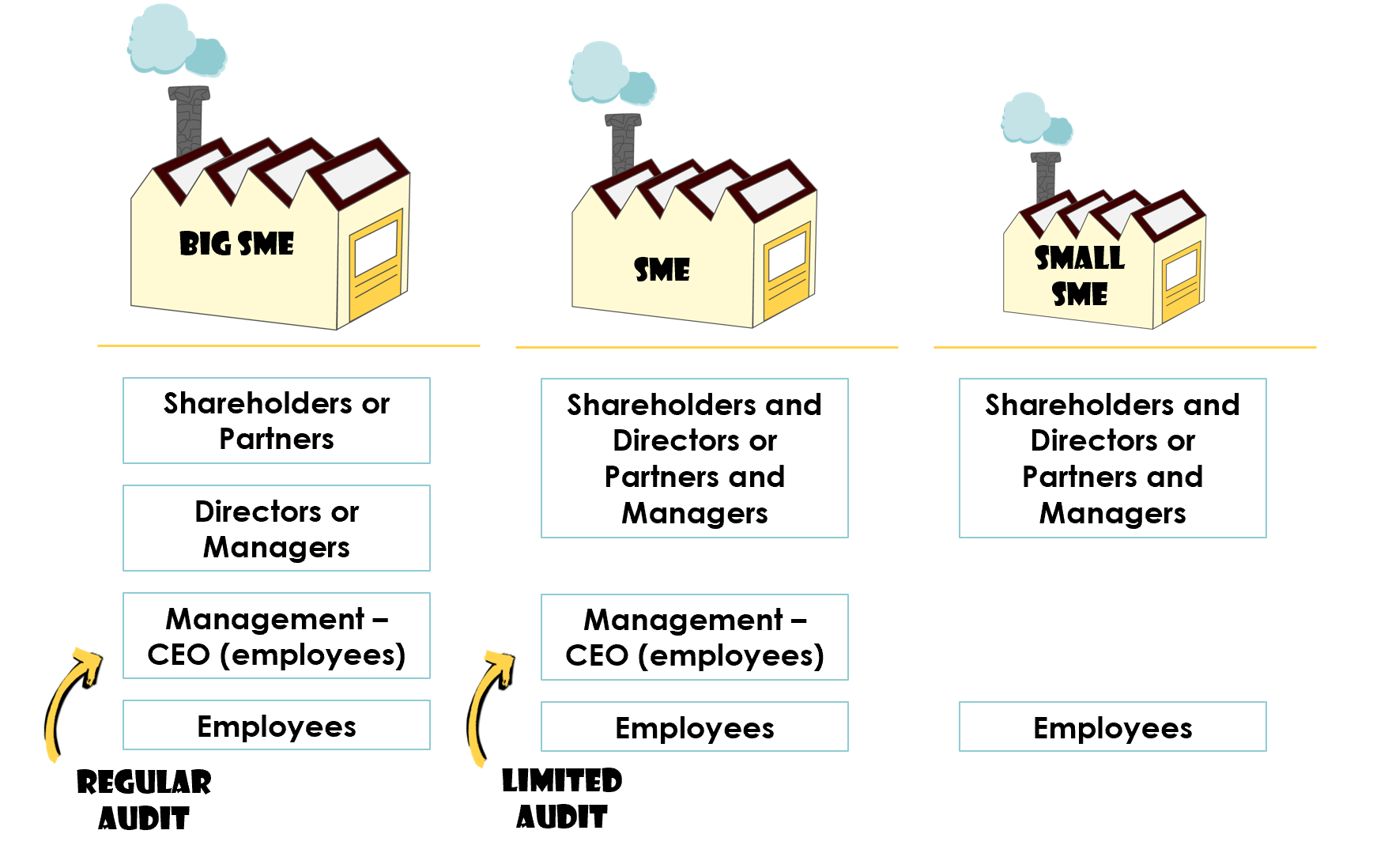

I won’t go into too much detail here, because for all small companies (less than 10 full-time equivalent employees), Switzerland offers a welcome option under Article 727a (CO) to be exempt from an audit thanks to the procedure called “opting-out”. If your company grows and exceeds this threshold, congratulations! That’s great news, but be aware that, as in many other countries, Switzerland then requires your accounting to be regularly reviewed by an external person to ensure reliability and transparency.

