Written by Yanis Kharchafi

Written by Yanis KharchafiEverything you need to know about accounting for SMEs in Switzerland

Introduction

Although accounting is often seen as the most tedious — or frankly boring — part of administrative tasks, it remains essential for anyone wanting to start a business. Maybe bad news for you, but great news for me!

For small businesses, carefully maintained accounting provides a clear overview of financial health, allowing you to analyze business performance, profit margins, and generated earnings. It also enables effective year-on-year comparison of results to better guide the company’s strategy. But let’s be honest: for most entrepreneurs, accounting often has just one concrete purpose — to deliver precise information to tax authorities so they can determine the corporate income and capital taxes due. However, as the business grows, this narrow view usually evolves into a more strategic approach.

In this article, we focus specifically on Swiss SMEs with between 0 and 50 employees — those who must at least provide accounts to the tax authorities. Our goal is to help you better understand how accounting works in Switzerland: the different methods available to you, how to organize your accounting efficiently, associated costs, and most importantly, to determine whether hiring a fiduciary or an accountant is truly necessary to manage your business with peace of mind.

Finally, before you continue reading (and I continue writing!), I want to give a quick disclaimer to freelancers who may have landed here by chance: this article is not intended for you. Although accounting rules may seem similar, there are important specifics that concern you. I therefore invite you to consult our dedicated article on Accounting for Freelancers.

The line-up:

Why do swiss companies have to keep accounting records?

Everyone knows, at least in theory, that when you start a business, you need to deal with accounting. It seems obvious, but in practice, few really understand why accounting exists, how it precisely works, and what its real purpose is.

Accounting: The salary certificate of an SME?

The first reason is actually quite simple: accounting is a legal obligation directly written into our Swiss Code of Obligations, which requires every legal entity to keep regular and up-to-date accounts (Article 957 CO). But why such an obligation? Again, the answer is clear: mainly to allow the State to collect taxes.

Imagine for a moment a country with taxes but no accounting system: how could anyone determine precisely what constitutes income, what can be deducted or not? It would be unmanageable! Establishing a clear accounting and tax framework is therefore the only effective way to ensure fair treatment of all businesses and to prevent potential abuses.

In conclusion, yes, depending on how it is organized, accounting can provide very useful information about a company’s financial situation. But its primary role remains, above all, to enable the State to correctly calculate the annual tax burden.

Accounting: An argument to finance your company’s future projects?

The second major reason is that rigorous accounting allows anyone involved, or wishing to get involved in your company, to get an accurate picture of its current and past situation. Among these people are notably:

- Banks and creditors: Imagine you want to borrow CHF 1,000,000 to finance a small factory. Your accounts and tax returns will be carefully reviewed by financial institutions to precisely assess the strength of your business over recent years and ensure you have sufficient reserves in case of future difficulties.

- Future partners or buyers: If you plan to sell all or part of your company, it will be essential for potential buyers to have reliable and complete financial documents tracing the company’s financial history. Certainly, in private company transactions, the valuation of shares is not based solely on accounting—other criteria come into play depending on the chosen valuation methods—but clear accounts remain a decisive asset to build trust and justify the price.

Accounting: A necessary tool for selling, partnering, and transferring your business?

Finally, a third reason justifies keeping careful accounting records: it is an essential tool for the daily management of your business. Admittedly, in small companies, it is rare to implement advanced analytical accounting specifically tailored to detailed profitability calculations for each activity. Nevertheless, even simpler accounting, aimed at tax or financial purposes, allows you to draw useful conclusions and provides a reliable overview of your business’s performance and potential areas for improvement.

What does keeping accounting records mean for an SME in Switzerland?

Let’s now get to the heart of the matter: concretely, how do you keep accounting when you start a business in Switzerland? And honestly, I think it all boils down to two very important points.

