Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 14th 2024.

How does the LAMal work and who pays for what?

The line-up:

Introduction

In this article on health insurance, we’ll take a clear and simple look at the process that follows choosing and paying for your health insurance, with premiums rising all the time.

At some point, you will need to use these services for medical care.

But does the insurance cover the full cost from the first franc spent? Or will you still have to pay some of the costs yourself? In Switzerland, the reality is that in addition to the premiums, you could be charged three extra bills.

- Deductible.

- Quote-part.

- Nights in hospital.

By the end of this article, not only will you be able to take into account the cost of this health insurance on your household budget, but you will also be able to predict the maximum medical expenses you could be expected to pay over a calendar year.

Fee n°1: The deductible

In Switzerland, all health insurance policies have an excess system. This is a sum that you have to pay each year until you reach the specified amount. The higher your excess, the lower your monthly premiums.

Let’s take a relatively simple example. I chose an excess of CHF 2,500 for 2024 and, unluckily, I started the year with a sty in my right eye, which meant I had to see several doctors and specialists for a total bill of CHF 3,000.

In this example, I will have to pay the first CHF 2,500, and the health insurance will start to reimburse me for the remaining CHF 500.

If, “by chance”, I had opted for a lower excess of CHF 300, I would have had to pay only the first CHF 300 in addition to my premiums. The remaining CHF 2,200 would have been paid by my insurance company.

And remember, there are still two bills to come on top of your insurance premiums and deductible, so keep the faith and let’s get on with it.

Fee n°2: The quote-part

The truth is that I haven’t told you the whole story about the franchise… The quote-part is a part of your medical bills that remains your responsibility to pay, even though your medical expenses exceeded the deductible.

I already know what you are about to say “But Noé, isn’t this the whole purpose of the deductible? Determining the maximal amount we will have to pay in case of a problem?”

Yes, yes, you are completely right. But in case of a serious problem leading to costs that are above your deductible, a contribution of up to a maximum of 10% of the medical fees will be asked from you, it is the quote-part. Looks like even the mandatory insurance has gaps…

However, this quote-part can never exceed:

- 350 CHF per child, a maximum of 1,000 CHF if you have more than two children within the same health insurance company.

- 700 CHF for adults.

So, what do you think? It is not that bad after all, right?

Let’s use various examples to make things more understandable.