In Switzerland, two types of audits are possible:

- Limited audit (light check): Article 727a CO

- Ordinary audit (comprehensive check): Article 727 CO

The first type, which I like to call the “chill audit,” involves a review by a certified auditor who will check that all declared accounting entries are consistent, justified, and supported by appropriate documentation. The goal? That at the end of the review, the auditor can simply confirm that no obvious errors were found in the accounts. And if any errors are detected, they will be clearly listed in the report, so that anyone accessing your accounts can easily see them.

The second type of audit is much more thorough. It follows the same basic principle as the limited audit, but goes much further. This time, the auditor has the responsibility not only to check your accounting entries but also to actively verify the existence and accuracy of the transactions themselves. They have the right (and even the duty) to contact your clients, suppliers, or other third parties involved, to ensure that all invoices and transactions exactly match reality. Here, it’s no longer enough to say: “At first glance, everything seems fine.” The goal is far more ambitious: to certify, after a thorough investigation, that your accounts are completely reliable and reflect the actual economic situation of your company.

Let’s be honest, auditing isn’t the most exciting topic in the world, and it’s not really the focus of this article. Even I, who have a very good friend who is an auditor, prefer to avoid thinking about it whenever possible! Just remember: as long as your company does not exceed certain regulatory thresholds, you won’t need to worry about this additional administrative requirement.

And because you’ve taken the time to carefully read through this long introduction on how a company operates in Switzerland, here’s a small visual summary to help you easily synthesize everything we’ve covered:

The 4 steps to start your business in Switzerland

Here we are at last! The theoretical part is now behind us, and you have all the necessary information to understand the next steps. Let’s now move on to the practical steps so you can quickly and efficiently launch your business.

A small clarification: in the lines below, I’ve grouped several distinct points under the same “Step 1”, simply because these tasks are generally carried out simultaneously, in the same place, and with the same contacts.

Step 1.1 – Define your company name

When you decide to start a business, it often begins with a strong idea. But very quickly, an essential question arises: what will you call your company?

Legally, you must meet two main criteria to choose a valid name:

- A unique and distinctive name: Two companies, especially if they operate in a similar activity, cannot have a name that causes confusion. If such a situation arises, two scenarios are possible: either the similarity is obvious and the commercial register will simply refuse to register your company, or, worse, you may quickly receive a registered letter from a lawyer representing the other company asking you (politely or not) to immediately change your name.

Pro tip: In Switzerland, there is a registry (ZEFIX) that allows anyone to check whether a name is already taken, whether the business is a SA, Sàrl, or even a sole proprietorship.

- A name that is not misleading: For example, for us, “FBKConseils” isn’t very original, but it works because we do provide consulting services. However, if we had chosen to call ourselves “FBKGeneral Medicine,” I seriously doubt it would be accepted, as it would clearly be misleading and in total contradiction with our actual services and expertise. In other words, your name should either be neutral or coherent with the actual activity you intend to conduct.

Beyond these legal requirements, I encourage you to reflect on a few additional questions, preferably resolved before submitting your articles of association to the notary:

- Brand visibility / SEO: If you’ve reached this article, it’s probably because ChatGPT or Google considered what I write here relevant. If I had known at the beginning that the choice of my company’s name could affect its online search visibility, I might have approached it differently from the start.

- Internationalization: Suppose your business becomes very successful in Switzerland. If your company has a very French-sounding name like “FBKConseils,” it may not be optimal for future expansion abroad, whether in the U.S., Australia, or Asia. In my opinion, your company name should resonate with your current clients, but also with the potential clients you aim to reach tomorrow.

I’ll stop here on this topic because, as you can see, my profession is not marketing consulting. However, just keep in mind that choosing a name requires careful consideration and can have more consequences than it may appear at first glance.

