Written by Yanis Kharchafi

Written by Yanis Kharchafi17 tax deductions to claim in the canton of Valais for 2025

Introduction :

You have barely had time to digest the Christmas turkey, your ears are still ringing from New Year’s Eve, and the first days back to work are still weighing on you, yet here we are already. The tax return is making its grand entrance.

And, as usual, there are no more than two options:

- Entrust your tax return to people of a different species, who apparently have nothing better to do with their lives. These guys are so passionate they even have created a dedicated App to ease your life when it comes to tax returns.

- Alternatively, you can download VSTax and refer to this article outlining the main deductions allowed in the canton of Valais.

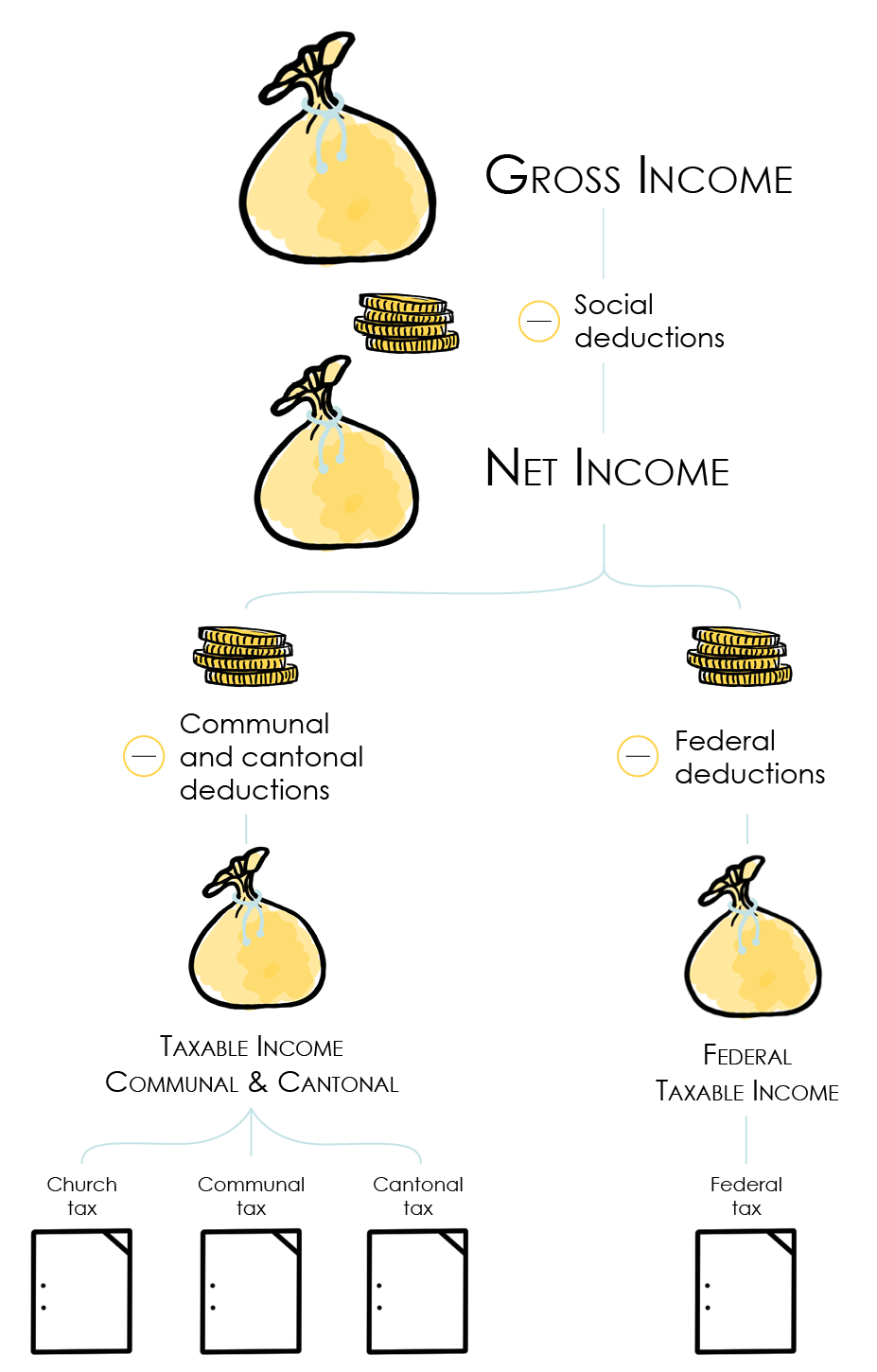

And if you happen to be of our fellows who, beyond wanting to perform your tax return by yourself, appreciate understanding the mechanisms of calculating communal, cantonal (ICC) and federal (IFD) taxes, these articles are made for you.

