Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 14th 2024.

How much does the LAMal cost and how to choose one’s health insurance?

The line-up:

Introduction

Health insurance is a major issue that, with a few exceptions, concerns anyone living in Switzerland or wishing to settle here. Apart from the fact that you have no choice, the costs associated with this insurance can represent a significant proportion of your income.

There’s no need to cast any further doubt: compulsory health insurance in Switzerland is expensive! Very expensive indeed. So it’s best to understand how it works and, if possible, not to pay more than you have to, because if you didn’t know yet – or if you’d forgotten – remember: no matter which company you choose, you’ll have the right to the same cover!

If you do not know yet or if you had forgotten, let me remind you that no matter what company you pick, you will receive the same cover! There is no difference between insurance companies, as they are governed by the Health Insurance Act (LAMal).

Here’s a quick and easy tip: don’t waste any more time on sites that offer to compare your insurance premiums: Switzerland has a free site, updated every year, which lists all insurance policies, all deductibles and all the models on offer.

All you have to do is select your age, your municipality and whether accident insurance is included or not, and you’ll have access to all the health insurance companies in Switzerland.

This article will help you navigate this site, understand the overall system and how prices are set.

In Switzerland, health insurance premiums are calculated on the basis of 6 factors, which I’ll explain in detail below.

Health insurance: The 6 elements influencing your premium

First factor: Your age

It may seem fairly obvious, but adults on average spend more than children on medical expenses – nothing shocking at the moment. Consequently, insurance premiums are differentiated according to two age brackets:

- Premiums for children and teenagers: between 0 to 18 years old.

- Premiums for adults.

Some insurances offer an intermediate age-range going from 19 to 25 years old.

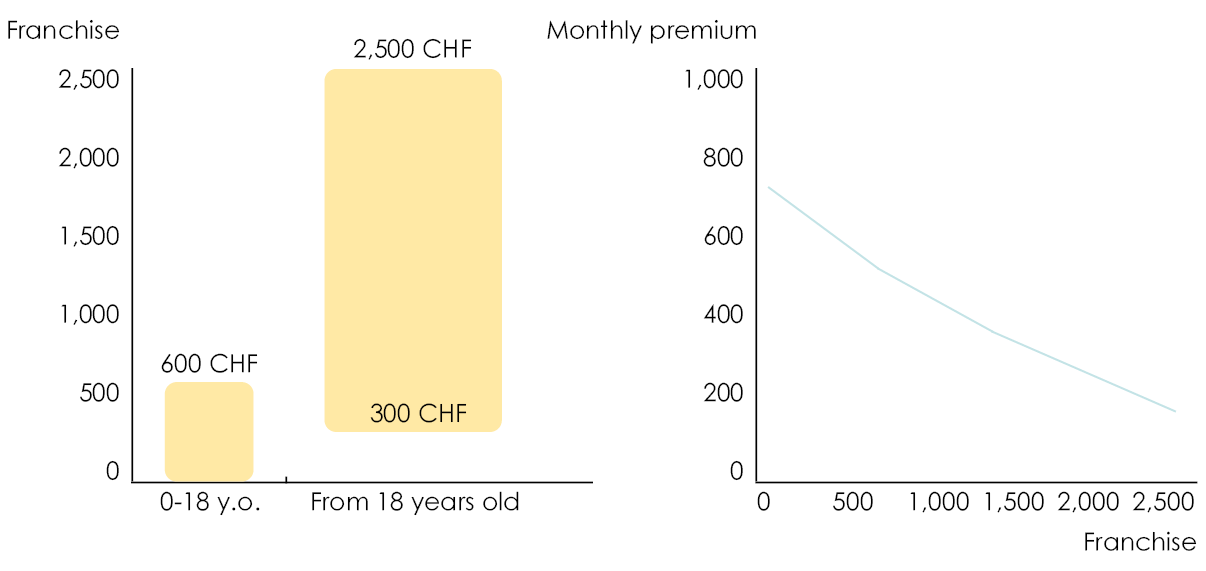

Second factor: Your franchise

The higher the franchise, the cheaper the premiums.

While the first age-range (i.e. child premiums) can choose a franchise going from 0 to 600 CHF, adults can choose a franchise starting at 300 and capped at 2,500 CHF! It is therefore crucial to pick the right franchise since it will have a considerable impact on the monthly premiums you will be paying:

- Adults: 300.- / 500.- / 1,000.- / 1,500.- / 2,000.- / 2,500.-

- Children: 0.- /100.- / 200.- / 300.- /400.- / 500.- / 600.-

To give you an idea: by 2024, the deductible would make a saving of up to CHF 1,462 per year.

Third factor: Your location

If you live in a big city (yes, I know, in Switzerland, Yverdon is already considered a town!), you will pay more than if you live in the countryside.

Why? Simply because insurers divide populations into risk groups. Is it still unclear? Let’s put it this way: in the city-centre of Lausanne, the population density is a lot higher than in the nearby small village of Colombier. There will thus be considerably more treatment requests in Lausanne than in Colombier, resulting in the fact that an individual living in Colombier will most likely pay less expensive premiums than someone living in the city center.

