Written by Yanis Kharchafi

Written by Yanis KharchafiHow does accounting and taxation work for the freelancers?

Introduction

When deciding to become self-employed in Switzerland, accounting is often not the first thing that comes to mind. And yet, it is much more than just a legal requirement: it’s an essential tool for managing your business effectively, optimizing your taxes, and avoiding potentially costly tax pitfalls. But don’t worry—you don’t need to be a certified accountant to succeed. In this article, we’ll break down everything you need to know to keep your accounting simple, efficient, and fully compliant with legal requirements.

Quick note: This article is long, sometimes complex, and not every section will apply to your situation. Feel free to use the table of contents to jump straight to the parts that matter most to you. The first major part of this article focuses specifically on accounting for self-employed individuals, while the second part addresses the tax aspects related to this type of activity.

The line-up:

Why do self-employed individuals need to keep accounts?

Accounting — A legal obligation

At first glance, this question may seem odd, as the immediate answer would simply be: “Because it’s mandatory!” Indeed, according to Article 957 of the Swiss Code of Obligations, all sole proprietorships are legally required to maintain proper accounting records. However, this legal reason is not the only relevant justification.

Accounting — Deductible expenses and lower taxes

Good bookkeeping primarily allows you to claim what are commonly called deductions for individuals, but referred to as “expenses” in the business world. These legally allowed business expenses reduce your gross revenue, thereby lowering your taxable profit—and as a result, your overall tax burden. Don’t worry, we’ll dive deeper into the topic of tax-deductible business expenses later in the article.

Which self-employed individuals must keep accounts in Switzerland?

The answer is very simple: all self-employed individuals in Switzerland are required to keep accounts, even if in a simplified form. There are no exceptions to this rule.

However, a slightly less obvious question then arises: who is considered self-employed in the eyes of the Swiss tax authorities? While many self-employed individuals are aware of their status, a significant number of taxpayers don’t realize they could actually be classified as self-employed.

The Swiss tax authorities have established certain criteria to determine whether an activity qualifies as self-employment or is simply a hobby. These criteria include:

- Carrying out a profit-oriented activity

- Acting in one’s own name

- Having a structured organization

It is not necessary to meet all of these criteria at once—sometimes, two or even just one is enough to be officially recognized as self-employed.

The risk of being self-employed in Switzerland without knowing it

If this situation seems unlikely to you, think again — it’s far more common than you might imagine.

Being classified as a real estate professional

For example, imagine you inherit a plot of land in Rougemont, in the canton of Vaud. You decide to divide it into three building plots and sell them, simply because you don’t like the location or it doesn’t suit your interests. Be careful: in Switzerland, the tax authorities can quickly reclassify this kind of project as a professional self-employed activity. In this case, the profits from the sales might be considered taxable income, and you could also be liable for AVS (social security) contributions. What began as a simple effort to add value to an inheritance could become taxable income subject to about 40% in taxes, plus around 10% in social security contributions.

Being classified as a professional investor

Similarly, someone who frequently buys and sells financial assets like Bitcoin could be considered a professional investor. Normally in Switzerland — unlike in many other countries — and according to Article 16 paragraph 3 of the Federal Law on Direct Federal Taxation (LIFD), gains made on assets held as private investments are not taxable. However, if these transactions become regular and significant, the tax authorities may reclassify them as professional activity and tax the resulting gains.

That said, don’t worry too much — it’s very rare for the Swiss tax authorities to reach this conclusion. This is mainly because most private individuals active on financial markets tend to incur losses over the long term. To avoid having to recognize and accept those losses for tax purposes, the authorities usually refrain from classifying personal trading as a self-employed activity.

Buying and selling everyday items

Once people reach a certain age — usually their thirties — many develop passions that can become quite expensive, such as wine, watches, or vintage items. At first, selling the occasional item you bought a long time ago poses no tax issues, as previously discussed under Article 16 paragraph 3 of the LIFD. However, if this becomes a frequent practice that generates regular income, the hobby slowly transforms into a taxable self-employed activity.

In conclusion, whether you’ve deliberately chosen to pursue a self-employed activity or it naturally evolved that way, the outcome is the same: the obligation to keep accounts and pay taxes.

What does accounting look like for a self-employed person in Switzerland?

