Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on July, 17th 2025.

Entrepreneurs in Switzerland: What’s the difference between salary and dividend?

Introduction

Becoming your own boss is already a challenge in itself. But once you’ve crossed that first milestone—when the difficult early years are behind you and the prosperous ones lie ahead—other important questions start to arise. One of them is: Would it be more beneficial to pay myself in dividends rather than a salary?

First of all, this is an essential question. And second, it’s far from as simple as it may seem. On the surface, money is money—but from a tax and accounting perspective, salaries and dividends have very few things in common. They impact key areas such as unemployment insurance, pension contributions, tax deductions, withholding tax, and much more.

I know your time is valuable. But I’m convinced that after spending just ten minutes reading this article, you’ll have a much clearer understanding of the topic. And if needed, don’t forget: at FBKConseils, we offer a free first consultation to take a closer look at your specific situation.

Today, we’ll start by looking at the theoretical aspects of both forms of remuneration. Then, at the end of the article, we’ll walk through a concrete example with numbers to clearly highlight the pros and cons of salary versus dividend.

The line-up:

Salary or Dividend: What’s the difference?

In my opinion, the simplest way to understand the difference is this: a salary is primarily meant to compensate work performed, and is governed by employment law and your work contract. In contrast, dividends are based on the Swiss Code of Obligations, specifically on company law. They are exclusively intended to reward an investment. This principle applies just as much to your own business as it does to large multinationals.

Let’s take an example: when you buy Nestlé shares, it’s fair to assume you’re not directly contributing any work to improve the company’s performance. Therefore, you can’t expect to receive a monthly salary. However, by acquiring even a small stake in the company, you’re contributing to its development. If the company performs well financially, you may be entitled to a share of the profit in the form of dividends.

Of course, this example isn’t perfect—you’re unlikely to buy shares directly from Nestlé, but rather through another investor. Still, the core idea remains the same.

This initial point helps establish a fundamental difference between salary and dividend. But simply understanding this distinction isn’t enough: it leads to very different tax, social security, and accounting treatments, both from your business’s perspective and your own personal situation.

Definition of a salary

As mentioned earlier, it’s important to remember that you and your company are two distinct legal entities. Everything that follows must therefore be understood at both levels: your company’s perspective on one hand, and your personal financial situation on the other.

How is salary treated at the company level?

Quite simply, a salary in Switzerland is considered a 100% tax-deductible accounting expense, whether it’s paid to your employees or to yourself. There’s no difference in treatment. In other words, all HR-related expenses are taken into account, including:

- Net salary

- Social security contributions (1st pillar – AVS, 2nd pillar – LPP)

- Loss of earnings insurance

- Accident insurance

All these costs are deductible for your company and reduce its taxable profit, directly lowering the total corporate tax burden. In summary: The more salary your company pays out, the lower its taxes will be.

How is salary treated at the personal level?

And because tax authorities are no fools, what’s deductible on one side is obviously taxable on the other! That’s right—anything that looks like a salary and lands in your personal bank account (or sometimes even if it doesn’t!) is considered taxable income. This even includes tips (Art. 17 LIFD)!

Of course, salary also means social contributions. Without going into too much detail (we’d be here all day), just remember this: Every salary you pay yourself will always come with its share of social security contributions.

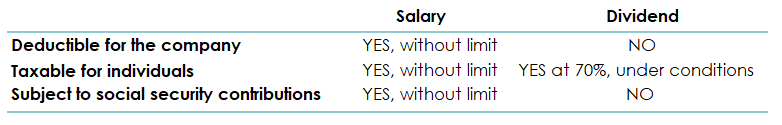

Summary: What you need to know about salary?

- It’s a deductible expense for the company

- It’s taxable at the personal level

- And in most cases, it’s subject to social contributions

What is a dividend?

As mentioned earlier, a dividend is not income earned from your labor, but rather compensation for the financial “risk” you took in supporting the development of a company. It is a form of remuneration governed by strict rules and can only be paid out if the company has generated a profit—that is, revenue exceeding expenses.

