Written by Yanis Kharchafi

Written by Yanis KharchafiInvestment and taxation: Everything you need to know about taxes on your investment funds and ETFs in Switzerland

Introduction

Welcome to our new series of articles dedicated to the taxation of investments.

Just a few years ago, let’s say before COVID, many investments were made through banks, often without really trying to understand the what, the how, and the why. Since then, the trend has clearly shifted: more and more clients are informing themselves, comparing options, and looking to optimise their financial situation.

This is an excellent development. However, there are still too many grey areas, and too many poorly explained products presented by some advisors, sometimes with costly consequences. Yet when it comes to investing, the truly decisive criteria are relatively few: returns (often the most important), risk, fees (entry, management, transaction), and the tax treatment of the investment.

It is precisely this last aspect, taxation, that we will focus on today, and more specifically on investment funds and ETFs. If you also invest through other vehicles, these articles may also be of interest to you:

- Taxation of shares

- Taxation of real estate investments

That’s enough for the introduction; let’s get started.

The line-up:

What is an investment fund / ETF?

Investment funds, like ETFs, are a grouping of several assets under a single product. It’s as simple as that: as soon as you have more than two assets you can buy in a single transaction, you’ve invested in a fund (in this example, a fund with very little diversification).

Why buy investment funds? Because they allow you to diversify your portfolio by:

- Region (country, continent)

- Theme

- Valuation

- Type of industry

It is often complicated to select all the interesting companies, and even more difficult and costly to buy a share/bond or other financial product in each of these pre-selected companies. That’s why funds exist. In a single purchase, you can gain exposure to two or more companies.

What’s the difference between an investment fund and an ETF?

From our perspective, the main difference lies in the management style. A fund is managed actively: a team (more or less talented) analyses the markets, meets regularly, and decides whether to buy, sell, or wait, with the goal of outperforming the market. By contrast, an ETF follows predefined rules and is managed almost automatically. Once the index or methodology has been chosen (e.g. “buy the largest-cap stock in each country”), the rebalancing process (buy/sell/do nothing) is carried out without day-to-day human intervention. By eliminating meetings, committees, and administrative layers, costs are significantly reduced, while offering a passive and highly diversified product.

In one sentence: a fund brings together positions based on human decisions (active management), whereas an ETF replicates a set of rules or algorithms (passive management), with little to no human intervention.

What types of funds / ETFs are there?

There are hundreds of thousands of different funds, and any bank or asset manager can create investment funds under certain conditions. All they have to do is define the rules for selecting assets, then buy and sell them accordingly. Among the funds you can find :

Equity funds

Made up entirely of company shares.

Bond funds

Made up entirely of corporate or government bonds.

Crypto funds

Composed solely of cryptoassets.

Real estate funds

Mixed funds

These are funds that can be made up of equities, bonds or other products.

Taxes on investment funds and ETFs

This is where our article really comes into its own: investing in funds is great… but how much will be left after the tax authorities have taken their share? The answer depends largely on the composition of the fund (or ETF). Let’s take a step back and set the Swiss tax framework. Everything starts with the distinction between taxable income and non-taxable gains:

- Taxable income: In Switzerland, anything that resembles income is, in principle, taxable. In an investment portfolio, this mainly includes:

- dividends (shares),

- coupons (bonds),

- rental income (real estate vehicles).

- Tax-exempt capital gains (private assets): Unlike France, Switzerland does not tax private capital gains on the sale of an asset (art. 16, para. 3 of the Federal Direct Tax Act – LIFD). In other words, reselling a bottle of wine for CHF 1,000 that you bought for CHF 10, a bitcoin bought on a whim in 2002, or financial securities (shares, ETF units) at a profit does not generate income tax, as long as you remain within the scope of private assets.

In summary: when you invest in an ETF, you need to separate:

- Performance linked to price appreciation of the underlying securities: private capital gain, non-taxable.

- Income generated during the year (dividends, coupons, real estate income): taxable and must be declared.

Only after making this distinction can you correctly estimate the tax burden to report in your tax return.

In conclusion: since a fund is not a specific product but rather an aggregation of different financial instruments, it is less straightforward to say precisely how your fund units and the income they generate will be taxed.

Everything depends on what is actually held inside the fund:

Equity funds

You will be taxed on the dividends received. If the fund increases in value due to rising market prices, this capital gain is not taxable; however, you must declare the value of the fund as at 31 December in your statement of assets (wealth).

Bond funds

Same principle: the coupons and interest received are taxed as income. However, within certain limits, part of this income may be exempt when it is classified as “accrued interest on savings capital”.

Real estate funds

Here things get a bit more complex, and without going into overly technical details, keep the key point in mind: in Switzerland, most real estate funds are themselves subject to tax. In practical terms, this means that tax is already levied at the fund level, and that the income distributed to investors is net of tax. This represents a significant tax advantage, especially for those looking to diversify their assets without increasing their overall tax burden.