To be honest, unlike most neighboring countries, Switzerland gives self-employed individuals a great deal of freedom when it comes to both the form and content of their accounting. In my opinion, this is a smart approach: beginner freelancers don’t need to hire a certified accountant or a fiduciary to manage their books. There is no legal requirement until you exceed the threshold of 10 full-time employees (FTEs). Below this threshold, no audit or review is required — the only people who will read your accounts are the tax authorities. In other words, if you trust your own experience, by reading articles like this one or following online tutorials, you can manage your own accounting for as long as you stay under 10 FTEs.

That being said, although anyone can handle their own accounting, there is one key legal limit according to Article 957 of the Swiss Code of Obligations: as soon as a self-employed person exceeds CHF 500,000 in annual turnover, they are required to keep what is known as “strict” accounting. This doesn’t necessarily mean you need an expert, but it does involve complying with specific rules — which we’ll explain later.

Before reaching that threshold, a self-employed person can simply use a basic record, often referred to as a “milk book” or simplified accounting.

Simplified accounting for the self-employed: The “Milk Book”

Simplified accounting boils down to a basic income and expense log where you simply record the invoices sent to your clients and all the expenses incurred to acquire those clients and generate income. That’s it. Just a quick note: it’s called “simplified” because, unlike strict accounting, entries do not necessarily require a corresponding accounting counterpart.

And what’s better than a well-structured Excel spreadsheet to manage your bookkeeping? Honestly — nothing. There are many software options out there, but they can be expensive and complex to use.

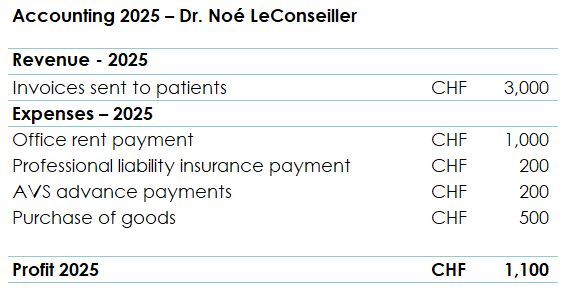

Let’s say you’re a doctor who just got approved to practice independently, and you start your business on December 20. During the last week of the year, here’s what happened:

- Invoices sent to your patients: CHF 3,000

- Payment of office rent: CHF 1,000

- Payment of your liability insurance: CHF 200

- Payment of AVS (social security) instalments: CHF 200

- Purchase of office supplies: CHF 500

This is more than enough to include your accounting in your tax declaration.

In conclusion, even though simplified accounting is sufficient below CHF 500,000 in turnover, I would say another threshold applies when your activity involves assets and liabilities. If you hold capital or have debts, I would recommend switching from simplified accounting to ordinary accounting, also known as double-entry bookkeeping.

Ordinary accounting for a self-employed person: double-entry bookkeeping

Although ordinary accounting may seem intimidating, it remains very accessible for most motivated individuals. Once adopted, it requires compliance with several criteria including a minimal structure. In other words, your accounting must include at least these four elements:

Your financial statement: Assets and Liabilities

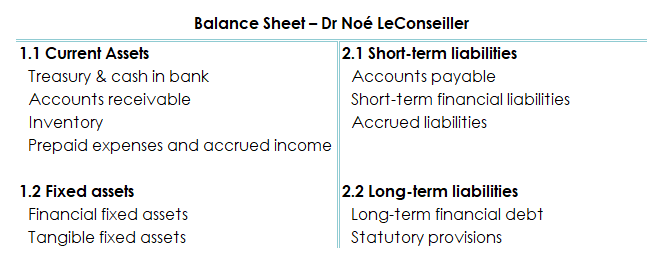

This section does not concern all self-employed individuals, as most do not have significant assets or liabilities. Generally, they only have income and expenses. However, some activities require investing in assets and taking on loans.

Here is a typical simplified balance sheet for an independent activity (95% of cases):

On the left, you find the assets acquired by the self-employed individual through their activity, ranging from the most liquid assets (cash in bank, accounts receivable) to less liquid assets, such as a building used as commercial premises.

On the right, there are liabilities to be repaid quickly, such as suppliers, or over the long term, like mortgages financing your commercial property.

