Written by Yanis Kharchafi

Written by Yanis KharchafiTaxes on investments: How are your shares and their dividends ?

Introduction

As part of a series of articles on investing and tax, this one looks at the tax treatment of equities.

As with the other articles in this series, we will break this study down into several parts:

- What kind of returns can I earn and how are they taxed?

- How does tax on shares work in practice?

- Can I expect tax deductions on this investment?

- How can I report this investment on my tax return?

Let’s go!

The line-up:

Act 1: Dividends, those little tips that also please the tax authorities.

Fiery young business start-ups rarely pay out dividends. Instead, it’s the entrenched giants, the pachyderms of finance, who generously hand out these little treats based on their annual results. Let’s take an example of a deal you might find: for every share of my company you buy, I promise to give you CHF 1. So you know that if you buy 100 shares, you have a good chance of generating an income of CHF 100. That’s rather reassuring and pleasant, but unfortunately in Switzerland, the tax authorities will ask you to enter every penny received on your tax return, and tax it along with all your other income. If you had a taxable salary of CHF 60,000 before this investment, you would have to declare CHF 60,100. What would that mean? Your taxable income increases and so does your tax rate. It’s a nice trick, isn’t it? And yet you don’t know everything… There’s even a good chance that withholding tax will be levied to prevent the most careless from not declaring these dividends: more info in the rest of this article.

The qualified participation relief

I hesitated to address this specific feature of the Swiss tax system, as it is not easy to explain in just a few lines and mainly concerns entrepreneurs who hold a significant stake in their company.

The term participation simply refers to owning shares (equity) in a company. A participation is considered “qualified” when your ownership percentage is significant: to qualify, you must hold at least 10% of the share capital (or participation rights).

Once this threshold is reached, you benefit from a 30% reduction on the taxable amount of dividends, in order to avoid economic double taxation (profits taxed at the company level + dividends taxed at the shareholder level). In other words, if the company distributes CHF 1,000 in dividends, you only declare CHF 700 as taxable income.

If this topic interests you, I recommend our article dedicated to entrepreneurs on the difference between salary and dividends. It really helps to clarify the possible trade-offs.

Act 2: Capital gains, legal tax evasion.

Where dividends look like a regular tip, capital gains are that (more or less) unexpected surprise, like discovering a CHF 50 note in an old jacket. Start-ups often start small, with few customers and even fewer profits. But with time and the right decisions, some of these tiny companies can take off and, by extension, boost the value of their shares.

The good news is that if your share price soars, Swiss tax won’t eat any of your gain – at least not on income. From CHF 5,000 to CHF 5,000,000, it’s all net to you. For the purists reading this, we are talking here only about income tax and not wealth tax, because you will still have to carry forward the value of your shares on 31.12 in order to establish your taxable wealth.

It is also worth pointing out that, for the sake of clarity, we have simplified this type of investment by reducing it to one of two outcomes: dividends or capital gains. In reality, however, a share’s valuation always evolves over time, whether upward or downward (at least for publicly listed companies).

By contrast, a share may very well not pay any dividends, and this is actually quite common.

In conclusion, when you buy a share on the financial markets, you will always be exposed to price movements (capital gains or losses) and potentially to dividends, but dividends are never guaranteed.

How does the taxation of shares work in practice, and more specifically the taxation of dividends from Swiss sources?

Step 1: Withholding tax

When we talked about dividends a few lines back, we raised an innocent but rather important question: why declare my dividends if they will ultimately be taxed as an income?

