How do I choose between a OPA pension and a OPA capital sum?

Ah, that old question... Well, the most direct and simple answer would be: “It all depends on your needs, your health, the way you live, and your knowledge of financial management...”. But that answer doesn’t sound that satisfying, right?

Ah, that old question... Well, the most direct and simple answer would be: “It all depends on your needs, your health, the way you live, and your knowledge of financial management...”. But that answer doesn’t sound that satisfying, right?

The good news is that there is no wrong answer to this question – but once you choose, there is no coming back!

Here are a few things to think about when making your choice:

- What to remember when choosing your capital:

o You must be able to manage a very large capital over the long-term.

o You can do big projects if that's your goal.

o You will have wealth to give/leave to your descendants if you don’t spend it all.

- And on the other hand, when it comes to annuities:

o You prefer the security of having a monthly income.

o You are in (very) good health.

o You will get better social welfare for your spouse (widow(er)’s pension).

It’s also good to know that some pension funds allow you to choose a third option: To draw a part of your 2nd pillar pension as an annuity, and the rest as capital..

How much tax will I have to pay when I’ll get my 2nd pension?

Unfortunately, no one can avoid taxation and no matter which solution you choose (annuity, capital, or a mix of both if your pension fund allows it), you will have to pay taxes...

Unfortunately, no one can avoid taxation and no matter which solution you choose (annuity, capital, or a mix of both if your pension fund allows it), you will have to pay taxes...

If you choose a capital sum, you will have to pay a one-off tax on the withdrawal. This is called a one-off tax because once you have paid it, you won’t have to pay income tax ever. On the other hand, the money withdrawn will be added to your wealth and will increase your wealth tax.

If you opt for an annuity, each franc paid out will be considered as taxable income. You will have to pay annual income tax as you did when you were drawing your salary at the time. But you won't have an increase in wealth tax.

Now, maybe you know what I mean, in the latter possible case, in which you can withdraw part of it as a capital sum and part as an annuity, well, you'll pay a one-off capital withdrawal tax on the amount you withdraw, and an annual income tax on the annuity you receive.

| Payment | Income tax | Wealth tax | Tax on withdrawal |

| Annuity | Yes | No | No |

| Capital | No | Yes | Yes |

| Annuity and Capital | Yes | Yes | Yes |

What about the payment of supplementary pensions to the OPA?

It’s important to know that your 2nd pillar is not only used for retirement. If you weren’t blessed by life, it’s good to know that your 2nd pillar can also be a spare tire, especially if you become disabled or lose your spouse.

It’s important to know that your 2nd pillar is not only used for retirement. If you weren’t blessed by life, it’s good to know that your 2nd pillar can also be a spare tire, especially if you become disabled or lose your spouse.

