Written by Yanis Kharchafi

Written by Yanis KharchafiSelf-Employed and Businesses: How does VAT work in Switzerland?

VAT in Switzerland, like everywhere else, is anything but simple.

In fact, it’s so complex that there are now specialists who deal only with VAT… and for good reason. With different rates, reporting methods, and a cascade of exceptions, it’s easy to get lost.

But don’t worry, the goal of this article isn’t to drown you in regulatory details. On the contrary, we’ll help you understand the fundamentals quickly, so you can move forward with your business without making the classic mistakes.

In the rest of the article, you’ll discover two ways to report VAT. And spoiler alert: they can lead to very different results.

If you’d like to test how each method impacts your business, simply book a free introductory call, we’ll be happy to share our calculation tool with you.

Here’s what this short guide covers:

What is VAT, in a nutshell?

Unlike income or profit tax, VAT (Value Added Tax) is an indirect tax. In simple terms: the entity that pays the tax to the Confederation (the business) is not the one who actually bears the cost, that’s the final consumer.

In Switzerland, all businesses, whether sole proprietorships, limited companies (SA), or LLCs (Sàrl), must, with few exceptions, add a VAT rate to their sales prices.

They collect VAT from their customers, then transfer it to the Confederation. In return, they have the right to deduct the VAT they themselves have paid on business-related purchases.

There are exceptions, however: some activities are exempt from VAT, such as medical services, cultural activities, or education. In these cases, no VAT is charged, and no deductions are allowed either.

Who, when, and how should you register for VAT in Switzerland?

In principle, anyone (individual or legal entity) carrying out a business activity in Switzerland, regardless of their legal form, is subject to VAT.

This allows the business to add VAT to its prices, and also to deduct the VAT it pays on its expenses.

However, to avoid burdening very small businesses from day one, VAT registration only becomes mandatory once you generate more than CHF 100,000 in annual turnover (excluding exempt activities).

Before reaching this threshold, registration is optional. After, it becomes compulsory.

So how do you register?

It’s fairly simple:

If you believe you’ll exceed CHF 100,000 in turnover this year or next, head to the website of the Federal Tax Administration (FTA).

There, you’ll find an online registration form. It only takes a few minutes to complete.

Depending on the accounting method you choose (more on that shortly), the deadlines for submitting your VAT returns may vary, but we’ll break all of that down in the next sections.

How is VAT calculated: Standard method vs. Net Tax Liability method (TDFN)?

If there’s only one paragraph you take away from this article, let it be this one.

As a fiduciary, we still see far too many entrepreneurs who, either due to lack of time or guidance, don’t even realize that there are two different ways to calculate VAT in Switzerland.

And yet, these two methods can lead to very different results.

Here’s the key takeaway: one method is often less favorable than the other, which means you could end up paying more tax than necessary.

It’s a bit like forgetting to claim a deduction or omitting an eligible expense, not a huge mistake, no one will penalize you…

But you’ll have paid extra tax for no reason.

Method 1 – The Standard Method

If you’re not yet a whiz at accounting, I highly recommend checking out our dedicated articles:

In my opinion, if you’re starting from scratch, that’s probably the best place to begin.

For everyone else, let’s get back to our article.

In my opinion, if you have no background in accounting, that’s probably where you should start. For everyone else, let’s get back to our article.

This first method is the easiest to understand:

You add VAT to your invoices, and the full amount of that VAT must be paid to the Swiss Federal Tax Administration (FTA). In return, you can recover all the VAT you’ve paid on your business-related purchases.

To avoid paying on one side and requesting reimbursement on the other, it makes sense to keep a VAT account, allowing you to do a single transaction and automatically balance everything at the end of each reporting period.

To make this clearer, I’ll use the real-life example of a friend of mine, a real estate broker, who, during an evening at Cully Jazz where the biggest decision should’ve been between a Spritz or a Lillet, chose instead to tell me that her fiduciary had opted for the standard method to handle her VAT.