In other words, as long as your company is still navigating its early, more challenging years, only salary payments are an option. Dividends are reserved for those who have passed this stage and whose business is now profitable.

How dividends are treated at the company level?

If your company has a successful year, you may choose to reward your shareholders (including yourself) with a dividend. However, unlike salaries, this kind of cash outflow is not deductible from your company’s taxable profit. In short, you can distribute money to shareholders, but it won’t reduce your company’s tax bill.

How dividends are treated at the personal level?

Strangely enough, even though dividends are not deductible for your company, they are still taxable as personal income. On paper, this might seem like a terrible deal!

But before you conclude that “paying dividends is pointless since it’s taxed on both ends,” let me reassure you: there are 1.5 pieces of good news.

- The first good news: If a person owns at least 10% of the company’s shares, this is considered a qualified participation. That means you’re treated as a significant investor, and you only have to declare 70% of the dividends you receive as taxable income. This is provided under Article 20, paragraph 1bis of the Federal Direct Tax Act (LIFD)—and yes, we’re very fond of that one!

- The “half” good news: Dividends are not subject to social security contributions. In other words, every franc you pay out in dividends goes entirely to the shareholder—no AVS or LPP taking a cut. This allows you to retain a greater share of your profits. I call this a “half” advantage, though, because managing your social contributions wisely can also offer real long-term benefits. Avoiding them entirely could be a costly mistake.

How can a business owner optimize their tax situation?

Well, that’s an excellent question! And despite the wall of text you just read above, the answer is still not as straightforward as it may seem.

On one hand, you can deduct all salary-related expenses from your company’s taxable income, but in return, you’ll be subject to social security contributions and your salary will be fully taxed as personal income.

On the other hand, dividend payments are not deductible for the company, but they are not subject to social contributions and only 70% is taxable if you qualify as a major shareholder…

Faced with this dilemma, what should you do?

To make things clearer, let me walk you through a deliberately exaggerated example (with very little chance of happening in real life) to clearly illustrate how the mechanisms work, before concluding with the limitations of each income distribution method.

Dividend vs Salary: The case of a doctor

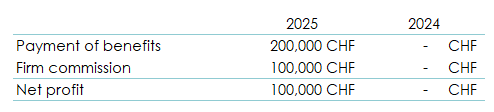

To illustrate this, let me introduce myself—I’m Noé, newly retrained as an ophthalmologist and authorized to practice under my own company. In 2025, my professional activity generated income with almost no expenses, since the medical center where I work covers all operating costs in exchange for a 50% cut of my fees.

Here’s what my income statement for the year might look like (before social contributions and taxes):

For now, I haven’t paid myself a single franc. I’ve been living off my personal savings, but today one key question arises:

Would these CHF 100,000 be more advantageously distributed as salary or as dividends?

Example – Paying myself a salary

Decision made: I want to contribute to my retirement and build solid social protection. As a result, these CHF 100,000 will be paid entirely as salary! Now let’s see what that actually implies.

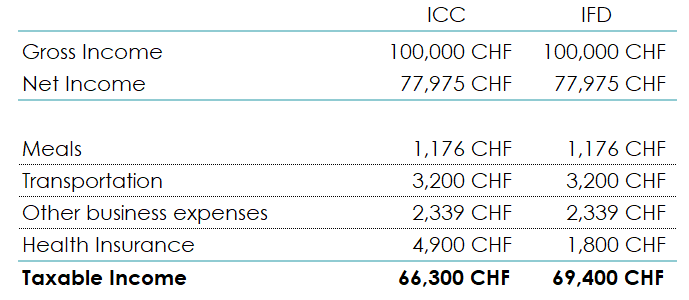

The CHF 100,000 represent my gross salary. Therefore, we need to deduct all social contributions before determining the amount that will actually land in my bank account.

