Written by Yanis Kharchafi

Written by Yanis KharchafiInvesting in real estate, still a good idea in 2025?

The line-up:

Introduction

Oh… Real estate…

We’ve all heard about the crazy story of the visionary (or lucky) friend of a friend of a friend who bought a house and resold it for triple of the price a few years later.

That’s wicked!

We’ve all watched the sad spectacle of the subprime mortgage crisis of 2008 and the direct demise of the American dream. Entire families thrown out into the street, financially incapable of reimbursing loans taken out by wolves of finance.

Shoot!

Would the real estate market be a monster with feet of clay? A paper tiger? A House of cards?

Please put down your newspaper, turn off the TV, and analyze the figures.

According to a collaboration between the website comparis.ch and the Chair of Entrepreneurial Risks of the EPFZ [Swiss Federal Institute of Technology in Zurich] (in short, this is serious stuff!), the price per square meter in Lausanne for an apartment went from CHF 5,500 in 2007 to CHF 9,000 in 2018, reaching a peak of CHF 9,400 in 2017 (the figures are rounded up to the next hundred).

Although, you might fire back: “But Noé, we know very well that prices keep rising in big cities of Switzlrand. what other city are you going to name to make your point? Geneva? Zurich? Water is wet, fire burns—no problemo, thanks a lot!”

True, all you have to do is to start looking for an apartment in Geneva or Lausanne to grasp that prices are not about to decrease.

While the price per square meter in the City of Calvin still costs an awful lot of money, it’s not there that the the biggest price fluctuation occurred—going from CHF 7,500 to CHF 11,000 in 2018.

At Le Locle [a UNESCO awarded city in the Canton of Neuchâtel, home to famous Swiss watch manufacturers but to no McDonald’s restaurants], the price per square meter experienced a 72% variation for the indicated period, one of the most impressive in the entire country! In 2007, the average rounded up price per square meter was around CHF 2,000, compared with CHF 3,400 eleven years later.

Of course, no one can predict future prices—predictions remain, per se, nothing more than methodical calculations.

Even more so that, even in an area as small as Romandy, the French-speaking part of western Switzerland, specialists (who spend their days calculating tendencies) are having a hard time drawing an obvious line. Their algorithms are irreparably torn between secluded areas where owners offer the first three rents to their future tenants and real estate agencies in Lausanne who have countless tenant applications.

“Ok Noé, we got it, but is there still a pattern that could emerge?”

Real estate as of 2022/2023 —what are the price trends?

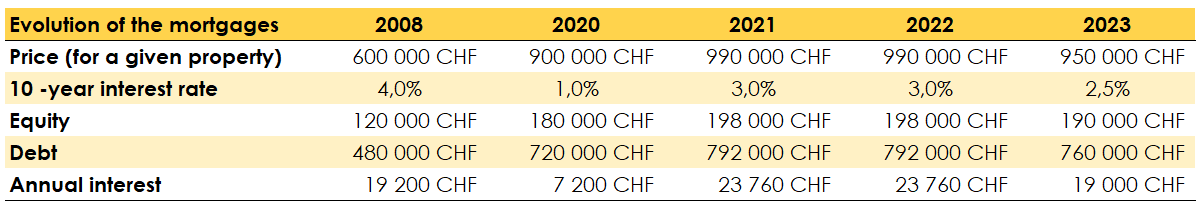

Once upon a time, the real estate industry was booming—as explained above. As the days went by, mortgage interest rates dropped. In other words, a property that cost CHF 600,000 in 2008, and on which a debt of CHF 480,000 was taken out at a fixed rate of 4%, cost the owner CHF 19,200 per year. The same house, twelve years later, in 2020, was priced 50% higher. It cost CHF 900,000 and owed CHF 720,000 at a rate of 1% rather than 4%; it then cost only CHF 7,200 per annum.

So, what does this mean? Even though prices were rising and, consequently, the required equity was also going up, the annual tax burden was becoming increasingly low.

So far, everything seems to be going smoothly… Prices are going up, but in reality, my credit is getting smaller. As interest rates plunged below the fateful zero mark, one was envisioning being paid every month to buy a house. A dream come true…

I can assure you that this euphoria quickly faded, and the wake-up call was brutal! Barely two years later (between 2022 and 2023), after a war, a pandemic, stress caused by climatic change, and so on, inflation went through the roof.

The outcome? Central banks panic, everyone raises their rates and 2008—here we go again! In a matter of a few months, we went from 1% to 2.5% and even 3% in the end of 2023.

I think you all knew about what was going on until now. The fact that rates are going up is not odd, but their impacts on prices is.