The value of this example lies in how straightforward it is: she sells apartments and doesn’t have any employees.

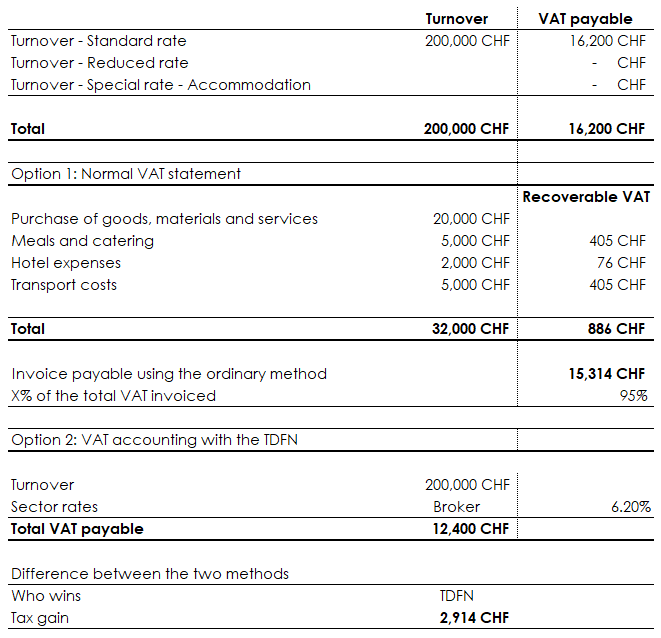

Here’s a quick snapshot of her accounting:

- Office rent: CHF 24,000

- Commission from real estate sales (VAT included): CHF 200,000

- Salary subject to AVS (social security): CHF 70,000

- AVS contributions (employee + employer / 12.6%): CHF 8,820

- LPP contributions (occupational pension): CHF 2,250

- Office supplies: CHF 15,000

- Food and coffee for clients: CHF 2,500

- Software and IT expenses: CHF 5,000

Of course, this simplified income statement doesn’t yet include the lines directly related to taxes (VAT, corporate income tax, capital tax), but that’s not the focus of this article, so let’s pretend those don’t exist for now.

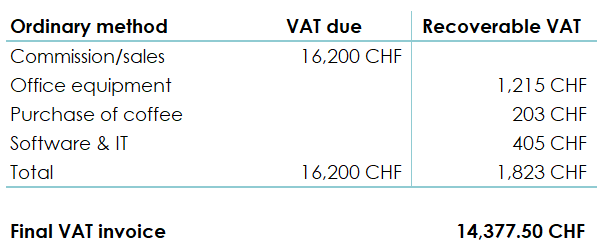

In the end, our broker:

- Charged VAT on her sales:

CHF 200,000 × 8.1% = CHF 16,200 - Paid VAT on her business expenses:

(CHF 15,000 + CHF 2,500 + CHF 5,000) = CHF 22,500

VAT paid: CHF 22,500 × 8.1% = CHF 1,822.50

In the end, she will have to pay to the Confederation: CHF 16,200 – 1,822.50 = CHF 14,377.50

Method 2: The Net Tax Liability Rate (TDFN)

Still at that same evening, just as we were leaving her apartment to head to the festival, I tried hard to explain to her that there is a second method. A method that is easier to understand, quicker to implement, and, in her case, financially much more advantageous.

The Net Tax Liability Rate (TDFN) is a bit like withholding tax for people living in Switzerland who don’t yet have a C permit or Swiss nationality. It’s a system based solely on gross turnover.

The only two pieces of information needed are:

- Gross turnover

- Business sector

No need to keep a VAT account or determine what you must pay and what you can deduct. Everything is automatic.

How does the net tax liability rate (TDFN) or flat-rate method work?

The Swiss Federal Tax Administration (AFC) has probably studied hundreds of thousands of businesses. Based on this data, it was able to estimate, according to activity sectors, the average share of professional expenses entrepreneurs face.

