Written by Yanis Kharchafi

Written by Yanis KharchafiTaxes in Switzerland – How your canton of residence affects your tax burden?

Introduction

Let’s be honest: if you’ve been living in Switzerland for a while, someone has probably whispered this in your ear –

“That canton is a tax nightmare… I’m seriously thinking about moving. I heard taxes are way lower in Valais!”

Am I wrong?

Since I started writing about Swiss taxation, I’ve often asked myself the same questions: Are they right? Are there really significant tax differences between cantons? And if so, why?

Can you really deduct more in Valais than in Geneva? Are some cantons more lenient when it comes to tax rates? Are there even types of income that are exempt here… but not there?

In short, you guessed it: today, we’re breaking it all down.

The line-up:

And as always: If your situation is unique or you can’t find all the answers in our articles or on our YouTube channel, feel free to book a first appointment with no introductory fee.

Taxes in Switzerland – The 3 Laws that govern taxation across all cantons

Before we dive into cantonal comparisons, let’s get one thing straight.

Even though you’ll soon discover that Swiss taxation is relatively easy to grasp, I have to admit something:

At first, I also thought each canton could basically make its own rules when it comes to taxes — that everything might be completely different between Geneva, Vaud, or Valais.

Well… that’s not true.

In reality, three main tax laws form the foundation of the Swiss tax system, and they apply to every single canton. These laws create a shared legal framework, and from there, each canton has some flexibility — but within clearly defined limits.

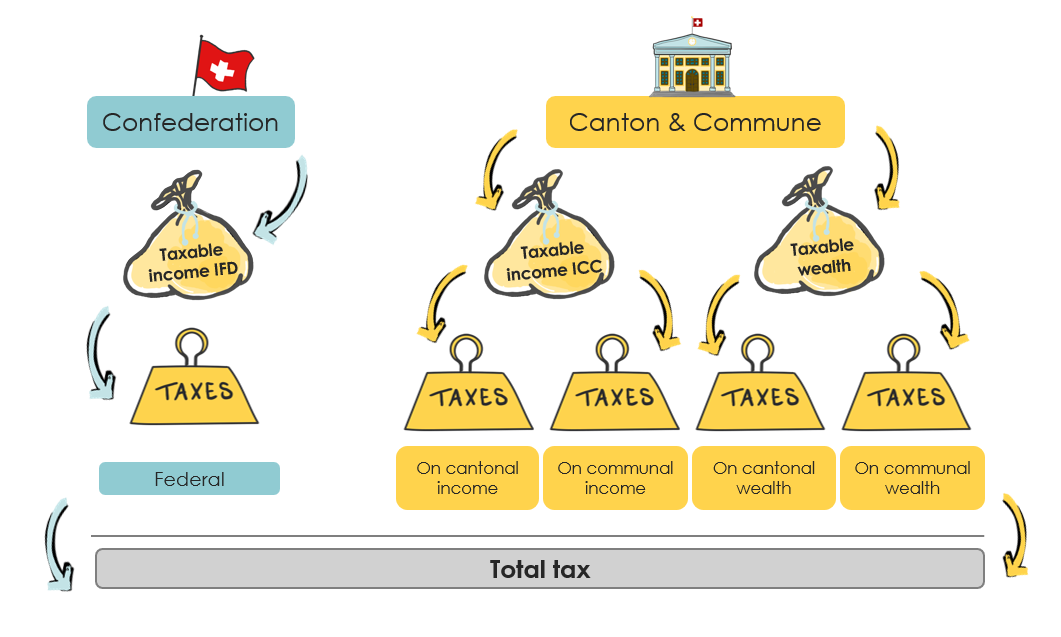

The illustration below will give you a general overview of what your tax structure looks like, no matter which canton you live in.

Important: The rules we’ll cover here apply only to Swiss tax residents. If you hold a permit B (which makes you a Swiss tax resident) or are a cross-border commuter, different rules apply — and we’ve covered those in separate articles.

In Switzerland, calculating your total tax burden means adding up several components:

- Cantonal taxes on income and wealth

- Communal taxes on income and wealth

- And finally, federal taxes, which apply to income only

This combination determines what you’ll actually pay at the end of the year.

But how did we end up with this three-level system?

Let’s take a look at the legal foundations behind it.

Federal Act on Direct Federal Taxation (DFTA)

The first layer of our tax system: the DFTA, or Federal Act on Direct Federal Taxation.

This law, established by the Confederation, defines what income is taxable and which deductions are allowed — no matter which canton you live in.

