Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 17th 2024.

What is household insurance?

Have you ever completed an inventory of your home?

If not, it is a fascinating exercise. You will see that the value of the goods in your household is three times more than what you thought it was!

If you have done it, are you sure you are properly insured? For instance, if someone steals your new iPhone on the metro, will you be refunded for it?

By the end of this short article, you will know exactly what household insurances are for, which terms to check and the options that have become essential now that smartphones are worth the same as computers!

The line-up:

What is household insurance?

Household insurance covers damage caused to personal belongings, inside and outside your home.

In the early hours, you wake up, your eyes are still half-shut from a good night’s sleep, you make you way to the kitchen to grab some coffee. There, you notice you MacBook is no longer on the table. Or, you are heartbroken to find out the wood from your vintage bookshelf gave way under the pressure of a water infiltration. Or else, a meteorite fell in the middle of your living room and your TV shattered into pieces.

In each one of these situations (yes, even in the event of a meteorite or an emergency landing of a space vehicle), all you have to do if notify your household insurance, which will refund you shortly.

In a nutshell: household insurance is there to reimburse you when someone or something has caused damage to your personal belongings. Unlike civil liability insurance, which protects your actions against the property of others, household insurance insures your own personal property.

Is household insurance mandatory?

In Switzerland, household insurance, like civil liability insurance, is not compulsory but highly recommended. When striking a balance between, on the one hand, the price of one’s furniture, dressing and electronics and, on the other hand, the minimal cost of household insurance, the conclusion that should be drawn seems to be a no brainer.

That being said, everyone remains free to leave the entirety of the items of their household at the mercy of natural disasters and burglaries of all kinds.

What exactly does household insurance cover?

It covers all movable personal belongings which are in your household. From your first watch to your Samsung Ultra HD, including your instant Polaroid and your precious Pléiade collection.

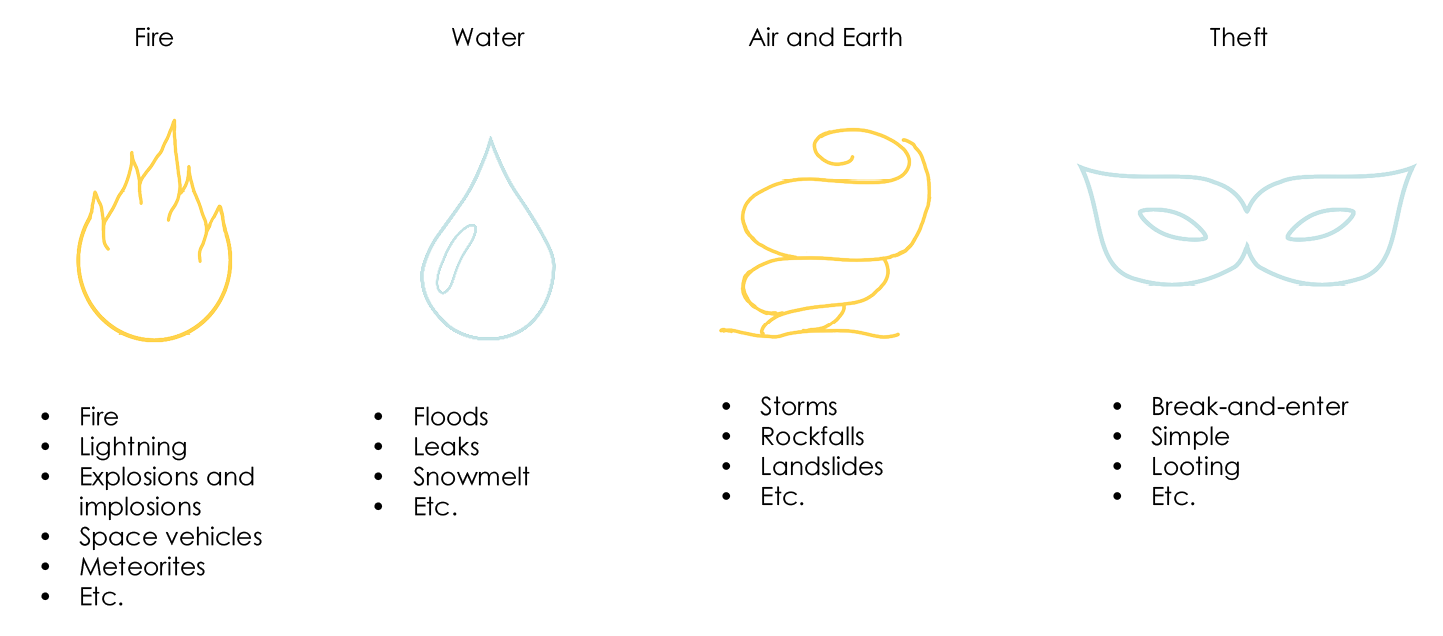

Your belongings are insured at least against:

However, these coverages can be expanded to include more claims.

Is theft covered by your household insurance?

Generally, insurances distinguish between three types of theft.

Break-and-enter

I return home after a nice weekend in Tuscany. I see, with dismay, the living room bay window shattered into a thousand pieces. If I am properly insured, no need to drown my sorrows in the Chianti bottle I had planned to age in my cellar!

Every break-and-enter robbery in your home is covered by your household insurance. However, in order to be covered, there obviously need to be evidence of a break-in.