On this basis, it defined average flat rates, which are applied directly to the VAT-inclusive turnover.

Let’s go back to our example: as we saw, a real estate broker has very few expenses:

- No raw materials

- No subcontracted services

- No inventory to manage

She charges VAT but deducts almost nothing. If, on the other hand, she were building the properties she sells, it would be very different:

She would have to hire dozens of companies, buy huge amounts of materials, pay for storage, etc.

It is exactly this reasoning that led the AFC to create standard rates by sector of activity.

You can find the full list of TDFN rates by industry here: Net Tax Liability Rates – AFC

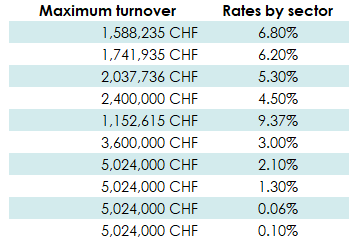

In summary, there are 9 standard rates:

- 6.8%: For activities with very few deductible expenses. Typically: translators, tour guides, domestic helpers, independent trainers…

You charge VAT but deduct almost nothing. - 6.2%: Same logic as the previous rate but with slightly more expenses. Examples: real estate brokers, consulting firms (like ours), art galleries, engineers, web developers…

- 5.3%: For training activities, coaching, technical consulting, or certain agencies.

- 4.5%: Applies to some providers in artistic or cultural fields, or professions related to advertising.

- 3.7%: Activities like maintenance, cleaning, home services, with a bit more equipment and recurring purchases.

- 3%: For companies with a slightly more complex structure or salaried staff, but still in the service sector.

- 2.1%: This is the typical rate for merchants. You buy goods (or raw materials) with VAT and then resell them at a higher price. Often the case in retail, fast food, or small shops.

- 1.3%: For some mixed activities (products + services), or in more industrial sectors.

- 0.6%: The lowest rate. Reserved for industries with massive deductible expenses: wholesale trade, heavy industry, certain construction trades, etc.

At this point, you’re starting to get the idea: these rates allow you to quickly take your gross billed turnover and apply the corresponding rate to know what you owe to the tax authorities.

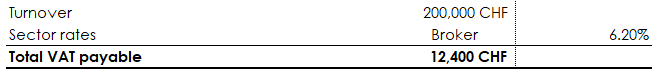

Let’s go back to my broker friend and her CHF 200,000 turnover.

With the net tax liability method, she would simply multiply this amount by 6.2%.

CHF 200,000 × 6.2% = CHF 12,400 to be paid to the AFC.

Compared to the CHF 14,377.50 under the ordinary method, the difference is far from negligible…

Thanks to this second method, the bill to be paid — for the same turnover and the same expenses, would drop from CHF 14,378 to CHF 12,400, an annual saving of CHF 2,914.

I don’t know about you, but even though VAT is often the last thing on our minds when starting a business, I think paying almost CHF 3,000 in unnecessary tax every year, on top of your fiduciary’s fees, is just a real shame…

Anyway, we’re not here to argue, and we still have a few more questions to cover. Probably less critical, but still useful to understand.

Who must apply which method: Standard or net tax debt rate (TDFN)?

Choosing the right method shouldn’t take too long to explain, because the rule is fairly simple.

To be eligible to apply the Net Tax Debt Rate (TDFN), two conditions must be met:

- Your annual turnover (including VAT) must not exceed CHF 5,024,000 in 2025

- The amount of VAT payable must not exceed CHF 108,000

And since each industry has its own TDFN rate, you just need to divide this CHF 108,000 threshold by the rate for your sector to find out the maximum turnover allowed in your field.

In other words, our real estate broker, with a TDFN rate of 6.2%, can use this method as long as her turnover does not exceed CHF 1,741,935 in 2025.

And as long as she stays below this threshold, she can continue saving nearly CHF 3,000 in taxes per year — without changing any of her expenses. Simply by choosing the right method.