Second-to-last important clarification, this article details the main deductions at the level of the canton and the commune – but is not focused on the Confederation’s level. Despite an apparent standardization of the deductions, considerable variations may exist. If that’s what you are looking for, we invite you to take a look at the main deductions of the direct federal tax.

The line-up:

Deduction 1: Professional expenses – Transportation

Although for the past few years we have experienced the advent of remote working coupled with a rising ecological awareness, some workers are still required to commute to work. The Valaisan tax administration, unlike the Swiss Confederation, is quite flexible when it comes to deducting transportation expenses. It provides taxpayers with 3 fairly generous solutions:

The “cycle bike”, that the rest of the universe has chosen to call, more simply, the bike

Regardless of whether it is electrical, has two or three wheels, or even has a small internal combustion engine, it makes no difference. Your deduction will be 700 CHF (which probably does not cover your investment).

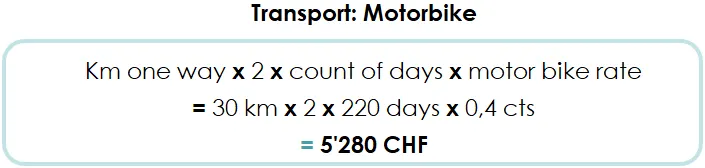

Motorcycles also called motorbikes or scooters

You did not feel like pedaling, so you bought a small Tmax to avoid the morning traffic jams? This solution will allow you to deduct 0.40 CHF per km ridden over the year.

For this calculation, you must consider a maximum of 220 working days per year and know the distance of your daily round trip. If you work 30 km from your home and you work the entire year, meaning 220 days, your deduction will amount to CHF 5,280.

A note here, and this will also apply later: there is no need to count the exact number of days worked, the holidays, the long weekends, and so on. This is tedious and not really necessary. Let’s look at a few examples:

- If your employment rate is 100 percent, then count 220 days.

- If, despite a 100 percent employment rate, you work from home an average of two days per week, which represents 40 percent of your time, simply indicate 220 × 0.6 = 132 days.

- If your employment rate is 80 percent, simply calculate 0.8 × 220 = 176 days.

- You worked at 100 percent for only four months of the year, then… nothing? In that case, take 220 × 4/12 = 55 days.

Are you still with me?

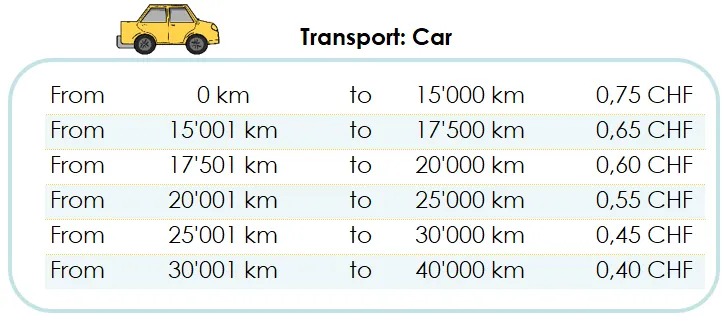

The car, the vehicle, the ride, the wheels

This penultimate category of transport, authorized by the Valais tax authority, entitles you – provided you have no other transportation means at your disposal – to deduct as for motorcycles an annual amount that depends on the distance you need to travel in order to work on-site:

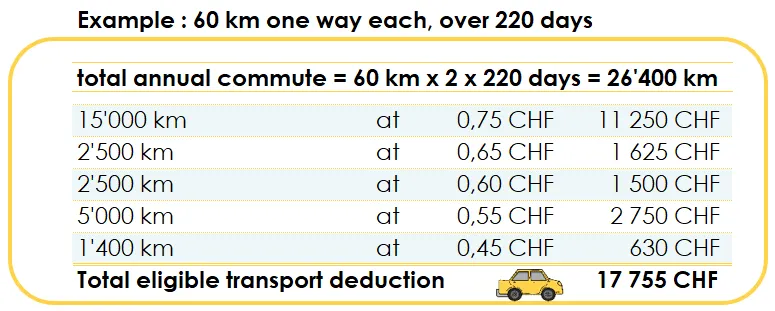

To clear up any remaining doubts, let’s take another example in which I work 220 days per year, meaning a 100 percent employment rate in 2025, with a daily one-way commute of 60 km.