In short: the basic rules are the same for everyone.

The DFTA doesn’t create any tax differences between cantons. It simply sets the general framework — what the federal government can tax, and on what basis.

The Federal Act on the Harmonization of Direct Taxes (FADHDT)

Now we come to the second level of the system: the FADHDT, or Federal Act on the Harmonization of Direct Taxes. This law plays a key role: it tells the cantons what they must do, what they’re allowed to do, and where the limits are. In other words, it gives cantons some flexibility — but within a clearly defined framework.

A concrete example:

The DFTA does not impose a tax on personal wealth, but Article 2 of the FADHDT requires cantons to levy a wealth tax on individuals.

This means:

- All cantons must tax personal wealth — no exceptions

- But they are free to set their own thresholds, tax brackets, and rates

So, this is the law that explains many of the tax differences between cantons.

The Final Layer – Cantonal Tax Laws

At the top of the system, we find the cantonal tax laws.

Each canton, based on the DFTA and within the limits set by the FADHDT, writes its own tax legislation. These laws are updated regularly and define the tax rates, calculation methods, brackets, specific deductions, and local allowances.

The result? There are as many tax laws as there are cantons in Switzerland.

At FBKConseils, we focus primarily on the following cantons:

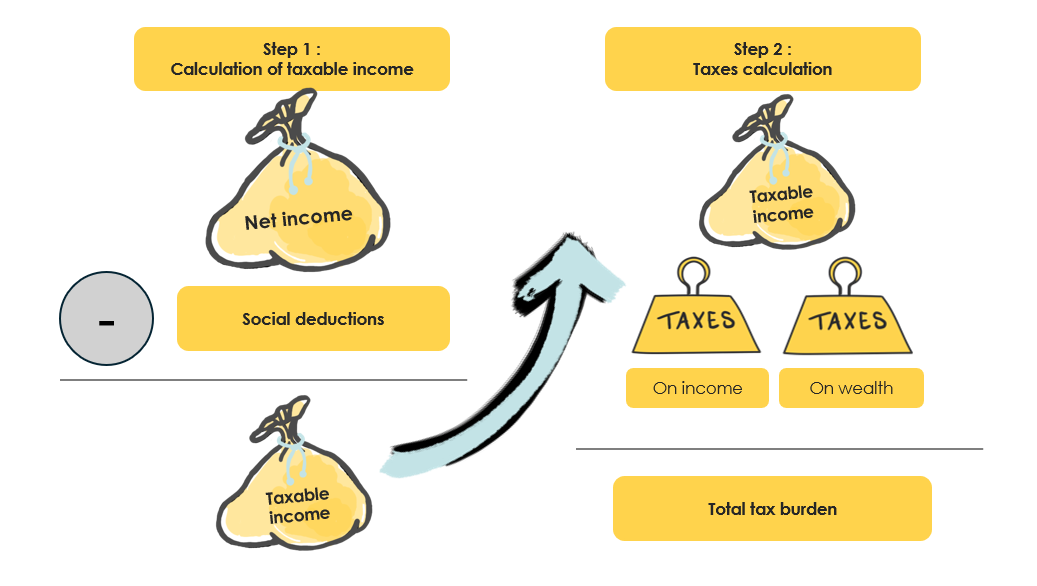

Taxes in Switzerland – A Story of 3 Laws… and 2 Key Steps

Now that we’ve reviewed the legal foundations of the Swiss tax system, let’s take a brief but essential detour to better understand what comes next.

In Switzerland, your taxes are calculated in two clearly defined steps — and each of these steps can lead to significant differences between cantons.

Why? Because:

- Some cantons offer generous tax deductions, but make up for it with higher tax brackets

- Others, on the contrary, limit deductions… but provide lower tax rates

At this point, you might be wondering:

Does the canton of Valais combine both attractive deductions and lower tax rates?

Is that what’s convincing so many taxpayers to consider moving?

Wait and see. We’ll explain everything in the next sections.

Step 1 – Calculating your taxable income

In a previous article, we covered how taxable income is calculated in Switzerland — but only in broad terms.

