Written by Yanis Kharchafi

Written by Yanis KharchafiUnderstanding Wealth tax in Valais

Introduction

Worldwide, this form of taxation is being debated and many countries have decided not to tax the capital saved by their taxpayers. Bad luck for the residents of Valais and more generally for the Swiss people as this tax remains applicable in the commune and canton.

Along with communal, cantonal and direct federal income taxes, you will be required to declare your assets and debts in order to be fiscally compliant. By the way, if you need a hand with your tax return in Valais, feel free to ask! 😉

The line-up:

What makes up taxable wealth in the canton of Valais?

Before looking at net wealth, let’s first go over what the tax authorities consider to be part of your taxable assets:

Your movable assets

These are all assets that are not real estate, meaning everything except immovable property such as houses, buildings, or land. This category includes in particular:

- bank accounts in Switzerland and abroad;

- securities such as shares, bonds or investment funds;

- equity in your company (SA or Sàrl);

- business assets for self-employed individuals;

- valuable items;

- life insurance policies;

- livestock;

- and even doubtful receivables, as long as there is still a chance you might recover the money.

Excluded from this list are household belongings, retirement assets (second and third pillars under Swiss rules), and personal items used in everyday life.

An important point: it is common to see significant fluctuations in wealth during the year, for example due to pension buy-ins, market gains or losses, or the volatility of crypto assets. What matters for tax purposes is the value of your movable assets on 31 December of the relevant year.

And for anyone thinking of getting creative: withdrawing your money on 30 December and keeping it “under the mattress” until 2 January won’t help. Whether it sits in your bank account or at home in cash, it must, in principle, be fully declared in your tax return.

Real estate assets

Unsurprisingly, if livestock or watches form part of your taxable wealth, your real estate does too. And this does not only apply to property located in Switzerland. Even though foreign real estate is not taxed in Switzerland, it must still be declared and it will affect your overall Swiss tax burden. That’s the reality.

Be careful: when we talk about real estate wealth, we need to distinguish between the following:

- Rental income, which is taxed as taxable income;

- The tax value of the property, meaning the value assessed by the tax authorities, which is taxed as wealth.

In this article, we are only concerned with wealth, meaning the property’s tax value.

Without going too far into the details, here is how the canton of Valais values your real estate depending on where it is located:

- Real estate located in the canton of Valais: The canton of Valais provides the official tax value. It does not depend on you and must be reported exactly as it is in your tax return.

- Real estate located in Switzerland but outside Valais: As with Valais, the canton where the property is located is responsible for determining the tax value. After that, without diving into the complexities of Swiss mechanisms, an intercantonal allocation is applied with revaluation factors (CSI). All you need to remember is that you report the value provided by that canton, and the Valais tax authorities handle the rest.

- Real estate located outside Switzerland: This is where things get more complicated. In Valais, everything depends on whether an official tax valuation exists in the country concerned:

- If the country provides an official valuation, use that value, apply the exchange rate, then multiply it by 1.5.

- If no official valuation exists, use the purchase price (or another reliable value) and apply the exchange rate.

Naturally, claiming that “no official valuation exists” can sometimes help reduce your effective tax rate a little.

Identify your taxable wealth in Valais

Once this aggregation exercise is completed and the total value of your assets is known, you will be allowed to deduct all the debts (credits and mortgages) for which you pay interest.

In addition to deductible debts, the canton of Valais grants a standard deduction so that your wealth is not taxed from the very first franc. This deduction depends on your personal situation. In 2025, it is:

- For single, widowed or divorced persons without children: CHF 45’000.

- For married couples (with or without children) and single persons living in a common household with a dependent child: CHF 90,000.

Now you can claim to know how to calculate your taxable wealth. Quite fancy, isn’t it?

Do we pay a lot of wealth tax in the canton of Valais?

It’s hard to say… What do we mean by “a lot of tax”? Instead of giving you my opinion, I’ll let you form your own judgment through some concrete examples.

Wealth tax in a tax-advantageous commune (e.g., Verbier)

- With a taxable wealth of CHF 50,000: CHF 150, which represents a tax rate of 0.30%

- With a taxable wealth of CHF 100,000: CHF 340, which represents a tax rate of 0.34%

- With a taxable wealth of CHF 500,000: CHF 2,200, which represents a tax rate of 0.44%

- With a taxable wealth of CHF 2,000,000: CHF 12,000, which represents a tax rate of 0.60%

Wealth tax in a tax-disadvantageous commune (e.g., Grächen)

- With a taxable wealth of CHF 50,000: CHF 180, which represents a tax rate of 0.36%

- With a taxable wealth of CHF 100,000: CHF 408, which represents a tax rate of 0.408%

- With a taxable wealth of CHF 500,000: CHF 2,640, which represents a tax rate of 0.528%

- With a taxable wealth of CHF 2,000,000: CHF 14,400, which represents a tax rate of 0.72%

Do these examples help you draw your own conclusions? What we can deduce is that the commune can influence your tax burden. However, regardless of the municipality you choose to live in, your wealth will generally not be taxed at more than 0.72% in 2025.

In short, now that the numbers are laid out and the die is cast, I invite you to think further and investigate together how we arrived at these figures by carefully breaking down the calculation of wealth tax. Ready?

How is wealth tax calculated in the canton of Valais?

