Entrust your 2025 Geneva tax return to FBKConseils

Why entrust your Geneva tax return to a professional? At FBKConseils, we see two strong reasons to delegate this task. First, you benefit from an expert review to ensure you take advantage of every deduction available in the canton of Geneva. We identify optimisation opportunities you may have missed and, if your situation is not as tax-efficient as it could be, we explain clearly what can be improved in the coming years. Second, even when your situation is already optimal, filing a tax return remains a tedious and time-consuming process. We handle everything: document collection, completion, checks, and submission to the Geneva tax authorities. You save valuable hours and entrust this important responsibility to specialists.

Make an appointment Entrust your tax return

Why choose FBKConseils?

At FBKConseils, our entire team is qualified, trained and passionate in multiple areas that will be useful to you throughout your projects.

Quality and accuracy

At FBKConseils, we are fortunate to work with team members who have followed fiduciary expert training. Beyond qualifications, our teams have built broad professional experience over time, covering most tax situations that private individuals may encounter in Geneva: Swiss or foreign real estate owners, taxpayers holding a legitimation card (CDL), limited tax liability, self-employed individuals, or shareholders of their own company.

This cross-disciplinary expertise allows us to handle your Geneva tax return with rigour and precision, regardless of how complex your file may be.

You’re no longer alone with the authorities

At FBKConseils, professional responsibility is at the core of our service. We do not stop at submitting your tax return: we are here to answer all your questions, and those of the cantonal tax administration.

We take full responsibility for our work. If the tax authorities contact you for details, supporting documents, or clarifications, we can manage these exchanges on your behalf. In the vast majority of cases, our firm can represent you directly with all Swiss social security and tax authorities, whether for a simple clarification or a dispute procedure.

In practical terms, you are never left alone with an unclear administrative letter or a request from the tax administration. You forward it to us, and we take care of the rest.

Long-term tax optimization

Unfortunately, what clients often feel with traditional fiduciary firms is that, beyond declaring taxable elements and deducting what is allowed, real advice is missing. When we created FBKConseils, our goal was, and will always be, to advise first and foremost.

We look at your situation as it is today, but also as it will be in the medium and long term. Concretely, this means identifying optimisation opportunities that go beyond the annual tax return: pension fund buy-back strategy, third pillar optimisation, dividend vs salary decisions for shareholders, and tax planning for a real estate project or retirement.

Our role is not only to complete your 2025 tax return, but to support you with smart, sustainable tax management aligned with your life plans.

.

Valuable time savings

For clients who do not want to spend time learning how to file Geneva taxes, we have built a tailored digital platform. Year after year, it helps you automatically generate your personalised document checklist, obtain a clear quote, and submit all supporting documents directly through our website.

All of our processes are designed to save you time while maximising the efficiency of our services. The objective is simple: automate what can be automated, so we can free up time to deliver the most personalised advice where it truly matters.

The result: you upload your documents in a few clicks, and we handle the rest. Simple, fast, efficient.

.

Our offers for tax return services in Geneva

With us, everything usually starts with a free first consultation, either at our office or by video call, to discuss your needs and guide you in the best way possible.

195.-

/hour

Includes:

- Free 15-minute introductory meeting.

- A session with a tax expert, for as long as you need.

- Detailed explanations about your taxation, deductions, and obligations.

- Step-by-step guidance to complete your own tax return.

Personalized quote

Includes:

- A simple and clear list of required documents.

- We manage the entire process: analysis, request, complete tax return, and follow-up with the authorities (depending on the options chosen).

- Ideal if you want complete support and zero stress.

Personalized quote

Includes:

- Free 15-minute introductory meeting.

- A simple and clear list of required documents.

- We manage the entire process: analysis, application, complete tax return, and follow-up with the authorities.

- Ideal if you want total support and peace of mind.

They already trust us.

Tailored pricing

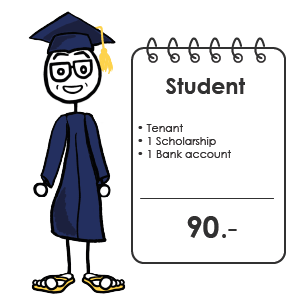

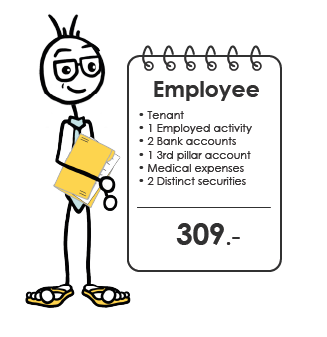

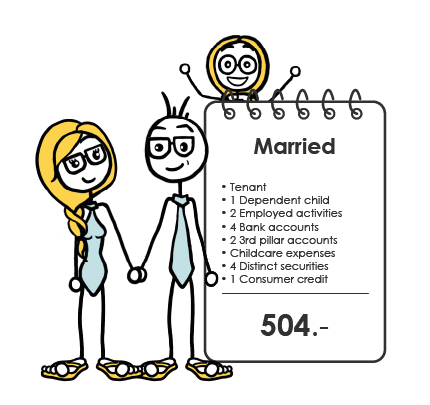

The time and cost required to complete your tax return depend on your personal situation. Our goal is to offer fair, tailored pricing: you pay a fair amount based on the number of documents to be processed.