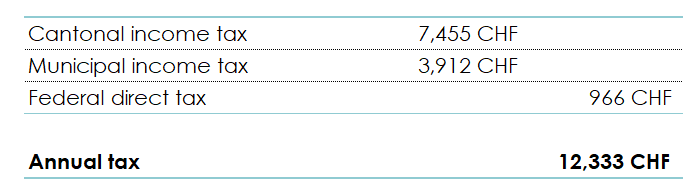

It’s only after this step that I can calculate my personal taxes:

Here’s a summary of the situation if I had chosen to pay everything as a salary:

- Profit before tax: CHF 100,000

- Corporate tax: CHF 0

- Social contributions: CHF 22,025

- Net income: CHF 77,975

- Personal income tax: CHF 12,333

My available income therefore drops from CHF 100,000 to CHF 65,642, representing a 34% decrease.

(For the purists: yes, social contributions can vary significantly depending on the chosen institutions, pension plans, and income levels. The goal here is simply to illustrate the path from corporate income to available personal income when paid as a salary.)

Example – Dividend Distribution

Let’s be transparent: the following example isn’t entirely realistic from a legal standpoint. As we’ll see in the conclusion of this article, dividends—just like salaries—are strictly regulated and must comply with specific rules. To simplify the tax explanation here, we’ll also ignore the withholding tax (which is covered in a separate article), as it wouldn’t change the main conclusion.

Here we are: the new year has begun, FBKConseils has delivered the annual accounts, and it appears that CHF 100,000 is available to be distributed as dividends. Without hesitation (yes, that’s just how I am!), I decide to distribute the full amount.

But immediately, the person managing my file at the firm brings me back to reality:

“Be careful, before distributing a dividend, you must first ensure that corporate taxes are paid.”

So, it’s necessary to adjust the accounts so that the distribution takes place after setting aside the portion owed to the tax authorities.

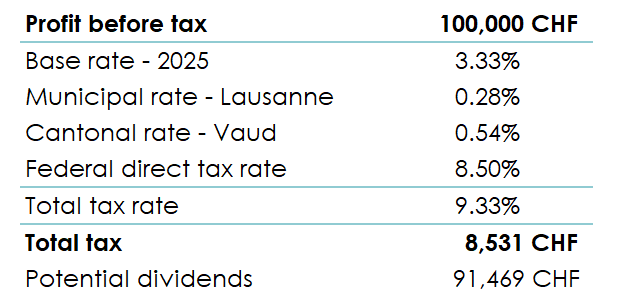

A dedicated article on corporate taxation covers this in more detail; here, let’s keep it simple and continue:

- Initial profit: CHF 100,000

- Corporate tax: CHF 14,000

- Amount available for dividends: CHF 86,000

Thus, CHF 14,000 went to taxes, but I still have CHF 8,000 more in my account compared to choosing the salary route!

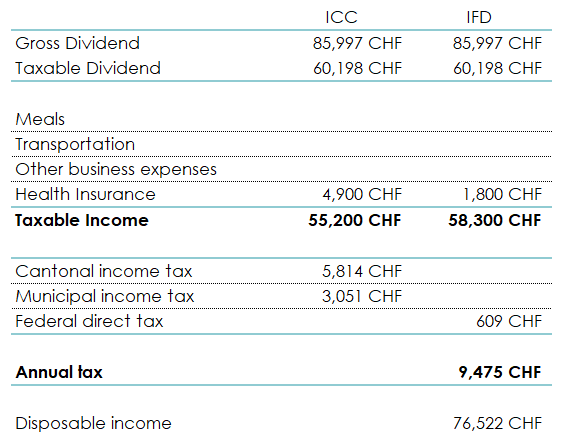

However, just like with salaries, I now have to declare this dividend in my personal tax return. And in the case of a qualified participation, only 70% of the amount will be added to my taxable income.

A small drawback to note: without a salary, I also lose certain tax deductions linked to employment (social contributions, second pillar pension, etc.), which impacts the final taxable income.

Here is the final summary if I had paid everything as dividends:

- Profit before tax: CHF 100,000

- Corporate tax: CHF 14,000

- Net dividend paid: CHF 86,000

- Personal tax (after reduction): approximately CHF 9,500

- Final disposable income: CHF 76,500

Final comparison:

- With salary: CHF 65,600 disposable

- With dividend: CHF 76,500 disposable

That’s nearly CHF 10,000 more in favor of dividends!

