Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 21th 2024.

Vehicle insurance in Switzerland: Civil liability, partial or full cover?

No need for any further introduction, as you’ll have gathered by now that this article is designed to provide as much information as possible about vehicle insurance in Switzerland. Over the years, we’ve noticed that our customers are willing to pay out astronomical sums for vehicle insurance without giving it much thought. Today we’re going to take a look at the issue and see whether each of these types of insurance is really essential.

To avoid indigestion, we’ve prepared an article in menu form, to be read in full or point by point. Like a good meal, good car insurance is a three-part composition.

The line-up:

Introduction: Vehicle insurance in Switzerland

If you decide to buy a car, you’re going to have to choose not only which car to buy, but also which insurance you want to work with. It’s an inseparable choice: no insurance, no car. Car insurance is one of the only compulsory insurances in Switzerland (along with health insurance).

Before you can drive off in your new car, you’ll need to choose between 3 categories of vehicle insurance:

– Civil liability insurance for motor vehicles

– Partial cover insurance

– Full cover insurance

This choice will have a huge impact, not only on the price of premiums (which can range from 1:1 to 4:1) but also, and above all, on the cover offered.

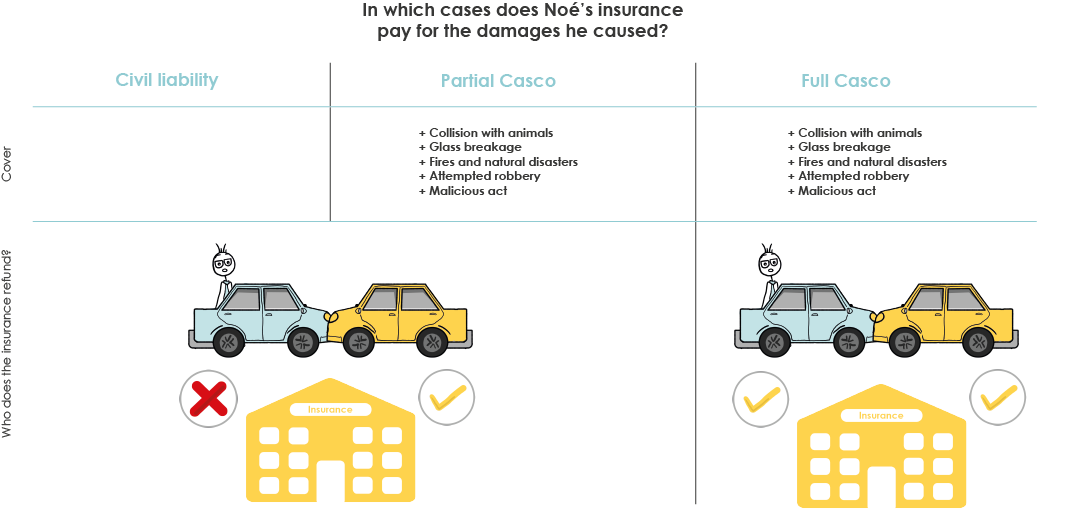

What is civil liability car insurance?

As explained above, it is a cover that is required for you to be allowed to drive with your own car.

It works just as the private civil liability insurance. It protects you against physical, material and immaterial damages you involuntarily caused to another road user.

More specifically, it covers two things:

- Material damage caused to a third person’s vehicle in the context of a road accident or a parking mistake.

- Bodily injury to the victim or victims of the said accident.

In both cases, physical and material damage of the insured person are not included.

The two important clauses in a vehicle CL contract

Even though the civil liability insurance, as a mandatory contract, is rather standardised, there are a few variations between each insurance:

- The amount covered. Though the legal minimum in Switzerland is 5 million CHF, some companies offer up to 100 million CHF in cover for a tiny price difference.

- Serious errors. According to the law, your vehicle CL insurance can make you participate in costs incurred if you erred seriously. It will do so based on the situation, but you should be sure to know about your insurance’s policy on this topic in order to avoid any bad surprises in such an instance. Insurance’s definition of a “serious error” is quite broad.