You will find below some examples of typical situations. You can also consult our full price list per document, or use our online platform to get an instant personalized quote based on the type and number of documents that apply to you.

The year moves forward and the pattern remains the same in the canton of Geneva. In 2026, you must submit your 2025 tax return by 31 March 2026.

Need more time? No problem. The Geneva tax administration grants paid extensions: 3 additional months for CHF 20, 4 months for CHF 40, or 5 months for CHF 60. These extensions are easy to request online via the tax administration website and are almost automatically granted.

Special cases: if you have serious reasons (illness, extended business travel, missing documents) that prevent you from filing even with a 5-month extension, you can contact the tax administration directly to negotiate a deadline suited to your situation. It is always better to anticipate and communicate rather than miss the due dates.

For a few years now, the canton of Geneva has provided a personal online space (“E-Démarches”) allowing taxpayers to access administrative procedures, including taxes and extension requests.

If you do not have your credentials or have lost them, an online extension request form is available between January and October. After that period, extension requests must be submitted in writing directly to the cantonal tax administration.

Tip: a request via E-Démarches is instant, and you receive immediate confirmation. It is by far the simplest and fastest solution.

The most common case includes all people residing in Switzerland who are Swiss nationals or hold a long-term residence permit (Permit C): employees, self-employed individuals, retirees, or students. These taxpayers must systematically file a tax return.

Residents with Permit B are normally taxed at source, but must also file a tax return (subsequent ordinary taxation – TOU) if certain thresholds are exceeded: annual gross salary above CHF 120,000, taxable wealth, or foreign-source income not taxed at source.

Non-residents may also be concerned if they own property located in Geneva or carry out a professional activity in Geneva. In such cases, a tax return limited to the elements taxable in Geneva must be filed.

Exceptions: Swiss residents staying temporarily in Geneva without the intention to settle there long term (foreign students in short training programmes, people in medical stays) may, in some cases, be exempt from the obligation to file.

Not sure about your situation? Contact us for a free initial assessment of your Geneva tax filing obligation.

If the delay remains “reasonable”, you will receive reminders from the Geneva tax administration, with reminder fees. If the delay continues despite these reminders, you will receive formal notices, which also come with additional fees.

Beyond these administrative costs, the tax administration adds late-payment interest to your total tax liability. In 2026, this is an annual late interest rate of 2.60%, calculated on the amount due. The longer you wait, the more interest accumulates.

Our advice: if you know you will be late, request an extension immediately via E-Démarches. It is quick and inexpensive (CHF 20 to 60 depending on the duration).

It is less common, but it can happen. If you remain inactive for an extended period despite reminders and formal notices, you may receive an estimated assessment (“taxation d’office”) based on the information available to the tax administration. These estimated assessments are almost always overstated and can result in an unjustified tax burden far higher than reality.

Once you receive an estimated assessment, you have 30 days to challenge it and request correction by submitting your complete tax return. This deadline is strict: do not miss it.

Exceptional circumstances: certain life events can justify a significant delay (serious illness, hospitalisation, death in the family). If this applies, the Geneva tax administration should accept the situation and grant the necessary time to regularise your return, even beyond the usual deadlines. You must, however, inform them and provide supporting justification.

This depends on two factors: your organisation and the complexity of your tax situation.

On average, if all documents are available and your situation is standard (employee with no additional income), you should expect between 1 and 3 hours to complete, review, finalise, attach supporting documents, and submit everything to the Geneva tax administration.

At FBKConseils, including the client back-and-forth needed to ensure perfect execution and maximise your deductions, we typically need about one week between receiving your documents and final submission. This timeframe includes a full review of your file and our personalised tax recommendations.

Everything starts with a free initial meeting of around twenty minutes. This meeting helps determine which service best fits your needs and answers your first questions about Geneva tax filing.

After that, you send us your documents via our secure platform, by email, shared folder, or even by post for those who prefer traditional methods.

Once received, we start completion and optimisation. When questions arise, we contact you to clarify specific points. It is common to have several exchanges until you are fully satisfied with the final version.

Once validated together, we submit your tax return directly to the Geneva tax administration in our name. When you receive your tax assessment decision, we can reconnect if needed to evaluate any further steps (objection, correction, optimisation for the next year).

Important critical deadline: once the assessment decision is received, you have only 30 days to challenge it. If you have any doubt, send it to us immediately.

A fiduciary firm should not simply be someone who files your taxes because you lack time or knowledge. A fiduciary firm, as we see it, should be a trusted partner for all your tax and financial questions.

Because retirement, real estate, and taxation are closely connected, at FBKConseils we make it a point of honour to provide the advice we would follow ourselves in your position.

By using our services, you benefit not only from precise answers to your questions, but also from proactive advice and adjustments across the areas we master even without a specific request on your part.

That is the fiduciary support as we define it.

How can we help you?

Find more articles on this topic.

How can I maximise my tax savings in Geneva?

Reading time 15 min.

Updated on December, 3rd 2025.

How will marriage affect your taxes in Geneva?

Reading time 5 min. Updated on December, 3rd 2025.

The 12 tax deductions to claim in 2025 in Geneva

Reading time 13 min. Updated on November, 13th 2025.

Understanding income tax in the canton of Geneva

Reading time 13 min. Updated on October, 27th 2025.

How to calculate wealth taxes in Geneva?

Reading time 6 min. Updated on November, 11th 2025.