If we stopped the analysis here, it would seem that paying dividends is more advantageous, despite their non-deductibility for the company.

However, without salary, there are no contributions to the 2nd pillar, no possible LPP buybacks, no 3rd pillar, and more broadly, goodbye retirement.

Is this a good idea in the long term? Certainly not. That’s why we will now highlight some essential limits to keep in mind.

Excessive Salary and Dividends

Whether it’s the tax authorities or social administrations, nobody likes abuses. To limit excesses in the use of salary or dividends, rules—sometimes vague—have been put in place. The goal is clear: prevent either method, taken to extremes, from becoming fraudulent practice.

An excessive salary

Not so long ago, dividends did not yet have the tax appeal they have today, and were often underused. At that time, many business owners paid themselves astronomical salaries, enabling them to make massive buybacks into their 2nd pillar pension plans. The result: a large part of the salary disappeared fiscally in these buybacks, drastically reducing the taxable base.

To regulate this practice, rules were introduced to define what an acceptable salary is.

The logic is simple:

If I had to replace my position, how much would an equivalent person cost on the job market? The market salary is the reference used—albeit with some approximation—to determine what is deemed reasonable.

An excessive dividend

In the same spirit, a business owner alone in their SME who decides to pay themselves only dividends would not only avoid social security contributions but especially those of the 1st pillar (AHV/AVS), which funds social insurance for the entire population.

If this practice became widespread, it would cause serious funding issues for the system.

That’s why the AVS has the right to reclassify your dividends as salary and retroactively demand payment of the corresponding social security contributions.

Intermediate conclusion: It is always wise to consult a consulting firm to accurately simulate the fiscal and social impact of distributing income as salary or dividends. The economic consequences can be considerable in the long run.

Exception for investment companies

It is not uncommon for some individuals, after saving for several years, to decide to create a capital company (SA or GmbH) to invest in various assets: real estate, financial products, participations, etc.

These companies have no real economic activity, and in principle do not employ any staff. All their income is passive and does not require any actual work.

Therefore, quite logically, these entities can—after complying with all legal requirements regarding dividends—distribute their entire reserves in the form of dividends, without having to pay salary.

What are the rules to follow before paying dividends?

The total capital must be fully paid up

A somewhat technical but essential point:

When setting up a corporation (SA) in Switzerland, it is possible to pay only part of the initial capital (instead of the full CHF 100,000).

However, before being able to distribute dividends, the unpaid portion of the capital must be fully paid up.

Legal reserves

Another important rule:

According to Article 672, paragraphs 1 and 2 of the Swiss Code of Obligations, any company making a profit must set aside 5% of its profit each year.

This reserve-building obligation continues until these reserves reach half of the share capital.

Distributable profits and/or reserves

To be able to pay a dividend, the company must have so-called distributable profits.

These profits can come from the current fiscal year or from reserves accumulated in previous years.

Available cash

This may seem obvious, but it’s important to remember: to distribute dividends, there must be sufficient cash available.

As a friend auditor recently reminded me, it still happens too often that clients forget that even a company with significant accounting profits may lack cash liquidity.

A high profit does not necessarily mean money available in the bank account!

Woooow, this article turned out to be much longer than expected… and yet, there would still be so much to say on this topic… Let’s keep the momentum, article after article!

But let’s stop here for today. I suggest concluding by presenting what FBKConseils could bring to you.

How FBKConseils can help you?

Introductory meeting

You’ve taken the time to read everything, but despite your best efforts, some things are still not completely clear?

Know that we offer a free initial consultation, about twenty minutes long, to answer your remaining questions.

Don’t hesitate to take advantage of it!

Starting your business

Are you looking to start your activity, whether as a doctor, architect, e-commerce entrepreneur, or in any other field?

At FBKConseils, we help you better understand the financial and administrative aspects of your project, draft your articles of association, and set up your company under the best conditions.

Accounting and Taxation

As this example shows, keeping proper accounting records and managing taxation correctly can quickly raise many questions.

With great pleasure, FBKConseils is also here to support you throughout your company’s life, from its inception to its growth.