Deduction 2: Professional expenses – Meals

For the vast majority of us, the deduction for public transport is the one that will be accepted. And in this case, nothing could be simpler, provided you kept the receipts. The deduction is simply the annual amount you paid to travel to your workplace.

Important: all the figures shown above apply only to Valais, the cantonal and communal tax (ICC). They do not apply to the federal tax (IFD), which limits the transport expense deduction to CHF 3,300 per year.

Professional expenses – Meals away from home

Simple. In Valais, as elsewhere, each lunch can be deducted up to CHF 15 per day, with a maximum of CHF 3,200 per year. There are two exceptions to this rule.

Meal expenses with partial employer contribution

If your employer contributes in any way to lowering the cost of your lunch or your evening meal, if you work nights, the deduction is reduced by half, meaning CHF 7.50. What do we mean by contributions? A workplace canteen with favourable prices or financial support for meals. Such a contribution is indicated on your salary certificate by a tick in box “G”.

Meal expenses with a significant employer contribution

If your employer provides substantial support to cover your meals at a very low cost, then that’s the end of the story, no deduction will be accepted.

Deduction 3: Accommodation away from home

For simplicity’s sake, have you opted for the solution of settling away during the week in order to escape the 3 hours of traffic jam implied by a daily Sion-Geneva commuting? You have rented a small studio in front of your office? In this case, you are entitled to claim :

- CHF 15 extra for the evening meal, up to a maximum of CHF 3,200 per year

- The cost of renting your accommodation, up to a maximum of CHF 700 per month or CHF 8,400 per year

Deduction 4: Other professional expenses

It is also a common deduction that allows, in the Valais as elsewhere, to claim all the expenses you may have incurred in order to carry out the work that was entrusted to you. By expenses, we mean computer software (word, exel), work clothes, tools, books etc.

You can claim this deduction in two distinct ways, provided your employer does not compensate you with a lump-sum allowance to cover these costs. And to confirm this, once again, it is your salary certificate, specifically figure 13.2, that will serve as proof.

Flat-rate business expenses

If you know that you did not keep all the receipts or that you did not have major expenses to cover the annual costs of working, then this is the right solution for you. No questions asked, you will be able to deduct 3% of your net income as long as this amount remains between CHF 2’000 and CHF 4’000. In other words:

– Net income below CHF 66’666, then the deduction will be CHF 2’000

– Net income exceeding CHF 133’333, then the deduction will be CHF 4’000

– Net income between CHF 66’666 and CHF 133’333, then you will be entitled to 3% of your net income

Easy, isn’t it?

Actual business expenses

This deduction is more technical to claim and is aimed at organised taxpayers, the ones who are able to keep track of their professional expenses throughout the year.

If you spent more than the lump-sum allowance described above and you kept the receipts, choose this method.

Important: all supporting documents must be attached to the tax return.

A case that was still rare a few years ago but has become increasingly common: deducting a share of your rent. Not everyone can benefit from it, but some employees can. This deduction falls under other professional expenses for people who do not have a fixed office provided by their employer. Since COVID, many companies have reduced their office space and have effectively required employees to create a workspace at home. For these employees, the portion of the rent corresponding to the area dedicated to work can be deducted based on actual expenses, rather than using the lump-sum allowance.

This also applies to employees who occasionally have to pay for temporary accommodation, for example a studio or hotel nights, in order to be closer to their workplace, without reimbursement from the employer. These amounts can be deducted as actual expenses, with invoices as supporting evidence.

Professional expenses for employees and the self-employed

An important clarification this year: even though employees and self-employed individuals both file a Valais tax return, the authorised deductions, especially those related to professional expenses, such as transportation, meals, and other costs, do not apply in the same way.

- Employees: professional expenses can be deducted in the tax return as explained above.

- Self-employed individuals: these expenses are not deducted in the tax return through sections labelled “professional expenses”. They must be recorded as actual expenses, not lump-sum, in the annual accounting of the activity, meaning in the operating expenses or profit and loss statement.