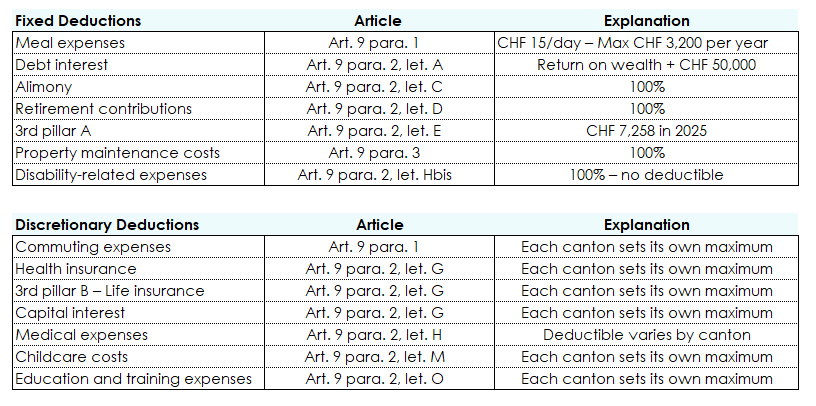

Today, let’s go deeper. The goal: understand which deductions are standardized nationwide, which can be modified or removed by cantons, and which are fully discretionary depending on the canton.

Why is this important?

Because these variations in tax deductions explain a large part of the differences in your final tax burden — whether you live in Geneva, Vaud, Valais, or even Fribourg.

And since I’ve always preferred visuals over long explanations, I’ve prepared a (hopefully clear and concise) infographic that summarizes the different categories of deductions and how flexible each is at the cantonal level:

What we can already take away from the previous analysis is that among the most commonly used deductions by Swiss taxpayers, there is an almost equal split between:

• Those that are fixed and uniform across Switzerland

• And those that cantons can adjust, increase, or limit at their discretion

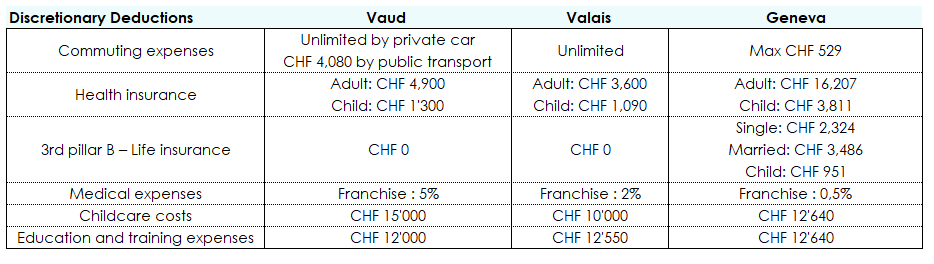

But the real question now is: Are these cantonal variations in deductions truly significant? Can they alone cause noticeable differences in your taxable income? In other words, when filling out your tax return, can your canton of residence really make a difference?

Spoiler alert: In some cases, yes. And here is what these differences look like in numbers.

This is where things start to get interesting. Depending on your personal situation, the canton you live in can have a real and measurable impact on your taxes.

Let’s take a concrete example: In the cantons of Vaud and Valais, commuting expenses are deductible with virtually no cap. The result? For some of our clients, this means several thousand francs in deductions every year.

Which raises a real question: Is it worth leaving Les Eaux-Vives to move to Lutry? Does the tax savings truly offset the lifestyle change?

The answer depends on your profile, your income, your commute… and your canton’s rules.

At this stage, you now have:

• A solid understanding of the legal foundations of the Swiss tax system

• The logic behind calculating taxable income

• And a clear idea of how much flexibility cantons have to favor (or penalize) certain taxpayers through deductions

To go further, here are our in-depth articles on cantonal deductions:

• Key deductions in the canton of Vaud

• Key deductions in the canton of Geneva

• Key deductions in the canton of Valais

Now that your taxable income has been calculated, it’s time to move on to the second step of your tax return: determining your actual tax burden.

And this is where cantonal tax scales and municipal coefficients come into play.

Step 2 – Calculating Cantonal Taxes

Now that you understand how taxable income is calculated, let’s move on to the second step in the Swiss tax process: the tax rates and brackets applied to that income.

And since I now consider you almost tax experts, I encourage you to take a look at the Federal Act on the Harmonization of Direct Taxes (LHID) — more specifically, Article 1, paragraph 3, titled “Purpose and scope”.

What does paragraph 3 tell us?

The cantons remain fully responsible for setting their tax brackets, tax rates, and exemption thresholds.

In other words:

Each canton is completely free to define its tax rates, income brackets, exemption amounts, and even the calculation method. And this is where the real differences begin.

As you may have already seen in our articles on tax calculations in French-speaking Switzerland, the differences between cantons are significant.

Comparing tax scales? Mission impossible. There is no uniformity — neither in the rates nor in the structure.

But what we can do is take the same taxable income and see how it translates into actual taxes across major cities in each canton.