Step 1.2 – Define the purpose and mission of your company

It may seem obvious, but before moving further, you need to be able to clearly articulate, in a few lines, the purpose of your company. This purpose should explain what your business does today, what it will do tomorrow, and even in the years to come. Of course, like many entrepreneurs, myself included, you probably don’t have a perfectly clear ten-year vision, but you should at least know where you will start and the general direction you want to take.

Your purpose should be broad enough to encompass all the activities you envision in the near or mid-term future. For example, the statutes of FBKConseils, as drafted at its creation, are intentionally very open.

Today, we do not engage in insurance brokerage or financial investments in the strict sense. Of course, we advise our clients on real estate and offer them various perspectives on their financial investments, but the core of our activity clearly remains advisory services, not brokerage.

What happens if you do not respect your company’s purpose?

Honestly, if you are running a one-person business and suddenly decide to switch from selling craft beers to children’s toys, nothing dramatic will likely happen. However, in Switzerland, it is mandatory to define a company’s corporate purpose for three main reasons:

Ensuring compliance with legal requirements

If you are a tax advisor and want to open an aesthetic medicine practice, chances are it won’t work because you won’t have the necessary qualifications and authorizations to make people more beautiful only less poor.

Protecting your company against potential misuse by its executives

As we have seen earlier, in growing companies, the owners or shareholders often delegate daily management to a director. The corporate purpose registered with the commercial register then serves as a clear boundary not to be crossed. If a director deliberately acted outside the scope set by the owners, they could be immediately dismissed, as this framework precisely defines the limits of their authority.

Providing a reference for third parties (Clients, Partners, Banks…)

It is not uncommon for a company to need to work with external parties although personally, I prefer to avoid this—such as forming partnerships, borrowing from a bank, or creating collaborations. Thanks to the Swiss commercial register (Zefix), anyone can quickly and easily verify exactly which activities are authorized for your company.

In summary, the purposes stated in your company’s articles of association primarily serve to clearly define a framework to be respected. This framework can, of course, be modified over time, provided certain administrative and legal steps are taken with a notary. However, my personal advice would be to formulate your purposes with enough flexibility from the start to avoid significant costs if you wish to modify your activities later.

Step 1.3 – Appointing the organs of your company (General meeting and board of Directors)

Now that you know exactly who must legally make up a company in Switzerland, the next step is simply to designate the people who will be the owners of your company and those who will be responsible for managing it.

For this, you will need to clearly provide the full name, date of birth, and complete address of each person occupying the different roles or functions within your company.

Company formation – How to appoint the different organs in a corporation (SA)?

When creating a Société Anonyme (SA), you must gather an initial capital of CHF 100,000 (Article 621 CO), divided into shares, specifying clearly the holders, each in proportion to the amount invested. Later in this article, we will explain how to practically raise these funds and possible exceptions. A key feature of SAs is that shareholders remain anonymous, with their identity disclosed only to the tax authorities and directly concerned parties (partners, banks, etc.).

Regarding governance, especially at the time of company formation, it is common for one of the shareholders to be designated as a director (or board member) as long as the company does not yet employ staff. In other words, the person investing initially is very often the same as the one in charge of operational management.

Company formation – How to appoint the different organs in a limited liability company (LLC / Sàrl)?

The logic is largely the same for a Société à Responsabilité Limitée (Sàrl / LLC), with the notable difference that the minimum share capital is only CHF 20,000 (Article 773 CO). Another particularity: in an LLC, the identity of the partners is known to everyone, as it is explicitly recorded in the commercial register.

Regarding management, one or more partners will systematically bear the responsibility of managing the company on a daily basis.

Step 1.2 – Decide whether you want to be audited

As explained earlier, being audited essentially means having to reveal all your financial “secrets” to an external person. This individual, whom you will select and pay, must certify that your accounting is properly maintained and that no violations have occurred. My personal advice: if you do not particularly intend to work with banks or institutional partners, or if your company has very few shareholders, I recommend choosing the “opting-out” option for as long as possible.

On the other hand, if your shareholder structure is complex, composed of people you do not know well, or if you plan to raise funds in the near future, an audit becomes an excellent guarantee of transparency. It reassures everyone about the validity of your annual accounts… even though, to be honest, there are financial scandals every year where “everyone should have known,” yet, strangely, no one saw anything coming.