The income statement: Losses and Profits

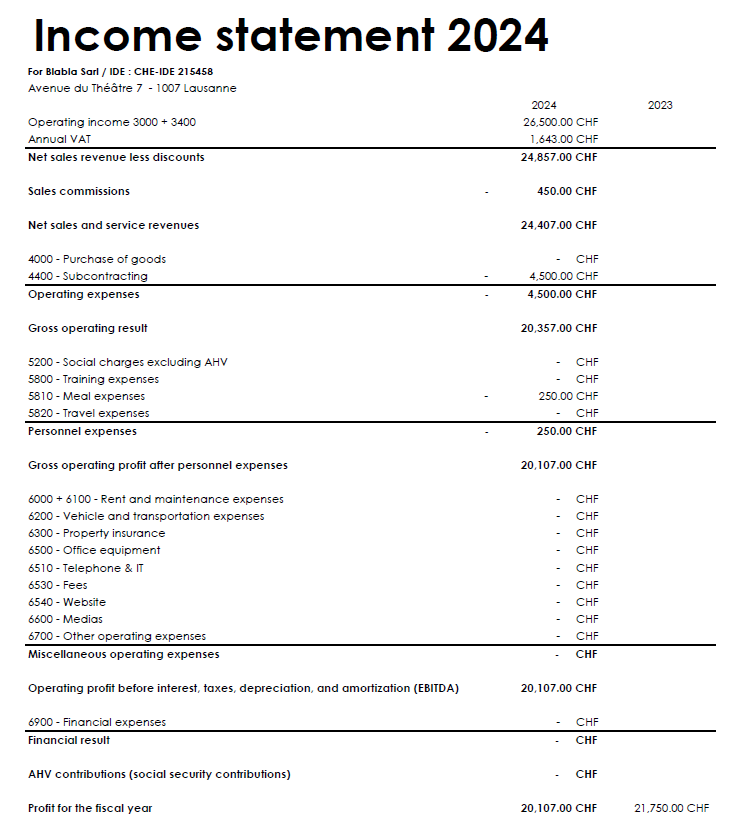

Similar to the simplified ledger (“carnet de lait”) mentioned earlier, the income statement gathers revenues and subtracts expenses, but this time, the entries must be structured according to a precise chart of accounts, which can be adapted to your company’s size and sector.

Structure of the income statement chart of accounts

Although no specific accounts are mandatory, depending on your size and activity, your income statement must include a minimum of information understandable by the tax authorities. Here is an example of the layout:

The goal is to avoid a simple list of individual expenses, which would quickly become unmanageable. The objective is therefore to group revenues and expenses into thematic accounts that make the information easier to read.

A little tip: By looking at this income statement, you can easily identify the different types of deductible expenses: purchase of goods, external service providers, social charges, rents, IT expenses, and other common costs.

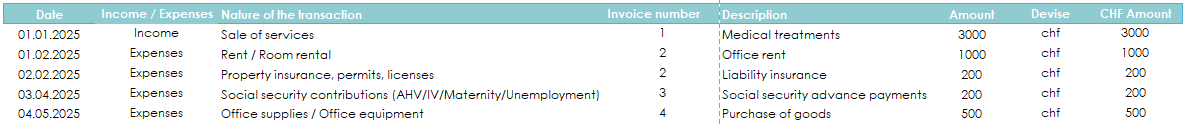

The general ledger: All annual entries

This may seem obvious, but to obtain an income statement structured by categories, you first need to have recorded all these entries. The general ledger simply lists all the accounting entries made during the year.

Let’s revisit the example of our doctor with these five entries:

- Invoice sent to patients: CHF 3,000

- Rent payment: CHF 1,000

- Liability insurance: CHF 200

- Social security prepayments (AVS): CHF 200

- Purchase of supplies: CHF 500

Ultimately, the general ledger is nothing more than your simplified register (“milk notebook”) that has not yet been structured into an income statement. This document is mandatory so that the tax authorities can verify each entry and, if necessary, request additional supporting documents.

The notes to the accounts: understanding your accounting

When keeping ordinary accounting, certain items in the balance sheet or income statement may seem difficult for third parties to understand. This is normal, because a business lives and evolves — it hires, lays off, buys and sells equipment, makes costly mistakes, or discovers past anomalies.

The notes allow you to explain precisely these elements, the methods used, the rates applied, and any unforeseen changes.

To get started with your accounting, this basic knowledge is more than enough. Obviously, as your activity grows, your accounting will become more complex.

Now that you know more, don’t hesitate to book a free 20-minute consultation so that we can answer all your questions.

Which expenses can be deducted from your accounting?

This is a recurring question, and rightly so: knowing which expenses you can deduct is essential when you’re self-employed.

Some deductions are obvious, such as:

- Professional rent

- Salaries

- Goods and raw materials

- Insurance and social contributions

- VAT

- Etc.

