Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on July, 17th 2025.

What is the real cost of an employee in Switzerland?

Introduction

When I launched FBKConseils, my main focus was to build a useful blog and a clear, educational YouTube channel. Hiring someone back then felt like a distant concern. But a few weeks, months, or years down the line, one question inevitably comes up for anyone looking to grow their business: Should I hire someone? And more importantly, at what cost?

That’s exactly the question I want to answer here: How much does an employee really cost in Switzerland?

Many entrepreneurs have a general idea of the gross salary they’d like to offer a future team member. But do they really know: what that salary means in net terms for the employee? And above all, what it truly costs the company once social charges and contributions are added?

Understanding the total cost of an employee is essential for:

- Designing a realistic business plan,

- Setting sustainable salaries,

- And identifying the minimum revenue threshold needed before considering a hire.

That’s the topic of this article – and I hope it will keep your attention for the next 15 to 20 minutes. On my end? That’s my plan for the next eight hours (yes, writing a good article takes time!).

The line-up:

Difference between gross salary and net salary

The Swiss employee payslip

We’ve already published an article aimed more at employees, explaining how to go from gross to net salary in Switzerland. But here, to fully understand what an employee costs an employer, it’s important to revisit the basics in just a few lines.

Each month, as a common practice rather than a legal obligation, Swiss employers provide their employees with a payslip.

This document shows all the deductions applied to the gross salary, helping each employee understand how their initial salary has been “eaten away” before it lands in their bank account.

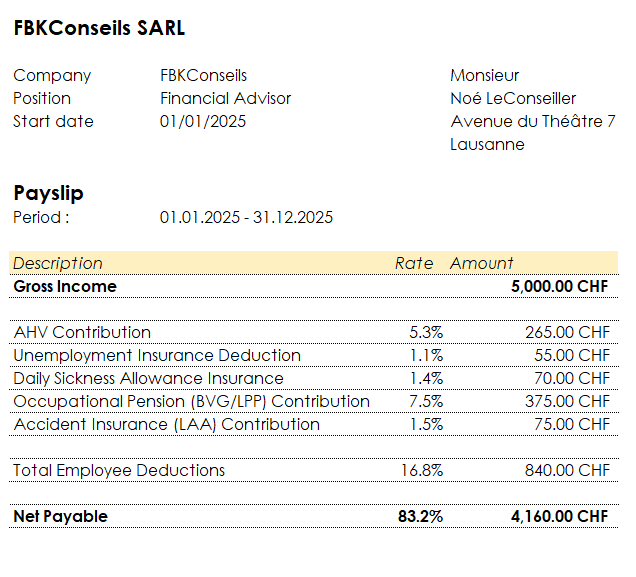

Here’s a very simplified example:

In this example:

- Gross salary offered: CHF 5,000.–

- Net salary paid out: CHF 4,160.–

- Amount of social deductions: CHF 840.–

What you need to remember is that from the CHF 5,000 agreed and signed, the employer will actually transfer only CHF 4,160 (or 83.2%) to the employee’s bank account. The CHF 840 deducted is paid directly to various social insurance schemes and public authorities.

Before we go any further, let’s take a quick look at these key deductions. If you’re already familiar with this topic, feel free to skip ahead to the next section.

AHV / IV / APG: The foundation of the Swiss Retirement System

The first pillar of the Swiss social security system is based on AHV (Old Age and Survivors Insurance), IV (Disability Insurance), and APG (Compensation for Loss of Earnings). These social insurances provide minimum protection against:

- old age (AHV),

- disability (IV),

- and certain types of income loss — maternity and military service (APG).

Each month, a portion of the employee’s gross salary is deducted to fund these social security systems.

AHV (Old Age and Survivors Insurance)

The contribution rate is 4.35% and is withheld from the employee’s gross salary. AHV is used to finance pensions for current retirees under a pay-as-you-go system. Each active worker contributes to guarantee income for retirees, without individual capitalization.

IV (Disability Insurance)

- IV operates similarly to AHV.

- It is funded by an additional deduction from the gross salary (included in the total 5.3% contribution rate mentioned above).

IV aims to provide pensions and financial support to individuals recognized as disabled. It also covers professional reintegration measures to facilitate their return to work.

Unemployment Insurance (UI)

The name says it all: unemployment insurance aims to protect employees in case of job loss.

In Switzerland, the contribution rate is 1.1% of the gross salary up to CHF 148,200 per year in 2025.