Understanding the difference between cash-basis accounting (“Milk Book”) and the ordinary method

Good news to start with: our Swiss Code of Obligations is much more flexible and understandable than the heavy European accounting standards. At the same article cited above, the Code clearly specifies that accounting must be adapted to the nature and size of each business. In other words, the accounting of a giant like PWC with its roughly 300,000 employees will certainly not look like that of an SME such as FBKConseils. Of course, the legal accounting framework is the same for everyone, but Switzerland offers companies significant leeway to adapt to their economic reality.

However, unlike sole proprietors, capital companies (SA and Sàrl) are not eligible for simplified accounting. They must obligatorily adopt what is called the ordinary method: Concretely, you cannot simply record your revenues on one side and deduct your expenses on the other with a few quick lines. This approach requires you to follow a precise chart of accounts and record every transaction according to specific rules: every inflow or outflow of money (including closing entries such as depreciations) must have a counterpart (each entry thus affects two different accounts). If these few sentences haven’t fully clarified things for you, no worries — once the theoretical framework is set, we will move on to concrete numerical examples.

Differentiating between cash-basis accounting and accrual accounting (the accrual method)

To complicate things a bit and make sure you’re still paying attention, let’s now introduce the two methods for keeping ordinary accounting records: a simple method, but less “clean” from an accounting perspective, and another that might seem more confusing at first, but is more faithful to economic reality. These two approaches mainly differ by the timing of when an expense or revenue is recorded.

- The cash-basis method, as its name suggests, requires you to record a transaction only when a payment is actually made. In other words, if you send an invoice for CHF 1,000 to a client, as long as that client hasn’t paid you, this invoice will not appear in your accounts and will not be taken into consideration, including for tax purposes. The sale will therefore only be recognized at the exact moment when the payment is received.

- By contrast, the invoicing method (or accrual method) consists of recording transactions as soon as amounts become due. Thus, upon issuing a client invoice or receiving a supplier invoice, you immediately enter the corresponding accounting entry. This approach allows revenues and expenses to be matched more accurately to the accounting period concerned.

To save you from rereading each paragraph four times, let’s jump directly to a concrete example. Imagine that at year-end, our accounting firm records the following four transactions:

- Tax declaration 1: Client Roxane Henrioux – 01.12.2025 – CHF 150

- Tax declaration 2: Client Fiona Wallace – 05.12.2025 – CHF 500

- Tax declaration 3: Client Clément Argelaguet – 10.12.2025 – CHF 500

- Rent payment (office) for December – 31.12.2025 – CHF 500

Example of cash-basis accounting

Using our previous invoices as a reference, you would never record an accounting entry at the moment you send or receive an invoice. Concretely, if Roxane, Fiona, or Clément decide never to pay you, it is as if you never performed those services, and you will not pay any tax on those amounts. However, as soon as the money is actually deposited into your bank account, that is the only time you will record the transaction in your accounting records.

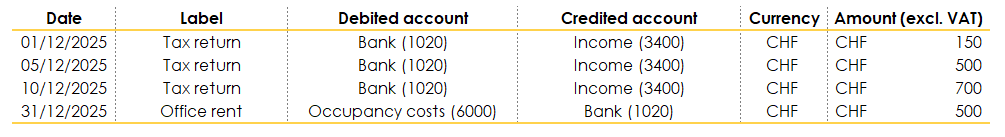

Here is concretely how these transactions would appear as accounting entries:

- For sales (services): the debited account will always be your bank account (account 1020), indicating that the money has actually been received. The counterpart, credited, corresponds to the “revenue” account (account 3400), thus representing the actual recognition of income.

- For expenses (rent): conversely, the debited account corresponds to the incurred expense (account 6000 – premises expenses). The bank account (1020) is credited, indicating the actual outflow of money.

This method has the major advantage of being particularly simple to manage. It notably spares you from having many accounts receivable or payable open, since only transactions actually received or paid are recorded.

