Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on April, 16th 2024.

What is an ETF? And how many exist?

An Exchange Traded Fund (ETF), works exactly the same way “traditional” investment funds do, with one major difference: nobody manages it.

An ETF bases itself on investment rules that are put in place and evolve according to the market.

Once these rules are set, no one will sit and think about whether or not to sell, the ETF will manage itself.

Are you getting confused? Don’t worry, I promise that within a few lines, you will see it is actually quite simple.

The line-up:

How does an ETF work?

In order to better explain how an ETF works, let’s use an example:

I am an asset manager and wish to invest in Swiss economy. Naturally, I think that as a general rule, Swiss companies will experience a good growth over the next few years.

Now, all I have left to do is create a portfolio that, thanks to the shares I will buy, is most true to the global results in Switzerland. To do so, I have three options:

- Buying a share from every Swiss listed company: this solution might be interesting but the transaction costs to purchase this many shares will ruin the plan. Plus, a company like Nestlé must be more represented than a company like FBKConseils (unfortunately, we are not (yet…) worth the same on the Swiss economic scale).

- Think of every Swiss company I know and buy shares from those I think are most successful.

- Lay simple calculation rules down in order to determine which companies I buy and how many shares of each.

I think you understood that an ETF uses this third option.

Let’s get back to our example,

Step 1 : Identify my investment universe

In order to best represent the Swiss market, I will ask my computer to organise every company by size (largest to smallest) and take into account, as a measurement unit, their market value.

Step 2 : Drastically reduce my universe

I have to find a way to reduce my pool of companies to a certain amount, which I will keep.

I therefore ask my computer to keep only the twenty biggest market capitalisations.

There you go, I now have the twenty biggest Swiss companies.

Step 3 : How many shares should I buy from each one of these 20 companies?

That is the whole question, I need to know how my portfolio will be divided. Smart like a fox (or sharp as a whip) I decide to calculate the total value of my twenty companies. The number that comes out of this is downright enormous (billions of billions) but at least this allows me to get an idea of each company’s weight.

Let me explain. If I had three companies:

- A: stock market value = CHF 1,000

- B: stock market value = CHF 3,000

- B: stock market value = CHF 500

The weight of each one would be:

- Company A represents (1000/4500) = 22.22%

- Company B represents (3000/4500) = 66.66%

- Company C represents (500/4500) = 11.11%

There you have it! Without realising it, we recreated the SMI! The Swiss reference index:

The Swiss Market Index brings together the twenty biggest Swiss companies listed on the stock market. They are ranked in the index according to their weight, which is calculated as a percentage.

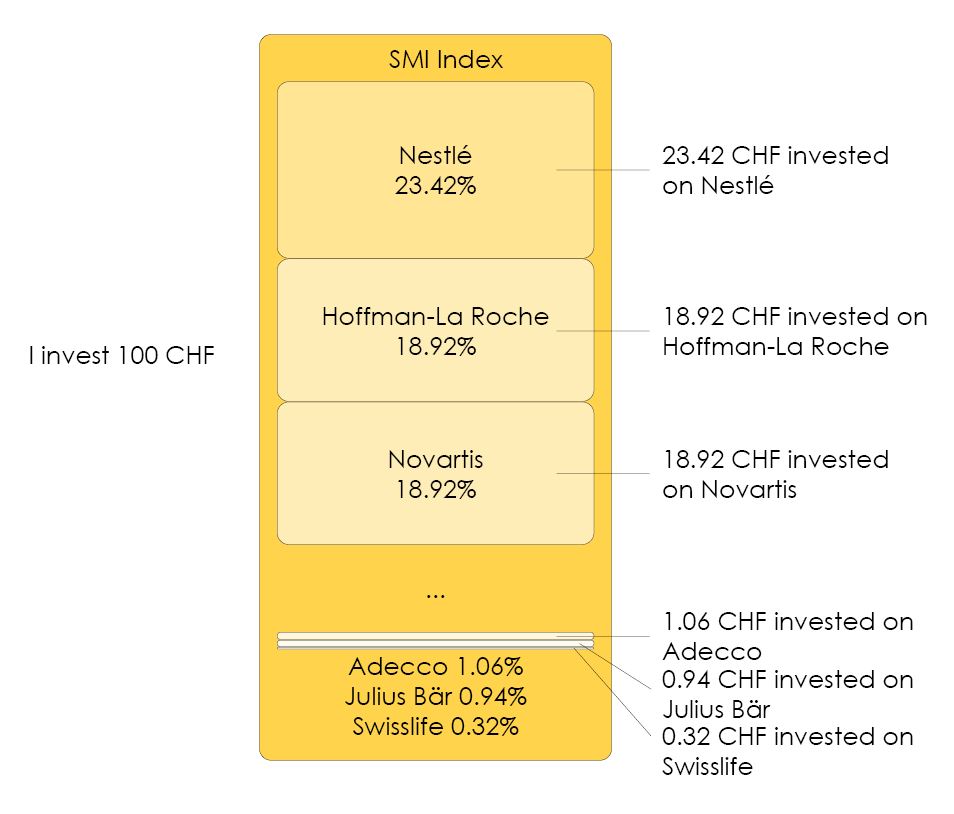

The first place goes to Nestlé with 23,42%. The second is, Hoffmann-La Roche with 18,92%, on an equal footing with Novartis. The three last ranks go to Adecco with 1,06%, the bank Julius Bär with 0,94% and SwissLife with 0,32%.

If you invest 100 CHF in the SMI index, 23.42 CHF will go to Nestlé, 18.92 to Hoffmann-La Roche and Novartis, etc.

Between 2010 and 2019, the SMI appreciated by 52.6%. Had you invested 10,000 CHF in 2010, you would have had 15,260 in 2019. This is thanks to the positive progression of the Swiss stock market index.

The ETF reproduces the stock market index.

As easy as a pie, just like we promised.

What are the advantages of an ETF?

There are several:

- Total transparency and easy to follow (the prices are recalculated daily).

- Portfolio highly diverse starting from a few dozens or hundreds of francs. Simply buying one SMI ETF grants you access to the results of twenty companies.

- No management fees.

How many ETFs exist?

I do not know the exact number of existing ETFs but what I do know for sure is that it must be breath taking. If you think of it, anyone can play around with creating investment rules based on countries (stock market index) and/or fields (medicine, technology, environment, etc…).

ETFs are multiplying at an incredible rate and are making steady gains against active management which I having trouble staying in people’s hearts.