Looting

Also called pilling sometimes, ransacking or raiding, it refers to any theft committed by violence or threat, from armed robbery to pickpocketing.

Based on your insurance policy, your insurance may or may not bear the costs, depending on where the theft occurred, in your home or outside it (for example, in the middle of the street). Upon signing your household insurance policy, you should find out about the details. Contact us and we will be able to support you throughout the process with your household insurance company.

Simple theft

You fell asleep and forgot to lock the door, a stranger shows up in your home and steals your phone from you. Or as you leave the metro, you realise your wallet is missing from your back pocket.

In both cases, it is simple theft, which mean there was no physical nor material violence involved (no threat, no damage).

In this case it is more complicated. Your best option is to be prepared to this possibility by taking out a full housing insurance, which specifically includes the “outside theft” option. It is a smart choice given the fact that:

- Most thefts occur in public spaces or outside your home.

- The price of movable objects such as smartphones increase yearly.

Either way, you will have to report the theft to the police.

Do any complementary household insurances exist?

A household insurance is, as we have seen, extremely useful by its very nature. It is important to note that depending on individual cases and situations, it allows for the inclusion of other options, such as:

- Change of deductible.

- Increase of coverages in case of thefts outside the household.

- Adding covered risks:

- Valuable items insurance (above a certain value)

- Cyber-protection

- Assistance in case of loss of keys

- Luggage insurance (when traveling)

Before taking up modifications, it is worth comparing the costs of services to their value, based on your personal situation.

Furthermore, you should take the time to make sure each insurance which is complementary to household insurance can be of use to you and that this cover is not already assumed by third-parties.

How much does household insurance cost?

While household insurance is one of the cheapest insurances, it is also one of the most precious ones. Though its cost can vary from single to triple depending on the value of your household inventory, on average, the cost ranges from 100 CHF to 300 CHF per year. That is just a few dozen CHF a month to insure the items in your household.

Be careful with price comparators!

I would like to digress for a moment and talk to you about the very important topic of online price comparators. While they can turn out to be useful for getting a general view, the latter will always remain approximative. Indeed, comparators present two major issues:

- Unlike qualified and personalised advice, they do not take your wishes, personal situation or lifestyle into account. In short, what makes you unique.

- They do not apply any form of discount whatsoever, nor do they consider negotiation. Though they will show you the cheapest price on the market, it will always be higher than what you could actually have gotten, had you directly dealt with an insurer or, even better, a specialised advisor.

Your environment can also make you benefit from big discounts:

- Combination discounts (several contracts concluded with the same insurer).

- Company discounts: your job can make you save money on the premiums you pay.

Price comparators are good, personalised advice is better. A lot better.

When and how to cancel household insurance?

As with all property insurance (civil liability, legal protection, motor vehicle, etc.), household insurance can be cancelled in at least 3 cases:

- At the end of the contractual term (the termination request must be placed three months before the end of the time-period otherwise, if the deadline passes, the contract will be tacitly renewed).

- If the risk disappears, if you decide to leave Switzerland, the contract will no longer be relevant and will be terminated on your last day. Do not forget to do the required paperwork process.

- A cancellation in the case of a claim. After a claim, you will have the possibility to terminate your household insurance, once you received compensation.

- One last less known point, which can work in some cases: grouping two insured persons under the same roof: if you decide to move in with your other half, you can ask to keep only one contract and cancel the other.

Be careful: if, by some mischance, life keeps throwing unexpected events your way and, thereby, compensation claims at the insurance, the latter is also entitled to terminate the contract after a claim and no longer insure you for the future!

Notice periods

Whether it be your membership at the Let’s Go gym or your phone subscription, every contract works the same way.

There are fixed periods to terminate your insurances and, in most cases, it is necessary to ask for the cancellation of the policy at least three months before the final date.

Tips and tricks for your household insurance

Tip no. 1: Don’t let price dictate your choice of household insurance.

Unlike compulsory health insurance, where cover is uniform, household insurance policies vary considerably. Although the costs of these policies are generally not very high, it is crucial to prioritise the quality and extent of cover before considering the price. Concentrate on what your insurance covers: this could save you much greater expense in the event of a claim. In fact, trying to save money on the price of your household insurance is unlikely to offer significant savings potential in the long term.

Tip no. 2: Group your civil liability and household insurance under a single policy.

This advice, although widely known, is worth remembering. Opting for combined household-liability insurance has a number of significant advantages. Firstly, it simplifies the management of your insurance: a single point of contact takes charge of all disputes relating to your personal property, eliminating any confusion over which cover is liable in the event of a claim. Secondly, it often reduces the total cost of the two policies, offering significant savings. Finally, this approach centralises and accelerates all the administrative procedures associated with your insurance. Simplify your protection and your budget with this little tip.

Tip no. 3: Use your insurance wisely and avoid calling on it for every little financial incident.

As mentioned above, insurance companies can decide to cancel your contracts after a refund, without having to give explicit reasons. If you frequently use your insurance for small amounts, don’t be surprised if you suddenly find yourself without cover. It is therefore advisable to reserve your insurance for more significant claims. For small claims, it may be more advantageous to pay out of pocket. This way, you save your insurance ‘joker’ for really critical situations where the costs would otherwise be insurmountable.