However, this simplicity also has an important drawback: it does not faithfully reflect the economic reality of the business. For example, imagine you worked all year on a major architecture project and sent a large invoice to your client in mid-December. If this invoice remains unpaid as of December 31, you will close the fiscal year without any revenue, even though you worked all year. Your annual profit will thus appear artificially low, which can be problematic if you want to convince partners, investors, or banks.

Conclusion? This cash-basis method is simple to implement and limits complexity related to transitional accounts, but if your business is meant to grow, you will quickly need to switch to accrual-basis accounting, which is the only approach truly suited to realistic financial management.

Example of accounting on an accrual basis (engagement method)

Here we go: the only truly professional method that reflects the economic reality. Concretely, as soon as you receive a supplier invoice or send an invoice to a client, the transaction must immediately appear in your accounts. As you might expect, this approach generates twice as many accounting entries as the cash basis method, because each transaction must be recorded twice—first when the invoice is issued or received, then a second time at the moment of payment.

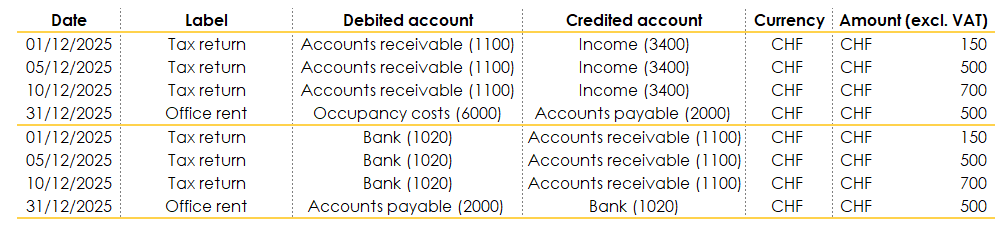

If we take the same four entries as before, here is what they would look like:

- In the first section, you record the initial entries corresponding to invoices sent or received. Unlike the cash method, at this stage, you do not touch the bank account since the money has not yet been received or paid. Instead, you create temporary accounts: either accounts receivable (asset account – 1100) or accounts payable (liability account – 2000).

- In the second section, you record the actual moment of payment or receipt, this time directly affecting the bank account. You credit your bank account when it’s an expense (outgoing payment) and debit it when it’s a sale (incoming payment).

In this specific example, the final result remains the same because all invoices were settled within the year. However, in a company’s economic reality, some invoices often remain unpaid at the end of the accounting period. The balance sheet must then accurately reflect these outstanding amounts, providing an exact and realistic picture of your financial situation.

Conclusion: Although this method requires more administrative work, it is much more accurate and allows for a far more realistic view of the economic and financial health of your business. If your goal is steady growth and effective financial management, I strongly recommend adopting this so-called “accrual” method from the very beginning.

What does a complete accounting system for an SME in Switzerland consist of?

From a rigorous perspective and following the ordinary accounting method, a complete accounting system for a Swiss SME mainly relies on four essential documents that together form the annual financial statements:

- The annual balance sheet

- The income statement (also called the profit and loss statement)

- The notes to the financial statements

- The general ledger

In principle, only the balance sheet, the income statement, and the notes must be submitted to the tax authorities. The general ledger, however, is not systematically sent but remains an essential document: it forms the basis for all other accounting reports and can be requested at any time by authorities during audits.

To better understand, let’s revisit the four accounting entries we saw earlier and illustrate their role in each of these documents, clearly explaining their function.

