Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on May, 14th 2024.

Termination and change of health insurance

The line-up:

Thanks to our articles, you’ll know a little more about how health insurance works, what it covers, what it doesn’t cover, premiums and how reimbursements work.

The aim of this article is to explain when, how and why you should change your health insurance.

When can I change my health insurance?

The answer is simple and applies to all insurance policies in Switzerland (health or otherwise): you are free to change insurer the moment the insurance company announces a change in premium, upwards or downwards. If the prices change, the contract changes and you are free not to accept the new conditions proposed.

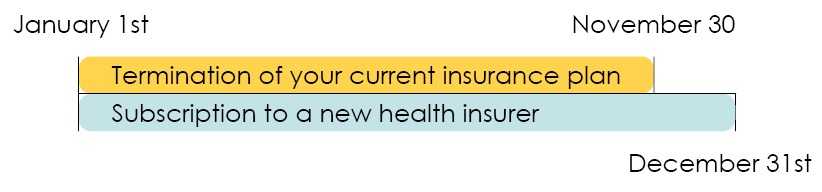

Health insurance premiums change every year in line with healthcare costs and price trends. Each year, around September (but no later than the end of October), insurers are required to publish the new premiums for the following year. Once they have been published, you have until November 30th to send your cancellation request to your insurer. The cancellation will take effect on January 1st of the following year.

Change your health insurance in 3 easy steps

Step 1: Choosing your new health insurance for 2025

Here we are, summer’s over, the last part of the year is upon us and, as they do every year, all the insurers have published their price lists for 2025 (not before September 2024).

Please take a few moments to enter all the information about your situation:

- Your age

- Your region

- Whether accident insurance is included or not

- The ideal deductible

Then press calculate. You will then be redirected to all the insurers and all the possible policies valid from 01.01.2025. All that’s left to do is compare and take out the insurance that you think offers the best service/price ratio.

Step 2: Cancel your old insurance policy

Once you have chosen your future insurer, you will need to write a letter of cancellation or use the one provided by FBKConseils to ensure that your change is carried out correctly, which will include certain information. Especially:

- Surname / first name

- Address

- Policy number

- Reason for cancellation

And make sure that this letter reaches your insurance company before November 30th 2024.

Step 3: Register with your new health insurance

Now that the letter has been sent to your old health insurance company, you will need to take a few moments to apply for your new health insurance. In principle, this is done online via the websites of the various insurers. Since you are applying for membership with them, it is often simpler than cancelling. You can type “join XXX insurance” into your search engine and you should easily find the page in question.

You will need to provide some information:

- Personal details

- AVS number

- Choice of deductible

- Choice of model

- Inclusion or exclusion of accident insurance

And submit your form. A few minutes later, you should receive confirmation of your membership for the following year by email.

Please note: In principle, your former health insurance company cannot accept your cancellation until it has proof that you have been accepted elsewhere, to ensure that everyone is properly covered. As the system is more or less well designed, insurance companies should communicate with each other and validate your request.

Why change health insurance?

This is a crucial point that we regularly highlight in our articles: in Switzerland, all health insurers offering compulsory contracts offer identical terms and conditions. So there is no difference in treatment between insurers. So why consider changing insurance? Quite simply because the insurance that was cheapest in 2024 probably won’t be in 2025. Insurers face significant costs every year, collect premiums and manage their budgets as best they can. It is therefore crucial to check each year which insurance is the cheapest and the one you like working with, so that you can make a change if necessary. By doing so, you could make significant savings every month.

Tips and advice on changing health insurance

Termination deadlines

Even though, in theory, you can cancel your insurance policy up to November 30th and you can choose your future health insurance policy up to December 31th, we strongly advise you not to wait for these deadlines.

- The letter was sent on November 29th but didn’t arrive until December 1st.

- You have unpaid bills with your previous insurance company

- They have not received confirmation from your new insurance company

Ask everyone for confirmation

It’s time-consuming, but once you’ve made the two requests (the cancellation request and the affiliation request), take the time to ask the insurers for confirmation by email to make sure that everything is in order on both sides and to avoid any nasty surprises on January 1st of the following year.

Watch out for insurance brokers

As soon as the summer months begin, brokers will be rushing to the phone to arrange a meeting with you and convince you that they have an incredible insurance product in terms of cover and cost. Be careful, if a service doesn’t have a price then you are the price. Everyone has to earn a living, so ask yourself, how is this person being paid?

How can FBKConseils help you change your health insurance?

At FBKConseils we can answer all your questions about health insurance. We can then, of course, assist you with the administrative procedures between the various parties involved.However, FBKConseils no longer offers insurance brokerage services, and we no longer offer contracts to our clients. We have decided to remain solely an advisory service.