Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 17th 2024.

Household insurance: Understanding the risk of over- and under-insurance

The line-up:

When it comes to household insurance it is possible to be under-insured or, on the contrary, to be over-insured.

Either way, the insuree must rectify the situation in order to avoid problems down the road, which, in some cases, can have serious consequences. It would be a real shame to have paid for insurance for years, only for it to decide, on the day you (finally) feel you need it, to cover only “part of your damage”.

As always, let’s take the time to get informed and avoid this kind of disaster.

Household insurance: the risk of being over-insured

When you wish to take out a household insurance, you are required to provide the said insurance with the sum of all the items in your home: this is called the household inventory.

The inventory established must be precise enough so that you are not over-insured, which will lead to you paying premiums for nothing. Indeed, in the event of damage, the insurance will reimburse, at most, the replacement value of the relevant items.

In other words, paying more than what is necessary does not improve your insurance’s services in any way.

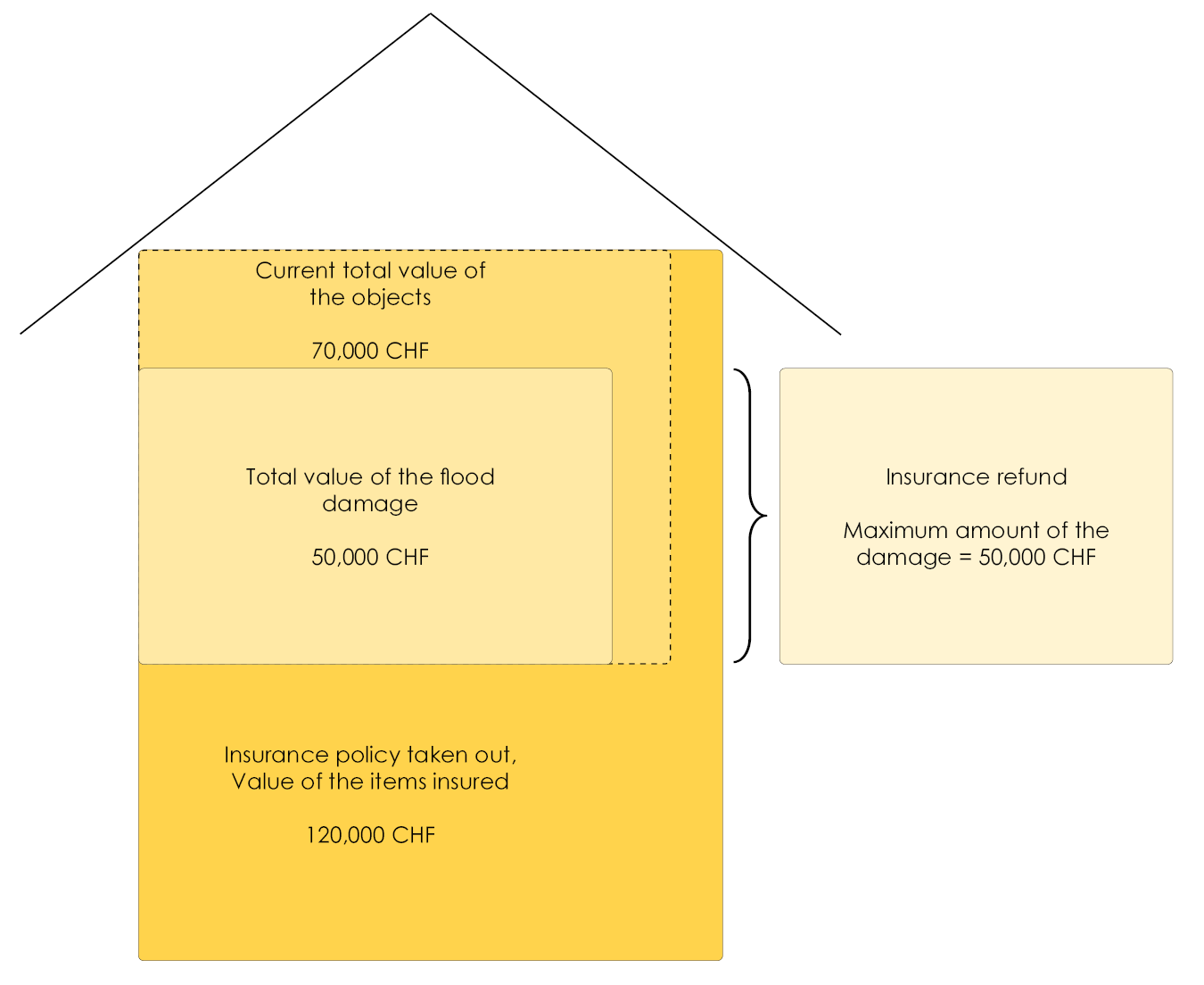

Let’s use an example: one evening, when Zoé and I were at a festival, the bathtub tap was not closed properly and the bathtub started to overflow while we were away. When we got back, a big part of our bedroom and living room were flooded and several of objects were damaged. We immediately contacted the insurance, which sent an expert. He came over and assessed the damage: 50,000 CHF.

Value indicated in the household insurance policy: 120,000 CHF

- Flood damage: 50,000 CHF

- Our actual damage: 70,000 CHF

They will refund, at most, the actual damage = 50,000 CHF. Even though we paid premiums on 120,000 CHF.

In conclusion, being over-insured is not dangerous in itself. It simply represents a loss.

You will be paying a high premium, which will not protect you any better than if you had paid a fair price.

Household insurance: the risk of being under-insured

Without further information, I’m sure you’re beginning to understand what underinsurance could be. The principle is almost exactly the same: when you take out household insurance, you have to tell your insurer how much you need to insure in the event of total damage.