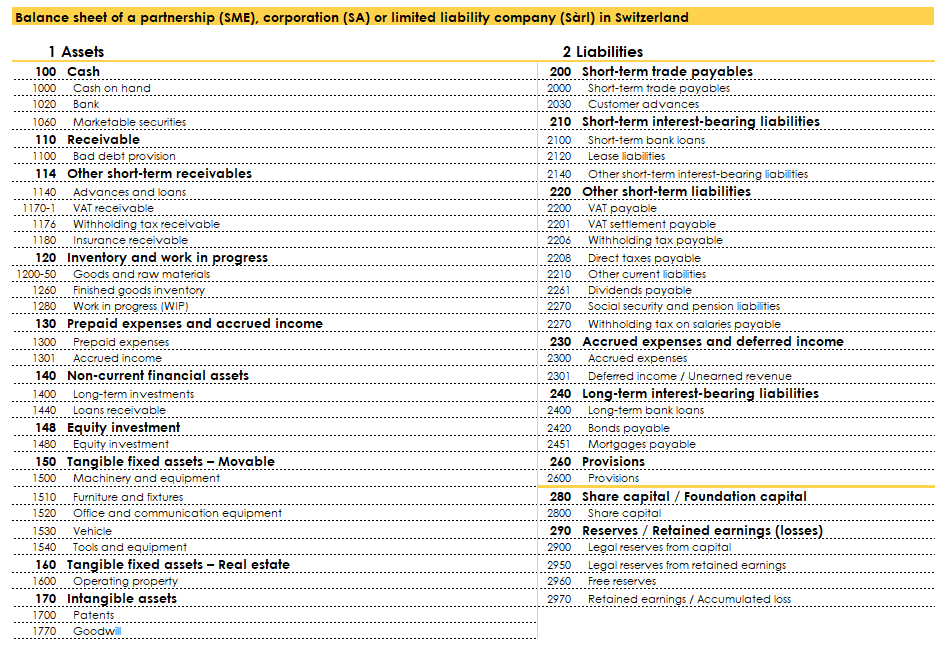

The annual balance sheet

The balance sheet is a crucial document that reflects the exact financial position of your company at the close of a financial year, generally set on December 31 each year, except in exceptional cases such as liquidation, restructuring, or exceptional dividend distributions.

On the left (“assets side”), you will find all the possessions of your company, ranked in descending order of liquidity — from immediate cash and bank accounts to less easily mobilizable assets such as buildings or equipment. The goal is to have a clear view of everything the company owns at the closing date.

On the right, the balance sheet is divided into two distinct parts:

- Top right (“liabilities due”): this section lists all the company’s debts and financial obligations, ordered from the most short-term payable items (e.g., supplier invoices) to long-term debts (such as mortgages).

- Bottom right (equity): here you record the company’s net worth — in other words, its assets after deducting debts. This is exactly where you see what really belongs to your company after accounting for financial obligations. Equity typically includes:

- Share capital: depending on the type of company, this capital must be at least CHF 20,000 for an LLC (Sàrl) and CHF 100,000 for a corporation (SA).

- Capital reserves from contributions: these reserves arise when a company issues shares above their nominal value, creating a premium (or share premium) that is placed in these specific reserves.

- Legal reserves from profits: to ensure companies maintain a sufficient financial base from year to year, a part of profits must mandatorily be allocated to these legal reserves until a legally defined threshold is reached.

- Free reserves from profits: finally, when profits have not been fully allocated to mandatory reserves or distributed as dividends, the remainder is placed in these free reserves, representing an accumulation of undistributed past profits.

- Retained losses: this category concerns companies that have incurred accounting deficits in previous years and were unable to fully deduct their tax charges. The remaining amount to be deducted is shown here and can reduce taxable profit over the next seven fiscal years.