Fourth factor: Your care package

This fourth factor is perhaps still the least well understood, simply because most insured persons are often unaware of its existence. Health insurance in Switzerland can be broken down into 4 care models:

- Basic insurance: the most expensive but also the most flexible

- Family doctor: A single doctor at the heart of your health

- Telemedicine: Less travel and greater savings

- The care network: An economical but somewhat restrictive premium

The aim of an insurance model is to offer all policyholders cover that best suits their budget and needs. As always, here are a few lines on each of these models.

The basic insurance package

It is the most expensive package on the market, but also the most attractive one, that makes sense…

It is offered by every health insurance company and gives total freedom in picking the healthcare specialist of your choice (hospital, family doctor, telemedicine) without having to make a request in advance. In case you require treatment, you can freely choose who will be your first contact person.

All in all, with this model you’ll never have to ask yourself any questions.

The family doctor package as a first contact person

This package allows you to get a more or less significant discount on the insurance premiums but it also compels you to get in touch with the doctor designated by your policy as a first person of contact. For a doctor to be eligible, he/she has to have signed an agreement with the insurances. Thus, not any doctor can be chosen.

You must inform yourself by asking your insurer whether you can benefit from such an advantage with your family doctor.

For those who might be worried, it’s worth noting that even if you choose this model, you’ll still have to play the game and contact your family doctor first for minor everyday problems. For urgent or vital cases – which, as the name suggests, need to be treated immediately – you don’t need to go to anyone else, just the emergency room.

The telemedicine package, over-the-phone consultations: discounted premiums!

This package allows you to get lower premiums, but (of course, against something in return…), you will be obliged to contact the 24/7 hotline of your insurance at first. It will give you access to initial medical advice free of charge, and in some cases you can even obtain the necessary prescriptions directly by email.

When you think of it, this package has a lot of advantages:

- Your monthly premiums will be greatly reduced.

- You will save on the first consultation fees, since you will have had it over the phone.

- In case of a minor problem, you will directly get your prescription, without having to go to a doctor’s office!

And as with the family doctor model, if you have an emergency, don’t ask any questions – go straight to the ER!

The health network package

Not only is it the least expensive package, it is also appreciated because it is copy-pasted from the good old family doctor model described above. The only difference is that you will not get to freely choose your doctor. It will be part of a list of doctors that your insurance preselected.

If you are lucky enough, your favourite doctor might be on the said list. This lucky coincidence would help you save quite a bit of money on your premiums. However, if your doctor is not on the list, then you will either have to accept changing packages and paying a higher premium, or benefit from the discounted premiums by leaving your doctor for another one.

This is not an easy choice, right?

As always, do not panic, it is not as bad as you think! These packages are decisive when the urgency of your health situation is low. Should you have a health emergency, you will always, no matter your package, have the possibility to go to the nearest hospital. The choice of package exists to determine “planned” appointments.

Fifth invoice: Inclusion of accident insurance

So as not to confuse you too much at the end of this article, just know that as long as you are employed, you will be covered against the risk of accident. However, students, pensioners and minors are not so lucky and must ask their health insurance to include accident cover. If you don’t, only medical expenses resulting from illness will be covered.

In terms of price, allow between 7% and 12% extra if you have to include accident insurance.

Sixth factor: Choice of insurance company

For regular readers who have read our entire article, it is now clear that the health benefits offered by the various insurance companies are identical. Whether you opt for Sanitas, Helsana, CSS or KPT, these insurers are required by law to cover you in a similar way. So the question is: do all insurers charge the same rates for the same age, address, excess and cover model? The answer is no… and here’s a small example to illustrate the point:

I am 30 years old, I live in Pully, my franchise is of 2,500 CHF and I opted for a basic insurance package.

The premiums offered by the various insurers range from CHF 364.80 per month for Vivao Sympagny to no less than CHF 690.70 per month for Galenos insurance.

In other words, poorly choosing my health insurance company can make me loose a few thousands a month while having a right and access to the same exact treatments.

You might be thinking: “who on earth would go pay more expensive premiums to get the same service?” Ok, you are right, there is still an explanation:

- The quality of the service is better (quicker reply time, faster reimbursement, third party paying…).

- The management convenience in case of a full insurance: if you have supplementary insurances on top of the basic insurance, it is often easier to centralise everything with the same insurer in order to make the administrative processing smoother (as well as the reimbursement process). Especially since sometimes, in order to get supplementary insurances, the insurer will require for your basic insurance to be purchased with the same company.

There you go! Now you know everything you need to when it comes to the price of your health insurance and how to pick the company that will be taking care of your health well.

All there is left is to find out is whether or not you are subject to the obligation to get insured in Switzerland? And if so, what covers are offered by the insurance? What your contribution will be in case of a problem related to your health?

How can FBKConseils help you optimise your health insurance?

At FBKConseils we have decided to move away from being insurance brokers. Unfortunately, we no longer wish to issue insurance policies for our clients, even though we retain our legal accreditations. We now offer a consultancy service to help you to :

- Better understand the health insurance system

- Optimise your insurance premium costs if necessary

- In the event of a dispute, take the time to discuss it with your insurance company

- And, as always, to provide you with free content in all these areas.

If you have any questions, don’t hesitate to contact us or make an appointment directly on our website.