Let’s use an example. My first car was a Saxo 1.1i X Citroën with the monstruous power of 75 horsepower. I used it to go to university. As a student, my finances were very limited, to put it mildly. I therefore took out a simple car CL.

Thankfully, Mr. Calm and Ms. Tranquille’s honeymoon made it that it did not have any problems. That being said, imagine me, Noé, a young 18-year-old driver in his little town car. Or any other young driver you know.

I try to type “Geneva” on my GPS but I’m having a hard time finding the “a”. I focus on the keyboard and, when briefly letting the road out of my sight, I hit another vehicle.

The impact is not very violent but violent enough for the driver, struck from behind, to hit his head on the windshield. The car is in a bad shape. We have to call an ambulance and the police.

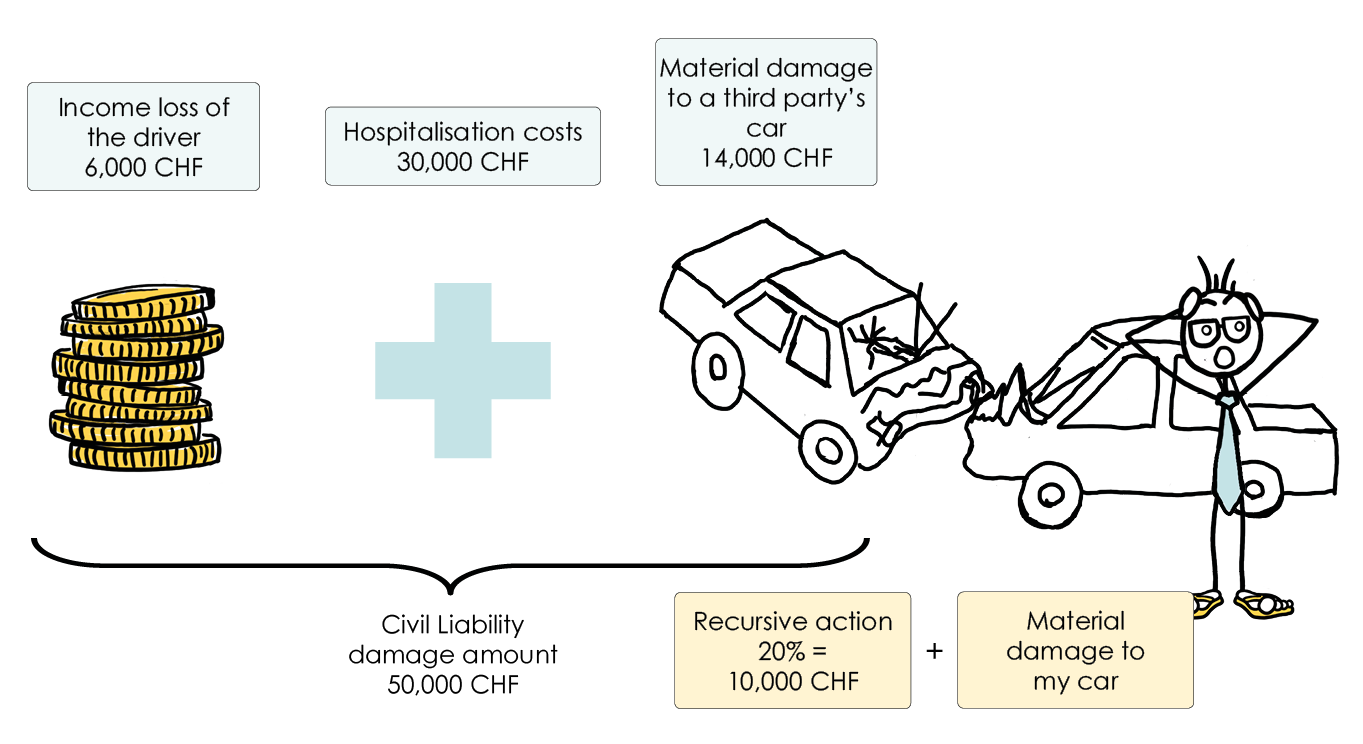

The damages are the following:

- Damage to a third party’s car body: 14,000 CHF.