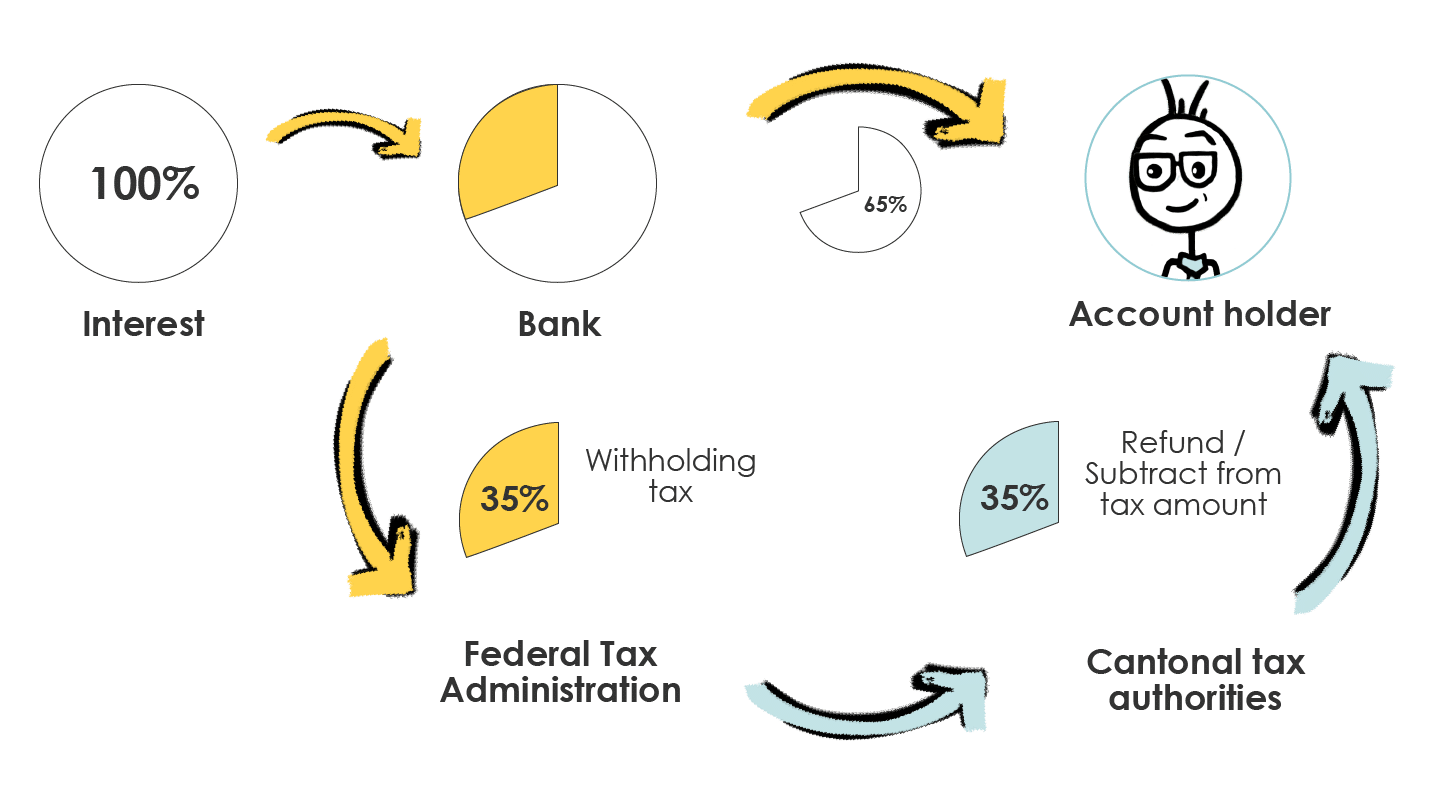

Be aware that Swiss dividends, and not only Swiss ones, are not always paid to you in full. The tax authorities have required banks and financial institutions to withhold a tax at source, both to spare you a dilemma and to encourage you to declare what must be declared. Once they are sure that you have complied with your tax obligations, the tax deducted will be refunded to you. Graphically, this would look like this:

And to ensure that this mechanism makes you lose the urge not to declare them for good, the rate applicable to income from movable property (e.g. dividends) is 35%.

Step 2: Reclaiming withholding tax

Now that you have paid 35% to the tax authorities and declared your dividends correctly, you will be entitled to claim a refund of the full amount of withholding tax.

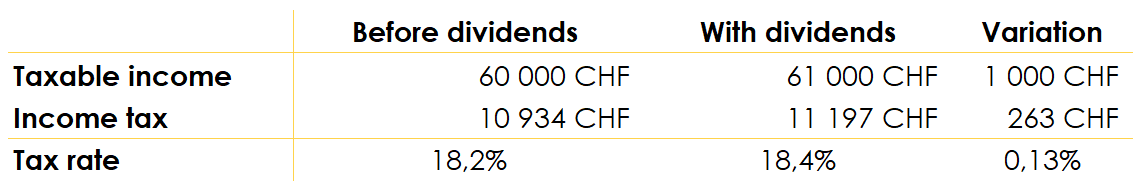

For example, if my taxable salary is CHF 60,000 and my FBKConseils shares generate a gross dividend of CHF 1,000, I will first receive CHF 650 in my account. I will have to declare this CHF 1,000 on my next tax return, which will increase my income from CHF 60,000 to CHF 61,000 and my taxes from CHF 10,934 to CHF 11,197. Finally, they will refund the CHF 350 in withholding tax. I will therefore have paid taxes of CHF 263.20 on the CHF 1,000 dividend.

Touto bene? So let’s get on with the deductions… And unfortunately, this chapter won’t be very long…

What tax deductions apply to equity (stock) investments?

A long time ago, when I was still a young tax padawan, I unfortunately wrote a few things that were… let’s say, not entirely accurate about deductions related to investments. Today, the 2026 version of myself sets the record straight and gives you the full truth on the subject.

So let’s go through this calmly: if you buy shares and those purchases generate costs, remember this clearly, there is no deduction you can claim.

The logic is straightforward: the tax authorities have chosen not to tax capital gains, and in return, they do not allow deductions for losses or related expenses.