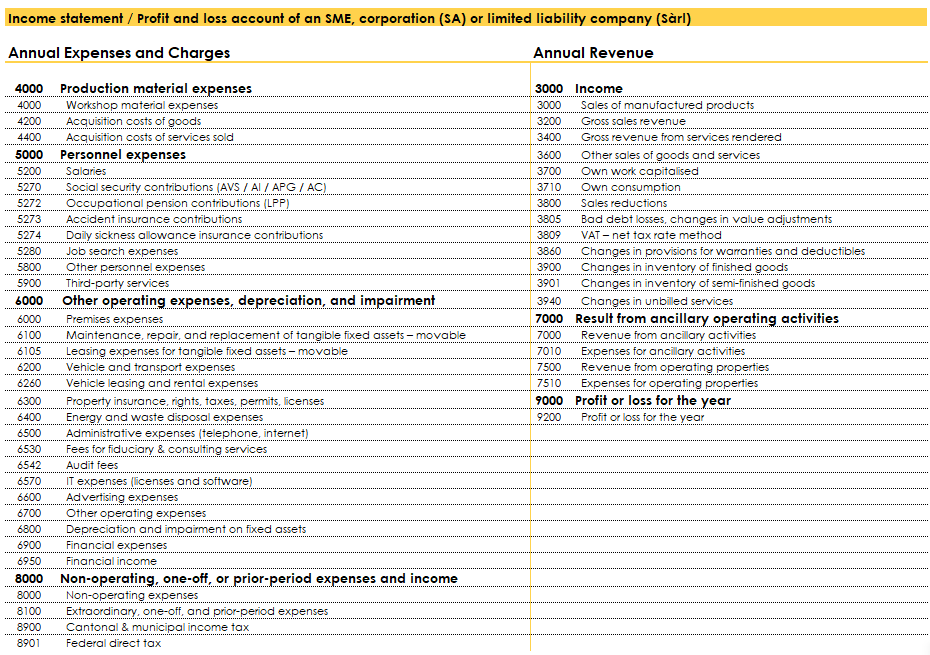

The income statement of an SME

The income statement, also known as the profit and loss account, is a table that aggregates all the accounting entries for a year according to different categories of revenues and expenses. For example, all invoices issued to your clients during the year will be grouped under account 3400 (“sales revenue”), while all invoices paid for office rent will appear under account 6000 (“office expenses”).

Its main purpose? To provide an overall view of your company’s financial performance over the fiscal year by clearly determining, through adding and subtracting the different categories, the annual result — in other words, your profit or loss.

Below is a simplified example of a typical income statement for a Swiss SME:

Naturally, not all SMEs need an overly detailed income statement: each company can adapt its chart of accounts according to its industry, simply removing unnecessary accounts to maintain a clear and relevant overview. Conversely, it is also possible to add accounts to more precisely track certain elements, such as sales of a specific product or service.

Notes to the financial statements of an SME

If you have followed along so far, you now know that the balance sheet shows assets and liabilities, while the income statement presents the annual profit (or loss). However, some entries may raise questions from external readers:

- “Why did you depreciate this machine more this year?”

- “What exchange rate was applied to convert these amounts into Swiss francs?”

- “What exactly does your inventory recorded as an asset on the balance sheet include?”

The notes to the financial statements are precisely meant to provide these clarifications. They help ensure a full understanding of your financial statements by all concerned parties.

A small note: if you are a very small company and no entries require legal commentary or explanation, the notes may not be mandatory.

The general ledger

Finally, the general ledger is the central place where everything really happens in accounting. It is a chronological journal that records every accounting transaction made by your company, systematically specifying the date, the accounts involved, and the amounts debited and credited.

Although this document is not automatically submitted to the tax authorities, it remains fundamental: it justifies the amounts shown in the balance sheet and income statement. In the event of a tax audit, it may be requested so that authorities can better understand how you arrived at your accounting results.

What are deductible expenses for your business?

This is probably the very first question every entrepreneur asks during their initial meeting with an accounting firm. It usually takes various forms, but often sounds like this:

- “Can I deduct the rent of my apartment since I don’t have a professional office yet?”

- “Can I deduct my private car as a business expense?”

- “Is it possible to deduct my meals at restaurants?”

- “What risks do I face if I claim an unjustified deduction?”

In Switzerland, it is important to clearly distinguish the following: in theory, you could record all your expenses in your accounts without anyone being bothered. However, a crucial question remains: will all these expenses be recognized as tax-deductible? The answer is not automatic. To find out, you must refer to tax laws, notably the Federal Direct Tax Act (LIFD), as well as the various cantonal legislations.