Deduction 5: 3rd pillar A contributions

It is true, in Valais as everywhere else in Switzerland, this is probably the most publicised deduction. The 3rd pillar A, also called tied or private pension provision, is a bank account or an insurance policy, focused on savings or risk coverage, into which you can contribute a certain amount each year. To keep things simple, let’s say that this amount depends mainly on your professional status, although in reality, what determines the available deduction is whether or not you are affiliated with a second pillar.

Employee :

Generally, everyone knows whether they are an employee or not. But to remove any doubt, here is a simple rule. Were you automatically affiliated with a second pillar? If the answer is yes, then you are an employee and you can deduct, starting in 2025, between CHF 0 and CHF 7,258 per year.

Self-employed :

Using the same definition, you are considered self-employed as soon as you have the choice to affiliate or not to the second pillar. If you are self-employed and you decide NOT to affiliate, then you can deduct far more than if you had chosen to join a pension fund voluntarily.

- Self-employed with voluntary affiliation to the second pillar: between CHF 0 and CHF 7,258 in 2025

- Self-employed without voluntary affiliation to the second pillar: you may contribute up to 20 percent of your income, but no more than CHF 36,288 per year for 2025.

Deduction 6: Buy-ins to the 3rd pillar A (applicable from 2026)

Without going into every detail, since a full article is dedicated to 3rd pillar buy-ins, here is what matters. Before 2026, an employee could deduct up to CHF 7,258 per year in the 3rd pillar A, and any missed contribution was lost. Starting in 2026, there is a major change. Contributions that were not paid in previous years, within the limits of your available rights, can be made up through additional payments and deducted for tax purposes, under certain conditions, such as AVS-liable activity, annual ceilings, and catch-up windows. In short, you will be able to fill your past gaps in addition to your contribution for the current year.

Deduction 7: Buy-ins to your second pillar (LPP)

As with the 3rd pillar A, buy-ins to the second pillar work the same way regardless of your canton and follow conditions that are uniform at the federal level.

Let’s be honest. The second pillar is a technical subject, although a fascinating one, and buy-ins are even more complex. Summarising them in just a few lines would be unrealistic, which is precisely why we have dedicated an entire article to the topic.

In summary, when there is a change in your salary or in your contribution conditions, this can create a gap in your pension provision.

For example, if your salary increases from CHF 50,000 to CHF 80,000, the contributions paid on the basis of CHF 50,000 are no longer sufficient to secure a pension that matches your new income.

Switzerland then gives you the possibility to buy back this difference in order to fill these contribution gaps, strengthen your future pension or your retirement capital, all while deducting the buy-in amount from your taxable income.

Without question, buy-ins to the second pillar are one of the best tax optimisation tools available to employees, as well as to self-employed individuals who have chosen to affiliate voluntarily.

But before leaping, it is essential to answer a few questions :

- How much can I buy back in total?

- Is it more advantageous to make these buy-ins all at once, over three years, or over ten years?

- Will I need these funds in the near future?

- What tax will I pay if I decide to withdraw my capital later on?

- And above all, is my pension fund financially sound?