As with income and as in other Swiss cantons, Valais taxes wealth twice: once at the cantonal level and once at the level of your municipality of residence. You must therefore calculate both taxes and then add them together to determine your total tax burden.

Calculating the Cantonal Tax

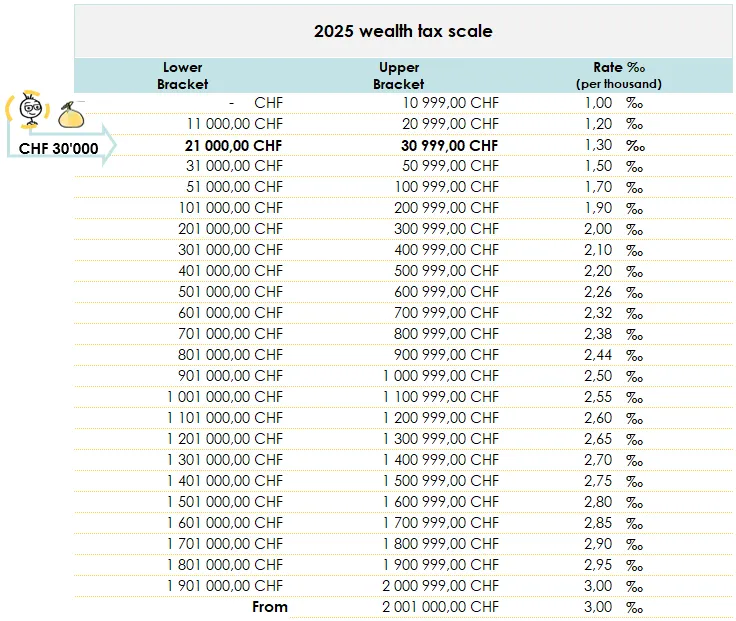

In this first step, the goal is to calculate the cantonal tax. To do this, we need to refer to the scale commonly known as “Scale 3 – Tabelle 3 Cantonal and Communal Taxes on the Wealth of Individuals”.

This table will allow you to easily determine the amount of tax to pay.

The rates range from 1‰ for taxable wealth not exceeding CHF 10,000, up to 3‰ for wealth exceeding CHF 2,000,000. It’s clear that, unlike income tax which is expressed in percentages, here we’re talking about per thousand (which is somewhat reassuring).

Example. Let’s say I am single and my only asset is an account at the BCVS showing, for once, a rather decent balance of CHF 75,000 (don’t judge me, I cut back a bit on Christmas gifts).

I must first deduct my CHF 45,000 allowance to determine my taxable wealth, then refer to the scale to calculate the cantonal tax.

In this case, it’s quite simple: 75,000 – 45,000 = 30,000.

With a taxable wealth of CHF 30,000 established, I can now take a look at the famous Scale 3.

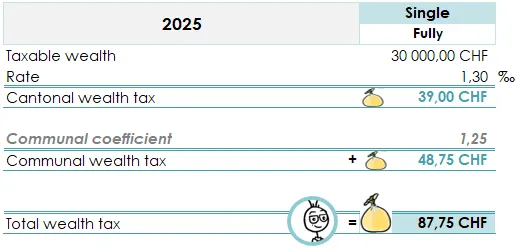

I would therefore owe CHF 30,000 × 0.00130, which comes to CHF 39 to the canton of Valais. You now know how to calculate your taxable wealth and determine the cantonal tax.

Calculating the communal tax

I warn you, it’s less pleasant than for the canton. But for those who have endured the calculation of the communal tax (and cantonal) on income tax alongside us, rest assured, we won’t be doing any indexation here, to anyone. However, the process is similar.

Let’s start with what we know. Everything that applied to the canton applies to the commune as well.

The first step is already done: you calculate your taxable fortune, and then you look up the corresponding tax in the table. In our example, CHF 39.

Then comes the commune. In the canton of Valais, each commune decides on a tax coefficient that will be used to increase the tax levied by the canton. Here are the 2025 values:

In 2025, these coefficients range from 1 (no increase, meaning the cantonal tax equals the communal tax) to 1.45 for municipalities where living is… less advantageous from a tax perspective.

If, in our example, I live in Fully, then I must multiply my CHF 39 by 1.25, which gives me CHF 48.75 to be paid additionally to the municipality of Fully.

In total, I would have to pay CHF 39 to the canton and CHF 48.75 to the municipality. This gives us a total wealth tax of CHF 87.75.

How can FBKConseils help you with your taxes?

A first free consultation

For 2025, we continue to offer anyone the opportunity to book a free consultation of 15 to 30 minutes. This meeting is the perfect opportunity to ask us any questions (yes, really any), and we will take the time to answer them. If you wish, we can also explain our method of work and how we can assist you with your tax procedures.

Tax simulation

After reading our articles, we are confident that you are now well-equipped to perform your own tax simulations in case of life changes. But if you’re short on time or prefer to delegate this task, we would be happy to assist you and help you make the best financial decisions.

Tax returns

At the heart of our profession are taxes. And when it comes to taxes, it inevitably involves tax returns. Every year, we are by your side:

- Either to teach you how to fill out your tax return like a true expert,

- Or to take care of the entire process for you, managing it from start to finish.

The goal? Always to adapt to your needs and provide you with a tailored and efficient service.