Some deductible expenses are clearly defined by federal law (Article 59 LIFD), such as:

- Federal, cantonal, and municipal taxes: Yes, unlike self-employed individuals, taxes paid by companies are considered tax-deductible expenses.

- Social security contributions (AHV, occupational pension plans) paid for employees.

- Professional training expenses for employees.

Apart from these clearly defined charges, the law remains somewhat vague, often using a key phrase: “All expenses justified by commercial use are deductible.” Simply put, what does this mean? In our view, this phrase means:

“If you can clearly establish a direct link between an expense and your professional activity, then all or part of that expense should be tax-deductible.“

In other words, as soon as you can prove that you incurred an expense for one of the following objectives:

- Gaining new customers;

- Increasing your company’s visibility;

- Improving your efficiency or productivity;

- Reducing your costs sustainably;

- Facilitating or improving your administrative management;

Then it is legitimate to claim a tax deduction.

A small note: Since this article focuses on accounting, the section dedicated to tax optimization is addressed in the article related to SME taxation.

Let’s now revisit our initial questions to illustrate this practical reasoning:

Can I deduct the rent of my own home?

Following the logic described above, if you can demonstrate that part of your home is specifically set up for the exclusive use of your professional activity, then yes, your rent can be deductible. The tax reasoning is simple: without your professional activity, you would probably have chosen a smaller dwelling. Therefore, you cannot deduct the entire rent, but a proportion corresponding to the area dedicated to your business activity can be taken into account. Moreover, all related expenses (electricity, heating, internet, etc.) will also be deductible in proportion to this area.

Is your private car deductible?

The deduction related to your private car should be separated into two distinct categories:

- Commuting between home and work: If you are an employee of your own company, the rules applicable are exactly the same as for any other employee. Practically, the trips made every morning and evening to get to your workplace are not expenses to be recorded in your company’s accounting. These costs must be declared directly in your personal tax return under the “transportation expenses” section.

- Business trips during working hours: If, during the day, you use your private car for strictly professional trips, your company (you as the employer) must reimburse the costs incurred, just as it would for any employee. To avoid the complexity of calculating actual expenses, the tax authorities generally accept a flat reimbursement of CHF 0.70 per kilometer traveled for professional purposes.

Practical example of accounting entry for transportation expenses

Let’s imagine that to sign a contract with my client Roxane, I drove 200 kilometers with my private car on December 3rd.

- First entry: I record an expense of CHF 140 (i.e., 200 km × CHF 0.70), deductible from the company’s taxable profit. In return, I create a liability of the company towards myself since I advanced these expenses privately.

- Second entry: I then reimburse this advance: I transfer CHF 140 from the company’s bank account directly to my personal account. This reimbursement does not constitute taxable income but simply a reimbursement of expenses advanced personally.

Is it more advantageous to invest in a company vehicle?

A quick note on vehicle expenses: Earlier, we discussed the example of an entrepreneur using their private car for business trips without investing in a company car. But how many times have we heard this remark:

“Why don’t you put your car in the company’s name? That way, you could deduct everything!”

In reality, what you need to understand is that fiscally, it doesn’t change much. If you decide to purchase a vehicle in the company’s name, you will indeed have to account for all the actual expenses incurred during the year (fuel, maintenance, vehicle taxes, etc.). However, at the annual financial closing, if you are honest with the tax authorities, you will also have to determine what portion of these expenses corresponds to private use of the vehicle—that is, use not directly related to your professional activity.

For example:

If your annual vehicle expenses amount to CHF 10,000 but you estimate that you used your car about 25% for personal purposes, you will need to deduct CHF 2,500 from these expenses, which are considered non-business. This is what is known fiscally as the “private portion” of an expense.

The result?

Whether your vehicle is owned privately or registered in the company’s name, the final amount of tax deductions should not differ much, since only expenses directly related to your business are deductible. In conclusion, buying a car through your company does not necessarily mean major tax savings, contrary to popular belief.