Apply for an OPA/AIA disability pension

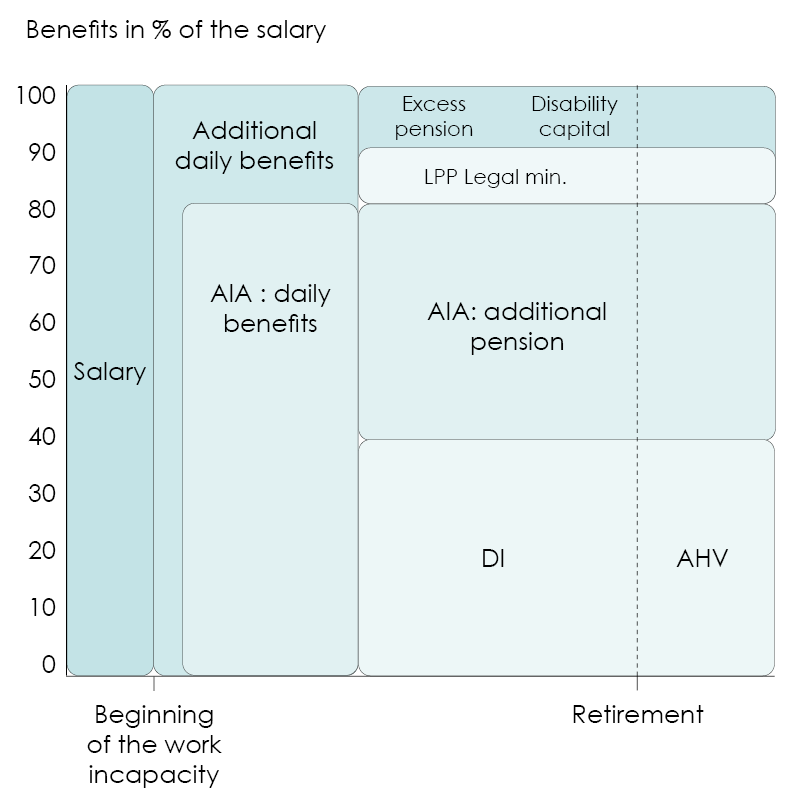

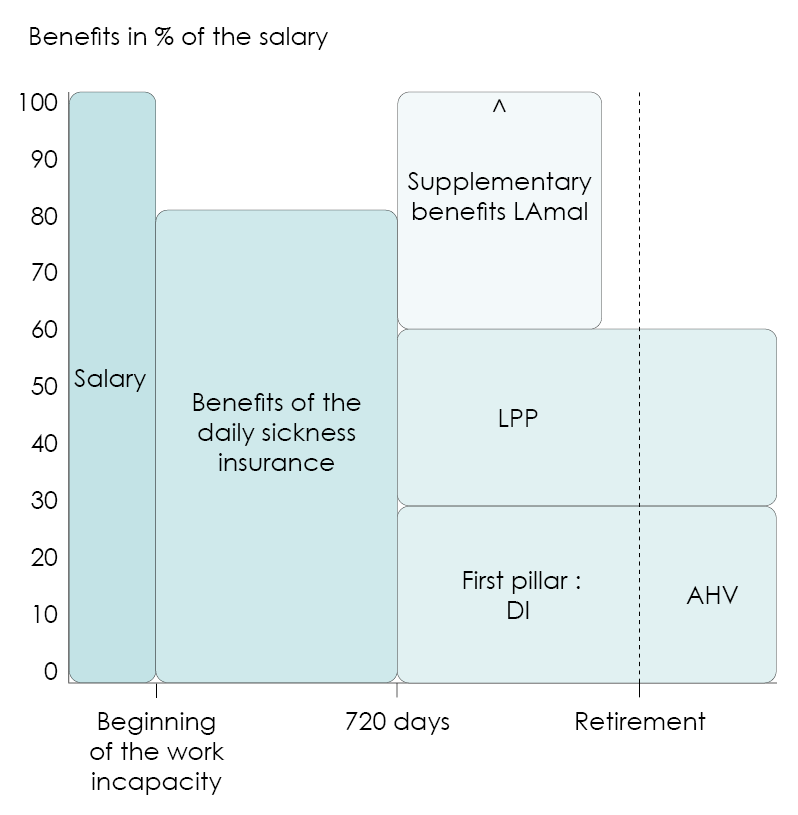

In the event of disability, it’s the OASI (1st pillar) that carries out the various evaluations to determine your ability to work. Based on these examinations, the OASI determines the degree of disability of a person.

To be able to claim a pension, whether from the 1st pillar (IV) or the 2nd pillar (OPA), the disability level must reach at least 40%.

When the degree of disability has been determined and communicated to the pension fund, a disability pension under OPA/AIA can be claimed, though it may take between one and two years before the pension starts to be granted (as determined by law). In practice, employers often take out an insurance for loss of earnings following an accident or a medical condition that leads to disability – this allows you to cover a part of your income until your 2nd pillar takes over.

Claiming a OPA widower’s or widow’s or an orphan’s pension

Unfortunately, the death of a loved one, including a spouse, is never a certainty. The trauma being irreparable, it becomes difficult to imagine the state of one’s finances after such an event occurs. Just as in the case of disability, the 2nd pillar enables you to provide financial support if such a tragedy happens due to an illness or an accident.

For this to happen, one of two conditions must be met:

- The surviving spouse must be responsible for the children of both spouses.

OR

- The surviving spouse is at least 45 years old AND the marriage lasted at least 5 years.

It is therefore not mandatory to be married to benefit from this pension.

Very often, this rule is also overridden to offer better conditions to the policyholders. For this reason, it is very important to refer to the regulations of your pension fund to find out in details about their cover rate. Generally speaking, this OPA pension corresponds to 60% of the invalidity pension that the deceased would have received.

Should the deceased have children, the latter can apply for an orphan's pension, which is linked to a widow's or widower’s pension, if:

- The child is under 18 years of age.

OR

- The child is a student under 25 years of age.

Obtaining the payment of the 2nd pillar pension or capital: Follow these steps designed by FBKConseils

1. The first date!

The goal is to meet in person or by videoconference to find out what your needs are and how we can help you obtain the payment of your 2nd pillar.

2. The creation of the file!

Less exciting but still a necessity, we will need to gather all the required documents to set up the solution we have found (assuming we have found one, of course!).

3. The contacts!

With your file created and the documents available, we will be able to discuss and organize all formalities with the pension fund for the OPA payment.

4. The 2nd date!

Once again, either in person or by videoconference, we will make a new appointment to offer you all the information concerning your OPA payment, plus to make any adjustments if necessary.

5. The final validation!

At this stage, we are only waiting for the payment of the OPA funds to be validated.

6. Peace of mind !

You'll finally be ready to enjoy your 2nd pillar to the fullest.

How long does this procedure take and how much does it cost?

This is an important part of retirement planning. It is very important to understand and simulate this pension before making this irreversible decision.

If we have all the documents, we can process your request fairly quickly. It takes about an hour to understand the situation and needs and then about three hours of work to present you the final results.

In all cases, we will provide you a quotation and estimate before starting the work and after making the first appointment free of charge helping us to better understand your situation.

- When you retire or up to 5 years prior to that (and if your pension fund allows it), you can ask your pension fund to pay you an OPA pension or an OPA lump sum.

- The 2nd pillar will pay a disability pension as soon as the insured person no longer receives income from their employer’s insurance for loss of earnings. The degree of disability must have been examined by the OASI and must reach at least 40%.

- You will have to pay a one-off tax on the withdrawal of the 2nd pillar capital. The calculation method is the same as for the calculation for the income tax (communal, cantonal, and federal), except that the tax rates are reduced. Consequently, it will vary depending on the canton and municipality of residence.

- In the event of death, the pension fund will observe the situation of the deceased and pay a surviving spouse’s pension corresponding to 60% of the deceased’s pension, as well as an orphan’s pension for children under 18 years of age, or under 25 if they are studying.