But other expenses can be trickier to handle: how do you manage your rent if you work from home? Your personal phone subscription? Your private vehicle? Taxes? Clothing? The purchase of expensive equipment?

These are all good questions. While I can’t explain everything in detail here, I can offer some useful guidelines. And of course, if you want more precise information, we’ll be happy to discuss it with you for free.

To summarize all deductible expenses in one sentence:

If you can clearly establish a link between an expense and your professional activity, then that expense is probably deductible.

This is based on Article 27 of the Swiss Federal Tax Act (LIFD), which states that all expenses justified by commercial use are deductible.

Deducting your personal rent

In general, yes. If you do not have a separate professional office and you use a room in your home exclusively dedicated to your activity, that portion of your rent is deductible in proportion to its size.

Ancillary expenses (electricity, heating, internet, etc.) follow the same reasoning.

Mixed expenses (private and professional)

Some expenses cover both your private life and professional activity.

You must therefore apply a clear allocation key to separate the private share from the professional share.

The tax authorities may review this allocation if it seems unrealistic.

Deducting a private vehicle

Similarly, estimate the total annual costs of your vehicle (fuel, maintenance, insurance, etc.) and apply an allocation key to attribute a portion to your professional activity.

The tax authorities may require a mileage log to validate this estimate.

A simpler method is to keep a logbook recording your professional trips and apply a flat rate of CHF 0.70 per kilometer traveled, covering all related expenses.

Deducting professional clothing

If your profession requires specific clothing (uniforms, safety gear, etc.), the deduction is fully justified.

However, if, for example, you are an insurance advisor and want to deduct CHF 1,000 suits, the tax authorities may question the justification for this amount.

Still, a reasonable portion may be accepted depending on usual sector standards.

The same reasoning applies to appearance-related expenses such as haircuts or accessories.

Deducting significant purchases (equipment and assets)

This is crucial because investments are frequent in a professional activity (computers, servers, specific equipment, etc.). How should you account for these expenses?

Here’s the key rule: if you plan to use an item for more than one year, do not record its full cost as an immediate expense.

Record it as an asset.

At the end of each accounting period, you will apply depreciation, representing the annual loss of value of this asset.

After several years, the asset will be fully depreciated (book value reduced to CHF 0), and the expense will have been fully deducted over time.

What does cash accounting mean compared to accrual accounting?

This is a technical topic and, to be honest, not very exciting. Unfortunately, it is a choice that every self-employed person faces and must stick to. In Switzerland, it is possible to change accounting methods, but this is not recommended.

This dilemma arises from a fairly simple issue: if I opened my medical practice at the end of December and send my invoices, but by December 31 I have not yet been reimbursed by the insurance companies, should I record these CHF 3,000 this year, the year the invoices were issued, or next year, when I actually receive the money?

If you decide to record your invoices when they are issued, this is called accrual accounting; if you prefer to record them when the money actually arrives, this is called cash accounting.

Again, this example is simplified, but this question can have significant consequences on several accounting items:

Accounts receivable and accounts payable

If you only record transactions when money enters or leaves your account, at the end of the year you will have no open receivables or payables, since only amounts actually received or paid are recorded.

However, if you opt for accrual accounting, you will need to report at the end of the year invoices sent to your clients but not yet paid, as well as invoices received from your suppliers but not yet paid. Your revenue and expenses will then include these amounts, even if the money has not yet been received or paid.

Social insurance contributions

When you start your independent activity, AHV (social security) and other insurances will ask you to estimate your income for the current year.

Using the example of the medical practice created on December 20: for this year, I declared CHF 2,000, while my taxable income subject to contributions was only CHF 1,000. So I paid CHF 100 too much.

If you use the cash accounting method, you will record the CHF 200 actually paid, even if that amount is excessive.

Conversely, with accrual accounting, you will only record CHF 100 of actual expenses, despite having paid CHF 200. The difference will be recorded as a prepaid expense, i.e., an asset for your business.

In summary, this mechanism impacts almost your entire accounting and it is therefore essential to master it well.

How to choose between cash and accrual accounting?

If you are just starting out and are not an accounting expert, choose cash accounting without hesitation. You will greatly simplify your life: no accounts receivable, no accounts payable, no worries with social insurance contributions. In short, life is easier.

Two small clarifications before closing this technical note:

- If your activity develops, which I sincerely hope, know that the general rule is to keep accrual accounting. You will therefore eventually have to switch to this method.