Can I deduct my restaurant expenses for my business?

When it comes to restaurant expenses (or other expenses “related to outings”), three common scenarios usually arise:

- The daily lunch break: No doubt, this is an expense related to your professional activity and therefore tax deductible. However, be careful: if every day at noon you dine at starred restaurants costing CHF 200, the tax authorities may consider this expense excessive. It is therefore advisable to keep amounts reasonable and proportional to your business activity.

- A business meal with a client or prospect: Without a doubt, this is a fully deductible expense. The tax authorities clearly understand the commercial utility of inviting a potential client to lunch to develop your business or maintain a good commercial relationship.

- A team outing to celebrate an event or strengthen cohesion: This is also a justifiable expense as it directly contributes to motivation and team spirit. However, be careful to remain reasonable in terms of frequency and amount.

- An outing with friends at the Montreux Jazz Festival: Here, the answer is clear and firm: absolutely not! Such an expense is not related to professional use and therefore has no place in your accounting. Of course, some might still try to include it (“if you don’t see it, it’s not caught”), but this will never make it fiscally justified.

What happens if I record a non-deductible expense? As we just saw with restaurant expenses, two common scenarios arise:

- The Valais doctor who decides to stay at the Beau-Rivage in Lausanne (CHF 600/night) to work on site: Such an expense may seem justified in principle but risks being deemed excessive by the tax authorities. In this case, the administration will recalculate the deduction by reducing it to a reasonable amount (for example, CHF 150 per night), rejecting the excess.

- The entrepreneur working from home who pays for personal groceries with the business account: This expense is simply non-deductible. If the tax authorities notice this anomaly, they will completely reject the deduction. However, if it goes unnoticed, it may end up buried among other expenses without being detected, but this remains risky.

With the tax authorities, everything usually depends on the intention behind the deduction:

- You genuinely incurred an expense you sincerely thought was deductible (like the doctor in the hotel): The worst-case scenario generally amounts to a refusal or reduction of the deduction without other serious consequences.

- You deliberately tried to artificially reduce your profit by adding fictitious or non-professional expenses: In this case, it clearly becomes tax fraud. The consequences can then be much more serious, ranging from financial penalties to criminal prosecution depending on the severity and extent of the fraud.

In summary, it will all depend on the materiality, intention, and context in which the deduction is made. Be cautious and realistic, and when in doubt, never hesitate to ask your fiduciary for advice!

Can I handle my accounting myself or should I hire an accounting firm?

After reading all these articles, you now know our philosophy at FBKConseils: no one serves you better than yourself! But beware, this phrase is only true if you know exactly what you’re talking about. We firmly believe that every entrepreneur, even without a particular passion for numbers, should understand how accounting works and the tax implications related to their activity. Financial mastery of a business indeed plays a decisive role in its success.

As long as your activity remains relatively simple to manage, an excellent solution is to take a few hours of training, either at FBKConseils or with another professional, to acquire the essential basics. At this stage, it can be wise to do your accounting yourself, while having your accounts regularly reviewed by a specialist until you are completely autonomous.

However, when your business starts to grow and your “free” time tends to decrease, it may be wise to consider external help. At this precise moment, when hiring an in-house accountant might seem too burdensome, delegating this task to an accounting firm becomes a particularly suitable solution, facilitating a gradual transition towards a more structured financial management.

In conclusion, if you are comfortable with numbers, doing your own accounting will not only save you money but also allow you to acquire valuable skills in managing your SME’s finances. However, as in all fields, some people are simply not cut out for this task. In that case, rather than wasting your time, money, and energy, calling on a professional is often the best option.

Which accounting software should a swiss SME use?

If you want to keep rigorous accounting in accordance with the double-entry bookkeeping method, you could theoretically use Excel. But let’s be honest: Excel is absolutely not designed for that, and trying to create your own mini accounting software is very likely to make you waste time… and maybe lose some hair.