How can I tell what will be taxed when I invest in a mutual fund or an ETF?

In principle, you need to review all the transactions that make up your fund (purchases/sales) and identify, over the holding period, the income actually paid out (dividends, coupons, etc.). I won’t lie to you: this is tedious, especially with dynamic or frequently rebalanced portfolios.

That said, rest assured: in most cases, the institutions that distribute these funds (banks or brokers) issue “tax statements” at the beginning of the following year. These documents summarise, on a single page, the key information required by the tax authorities.

What is a tax statement?

For us, fiduciaries, and for you, aspiring investors, the tax statement is truly a light in the darkness. Without exaggeration, without this document, filing your tax return becomes almost a mission impossible — unless you’re ready to really roll up your sleeves.

When it is issued by a Swiss bank, this document is ideal: it provides you with the two essential pieces of information needed to correctly declare your investments.

Taxable wealth as of 31 December of the relevant year

This refers to the total value of all your positions as of 31 December (as if you had sold everything on that date), including capital gains and losses. This is the amount that will be used for the calculation of wealth tax.

Taxable income for the relevant year

This includes all income generated during the year (excluding capital gains and losses), taking into account the purchases and sales made. These explanations are deliberately simplified, as one essential concept is still missing: withholding tax (or tax deducted at source). To avoid getting ahead of ourselves, let’s first take a short detour into this topic… and then return to the official tax statement.

Withholding tax and tax deducted at source

This paragraph was created for 2026 because it is important, but somewhat technical. It will probably deserve a dedicated article; for now, let’s summarise the essentials in a few lines.

Put yourself in the shoes of a trickster who doesn’t necessarily want to pay their fair share of tax. At first glance, nothing could be simpler: you invest via some broker and receive dividends every quarter. If nothing appears in your tax return, who would know? Would the tax authorities really have to monitor every Swiss and foreign financial institution for every single taxpayer? Almost impossible.

It is precisely to encourage proper reporting that the system of withholding tax / tax deducted at source was created: before paying you any income (dividends, interest, coupons), the financial institution withholds a significant portion at source and only pays you the net amount. It is then up to you to declare this income in your tax return in order to claim the refund (or offset) of the tax withheld. Clever, and remarkably effective.

To finish, let’s complicate things one last time: distinguishing income from Swiss sources and income from foreign sources. The mechanisms are similar, but the forms and recovery procedures differ—this is what we look at next.