Step 1.3 – Clearly indicate your company’s registered office

Again, this may seem obvious, but every company in Switzerland must have a registered office, i.e., a Swiss address to which all official correspondence will be sent. This is also the address where your company’s taxes will be calculated and invoiced, except in rare cases, such as a permanent establishment elsewhere or an effective administration located in another canton or country.

Step 1.4 – Have all your information validated by a notary

This step often hits the wallet… Indeed, becoming self-employed does not require any notarized act, and therefore no notary fees. In contrast, creating a SA (public limited company) or a Sàrl (limited liability company) necessarily requires validation by a notary, who must certify that your chosen name is available and authorized, that your corporate purpose is legally valid, and that all other information required for registration is fully compliant.

This is precisely when the first significant costs appear. The notary must be paid, and fees can easily vary from one to five times depending on the canton and the notary’s office. Today, thanks to our privileged partnerships, creating a legal entity rarely costs more than CHF 600. However, beware: if you contact a notary directly without going through a network or intermediary, the bill can easily reach CHF 2,000 or more.

Step 2 – Open a depositary account

The term “depositary account” might not sound very appealing, but don’t worry it’s simply a blocked account, similar to the one you may have had to open for your rental guarantee. This account will temporarily hold your company’s initial capital (CHF 100,000 for an SA or CHF 20,000 for a Sàrl) until the company is officially validated and registered in the commercial register. This step allows Swiss authorities to verify that the company indeed has the minimum starting capital to begin operations confidently.

This depositary account can be opened at any Swiss bank. Most banks offer this service for fees ranging between CHF 100 and CHF 300. To proceed, you simply need to contact the bank, provide the company’s founding deed validated by your notary, and wait for the bank to create the account and provide you with an IBAN in the name of your company. You can then transfer the necessary funds (yes, this step always stings a little…) and wait for the bank to issue an official certificate confirming receipt of the funds.

Two important clarifications on this point:

- Partial release of share capital: In Switzerland, the law allows an SA to initially pay only CHF 50,000 (article 632 CO) instead of the CHF 100,000 normally required. This option simplifies the creation of an SA, especially if you do not want to block the entire capital from the start. Be aware, however, that the remaining capital must eventually be released from future profits. Until this balance is paid, the distribution of reserves or profits may be limited. You must clearly specify at the time of creation whether you are releasing the full capital or only a part.

- Capital contribution in kind: I won’t dwell too much on this complex topic. Simply know that beyond cash contributions (the classic solution), you can also contribute part or all of the capital in the form of material or real estate assets useful for your business: machinery, vehicles, office premises, etc. If you choose this route, you must provide indisputable proof that the real value of these contributions exactly matches the declared amount. This requires a notary to include these items in the founding deed, as well as an approved auditor to validate the contributions (yes, the same one who might audit your accounts one day…). Conclusion? Contributions in kind allow temporary cash savings but significantly increase the creation costs.

Step 3 – Submit your information to the Commercial Register

Once your company’s founding deed has been validated and signed before a notary, and as soon as you have the official certificate confirming that the depositary account is indeed opened and funded, you (or your notary) can submit the complete file to the Commercial Register.

If everything goes as planned, you will quickly receive an invoice for the registration fees at the Commercial Register, which must generally be paid promptly in order to officially finalize the creation of your company.

Step 4 – Convert the depositary account into a current account

At this stage, most of the work is behind you: the money has been deposited, the notary has validated your file, and now you just need to wait calmly for approximately 3 to 4 weeks (this period may vary depending on the canton and time of year). After this period, your company will officially appear in the Commercial Register.

As no one works for free, you will simultaneously receive a new invoice corresponding to the fees of the Commercial Register.

Once the registration is official, you can contact your bank to request that your depositary account be converted into a standard current account, immediately usable to pay your first business invoices.

Quite a simple and reassuring process, isn’t it?