And that’s exactly what we’ve done in the examples below, based on 2025 data.

Important note: In Switzerland, your municipality of residence also plays a key role in determining your total tax burden.

In our simulations, we’ve selected the three main municipalities of each canton (e.g., Lausanne, Geneva, Sion) to provide a representative comparison.

However, keep in mind:

If you live in a smaller town or village, the tax rates can differ significantly — sometimes more favorable… but sometimes much less so.

This can lead to differences of up to 4–5% in total tax burden within the same canton.

Swiss Tax Calculations – What can we conclude?

In our comparison of the three main French-speaking cantons (Vaud, Geneva, and Valais), one thing quickly stands out:

The canton of Vaud comes out as the least favorable in almost every scenario, whether you’re single or married — as long as the taxable income is the same.

Between Geneva and Valais, it’s a closer match. Each canton has its own strengths and weaknesses depending on the taxpayer’s situation.

So, does that mean Vaud is always the worst choice for your taxes? Not so fast…

It’s true that Vaud’s tax brackets are higher — and that’s immediately noticeable.

But Vaud also offers some interesting tax advantages, including:

- The family quotient system, inspired by the French model, adjusts your tax burden based on household size.

Each dependent child adds a “share” that reduces your overall tax rate.

In our examples, we didn’t include any children. But with two or three children, Vaud’s results could have been much more favorable. - Unique social deductions in Vaud, such as:

- A deduction for housing expenses

- A deduction for low-income taxpayers, available to those with modest earnings

In short: Vaud’s tax system may penalize certain profiles, but it can be very advantageous for others.

Key takeaways:

- Some deductions are fixed and the same across Switzerland

- Others vary entirely by canton

- Tax rates and calculations differ greatly between cantons

- And your municipality can add another layer of complexity

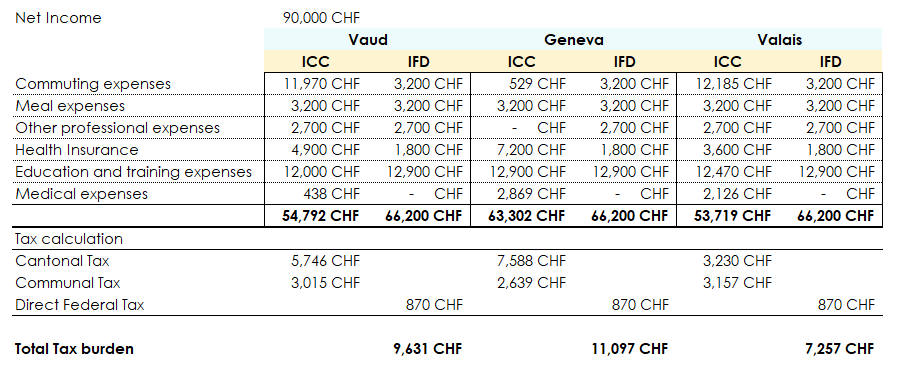

To wrap up this chapter, let’s take a practical example — my own tax situation.

We’ll create three identical tax returns: one for Geneva, one for Vaud, and one for Valais.

This will help us:

- Follow the transition from taxable income calculation (step 1)

- To the final tax burden (step 2)

A simple, clear, and — most importantly — highly revealing demonstration.

Tax comparison example – Living in Vaud, Valais, or Geneva

To illustrate everything we’ve covered so far, let’s take a very concrete example.

Imagine I’m your client. You’re my fiduciary advisor, and I come to you with a simple question:

“I have a job opportunity in Switzerland. I can choose between three cantons: Vaud, Valais, or Geneva. Where will I pay the least tax?”

Here’s my profile:

- Name: Noé LeConseiller

- Net annual salary: CHF 90,000

- Annual rent: CHF 18,000

- Commute distance: 40 km one-way

- Health insurance (basic + supplementary): CHF 7,200/year

- Training costs (fiduciary expert course): CHF 25,000

- Unreimbursed medical expenses: CHF 3,200

Goal of this comparison:

With this data, we’ll simulate three simplified tax returns, one for each canton, in order to analyze:

- The taxable income after deductions

- The total tax burden (including cantonal, communal, and federal taxes)

- The concrete differences between the three situations

The Bottom Line – Which Canton makes you pay the least tax?

Unsurprisingly, the canton of Valais comes out on top in our comparison. In our simulation, Noé LeConseiller pays nearly CHF 4,000 less in taxes if he lives in Valais rather than Geneva.

A significant difference—for the exact same situation!