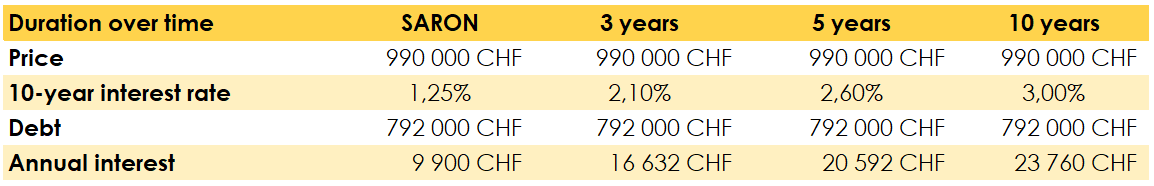

When reading my posts, you must be thinking, just as I am, that if rates go up, prices are bound to go down to maintain comparable annual expenses and, above all, so as to remain competitive vis-à-vis current rents. Well, that’s not the case! At least, not for the time being. Rather than curb the number of purchases—which would have reduced demand and stopped the rise in prices—buyers have preferred to take out mortgages with shorter terms in order to obtain lower rates.

But can it last? As long as homeowners are able to take out fairly attractive mortgages, prices are going to continue to stay stable or even go up. There are, however, several significant risks associated with this approach: SARON mortgage rates are attractive, and the number of such signed contracts continues to grow. But what if banks do not loosen their grip and continue to pressure by raising their policy rates? We’ll no longer be able to find a way to maintain a stable tax burden.

What’s the solution to a generalized increase in mortgage interest rates?

There’s only one way to deal with the ever-increasing costs of public utilities and service charges. There are, IMO, two possible scenarios:

Rents must increase

You were paying someone CHF 24,000 to live in their apartment. This person was paying a total of CHF 15,000 in utilities and service charges. Too bad, they now have an annual bill of CHF 25,000 for utilities. They’ll logically either increase your rent as soon as they get the chance or decide to get rid of the investment that this asset constitutes—if the latter is no longer profitable…

Whether the apartment belongs to a “small owner”, or a large pension fund, the result might be mostly the same— everyone should be able to find their niche.

The price of real estate must drop

Let’s suppose you’ve got a house with a price of CHF 600,000 (in 2008), which cost CHF 19,200 per year, and which could be rented on the market for CHF 24,000 per annum. Becoming an owner by providing 20% equity, paying high taxes, and greatly reducing our flexibility was still advantageous—we were saving on rent. If extras now rise up to CHF 25,000, it’s a safe bet that no one’s going to want to become an owner anymore, or at least not at such a price… Tenants are going to bid lower and lower to buy, so they don’t lose any money. The upshot will be the same in the end.

We, at FBKConseils, believe that what determines the remorseless rise in real estate prices in 2024 lies in the hands of central banks, depending even more precisely on policy rates.

Real Estate in 2024/2025 – What are the price trends?

Honestly, I’m amazed. Each year, as I update my articles, I realize just how much can change in just 365 days. In my analysis for 2022–2023, I offered solutions to deal with the “endless” rise in interest rates, convinced we would eventually reach “normal” rates (as the older generations would say): 5% over 10 years.

And yet, less than a year later, here we go again: interest rates are dropping, demand for real estate is picking up, and prices are soaring.

If we look at 2024, the rise in interest rates logically led to a slight drop in real estate prices in certain regions, although it was moderate (a few percentage points). But this decline will likely be quickly offset by the recent drop in mortgage rates, which is already driving demand.

Moreover, experts keep talking about the housing shortage in Switzerland due to growing demand. With this dynamic, it seems unlikely that prices will significantly drop in the short term.

Does this mean we’ll be able to achieve a neat x2 or x3 return on an investment, as our grandparents did? Personally, I doubt it. Here’s why:

Access to property remains difficult in Switzerland

- The requirement for personal equity remains high to buy a property.

- The higher the prices climb, the more this barrier becomes significant.

Income and savings are insufficient

- If prices continue to rise, this would imply that Swiss households are able to save more or increase their incomes at the same pace.

- Honestly, I have my doubts about this, given the current economic context.

Conclusion for 2025

In 2025, real estate prices are expected to return to their highest levels. But surpassing them? I have some reservations. The combination of required personal equity and a rise in the cost of living limits the room for significant price growth in the long term.

An Important Note

Caution: this article reflects my personal opinion and does not constitute investment advice or a reliable prediction. My goal is simply to share as neutral a perspective as possible. Always take the time to analyze your situation carefully before making any decisions.

How can FBKConseils assist with your real estate projects?

Introductory meeting via videoconference or in our offices

Have questions about your real estate project? At FBKConseils, we offer a complimentary first meeting. In just twenty minutes, we’ll analyze your situation and address as many of your questions as possible, either online or in person at our Lausanne offices.

Advisory meetings

Your project deserves our full attention. If a more in-depth meeting is needed, FBKConseils organizes comprehensive sessions with no time limit to thoroughly examine all aspects of your investment and provide you with the insights to make an informed decision.

Tax and budget simulations

Understanding the numbers is essential before making a real estate purchase. FBKConseils conducts the necessary research and simulations for you, delivering a detailed report to guide your decisions and negotiations.

Support with administrative procedures

Moving from theory to practice can be complex. FBKConseils is by your side to manage every administrative step, simplifying the transition from decision-making to the realization of your real estate project.