- Hospitalisation costs: 30,000 CHF

- Income loss of the driver who is not at fault: 6,000 CHF

- CL damage amount: 50,000 CHF

Because it is my fault, my insurance turns against me and asks for a 20% contribution. This is called a recursive action. Result: I have to pay 10,000 CHF out of my pocket and that is without counting the material damage to my car.

How much does a car CL cost?

The civil liability insurance is the cheapest of the three vehicle insurance alternatives.

Its cost strongly varies based on several criteria including:

- The driver’s age

- His previous history

- The cost of the vehicle

- The kilometres travelled per year

- The location it is usually parked

- If you are the main driver or if you often lend it

- Etc.

Each company sets its own criteria and has its own advantages and disadvantages.

Be careful with price comparators!

I would like to digress for a moment and talk to you about the very important topic of online price comparators. While they can turn out to be useful for getting a general view, the latter will always remain approximative. Indeed, comparators present two major issues:

- Unlike qualified and personalised advice, they do not take your wishes, personal situation or lifestyle into account. In short, what makes you unique.

- They do not apply any form of discount whatsoever, nor do they consider negotiation. Though they will show you the cheapest price on the market, it will always be higher than what you could actually have gotten, had you directly dealt with an insurer or, even better, a specialised advisor.

Price comparators are good, personalised advice is better. A lot better.

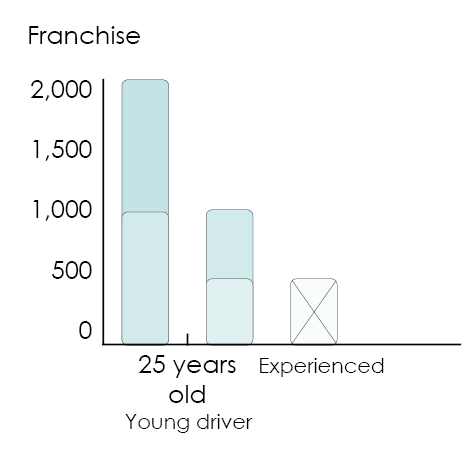

At how much is the car CL franchise price set?

The franchise depends on the contract signed and your age.

- Less than 25 years-old: between 1,000 and 2,000 CHF.

- More than 25 years old but young driver: between 500 and 1,000 CHF.

- More than 25 years-old and experienced: no franchise.

The franchises for experienced drivers can be set in a quite flexible manner. It is very important to take into account the situation in its entirety in order to avoid having to pay high fees in case of an incident.

The starter was tasty but you are left wanting more, right? So here is the main course: the partial casco and if you would rather skip this part and move on to dessert, or, in other words, full casco here it is.

What is the partial casco insurance?