Deduction 8: Children and apprentices dependent on their parents

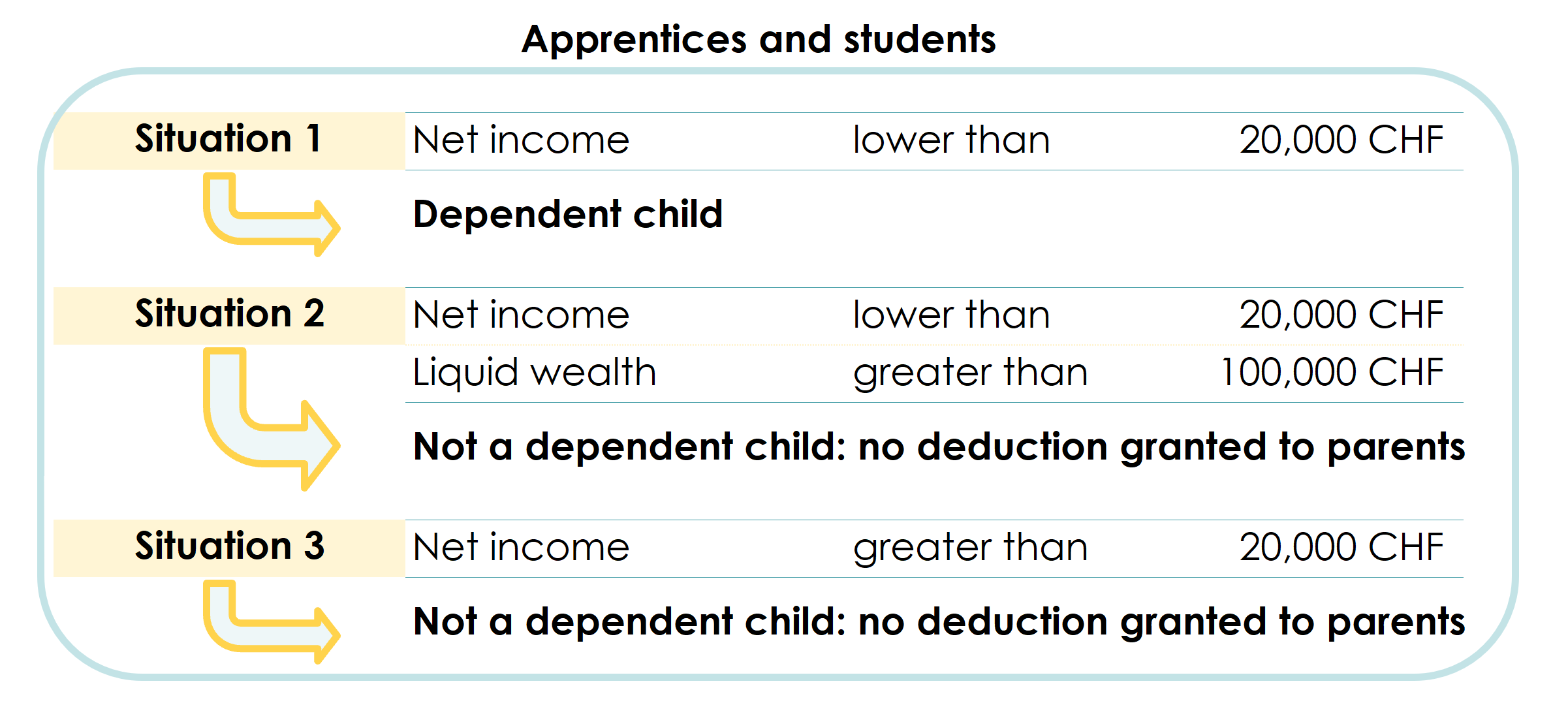

Before we talk about numbers, it’s important to know if your child is considered a dependent. There are two main considerations:

Children’s income and wealth

Regardless of your children’s age, if they have income and assets, it is likely that they can no longer be claimed as a deduction on your tax return. Here is a summary table based on the most recent values available (those of 2024):

Note: Parents whose children are required to move away from Valais to pursue tertiary education and thus need to reside permanently in another canton can claim an additional deduction of CHF 5,220 in 2025. A copy of the lease agreement and a certificate of enrollment from the university will need to be provided.

Your children’s age and status

Along with the income and wealth criteria, your children’s age and status will determine the amount you can deduct for 2025:

- Children up to the age of 6: 7’860 CHF per child

- Children from 6 to 16 years old: 8’940 CHF per child

- Child from 16 years old: 11’930 CHF per child

From the 3rd child on, the deduction is increased by 1’240 CHF per child.

Deduction 9: Childcare expenses

Across Switzerland, it is common to claim an additional deduction when you have to spend money on childcare. This comes on top of the deductions linked to the simple fact of having children. However, Valais is more generous than most other cantons. The deduction applies whether you have chosen to entrust this responsibility to a third party or whether you have decided to look after your children yourself. The amount, however, varies depending on the option selected, whether by choice or necessity.

- The childcare deduction amounts to CHF 3,130 per year and per child, provided that you look after them yourself.

- It reaches CHF 10,000 in 2025 if they are entrusted to third parties.

Deduction 10: Reduction of the spouse’s income for married couples

When married and both spouses are working, Valais and all its communes offer the possibility of deducting an amount of 6’290 CHF per year from one of the two incomes.

Deduction 11: Alimony and maintenance contributions paid

Let’s start by distinguishing between these two types of payments: alimony is paid to an ex-spouse, while maintenance contributions are paid for a child, following a divorce or separation.

If you pay alimony, then you will be able to deduct it entirely (100%). Please note that this deduction is no longer valid as soon as the child turns 18.

Deduction 12: Health and accident insurance

Unlike some of the more generous cantons, Valais, like the Confederation, combines several elements: your health insurance premiums, your life insurance premiums, and the interest accrued on your savings capital. The deduction allowed at the communal and cantonal level therefore depends on the composition of your household, which in 2025 is as follows:

- CHF 7,240 for a married couple

- CHF 3,620 for a single person, and

- CHF 1,130 per child.