Step 5 – Register your company with social insurance and VAT

Your company now officially exists and can theoretically start operating, but this is just the very beginning of your obligations as a business owner. Among the first administrative tasks to carry out promptly, you will need to contact:

1. An AVS compensation office

In principle, even if you forget this step, the authorities won’t forget you: you will quickly receive a letter politely inviting you to complete a form to register your company, yourself, and your employees with the Swiss first pillar (AVS). You will need to indicate who works in your company, since when, and their expected salaries. Don’t worry, this procedure is simple, and any errors are usually minor and easily corrected.

2. Choose a pension fund (2nd Pillar – LPP)

Unlike for independent workers, for whom this registration is optional, companies structured as a SA or GmbH must choose a pension institution for the 2nd pillar. Honestly, even in 8,000 words, I couldn’t cover this vast topic entirely. The options regarding pension funds are extremely numerous and can vary significantly in terms of costs, benefits, tax impact, and attractiveness for your future employees.

Choosing the 2nd pillar that best fits your company’s current needs is therefore a crucial step that should not be overlooked.

3. Mandatory accident insurance (LAA)

Although occupational pension plans often mention LPP/LAA together, these two insurances are actually separate. Accident insurance (LAA) is mandatory for every employer in Switzerland and must cover work-related accidents. In most cases, it also covers non-work-related accidents. This step is therefore essential as soon as you hire your first employee.

4. VAT registration

Unlike choosing a pension fund, we have prepared a complete article specifically dedicated to VAT in Switzerland, covering filing methods and possible optimizations. What you need to remember here is relatively simple: as long as your company generates less than CHF 100,000 in annual revenue subject to VAT (excluding specific exemptions), registration is not required. But once you exceed this threshold, registration becomes mandatory.

I strongly encourage you to consult this specific article on VAT to fully understand this central aspect of financial management before proceeding with final registration.

5. Subscribe to other specific business insurances

For some companies, subscribing to additional insurance policies will be purely optional. However, for other professions, especially regulated ones like doctors who must subscribe to professional liability insurance (RC pro)—these insurances will be mandatory from day one.

Among optional but often useful insurances, you can find, for example:

- Loss of earnings insurance for illness/accidents, complementary to the mandatory accident insurance (LAA),

- Professional legal protection, very useful in case of disputes with clients or suppliers.

Yes, creating a company is relatively “easy.” Managing it correctly from the start is a completely different matter. I sincerely hope that these few lines, along with the various links provided, will help you gain much clearer insight. And above all, if you have any doubts or need additional help, do not hesitate to contact us. At FBKConseils, we always offer an initial consultation free of charge to answer all your questions in detail.

How much does it cost to create an SA or GmbH in Switzerland?

Great question, but the answer isn’t so simple, as it mainly depends on the following factors:

- The chosen notary: Notary fees can vary considerably depending on the canton and the notary, generally ranging from CHF 600 to over CHF 3,000.

- The type of contribution made: If you fully pay in cash, additional costs are nonexistent. However, if you choose to contribute certain assets (contributions in kind), fees related to their valuation and legal validation by an accredited auditor can quickly reach between CHF 1,200 and CHF 5,000.

- External support or consulting: While entirely optional, this can be especially useful if you lack experience. Without guidance, it’s easy to be approached by various brokers or advisors trying to sell all sorts of contracts and services: insurance, legal, accounting, tax, or organizational advice. Of course, hiring a consulting firm like ours incurs a cost that will directly depend on the level of support you require.

To give you a concrete idea, at FBKConseils, the costs for creating a company currently generally range from CHF 1,500 to CHF 3,000, potentially including all the steps we’ve discussed so far (notary fees included).

How long does it take to create an SA or GmbH in Switzerland?

Here too, it’s difficult to give a precise answer because many factors can influence the required timeline, notably those mentioned above (choice of notary, type of contributions, quality of the file prepared in advance). However, if we consider a perfectly clear, complete, and well-prepared file from the start, you can reasonably expect a total creation time in Switzerland of between one and two months.

How to choose between an SA and a GmbH, and what are the main differences?