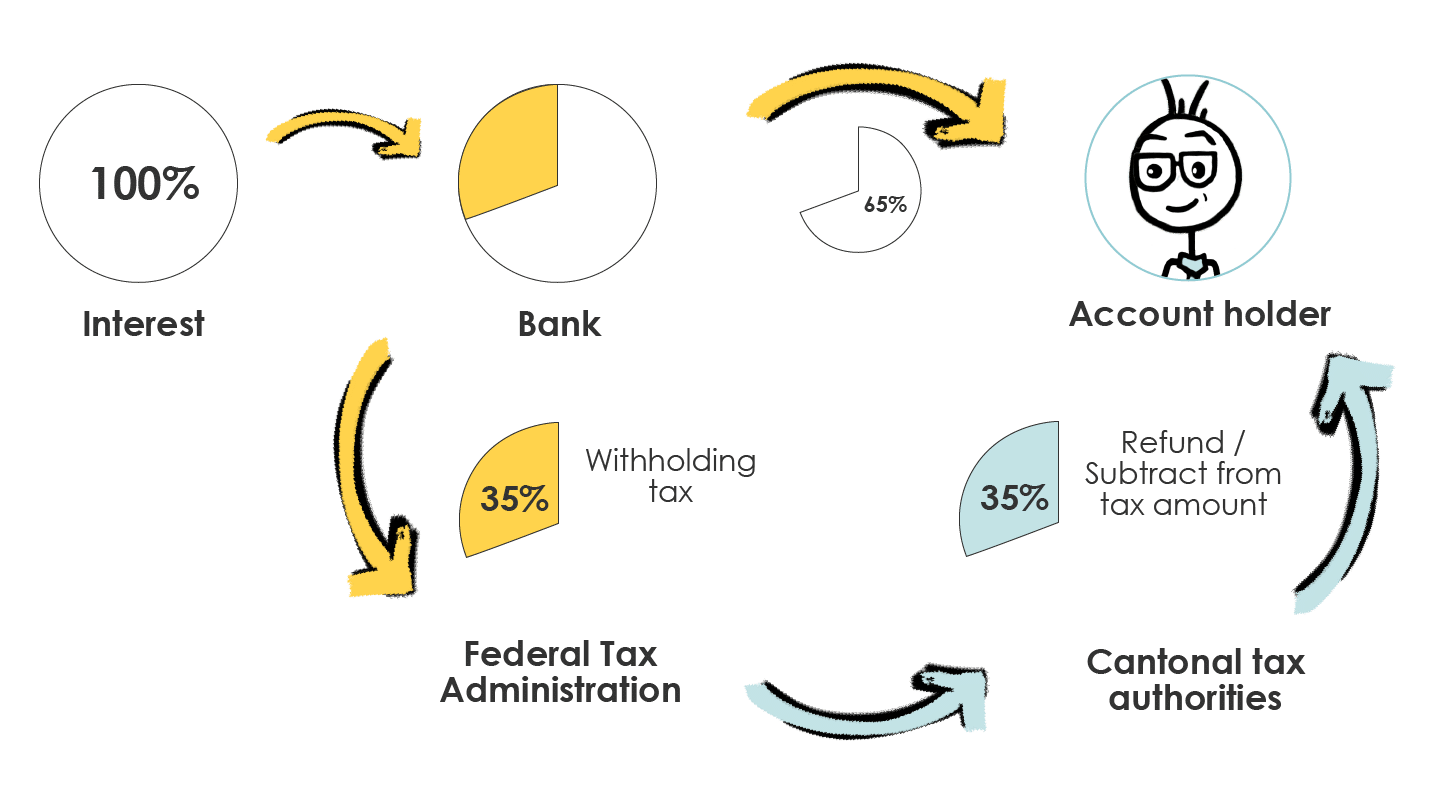

Withholding tax — A levy on Swiss-source income

This first category concerns your investments in Switzerland. Whether you are a shareholder in your own SME (and pay yourself a dividend in addition to your salary) or you hold Nestlé shares, the mechanism is the same: you initially receive only 65% of the dividend. The remaining 35% is withheld for the benefit of the tax authorities until you file your tax return. This 35% constitutes the withholding tax (WT).

Good news: in Switzerland, banks and brokers make this information clearly available in the tax statement. You will find in particular:

- Assets subject to withholding tax: the value of your Swiss-source assets that may be subject to the 35% withholding in the event of a distribution.

- Gross income subject to withholding tax: the total amount of Swiss income (100%, before withholding).

- Withholding tax: the amount withheld (35%) on this income.

These are the three pieces of information you must enter in your tax return in order to recover the withholding tax (by refund or offset).

Tax deducted at source — A levy on foreign-source income

This mechanism is similar to the one implemented in Switzerland, but it concerns foreign brokers and foreign investments: the 35% Swiss withholding tax no longer applies; instead, the rate of the country concerned is applied. That said, countries have entered into double taxation treaties to determine which country has the right to tax this income. In principle, and depending on the applicable treaty, all or part of this tax can be claimed as a tax credit in Switzerland.

To be frank, it sounds simple, but in practice it is often complex, and depending on the country, some form of double taxation may persist, despite the existence of these treaties.

My recommendation: all else being equal, product, fees and performance, opt for a Swiss broker that provides practical, reliable and tax-relevant tools, in order to avoid these complexities and the risk of paying “too much” tax.

How to declare your investment funds and ETFs in your tax return?

Nothing could be simpler, well, in some cases it’s fairly simple. Swiss financial institutions that are up to date technologically can provide you with a statement that includes a barcode on the first page. This barcode can be directly uploaded and scanned by tax software such as GETax, VaudTax or VSTax. With a single click, all values are automatically imported, without you having to manually enter anything.

For those who invest their money with a friend-of-a-friend-neighbour broker who does not provide a barcode statement… well, good luck. These documents are often very, very long, and you will need to be able to track down all the figures described above yourself. It’s tedious, but absolutely crucial, because in most cases, if everything is done correctly, you may be able to recover part of the tax already paid and therefore increase your net return.

After these few lines, I hope you’ll be able to approach the world of investment funds and ETFs with a bit more peace of mind.

How FBKConseils can support you with your investments and the related taxation?

A first introductory meeting

At FBKConseils, we offer all our clients and readers a first free introductory meeting of around 20 minutes. The goal is to answer your remaining questions and, if needed, to clearly explain how our firm can support you with your projects (investments, tax matters, and wealth planning).

Full delegation of your tax return

Like any fiduciary firm, we take care of your entire tax return process: collecting your documents, preparing the return, exchanging with you for validation, and then submitting it to the tax authorities.

To do this, we have developed an internal tool that allows us to:

- prepare a precise quote based on the elements to be declared,

- generate a tailor-made list of required documents,

- and upload your documents securely online.

Training to complete your tax return yourself

If your priority is to learn rather than delegate, we also offer a consulting/training session to guide you step by step through your tax return. We take the necessary time, either in person at our offices or by video conference, so that you become autonomous while fully respecting the specificities of the Swiss tax system.