In other words, a private investor cannot have the best of both worlds: no tax on gains, but no deductions for losses either.

As always, our goal is to refine and deepen the analysis year after year. To nuance what has just been said: if you buy a share that loses 30% of its value, no, you cannot deduct that capital loss from your income.

However, some cantons, such as Geneva, may allow all or part of wealth management fees: if you mandate a professional to manage and grow your assets, these costs may be considered expenses incurred to generate income and therefore be partially deductible.

But be careful: this practice is purely cantonal, and each of the 26 Swiss cantons sets its own rules.

What is a professional investor?

In Switzerland, there is a tax concept that is both rare and feared: the professional investor.

In theory, this refers to taxpayers who, based on several criteria, behave more like economic actors than simple private savers.

Typical indicators include:

- Very frequent buying and selling of financial securities;

- Gains realized represent a significant portion of your annual income;

- Very short holding periods for your securities;

- Use of leverage (debt, margin accounts) to amplify gains (and losses);

- Etc.

Let’s be clear: this list is not exhaustive, no single criterion is decisive, and no minimum threshold is formally defined.

This concept comes up often in discussions, but in practice it simply refers to a person who devotes a significant amount of time, money, and energy to creating value through investment activity.

And this applies whether the assets involved are stocks, watches, wine, or any other asset with potential capital appreciation.

Tax consequences of professional investor status

This is where everything changes.

Article 16 of the Federal Direct Tax Act (FDTA/LIFD), which exempts capital gains realized on assets held as private wealth, no longer applies.

Your investments are now considered part of a business (commercial) estate, and capital gains become taxable as ordinary income.

In return, however, this self-employed status allows you to deduct all expenses related to your activity through proper bookkeeping:

- Capital losses: if your securities lose value, the loss reduces your taxable income;

- Equipment purchases: computers, software, trading tools—your entire setup becomes deductible;

- Financial and management costs: acquisition fees, currency exchange fees, administrative costs, platform fees, etc.

In short, if this topic concerns you because you feel you “tick several boxes” among the criteria mentioned above—this is particularly the case for some of our clients who had the good idea to invest part of their savings in cryptocurrencies—there is no need to panic.

Even though this status does exist, it is very rarely applied by tax authorities.

Why? Because once a taxpayer is classified under this status, it becomes permanent. And while taxation may be heavy in a profitable year, the taxpayer would then be able to deduct a large amount of expenses in subsequent years.

Statistically, there are more traders who lose money than traders who make profits, which would ultimately lead to greater tax losses for the state over time.

As a result, this is a status that tax authorities generally prefer not to grant.

In summary: professional investor status is rare for financial investments, but it is much more common in the field of real estate investment taxation, where the distinction between private asset management and commercial activity is far stricter.

How do I report my shares in my tax return?

As with most investments and assets in general, only 3 points are essential for your tax return.

Wealth: What was the value of your shares at 31.12?

Although an increase in their value is not taxed as income, if the price of your shares rises from CHF 5,000 to CHF 5,000,000, you will still have to report this latter amount as part of your taxable wealth, which is subject to wealth tax.

Income: What income has been generated by your shares?

In addition to the value of your shares, you must also declare, in Swiss francs, the gross amount of dividends paid to you during the year. It is this income that will be taken into account and taxed:

- For investors holding at least 10% of a company’s shares, only 70% of the gross dividend income must be declared.

- For “standard” investors, you must declare 100% of the gross dividends received between 01.01 and 31.12.

Withholding tax and tax at source: Do not forget to declare taxes already paid

In order to obtain a refund of taxes withheld at source, you must file a request:

- Either directly in the “withholding tax / anticipatory tax” section for Swiss-source income;

- Or via the DA-1 / RUS forms for taxes paid in foreign countries.

How FBKConseils can support you with the taxation of your investments?

Introductory meeting

At our firm, we offer everyone the opportunity to book a first 20-minute introductory meeting free of charge. This meeting allows us to answer any remaining questions after reading our articles and, if needed, to explain how we can support you with all your tax and financial projects.

Tax simulations

At FBKConseils, we carry out tax and budget simulations for each concrete project, supported by key data, in order to highlight the advantages and disadvantages of each available option.

These simulations can be conducted in person, together with us, or in a more traditional way: once completed, we provide you with the full document so you can review it calmly at your own pace.

Coaching to help you complete your tax return

One of the key features of our fiduciary firm is that we offer personalized training sessions. The goal is to help you better understand the Swiss tax system, master the process of completing your tax return, and enable you to gain autonomy for the years to come.

Full management of your tax return

As an alternative to coaching, FBKConseils can also operate like a traditional fiduciary firm:

- you send us your documents,

- we process them,

- we send you successive drafts for review,

- and once the final version is approved, we submit it to the tax authorities on your behalf.