- The accounting method you choose must be the same for your VAT returns.

Accounting software for self-employed professionals in Switzerland

Before concluding this first chapter and moving on to taxation for the self-employed, let’s take a quick look at the accounting software our clients use, as well as a reflection on whether or not it’s useful to work with a fiduciary.

The goal: to better understand the differences between available tools and their actual relevance based on your situation.

In my humble opinion, as long as:

- You don’t have any employees,

- Your activity doesn’t involve stock or other balance sheet-specific elements,

- You apply the simplified net tax rate method for VAT,

- You keep your accounts using the cash accounting method,

- And most importantly, as long as you’re allowed to keep simplified accounts,

our good old Excel (or Numbers, if you’re on a Mac) is more than enough.

Indeed, adding up income and subtracting expenses to calculate your profit is a very simple task—often much easier to do with a basic spreadsheet than with a rigid and complex accounting software.

But what happens once any of these criteria no longer apply?

As you may have guessed, once your business reaches a certain size or complexity, accounting becomes more rigid and complicated.

Of course, everything could still technically be done in Excel, but it would require more time and effort than simply investing in a license for dedicated accounting software that can manage most operations for you.

What should you look out for before choosing accounting software?

Even though accounting principles remain the same regardless of the software you use, these tools still differ significantly from one another. Here are the main factors to consider:

- Price: Obviously, not all accounting software is priced the same. Costs can vary widely, from around CHF 19 per month to over CHF 70 per month, depending on the features offered.

- Software complexity: Some accounting tools are highly flexible and offer a lot of freedom. This is great if you already have accounting experience, but it can become problematic if you’re just starting out and want to move quickly without getting lost in technical details.

- Customer support: Let’s be honest—accounting can sometimes be more complicated to set up than an Ikea shelf! You’ll likely run into issues like unbalanced accounts or errors caused by accidentally checking the wrong box. Some software providers offer highly responsive customer service, which can quickly get you back on track—without needing to call in an external accountant or incur extra costs.

- Document storage: These days, keeping your accounting records is mandatory in case of a tax audit. Depending on the software you choose, you’ll either store your documents locally (on your computer or a dedicated server) or in the cloud. This decision mostly comes down to personal preference and whether you prefer a more traditional or modern approach, though it may also depend on the nature of your business.

- Integration with other systems: Of course, a freelancer selling a few online courses from home and an e-commerce company managing over a million items online don’t have the same needs in terms of inventory, payroll, or project tracking. Some accounting tools offer extension modules that allow you to integrate with other key business systems—such as your website, stock management, order tracking, or HR tools. A well-integrated setup can save you considerable time while significantly reducing errors.

These are the main factors to consider—though I’m sure other specific criteria might be relevant depending on your activity.

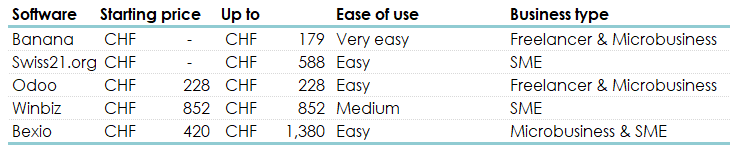

To help with your decision, here’s a quick summary table:

Of course, these assessments are personal, and other accounting software options are also available.

Is it necessary to hire an accountant or fiduciary to manage your bookkeeping as a self-employed person?

From a strictly legal perspective, the answer is no. In Switzerland, unlike in France, there is no legal obligation to hire an expensive certified accountant to handle your bookkeeping. Just like with your tax returns, bookkeeping is not a regulated activity, and there is no legal framework requiring businesses to delegate this responsibility.

However, in Switzerland, once you surpass the threshold of around ten full-time employees (FTEs), your accounts must be audited or reviewed by a certified auditor. The goal at that point is simply to certify that the person handling the bookkeeping has done it correctly. Before reaching that threshold, no one other than the relevant government agencies will scrutinize your accounting.

So then, why do so many clients turn to a fiduciary like FBKConseils to manage their bookkeeping and various filings? In my opinion, as with everything in life, it’s impossible to master every area perfectly. Moreover, just because a task is mandatory doesn’t mean you must handle it yourself. The same applies to accounting: well-maintained books mean fewer taxes to pay, fewer administrative headaches, and more free time to focus on your core business.