Vaud takes second place, thanks in part to its generous deduction for commuting costs, which can make a real impact for long-distance commuters.

Geneva, despite its appeal, ranks last in terms of personal taxation. In this specific case, higher tax rates and stricter deduction rules ultimately make the difference.

Wealth Tax in Switzerland – Key Cantonal Differences

It is impossible to write a complete article about taxes in Switzerland without mentioning wealth tax. And believe me, if it had been forgotten, I wouldn’t have been forgiven… Although in the vast majority of cases, income tax represents the heaviest part of the household tax burden, it should be known that a specific tax on net assets indeed exists—at the cantonal and municipal levels.

The federal law (LIFD) does not provide for this type of taxation, but the law on the harmonization of direct taxes (LHID) requires cantons to set up their own scale and calculation method. Each canton therefore has the freedom to set its rates and brackets, which once again leads to sometimes significant differences across Switzerland.

The calculation of taxable wealth is quite homogeneous: it simply involves adding up all your assets (bank accounts, real estate, investments, etc.) and subtracting all your debts. The result is your net taxable wealth, to which a rate will be applied. Some cantons offer flat-rate deductions based on household composition (in 2024 Geneva: single CHF 86,833 / married CHF 173,666; Valais: single CHF 30,000 / married CHF 60,000) while the canton of Vaud exempts the first CHF 58,000 for singles and the first CHF 116,000 for married couples—the tax is only calculated once these thresholds are exceeded.

In French-speaking Switzerland, wealth tax rates vary on average between 0% and 0.8%. For equal wealth, this can represent several hundred or even thousands of francs per year difference depending on your canton. In German-speaking Switzerland, these rates can drop significantly, making some cantons much more attractive for taxpayers with significant assets.

Let’s be honest: in most situations, wealth tax remains marginal compared to income tax. It often has more of a control function, allowing the tax administration to monitor what are called “wealth variations” from one year to another. But beyond a certain wealth threshold, its impact becomes very real—and it deserves to be fully taken into account in any tax simulation, whether considering relocation, investment, or estate planning.

What conclusions can we draw from the differences in taxes between Swiss cantons?

After these 2,000 words of comparisons, examples, and explanations, one could easily conclude that Valais is the promised land of Swiss taxation. And that’s not wrong: living in Valais often means enjoying a significantly more comfortable disposable income, with equal earnings.

But beware: this is not a universal rule.

In many cases, it’s the canton of Geneva that wins, hands down—especially for married families with children. Why? Because Geneva offers very advantageous deductions on:

• Childcare expenses

• And even health insurance premiums

Two expense items rarely as well treated in other cantons.

What you really need to remember: The best canton tax-wise is the one that matches your personal situation.

• The same profile, whether single or a parent of three children, can lead to radically different results depending on the canton.

• Your municipality of residence also plays an important role in the final calculation.

• And of course, some cantons offer very targeted deductions that won’t benefit everyone.

Our only real advice? Don’t assume anything. Don’t start with preconceived ideas. Take the time to simulate, compare, understand. Do the calculations. Because in Switzerland as elsewhere, tax is not a fatality.

It’s a complex matter, yes — but accessible. And well mastered, it can become a real optimization lever.

How FBKConseils can help you concretely?

At FBKConseils, we know that taxation is not just a matter of numbers: it is often about life projects, personal decisions, and unique contexts.

That’s why, beyond our articles, videos, and tools, we offer a human, personalized, and jargon-free support. Here’s how we can assist you:

A free, no-obligation introductory meeting

Even though we provide plenty of online content, it can’t cover every situation.

And yours probably deserves a tailored approach.

That’s why we offer every interested person a free 20-minute introductory meeting, via video call or phone.

Meeting objectives:

- Answer your initial questions

- Understand your situation

- And if needed, explain how we could support you in your financial or tax projects

Simulate your taxes based on your canton or moving project

Like Noé in our example, you might have:

- A job offer in another canton

- The desire to leave the city for a region with better tax advantages

- Or simply the curiosity to better understand the tax impact of changing your residence

At FBKConseils, we help you simulate your tax burden in different cantons and municipalities so you can make an informed decision.

Your tax return — with or without you

Short on time to complete your tax return?

Or on the contrary, eager to learn how to do it perfectly, without missing a thing?

Either way, we have the solution.

FBKConseils offers you tailored support:

- Turnkey service for those who want to delegate

- Educational support for those who want to learn to do it themselves

Whether you’re an employee, self-employed, cross-border worker, or in career transition, our goal remains the same:

Help you optimize your tax situation with ease.