Let’s be honest: if your goal is simply to create a small SME in Switzerland, the difference between an SA and a GmbH usually won’t be significant. From an accounting, tax, or economic perspective, you can accomplish exactly the same things with either structure. It’s unlikely that one day you’ll wake up realizing you made a catastrophic choice—and besides, it can be changed later if necessary.

However, since you’re reading this, you probably want an answer. Here are some concrete differences that could influence your decision:

Anonymity or public visibility?

Indeed, choosing a GmbH practically means becoming a “public figure.” Everyone, absolutely everyone, will be able to know that you own shares in your company, as well as your exact role within it.

On the other hand, an SA offers complete anonymity: only the administrators are publicly known, and it’s impossible for outsiders to know exactly who actually owns the shares.

Facilitating the total or partial sale of your company

As explained earlier, shareholders of an SA are anonymous and recorded only in an internal company register, so no official modification at the commercial register is required when transferring shares. In contrast, with a GmbH, any sale, succession, or transfer of shares must be reported to the commercial register, which generates additional administrative steps and associated costs.

Simplified transfer of shares

This point partially overlaps with the previous one, but with an important nuance: unless otherwise specified in the company’s statutes, selling shares of an SA is as simple as selling a Nestlé share on the stock market, with no specific procedure required. In contrast, in a GmbH, the transfer of company shares generally requires prior approval from the other partners, which can significantly complicate the transaction.

Of course, there are other points of comparison, such as the cost of creation or the minimum capital required, but we have already covered these extensively in previous sections of this article.

Finally, as we slowly reach the end of this article and you now have a good overall understanding of how a Swiss company operates (including our own statutes!), allow me to offer a concise, up-to-date summary of the services FBKConseils provides to its professional clients.

How FBKConseils can support you in starting your business?

Starting a business can be an exciting challenge, but it is also complex from an administrative and strategic standpoint. That’s why FBKConseils offers tailored support through several key services:

Introductory meeting

Whether you want full support or just have one or two specific questions, FBKConseils always offers a first introductory meeting free of charge, lasting about twenty minutes. This valuable session allows you to receive personalized answers to questions not addressed in our articles, helps us understand your specific situation and concrete needs, and, if you wish, gives you insight into our working methods and the solutions we can provide.

Tax and financial simulation – Independent vs. Corporation

Before starting your business, it is essential to clearly understand the difference between being self-employed and forming a capital company (SA or GmbH). This choice will have significant implications for your future retirement, the administrative management of your activity, and your personal and corporate taxation. At FBKConseils, we provide clients with precise and detailed simulations to help you assess these impacts concretely. These analyses can be conducted live during a personalized meeting or as a detailed written report, according to your preference.

Support through all stages of business creation

To simplify often cumbersome administrative procedures, FBKConseils works closely with various notaries and specialized digital platforms. We support you throughout the entire creation process, from the first step to the final signature. Our goal is clear: to facilitate your connection with trusted professionals while remaining by your side to answer any questions or concerns that may arise during the creation of your company.

Business domiciliation at our offices

Entrepreneurs generally choose to domicile their business with a fiduciary like FBKConseils for two main reasons. First, the daily administrative management (and unsolicited mail) takes too much time and energy. Second, if you do not yet plan to rent offices or professional premises, you may wish to keep your private and professional correspondence clearly separated.

At FBKConseils, we offer you the possibility to use our address and mailbox, with a convenient service for collecting, scanning, and organizing your mail. An ideal solution to save time and gain peace of mind.

Administration of your company (External Management)

As mentioned earlier in this article, some individuals not residing in Switzerland, or others who simply wish to avoid being officially responsible for the administrative management of their company, can entrust us with this role under certain conditions. Taking full responsibility for a company’s administration is a duty we take very seriously: we always ensure our clients fully understand the stakes and agree with our rigorous working methods.

Accounting and tax services related to your business

Finally, and most obviously, creating and managing a business involves numerous ongoing tasks such as maintaining accurate accounting, preparing annual tax returns, issuing employee pay slips, and submitting VAT statements and mandatory social security declarations.

At FBKConseils, we also provide all these accounting and tax services, allowing you to focus fully on what you do best: growing your business.