Entrust your 2025 Vaud tax return to FBKConseils

Filing your tax return can seem simple… until you discover the many deductions available, the supporting documents required, situations that become more complex over the years, and the deadlines you must meet. Every year, we see mistakes that lead to an unnecessarily high tax bill. At FBKConseils, we take care of your tax return in the canton of Vaud and support you to ensure your tax burden is accurate, save you time, and if you wish provide all the answers and simulations you could need to optimise the years ahead..

Make an appointment Entrust your tax return

Why choose FBKConseils?

At FBKConseils, our entire team is qualified, trained and passionate in multiple areas that will be useful to you throughout your projects.

High-quality work

During a free initial meeting, we take the time to analyse your situation and your objectives. We then prepare your tax return by reporting all your income and assets at their correct value, to ensure full compliance and limit tax risks. Finally, we review every deduction you are entitled to in order to optimise your tax burden, in strict accordance with the law..

Full delegation of responsibility

At FBKConseils, we are not simply here to complete your tax return. We support you from A to Z, with full follow-up of your file. If the tax authorities ask questions, request supporting documents, issue corrections, or amend your assessment, we remain by your side and handle the necessary exchanges. Our goal is to stand behind the work delivered and ensure your situation is taken into account as presented, within the legal framework.

Long-term tax optimization

FBKConseils was not created as a traditional fiduciary firm, but as a consulting company. We believe that a properly prepared tax return is only the starting point. The goal is then to work together to model your situation, understand the optimisation levers available, and implement concrete improvements for the years ahead always within the legal framework.

Valuable time savings

No more procrastinating every year in front of your tax paperwork. You send us your documents, and we take care of the rest. You save time… and money.

Our offers for tax return services in the canton of Vaud

With us, everything usually starts with a free first consultation, either at our office or by video call, to discuss your needs and guide you in the best way possible.

195.-

/hour

Includes:

- Free 15-minute introductory meeting.

- A session with a tax expert, for as long as you need.

- Detailed explanations about your taxation, deductions, and obligations.

- Step-by-step guidance to complete your own tax return.

Personalized quote

Includes:

- A simple and clear list of required documents.

- We manage the entire process: analysis, request, complete tax return, and follow-up with the authorities (depending on the options chosen).

- Ideal if you want complete support and zero stress.

Personalized quote

Includes:

- Free 15-minute introductory meeting.

- A simple and clear list of required documents.

- We manage the entire process: analysis, application, complete tax return, and follow-up with the authorities.

- Ideal if you want total support and peace of mind.

They already trust us.

Tailored pricing

The time and cost required to complete your tax return depend on your personal situation. Our goal is to offer fair, tailored pricing: you pay a fair amount based on the number of documents to be processed.

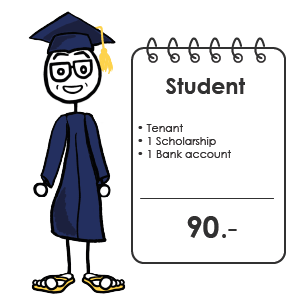

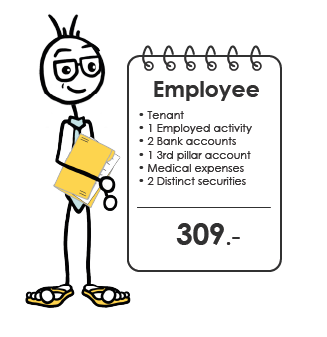

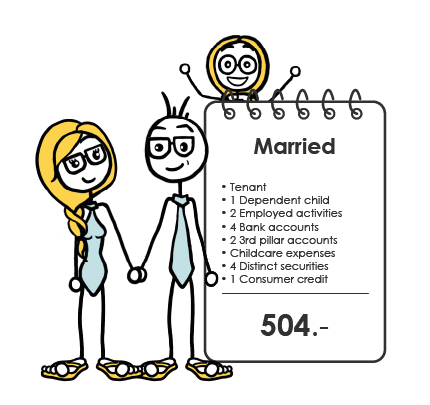

You will find below some examples of typical situations. You can also consult our full price list per document, or use our online platform to get an instant personalized quote based on the type and number of documents that apply to you.

Each canton has its specifics. In the canton of Vaud, the general deadline to file individual tax returns is set at 15 March 2026.

In practice, if you are subject to unlimited tax liability in the canton of Vaud, you benefit from a tolerance period until 30 June 2026, with no formal request and no additional fees.

If you still need more time, you can request a free extension before 30 June via the Vaud online service; under the applicable guidelines, an extension may be granted up to 30 September 2026.

Finally, if this third deadline still does not fit your situation and you have valid reasons (illness, missing certificates, ongoing procedure, etc.), you can write to the tax authorities to request an additional deadline adapted to your needs. Whenever possible, make this request in advance to avoid reminder fees.

It is not possible to provide a “perfect” list here, because everything depends on your situation. That is why we created a platform: you select what applies to your household, and you receive by email the exact list of documents needed for the relevant tax year.

In general, you should plan for: your income (salary certificate(s), pension/annuity statements, accounting records if self-employed), your assets (bank account statements in Switzerland and abroad, tax statements for your investments, information on your real estate), and supporting documents for the deductions you want to claim (Pillar 3a, loan interest, health insurance, medical expenses, pension fund buy-backs, childcare costs, professional expenses, real estate expenses, etc.).