In conclusion, as with any profession, there are outstanding fiduciary specialists—and others who are… far less effective. Some are expensive, very expensive, even excessively expensive. So, the decision to delegate your bookkeeping should always be made on a case-by-case basis, taking into account the volume of documents to process, the complexity of your business, and the time you’re willing to dedicate to administrative tasks.

How does taxation work for self-employed individuals in Switzerland?

After 20 minutes of reading—for those brave enough to make it this far—we finally arrive at the real purpose of accounting: the tax return for a self-employed person.

Let me reassure you right away: if you’re already familiar with employee taxation or if you used to be employed before becoming self-employed, things aren’t radically different. The most complicated part is now behind you.

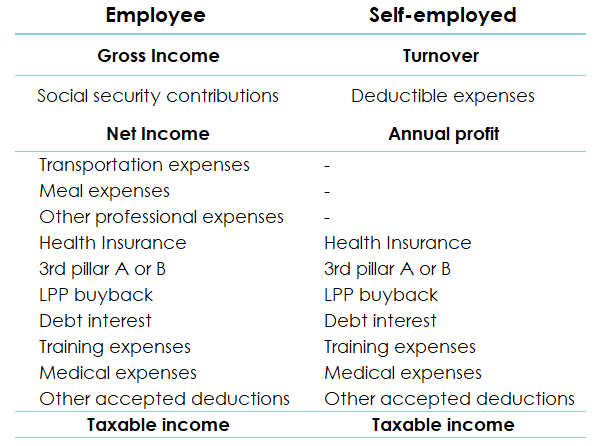

Your tax return will look almost exactly like that of an employee, with one key difference: you don’t have a salary certificate, but instead a set of accounts. An employee reports their net salary as the taxable base, while a self-employed individual reports their taxable profit from the income statement previously prepared. Here’s a simplified overview of how it works:

The main difference in terms of deductions concerns professional expenses. An employee can, depending on their canton of residence, legally deduct expenses such as:

- Commuting costs (home to workplace)

- Lunch expenses if not reimbursed by the employer

- Other professional expenses

A self-employed person, logically, cannot deduct these specific expenses, because all costs related to their business are already directly recorded in their accounting, specifically in the profit and loss statement. For the rest, there is no difference: a self-employed person can benefit from all other deductions allowed by their canton of residence.

How to declare business assets and liabilities as a self-employed person?

If your activity involves assets, such as equipment or materials, or any kind of debts, you must also include this information in your tax return.

Reporting these elements of your estate works the same way as for private assets. The only difference is that you’ll need to indicate that it’s business property (commercial assets), not private.

That’s it — we’ve reached the end of what we wanted to cover on accounting. Going further would only make things unnecessarily complex. To conclude this article — even if there’s little chance this last section will be read — allow me to briefly show you how FBKConseils can support you. Otherwise, see you very soon!

Should you hire a fiduciary or a tax advisor to file your tax return as a self-employed person?

If you’ve read our section on accounting, my opinion remains pretty much the same when it comes to your tax return. Once your accounting is done properly, entering the figures into your tax declaration is a quick and relatively simple process. In other words, if you’re confident in your bookkeeping, transferring the numbers into your return will be a piece of cake.

That said, here are two important clarifications:

- Based on our experience, very few clients manage to file their tax return without a single mistake. So our recommendation will always be to have it reviewed at least once by a professional — or even better, to get support for a full year to build a clear model that you can use in future years, as long as your situation remains similar.

- A quick note: when we speak here about taxes and tax returns, we are not referring to VAT. VAT is a far more complex topic that depends on your type of activity and where your clients are located. In this area, we strongly recommend having your VAT return reviewed every year to avoid costly mistakes.

There you go — now you know everything… or almost everything — except maybe what we can actually do for you.

How FBKConseils can support your self-employed activity?

Introductory Meeting

At FBKConseils, we continue to offer a free 20-minute appointment to answer your questions and guide you effectively.

Advisory and training session

We offer you the necessary time to clarify your tax obligations, show you how to meet them correctly, and help you become more autonomous in these areas.

Bookkeeping services

Like any fiduciary, we understand that some clients are not comfortable with accounting. That’s why we are happy to fully take care of these tasks and keep your bookkeeping up to date month after month.

Tax return and VAT statement

Similarly to bookkeeping, FBKConseils provides comprehensive assistance to self-employed individuals to finalize, verify, and integrate their accounting into the annual tax return. We also handle, depending on the chosen method, the preparation of VAT statements every semester or quarter for the Federal Tax Administration.