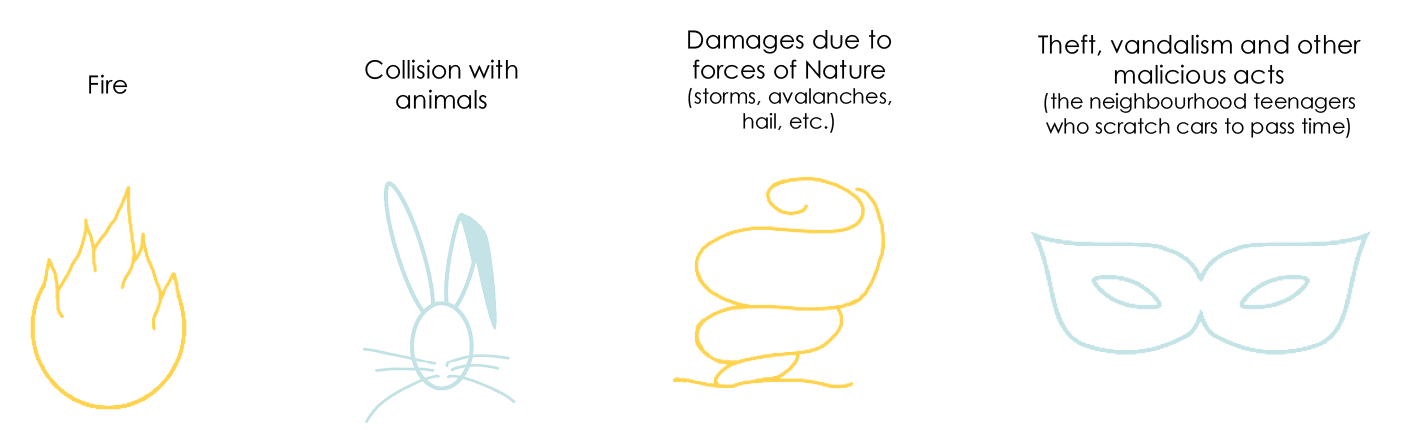

It covers all claims caused to your car that are not due to a collision between two vehicles. The extend of the risks covered is quite widely customisable, therefore, directly contacting a counsellor would be a good idea. That being said, the following elements are commonly included in the list:

Important clauses in a partial casco contract

It is quite simple: on one end, risks are covered, on the other end, a premium is requested.

If the idea of a partial casco remains the same among all insurances, meaning, the cover of the non-collision related damages caused to your vehicle, there are multiple additional options:

- Breakage of glass (windows, mirrors)

- Objects in the vehicle

- Parked vehicle

- Cyberattack

The amount of the premium (vastly) varies accordingly.

The premium is calculated per event and each event has its own franchise. Make sure the latter corresponds to your needs. For example, if you took out a parking cover because you are worried about your LED headlights but that the cover is of 1,000 CHF, this does not make sense.

When is a partial casco worth it?

The partial casco is ideal if you drive on country roads with little traffic in a car whose value is such that you could buy another one without trouble in case of an accident.

Is this your case? Then you can stop reading here.

If this is not your case, you should go check out the last option, the full casco.

What is full casco insurance?

Full casco insurance, also called comprehensive casco or collision casco, is an insurance that covers exactly the same risks as the partial casco does, plus collisions (whether they be simple crashes or more serious accidents)!

Driving with a peace-of-mind add-on is the cherry on the pie.

When is a full casco worth it?

While it is mandatory in order to purchase a leasing contract, the full casco is in general terms suitable for those who drive a brand-new car or an expensive car or for those who frequently travel on Swiss roads and care to be well protected.

It is a true financial armor that protects your vehicle.

Oh, I can fell my little finger move… It is telling me that your next question will be: “but, tell me Noé, when should I go from a full to a partial casco?”

Answering this question precisely is a delicate exercice comparable to walking on a long wire suspended between two cliffs. It is generally estimated that for the first five years of a car’s circulation, a full casco makes perfect sense.

Also, after eight years of going left and right on the road, a simple partial casco insurance is considered to be sufficient.

And what about between five to eight years? It is a grey zone, the decision is entirely yours. It depends on several elements, including the total cost of your car, the means you will have available in case something happens, the amount of kilometers traveled yearly on average, etc, etc.

How much does a full casco cost?

The cost greatly varies depending on the requested services, of course. Let’s take for example my current contract, which includes a full casco insurance for a leased Evoque Range Rover.