The only reliable way to ensure you’re not paying more VAT than necessary is to run a precise simulation. The good news? It’s quick to do, and we can help you with it.

What are the pros and cons of these methods?

The main difference between the two VAT calculation methods lies in how often you need to file returns with the Swiss Federal Tax Administration (AFC):

- With the net tax rate method (TDFN), you only need to file two VAT returns per year, i.e., one every six months.

- With the standard method, the VAT return is quarterly, meaning four times a year.

That being said — and speaking honestly from experience managing many clients — it’s quite rare to see bookkeeping done daily. Even monthly is uncommon… Most entrepreneurs push accounting and paperwork to the end of the year, often in a panic before closing.

If that sounds like you, the TDFN method will probably fit your management style better.

Can you switch from one method to the other?

Yes, you can switch between methods.

In principle, this change is allowed up to 60 days after the start of a new tax period (usually on January 1st). You simply need to contact the Swiss Federal Tax Administration (AFC) to inform them of your intention.

However, be careful: switching methods may require some accounting adjustments, especially if the change occurs mid-period or if there are differences in how past transactions were recorded.

The cash or invoice method – A method within the method

After everything you’ve just read, you might be debating whether to give up on your entrepreneurial dreams (because, let’s be honest, VAT isn’t exactly sexy) or take a painkiller to ease your headache.

But before we wrap up this article, there’s one more thing you need to know:

If you’re going ahead with your business and become liable for VAT, it’s not enough to choose between the ordinary method and the net tax liability (TDFN) method.

You’ll also need to decide whether to keep your accounts using the cash method or the invoice method.

We’re focusing on VAT here, but be aware: this choice affects your entire accounting system.

The cash method

You could call this the “money in, money out” method.

In simple terms, you only pay (or reclaim) VAT when the money actually moves.

Example: You send a client an invoice for tax preparation. They receive it… and decide to wait. As long as the money hasn’t landed in your account, no VAT is due.

Same goes for your expenses: if Swisscom sends you a hefty bill and it sits on your desk unpaid, you can’t reclaim the VAT.

Getting the picture? It’s simple: no cash, no VAT.

The invoice method

Think of this one as the “receivables and payables” method.

Here, it’s not about whether you’ve received or paid the money — the moment an invoice is sent or received, it counts for VAT.

As soon as you invoice a client, VAT becomes payable — even if you haven’t received a cent.

And as soon as you receive a supplier invoice, VAT becomes reclaimable — even if you haven’t paid it yet.

This method is, for companies above a certain size, the only one truly accepted by accounting standards (like IFRS, Swiss GAAP FER, etc.).

But be careful: its biggest downside for small businesses is that if your clients are late to pay, you’ll have to front the VAT without having the money yet.

And trust me, when multiple clients are dragging their feet, your cash flow can take a serious hit.

What should you remember about VAT?

Like income tax returns, VAT is a mandatory tax and a legal obligation for all self-employed individuals and entrepreneurs in Switzerland.

And as with most administrative procedures, VAT can become:

- just another chore you try to get over with as quickly as possible, rushing into the first method that comes along,

- or, like my friend, by simply following the advice of the fiduciary without asking questions,

- or — like our clients — by taking the time to understand the options, compare methods, and optimize the entire process.

The result: more clarity, less stress, time saved… and unnecessary tax burdens avoided.

How FBKConseils can support you with your VAT questions?

Introductory Meeting

As always, we offer a free initial meeting of about 20 minutes to better understand your project, answer your first questions, and guide you towards the most suitable method or solution.

VAT registration and annual returns

If you want to outsource your declarations, whether for VAT, accounting, payroll management, or tax filings, FBKConseils can handle this for you clearly and transparently. We invite you to create a tailor-made quote for your company directly on our website.

Business Creation: Do you have an entrepreneurial project brewing in your mind?

FBKConseils is here to help you choose the most appropriate legal structure, manage all legal and administrative aspects, and if needed, perform tax and economic simulations to help you make the right decisions from the start.