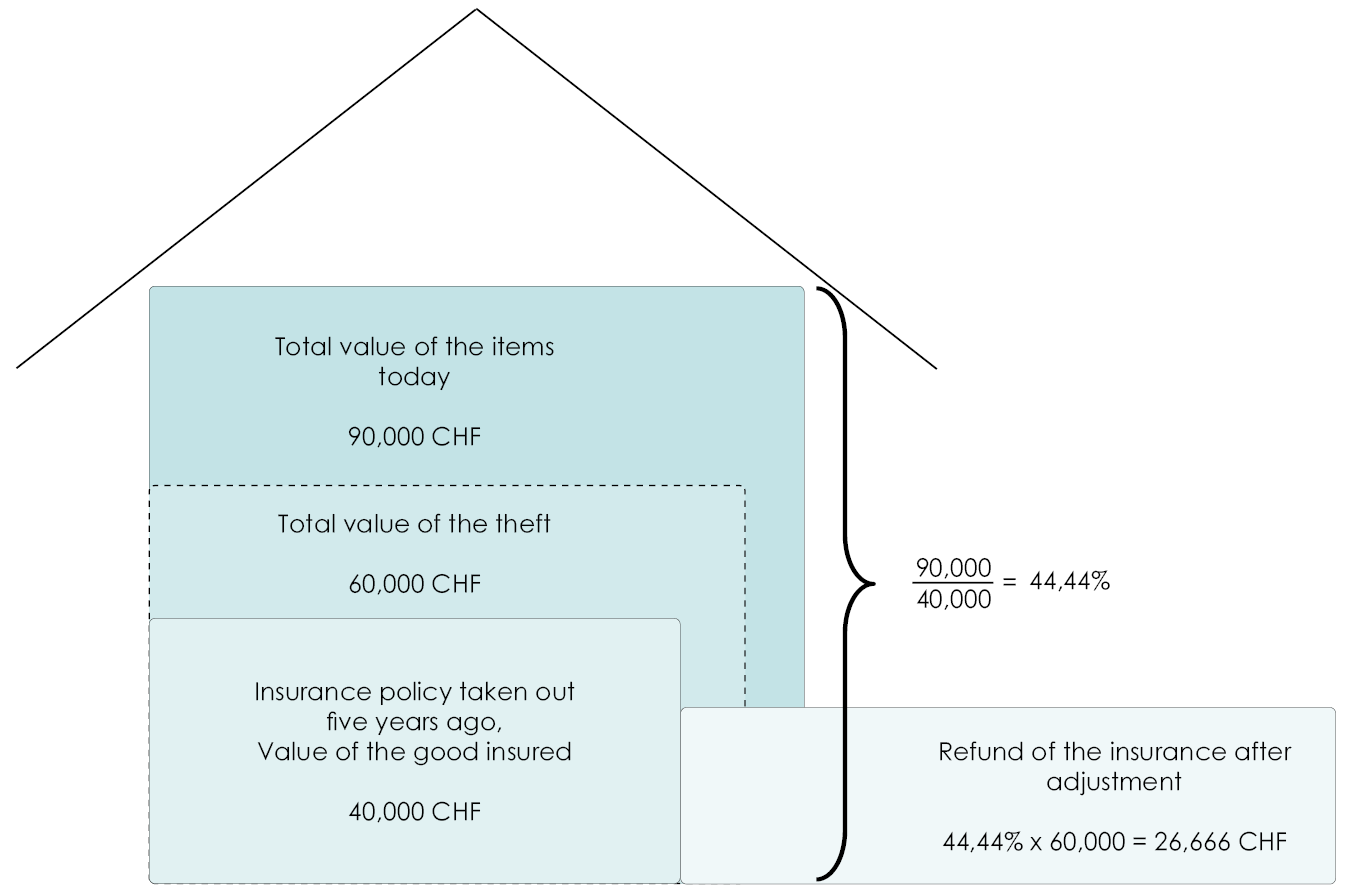

Let’s use an example: one evening, when Zoé and I were at a festival, burglars broke into our home. They managed to have enough time to steal a big chunk of our belongings. There was not a single valuable object left in the house. We contacted our insurance to report the theft. In order to process our refund request, the insurance sent us an expert to assess the damage. He estimated that the theft cost us 60,000 CHF. He then proceeded to ask us about our insurance policy:

- Value indicated in the household insurance policy:40,000 CHF

- Theft: 60,000 CHF

- Actual household inventory: 90,000 CHF

Though the value of our belongings when we first moved in five years ago was about 40,000 CHF, today, without even realising it, it increased to 90,000 CHF.

The insurance will thus proceed with the refund, but by adjusting it to the amount of the policy.

40,000 / 90,000 = 44.44 %.

Insurance refund: 44.44% x 60,000 = 26,666.66 CHF

Tips and tricks to avoid over- or under-insurance

Tip no. 1: Don’t underestimate the value of your inventory to reduce your premiums.

Even if household insurance is not compulsory and you have the freedom to choose the amount you wish to insure, declaring a lower value than the actual value of your possessions in order to save on premiums could prove counter-productive. In the event of a claim, you could end up with insufficient reimbursement, rendering the premiums you paid useless. Declaring the exact value of your possessions is crucial for adequate cover.

Tip no. 2: Adapt your insurance cover over time.

The value of your home inventory can change considerably: from your first flat during your studies to an established family life with children. It’s important to adjust your insurance regularly so that it reflects these changes and remains effective. Don’t neglect this essential step to ensure that your insurance provides you with adequate protection throughout your life.

Tip no. 3: Use your insurer’s simulator to determine the value of your inventory.

Calculating the exact value of your possessions is not always an easy task. Fortunately, many insurers offer simulators that take into account factors such as the number of rooms, the size of the home, the number of people in the household and your lifestyle to determine this amount. Use this simulator to make sure that your insurance covers all your possessions correctly, giving you peace of mind and adequate protection.