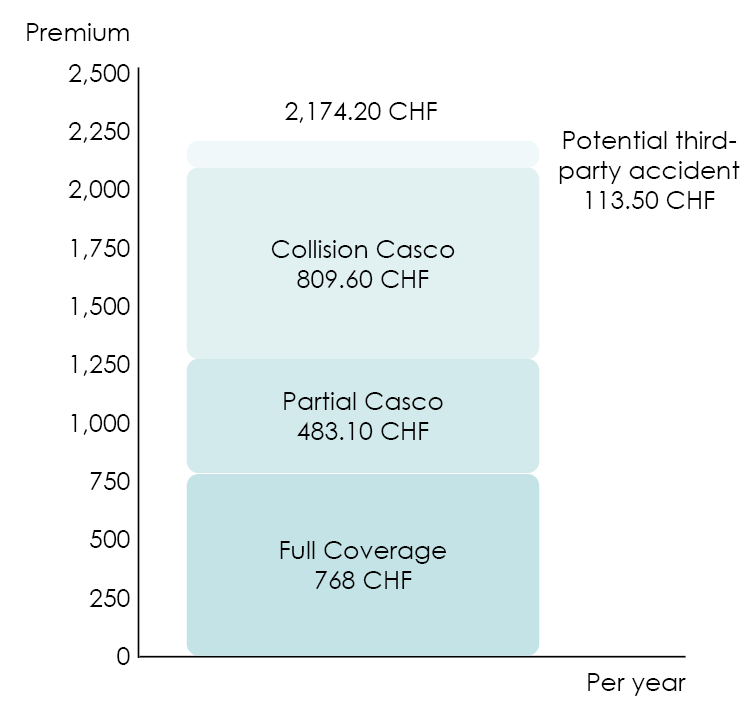

The gross annual premium is 5,215.30 CHF. The net annual premium, the one I actually pay, is 2,174.20 CHF.

What does the malus bonus system mean?

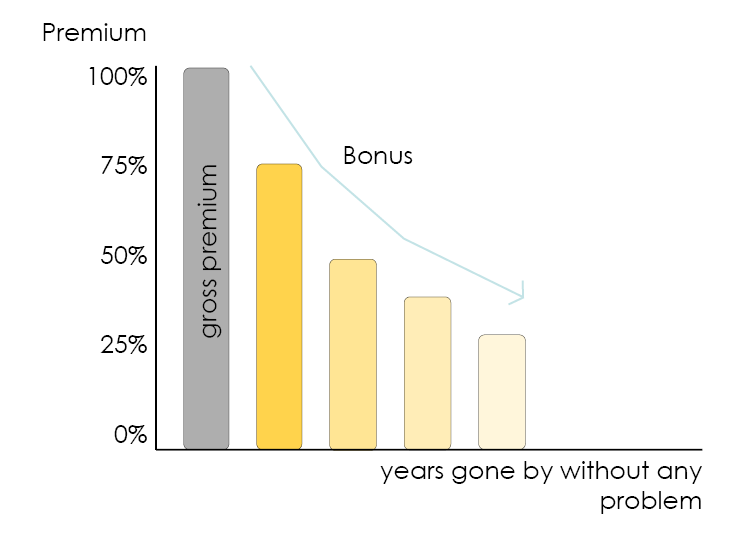

The gross premium corresponds to 100% of what would theoretically be required. Thanks to the bonus system, the premium is reduced to 75%, 50%, 40% or even 30% depending on the status and the history of the insured individual (age, licence suspension, accident, etc.). Each year that goes by without any problem allows you to retrograde to the tier below.

To circle back to my example, I pay 40% of the base premium for the civil liability insurance and 30% of the base premium for the casco.

For this full insurance, I thus pay 768 CHF of civil liability, including a serious error cover and a coverage of 100,000,000 CHF per incident, with a 0 CHF franchise.

I also pay 483.10 CHF of partial casco, which covers theft, natural disasters, glass breakage, special damage and personal belongings for up to 2,000 CHF.

To complete these two levels, I pay 809.60 CHF of collision casco, with a cover for serious error and compensation according to the base value, increased by 20% (I will explain this right below).

Finally, I also pay 113.50 CHF to cover potential passenger damages, including death expenses, invalidity expenses, daily allowances, daily hospitalisation allowances and treatment costs, illimited for five years.

Little bonus: a legal protection is included in the total, which amounts to 2,174.20 CHF.

What is increased market value?

To keep it short, the market value refers to the price of your vehicle on the market. The increased market value intervenes in case of full damage to your car. It offers protection against the astronomical loss of value of a new car on the market.

If my market value is increased by 20%, the insurance will reimburse be, in the event of a full damage, the cost of my car on the market in its current state (right before the accident), to which it will add 20%.

When can I terminate my car insurance?

A car insurance contract may be terminated in the following cases:

- You are selling and/or changing vehicles.

- The premium has changed (raise or reduction). In the event of a variation in the amount of the premium, the contract can be terminated.

- You were refunded for an accident case.

- At the end of the contractually agreed term, naturally.

The notice period is usually of three months. If you want to take out another insurance, do not forget to notify your current insurance minimum three months before the legal termination date of the contract.

Car insurance can also be terminated by your insurance, the same right is applicable on both ends. If you represent too big of a danger on the road for them, they have the possibility to request for the termination of your contract, following a reimbursement.