Deduction 13: Medical expenses not covered by your insurance

When, over the course of the year, you have to cover medical expenses in addition to your insurance premiums, you can deduct them from your taxable income once a certain threshold is exceeded.

The deduction is allowed once your medical expenses exceed 2 percent of your net income, after standard deductions.

Example: if your intermediate income, which is very close to your taxable income, is CHF 55,000, you can only begin deducting your medical expenses once they exceed CHF 1,100, which is 2 percent of 55,000.

Don’t forget to include dental expenses and the cost of glasses, which are often not reimbursed by basic insurance but are deductible as medical expenses.

Deduction 14: Disability-related expenses

This deduction follows the same logic as unreimbursed medical expenses, with one difference. It concerns expenses related to a recognised disability rather than a short-term illness. The 2 percent net-income threshold does not apply here, which means you can start deducting from the very first franc spent.

In addition, for certain disabilities, it is possible to opt for a deductible lump-sum amount rather than documenting each individual expense, in order to account for the recurring extra costs of daily life.

Deduction 15: Training expenses

If you decided to pursue training during the year, a deduction is allowed under certain conditions:

- You already have a secondary school diploma (Maturité, apprenticeship, etc.)

- Or you are older than 20 and the training is not aimed at getting a first diploma of secondary degree.

The maximum deduction was CHF 12,550 per taxpayer in 2025.

Deduction 16: Interest on debt

This deduction, well known among property owners in Switzerland, is a little less familiar to the general public. Yet in Switzerland, and this also applies in the canton of Valais, the interest you pay on your debts, whatever they may be, is deductible from your taxable income, at least partially. Among the most common types of debt, you will find the following:

- mortgage debt,

- credit card debt,

- consumer loans,

- student loans,

- real estate loans, even if the financed property is located abroad,

- amounts borrowed from relatives, provided that interest is actually owed and paid,

- Debts owed to the tax authorities if, as of 31 December, you still have taxes outstanding.

In short, whenever you have borrowed money and that loan costs you money each year, the interest you pay can be deducted from your taxable income.

Be mindful of legal changes. In September 2025, the Swiss population voted to abolish the imputed rental value. Although this measure targets a fictitious income applied to owners who do not rent out their property, it also results in the near elimination of the deduction for interest on debt, whether mortgage-related or not. Starting in 2028, these interest payments should no longer be deductible. Until then, remember to include them in your annual tax return.

Deduction 17: Wealth tax

Time for a break!

We’ve just gone through a dozen income-related deductions, and I believe you can already picture your future taxable income, once all applied.

However, my work is not done. In Switzerland, in addition to income tax, we also have a wealth tax. Rest assured, there are not a thousand deductions, there is only one.

Flat-rate wealth deduction

At the risk of surprising you, you will have to declare your total wealth, yes, both Swiss and foreign, in full detail in order to pay tax on that amount.

- Bank accounts

- Investment

- Real Estate

- Art objects

- Etc…

However, the canton of Valais does not tax your assets from the first franc and offers a lump sum deduction depending on your situation.

- CHF 45,000 for single people without children

- CHF 90’000 for married couples and single persons with dependent children

How FBKConseils can help you?

A Free initial meeting

Whether you’ve read the entire article or simply scrolled to this section, know that we offer a free initial meeting lasting 15 to 30 minutes. This is a great opportunity to get to know each other, understand your situation and needs, and, most importantly, answer any of your initial questions.

Tax simulation

You may have heard that the canton of Valais is some sort of not-so-secret tax haven? Beware of preconceived ideas! A good tax simulation will quickly show you that this reputation doesn’t always reflect reality. With a few exceptions, taxes in Valais are not much different from the rest of French-speaking Switzerland.

FBKConseils is here to help you clarify the situation and avoid any unpleasant surprises.

2025 Tax Return – Full Delegation

Whether you want to learn how to fill out your tax declaration or prefer to delegate it entirely, FBKConseils is by your side to assist you with your 2025 tax declaration.

2025 Tax Return – Learn how to complete your return with us

For those who prefer to prepare their own tax return without going through a firm, FBKConseils can guide you step by step. We complete the return with you, answer all your questions, and provide the explanations you need so that you can become more independent and make the process easier in the following years.