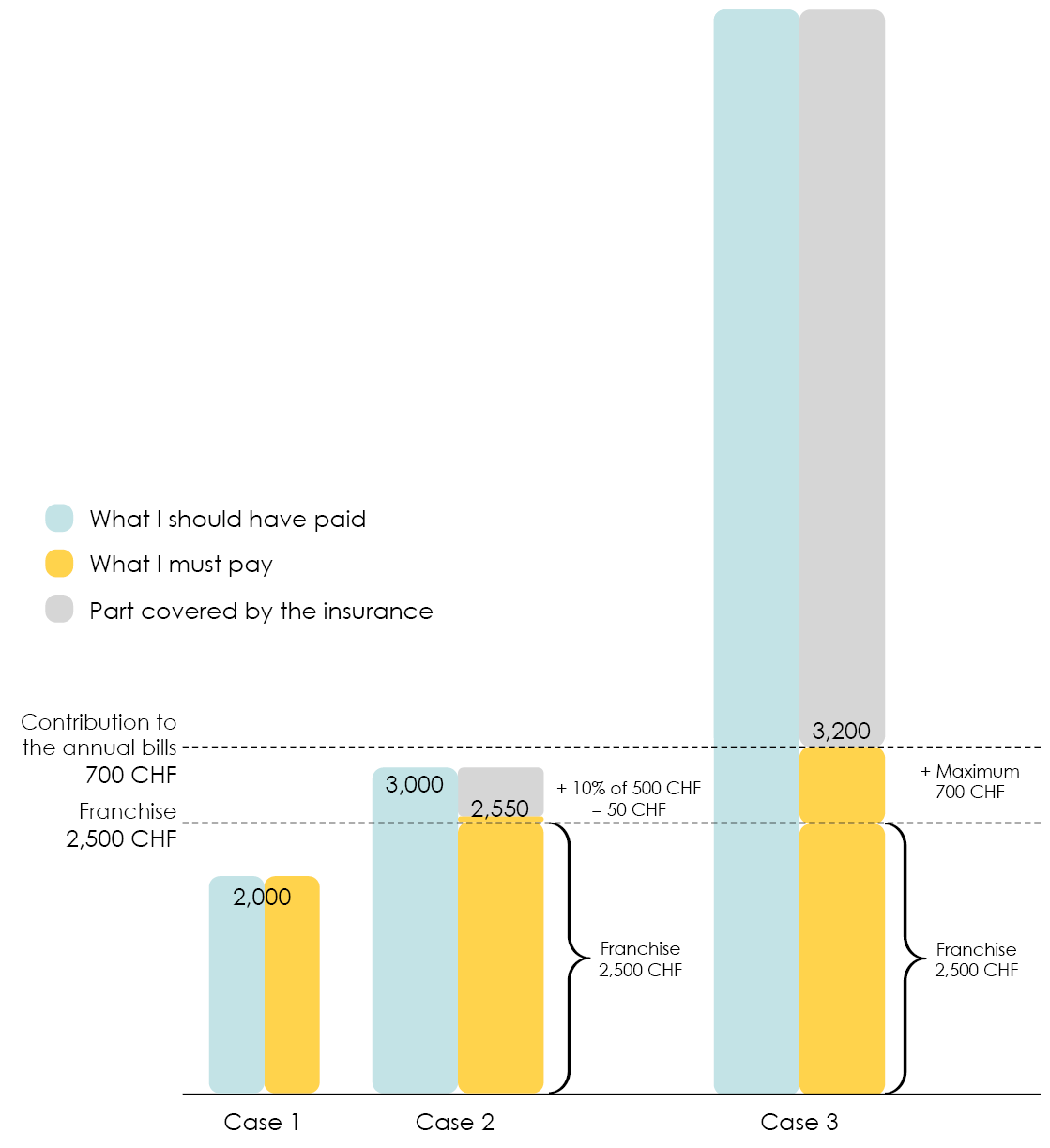

Say my deductible is still 2,500 CHF.

Case 1: this year, my medical costs were of 2,000 CHF. I will therefore have to pay for the whole thing myself.

Case 2: this year, my medical costs were of 3,000 CHF. I will have to pay 2,500 CHF (my deductible) + 10% of 500 CHF (that is 50 CHF) and pay a total of 2,550 CHF. My insurance will cover the remaining 450 CHF.

Case 3: this year, my medical costs were of 10,000 CHF. I will have to pay 2,500 CHF (my deductible) + 700 CHF and pay a total of 3,200 CHF. My insurance will cover the remaining 7,800 CHF. Why are the full 10% not added to my bill? Because 10% of 7,500 CHF is 750 CHF, which is more than the 700 CHF maximal annual contribution.

Fee n°3: Nights in hospital: The contribution per day towards the cost of hospital accommodation.

To sum up, so far you have paid your health insurance premiums, your deductible and you have also paid the co-payment of 10% of everything above your deductible. I can now tell you that if you have to stay in hospital, you will probably still receive a bill to contribute to hospital costs. Including:

- Food during your stay.

- Hospital room

- etc.

The only good thing about this paragraph is that it’s quite simple to explain: Each day spent in hospital will cost you CHF 15. No more complicated than that.

How does the reimbursement of a healthcare insurance work?

After reading these few lines, you’re probably thinking that you really have to be in pretty bad shape to hope to see the glimmer of a refund. You’re not entirely wrong, but I can assure you that refunds do exist, and we’re going to explain how they work.

The system is available in two models with slightly frightening names but that actually work in a very simple way: the third-party guarantor and the third-party payment.

What is the third-party guarantor?

The third-party guarantor is when I receive all the bills at home and I pay for all of them. Once the deductible is reached, I send the exceeding bills (which I will have paid for already) to my insurance and patiently wait to be refunded.

What is the third-party payment?

The third-party payment is simply the opposite of the third-party guarantor. It is when my insurance receives all my bills, pays for them and then sends me my part. The latter amounts to my deductible and my potential cost contributions.

How to know which model to use? This depends on two factors:

- The type of care. There exists four different ones: pharmacy, doctor, hospital, psychotherapy.

- Your insurance.

Pharmacy bills

The following insurance use the third-party guarantor system: Assura, Supra, Sanagate, Sanitas Compact One et Intras.

The other ones use the third-party payment system.

Doctor bills

In this case, for once, it is more straightforward, since every health insurer uses the same third-party guarantor system.

In practice, however, some doctors ask their patients if they can send the bill directly to the insurance.

If it contributes to printing less paper, why not, right?

Hospital bills

Here, it is even easier. The hospital fees use the third-party payment system, without making any exceptions.

And it makes sense: the amounts billed being rather high, the deductible is almost always exceeded. So the insurance might as well get the bill directly!

That being said, insurees, you and I, still have to double check the amount and details (contact details, dates, etc.) on the bill.

Psychotherapy bills

In 9 cases out of 10, the third-party payment system is used! In this field, very few insurances have price agreements with Santé Suisse allowing them to offer a third-party payment system.

How FBKConseils can help you with your mandatory health insurance?

At FBKConseils, we want all policyholders to be able to understand the Swiss health insurance system. That’s why we’re keen to provide you with as many free articles and videos on the subject as possible. In addition to our material, FBKConseils will always be there to support you:

– Choosing the right health insurance company

– Choosing the annual deductible for your health insurance

– How reimbursements work