In most cases, these documents are primarily used to substantiate the amounts and are not requested by the Vaud tax authorities; however, they should be kept in order to respond quickly if questions arise. That said, certain documents are requested more often, in particular salary certificates, self-employed accounts, confirmations of payments into the 2nd and 3rd pillars, childcare expenses, and real estate-related expenses.

The timeframe mainly depends on how quickly you provide the required documents.

Thanks to VaudTax, the Vaud cantonal tool, we work quickly and efficiently. For a standard situation with all supporting documents available, expect between 1 and 7 business days, from the first draft to final submission.

Complex files (real estate income, self-employment, multiple cantons) require additional time to guarantee tax accuracy.

Ah, the famous question. Unfortunately, it’s a bit of a lottery… The timelines vary widely depending on the cantonal administration’s workload.

What we see in practice:

- Fastest: 3 to 6 weeks after submission

- Most common: 2 to 4 months (the most frequent)

- Longest: 12 months or more in some cases

The canton of Vaud processes tens of thousands of returns every year. Simple files usually move faster, but complex situations or peak periods can significantly increase waiting times.

Once we have submitted your return, there is nothing more we can do the timing depends 100% on the tax authorities. We would love to speed things up, but unfortunately it is not in our hands.

You are completing your 2025 return and wondering what you can deduct?

Option 1: Read the official Vaud tax guide (long, technical, sleep-inducing… but complete).

Option 2: Consult our Vaud deductions guide, which is clear, useful, and fairly comprehensive.

Option 3: Follow our golden rule: deduct anything you can justify.

The principle is simple: if you have proof of payment, claim the deduction. The tax authorities will never fault you for requesting a deduction supported by documents at worst, it will be rejected. No penalty, no risk.

In practice: enter the deduction, add a clear description, and attach your documents. You will see on your assessment decision whether it is accepted or not. It is the best way to learn what works (or not) in your specific situation.

In summary, the main deductions include: professional expenses (travel, meals, training), Pillar 3a contributions, health insurance premiums (mandatory LAMal), childcare costs, alimony paid, donations to recognised charities, and many others.

The solution depends on when you identify the mistake:

- Before submission: correct your return directly this is the easiest moment.

- Less than 7 days after submission: you can resubmit a corrected version directly online via VaudTax. Quick and straightforward.

- More than 7 days after submission (but no assessment decision yet): you will need to send a corrected paper version to the cantonal tax authorities.

- After receiving your assessment decision: you have 30 days to challenge it and make corrections. This deadline is strict after that, it becomes much more complicated.

Special case: forgotten income or assets

If you forgot to declare income or assets, you should file a voluntary disclosure as quickly as possible, even after the usual deadlines. It is always better to regularise the situation yourself before the tax authorities discover the omission—the consequences will be far lighter, and in most cases none at all.

As a general rule, anyone domiciled in the canton of Vaud who holds Swiss nationality or a Permit C must file a tax return every year.

This obligation also applies to certain Vaud residents holding a Permit B (subject to withholding tax), if certain thresholds are exceeded. This is notably the case when:

- annual gross salary exceeds CHF 120,000, or

- taxable wealth exceeds CHF 60,000 for a single person (CHF 120,000 for a married couple), or

- you receive income not subject to withholding tax (for example dividends, pensions, or other forms of remuneration).

Finally, other specific situations may create a limited tax liability, regardless of where you live. This is the case, for example, if you own real estate in the canton of Vaud or carry out a self-employed activity there.

In all of these situations, filing a Vaud tax return is mandatory.

In general, it’s not a good sign. Two scenarios are possible.

1) The tax authorities were not aware that you were required to file a return.

This can happen, for example, when taxpayers subject to withholding tax have not submitted the TOU form to request subsequent ordinary taxation (TOU). In that case, it is advisable to regularise the situation as quickly as possible. As a rule, if you come forward on your own initiative, the tax authorities should not impose a penalty, since you are voluntarily correcting the situation.

2) The tax authorities are expecting your return, but do not receive it despite reminders.

In that case, the situation becomes more sensitive. After reminders and formal notices, you may receive an assessment decision based on the information available to the authorities. In most cases, this estimated assessment (“assessment by default”) overstates your situation and is almost never in your favour.

It is generally possible to challenge an assessment by default within a strict deadline by providing the correct information and submitting your complete tax return. After that deadline, and without a valid reason, the assessment becomes final and the tax claimed remains payable.

How can we help you?

Find more articles on this topic.

How can I maximise my tax savings in the canton of Vaud?

Reading time 12 min.

Updated on December, 12th 2025.

How will marriage affect your taxes in the canton of Vaud?

Reading time 6 min. Updated on December, 12th 2025.

The main 17 tax deductions in the canton of Vaud in 2025

Reading time 5 min. Updated on December, 12th 2025.

Understanding your income taxes in the canton of Vaud

Reading time 10 min. Updated on December, 12th 2025.

Understanding wealth tax in the canton of Vaud

Reading time 8 min.

Updated on December, 12th 2025.