Tax return in Valais: peace of mind, time savings, and tax optimization

In Valais, filing your tax return goes hand in hand with deadlines, extensions, supporting documents, and choosing your submission channel (VStax, forms, or paper). Even when you’re well organized, it’s easy to miss deductions or lose opportunities to optimize for the following year.

FBKConseils handles your file from A to Z: meeting deadlines, preparing via VStax, liaising with the authorities, and implementing optimizations to sustainably reduce your tax burden.

Why choose FBKConseils?

At FBKConseils, our entire team is qualified, trained and passionate in multiple areas that will be useful to you throughout your projects.

Mastery of deadlines and the VStax process

We secure your timelines (base deadline and extensions) and prepare and review your return in VStax or on paper, according to your preferences.

Accuracy & compliance

We identify applicable deductions and complete your return with rigor, then handle document requests and corrections with the tax authority through to the final assessment.

Advisory & long-term optimization

After filing, we offer a follow-up meeting to plan optimization paths (LPP buybacks, 3rd pillar, property purchase, lump-sum vs. actual expenses, etc.) to lighten your taxes in the years ahead.

Valuable time savings

Clear checklist, digital or paper submission, online platform: you send us your documents, we do the rest. Less stress, more time… and better-controlled taxes.

Our offers for filing your tax return in Valais

With us, everything usually starts with a free first consultation, either at our office or by video call, to discuss your needs and guide you in the best way possible.

195.-

/hour

Includes:

- Free 15-minute introductory meeting.

- A session with a tax expert, for as long as you need.

- Detailed explanations about your taxation, deductions, and obligations.

- Step-by-step guidance to complete your own tax return.

Personalized quote

Includes:

- A simple and clear list of required documents.

- We manage the entire process: analysis, request, complete tax return, and follow-up with the authorities (depending on the options chosen).

- Ideal if you want complete support and zero stress.

Personalized quote

Includes:

- Free 15-minute introductory meeting.

- A simple and clear list of required documents.

- We manage the entire process: analysis, application, complete tax return, and follow-up with the authorities.

- Ideal if you want total support and peace of mind.

They already trust us.

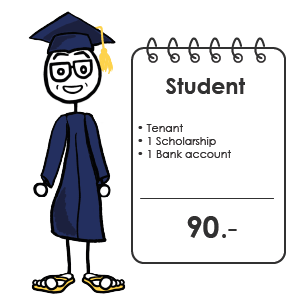

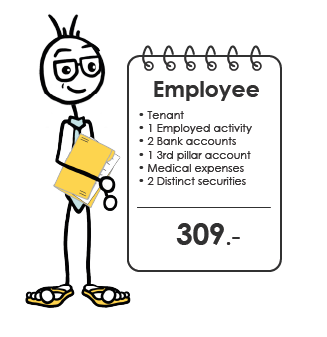

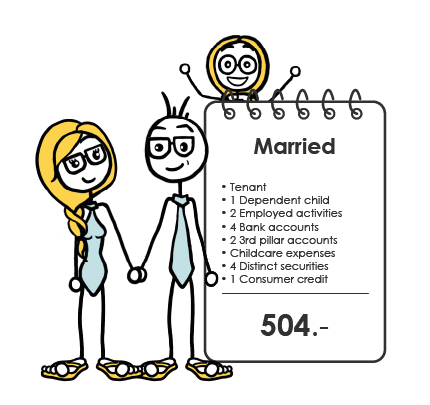

Tailored pricing

The time and cost required to complete your tax return depend on your personal situation. Our goal is to offer fair, tailored pricing: you pay a fair amount based on the number of documents to be processed. You will find below some examples of typical situations. You can also consult our full price list per document, or use our online platform to get an instant personalized quote based on the type and number of documents that apply to you.

The rule is quite simple. Your canton and commune of residence as of December 31st of the fiscal year are decisive.

If your family status changes during the year, the same rule that applies to your residence also applies to your civil status. Your situation on December 31st will be taken into account in your tax return.

Whether you live in the canton of Valais or elsewhere in Switzerland, retirement pensions are 100% taxed as part of your income.

Each canton has its own particularities. For the canton of Valais, it is allowed to deduct 30’000 CHF for single people and 60’000 CHF for married people or people with children.

Until you receive the final tax decision, you are free to adjust it. You will then have 30 days from the receipt of the final decision to make modifications.

How can we help you?

Find more articles on this topic.

17 tax deductions to claim in the canton of Valais for 2025

Reading time 10 min. Updated on December, 9th 2025.

Understanding Wealth tax in Valais

Reading time 4 min. Updated on November, 27th 2025.

Communal income taxes in Valais

Reading time 8 min. Updated on December, 9th 2025.

Understanding cantonal income taxes in Valais

Reading time 5 min. Updated on December, 4th 2025.