We therefore strongly recommend choosing a professional accounting software right from the start, tailored to your real needs and level of expertise. Here are the essential criteria to help you make your choice:

- Price: Although rarely prohibitive, price differences can easily reach CHF 1,000 per user per year between different software options. Choose a solution adapted to your actual budget and the functionalities you need.

- Actual usefulness of the software: If your need is simply to enter accounting entries, there is no need to opt for complex software offering automatic invoicing, inventory management, or integrated payroll. Only take the features that are truly useful to you.

- Ease of use: Generally, the more advanced features a software offers, the more complex it is for beginners. If you have no prior accounting experience, prioritize a simple, intuitive solution that is accessible from day one.

- Technical support and assistance: In our opinion, this is the most important criterion (even more than price). Nothing is more frustrating than losing hours over a minor technical detail. Choose software that offers responsive and available customer service, especially at the beginning. This will make all the difference.

Among the most popular solutions in French-speaking Switzerland, you can find Banana, Crésus, Winbiz, and Bexio—each with advantages depending on your business sector and size. We are also partners of Banana, a software we often recommend for its simplicity, flexibility, and excellent value for money.

The link between accounting and taxation for SMEs in Switzerland

We have reached the end of this article dedicated to accounting for SMEs in Switzerland. Since this is a topic that is both rich and complex, I offer you here a brief overview of the tax obligations related to accounting, before diving deeper into this subject in a future article focused exclusively on business taxation.

The main objective of accounting is to provide the tax authorities with the necessary information to calculate taxes, which mainly includes:

- The taxable profit of your business, after taking into account all expenses, depreciations, and possible tax deductions;

- The annual balance sheet, which allows authorities to verify, validate, or adjust the declared amounts if necessary, before sending you your final tax assessment.

In Switzerland, two types of taxes may concern your business:

- Profit tax, calculated on your annual result (revenue minus expenses);

- Capital tax, determined based on your equity (assets minus liabilities).

Just like individuals, Swiss companies are taxed at three distinct levels:

- The Confederation, which levies only a federal profit tax, at a uniform rate throughout the country;

- The canton where your company is established, which levies tax on both profit and capital;

- The municipality where your registered office is located, which also levies taxes on profit and capital, according to rates specific to each municipality.

In conclusion, even though accounting and tax rules remain similar across cantons, the precise location of your business in Switzerland will directly impact your overall tax rate.

So here we are at the very end! I invite you to discover how FBKConseils can support you in these processes, and I look forward to seeing you soon for a next article!

How FBKConseils can support you in managing your SME in Switzerland?

Complimentary introductory meeting

At FBKConseils, we offer you a first meeting of about 20 minutes at no charge.

The goal of this initial session is to answer all your questions about accounting, taxation, or the administrative procedures related to your business. If you wish, we can also take this opportunity to present our range of services for entrepreneurs—both for your business and on a personal level.

Managing your accounting

Depending on the size of your SME and your preferences, we offer several tailored options:

- Regular review: You handle your own bookkeeping, and we step in periodically to check and validate your accounting entries.

- Full management: We take complete charge of your company’s monthly and annual accounting, freeing up your time so you can focus on running your business.

- Custom training: We can train you personally so you quickly become independent in the day-to-day accounting management of your SME.

Tax returns and VAT filings

Just like with accounting, FBKConseils offers different solutions based on your specific needs and availability. We can:

- Fully manage your tax returns and VAT filings.

- Assist you on a one-off basis for specific matters, depending on your needs and preferences.

Managing social insurance and administrative procedures

Starting an SME in Switzerland unfortunately goes beyond just accounting and tax obligations. You will also need to handle social insurance: registrations, notifications during the year, and the selection of appropriate coverage and plans for yourself and your employees.

FBKConseils guides you through these complex administrative processes, answers your questions, and helps you make the best decisions for your company.