Beyond this threshold, no additional contributions are normally required (in 2025). Note: this rule can vary. During financially difficult periods, a solidarity contribution may be levied on incomes exceeding CHF 148,200, even though unemployment benefits remain capped at this maximum amount.

Daily Sickness Benefits Contributions (DSB)

Daily sickness benefits (DSB) are a slightly more technical topic. In summary:

- They are optional for the employer.

- They cover an employee’s salary if they fall ill and cannot work.

Practically, if you have not subscribed to this insurance, it is you, as the employer, who must pay the full salary of your employee during the entire legally mandated salary continuation period. This period depends on the employee’s length of service with your company: the longer the tenure, the longer the salary continuation entitlement.

The legal basis for this obligation can be found in the Swiss Code of Obligations, article 324a.

In summary:

- Without DSB: you bear the financial risk in case of prolonged illness.

- With DSB: you transfer this risk to an insurance company, in exchange for a premium.

Occupational Pension Contributions (BVG / 2nd Pillar)

Covering the 2nd pillar in just one paragraph is almost impossible due to its complexity. We have already published more than 10 articles on this topic on our website, and it could easily justify 50 more! But to summarize:

- As soon as your employee’s annual income exceeds CHF 22,600 (threshold in 2025), you are required to enroll them in a pension fund and contribute to the 2nd pillar.

- The amount of contributions depends on the employee’s age and, most importantly, on the policy you choose as an employer. This is where differences become huge: companies can opt for more or less generous plans, with contributions varying from one-third to triple for the same gross salary.

Key takeaway: the 2nd pillar can be a powerful tool to attract and retain talent if you offer attractive benefits. Conversely, it can remain just a mandatory expense if you stick to the bare legal minimum.

Accident Insurance Contributions (LAA)

Another essential legal obligation: protecting your employees against accidents in daily life. Two key rules to remember:

- In Switzerland, you must insure all your employees against occupational accidents (OA) from their very first day of work.

- Additionally, as soon as an employee works more than 8 hours per week, you must also cover them against non-occupational accidents (NOA).

In my opinion, understanding everything we’ve covered so far already provides an excellent foundation. Unfortunately, the payslip example we presented still hides two important issues you should keep in mind.

First, shared contributions: in our example, the CHF 840 was deducted from the promised CHF 5,000 gross salary. But this is only part of the real cost. In fact, at least the other half (and sometimes more) must be paid directly by the employer, without appearing on the gross salary. This expense is often underestimated when calculating the total cost of an employee.

Second, there are non-shared contributions, i.e., costs borne exclusively by the employer. These do not appear on the employee’s payslip but are added to the total cost. They vary by canton and include contributions to maternity insurance, vocational training fees, and especially a nearly universal charge: family allowances.

Which contributions are solely paid by employers?

To simplify, the vast majority of social security contributions are generally split 50/50 between employer and employee. Few of these contributions are legally borne exclusively by the employer. However, family allowances are an exception: they are entirely the responsibility of the employer (except, as is often the case, in the canton of Valais, where special rules apply). Contribution rates for family allowances vary by canton and compensation funds, typically ranging between 1.4% and 3.3% of the total payroll.

How to calculate the total cost of an employee starting from the gross salary?

Now that we’ve covered this important introduction and understood how social contributions work in Switzerland, the crucial question remains: how much will an employee really cost each month? Don’t worry, we’ll get there. And since you’ve been patient, I’m going to give you a super simple tool to calculate it in less than 20 seconds. Generous, right?

Step 1: Know the contribution rates by heart (Example 2025)

Here are the rates for our example. Keep in mind these rates (not all of them) can vary significantly from one company to another:

- AHV/AVS (Old Age and Survivors Insurance): 10.6% total ➔ Employee 5.3% / Employer 5.3%

- Unemployment Insurance (UI): Employee 1.1% / Employer 1.1% up to CHF 148,200

- Daily Sickness Benefits Insurance (DSB): Employee 1.4% / Employer 1.4%

- Occupational Pension (BVG/LPP): Employee 7.5% / Employer 7.5%

- Accident Insurance (AI/LAA): Employee 1.5% / Employer 1.5%

- Family Allowances: Employee 0% / Employer 2.25%

Step 2: Calculate total employer contributions

After requesting the exact rates from all your insurance companies and social institutions, you can create a summary table. This will give you the total amount of employer contributions expressed as a percentage of the gross salary.

Step 3: Add employer contributions to the gross salary

No need to be a math whiz, don’t worry. The formula is very simple:

In our example: CHF 5,000 × (1 + 0.193) = CHF 5,965

Conclusion: If you decide to pay an employee CHF 5,000 gross per month, part of the contributions will be deducted from their salary, but the other part will be added directly to your expenses. In the end, your employee will cost you approximately CHF 5,965 per month.

How to calculate the total cost of an employee starting from the net salary?

Sometimes, some employees only want to know what they will actually receive in their bank account at the end of the month. In that case, talking about gross salary doesn’t really interest them. What they want, and what they might negotiate, is a net amount.

So what to do if your future employee tells you: “I want to earn CHF 4,000 net per month, that’s all I know”? It will be up to you to determine how much this will really cost you, taking into account both the employee’s social security contributions and your own employer contributions.

Step 1: Convert the net salary to gross salary

The first step, when the employee sets a net salary, is to work backwards to the gross salary, which is the basis of all salary negotiations in Switzerland. The method is simple: just divide the net salary by (1 – employee social contribution rate).

In our example: CHF 4,000 ÷ (1 – 0.168) = CHF 4,807.70. This means that to pay your employee CHF 4,000 net, their contractual gross salary must be CHF 4,807.70.

Step 2: Converting net salary to total employer cost

Next, simply take this gross salary and apply the employer social contribution rate, just like we did in the previous example.

Here: CHF 4,807.70 × (1 + 0.193) = CHF 5,735.57.

Conclusion: An employee who comes to you saying “I want CHF 4,000 net per month” will actually cost you CHF 5,735, which is CHF 1,735 more than the amount you will transfer to their account. Admit it, this is not negligible… and being able to anticipate this kind of monthly expense is essential to avoid unpleasant surprises!

Salary and social contributions are tax deductible

At this point, you now have a much clearer idea of what an employee will actually cost you. But since we like to go all the way — and before talking about accounting and retirement (our little passion), let’s focus on taxes — I wanted to remind you of a very important point: all expenses related to an employee are tax deductible.

This includes:

- The net salary paid,

- The employer’s social security contributions,

- Benefits in kind (company car, housing, etc.),

- And any other work-related benefits.

According to the Federal Law on Direct Federal Tax (LIFD), Article 59, all these costs are fully deductible from your company’s taxable profit. Consequently, they reduce your taxable base and thus your tax burden.

To take our example: if your employee costs you CHF 5,735 per month, and your company is subject to an average tax rate of 15%, you will save about CHF 860.25 per month in taxes.

By including this last element in your calculation, you get an even more accurate view of the actual net cost of an employee, tax included.

Hiring a freelancer instead of an employee?

I wanted to end this article with an alternative that sometimes comes up: should you hire an employee or work with an independent contractor? Is the cost really the same? The answer isn’t so straightforward. First, from a legal standpoint, not everyone can be considered an independent contractor, especially if they work full-time for your company. You can’t just hold job interviews and, to avoid paying social contributions, suggest that the candidate become an independent contractor. If the social security authorities (AVS) discover this arrangement, it could lead to serious trouble. In principle, a full-time job with an indefinite contract must be treated as employment.

Aside from this crucial legal aspect, paying a freelancer can indeed seem simpler:

- No administrative procedures with social insurance,

- No social contributions to pay,

- No impact in case of illness or absence (except for contractual exceptions).

But in the end, whether freelancer or employee: all fees paid for their services are fully tax deductible, just like a salary.

That said, freelancers are not naive: they also do their calculations. To survive economically, they have to include in their rates all the costs a traditional employer would normally pay: social insurance, pension contributions, health risk, etc.

In other words, a competent freelancer will adjust their rates to cover these risks, and the final cost for your company won’t always be much lower than that of an employee… sometimes even higher.

How FBKConseils can support you?

An introductory meeting

At FBKConseils, we offer all our clients—whether they are freelancers, SME leaders, or future entrepreneurs—a free introductory meeting of about twenty minutes. The main goal is simple: answer all your questions, introduce our team, and, if needed, explain transparently how we work.

Conducting tax and financial simulations

If you are planning to hire staff or even start your own business, we are here to support you. Our team assists you with administrative procedures as well as with the actual creation of your company. We also carry out tax and financial simulations to help you calmly plan your expenses and investments.

Handling your accounting, payslips, and other statements

As a fiduciary, FBKConseils can take care of your complete accounting, the preparation of payslips, social security statements, and the delivery of all necessary documents to your employees and the various authorities.