Written by Yanis Kharchafi

Written by Yanis KharchafiUnderstanding cantonal income taxes in Valais

Introduction :

Before starting with a cheerful “Adieu, shall we have a drink or what?” (with a great Valais swiss accent), let’s take a few moments to go over the tax system in Valais. This will help you avoid any unpleasant surprises if you’re sure about settling in Valais.

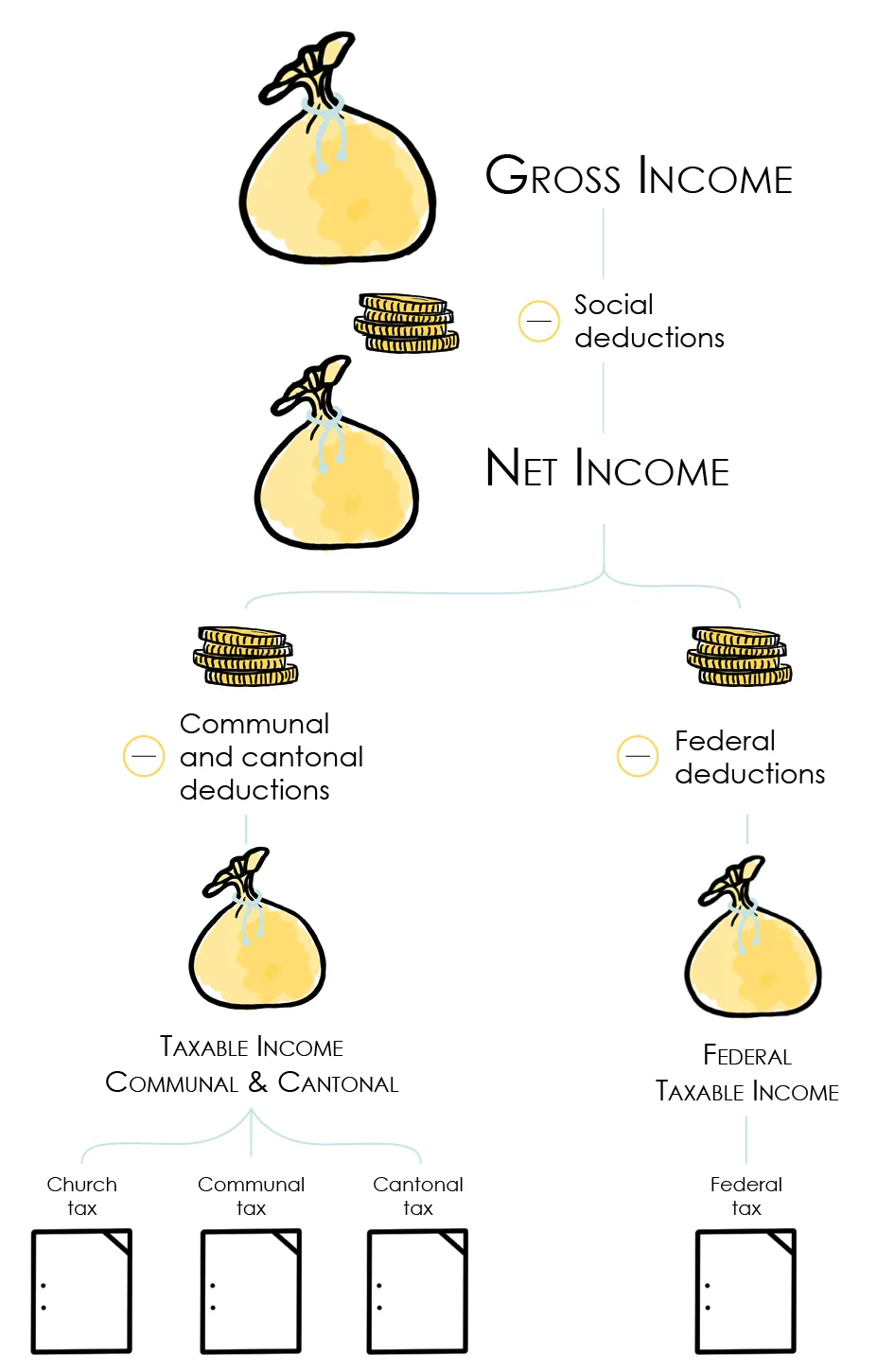

In this article, we’ll focus solely on one aspect of taxation in Valais: cantonal taxes. These are one of the three layers of income taxation you’ll be subject to.

To accurately understand and calculate cantonal and municipal taxes (ICC), it’s also important to get familiar with how municipal taxes in Valais work, as well as the additional layer of federal taxes (IFD).

Only by adding these three layers of taxation will you know the total amount of your tax bill. I know what you are thinking: why not put everything in a single article, it would be simpler. Trust me, once you get through this first layer and see the level of complexity added by the canton, you will agree that two, or even three articles are necessary.

And of course, if you need assistance with your tax declaration in Valais, our team would be happy to help.

The line-up:

What does income tax look like in the canton of Valais?

While this article primarily focuses on cantonal tax, it’s essential to set the stage by giving you an overview of what living in Valais might cost in terms of income tax. The first thing to know: as is the case throughout Switzerland, municipalities play a significant role and can greatly influence your overall tax burden.

Let’s look at a concrete example. With an annual income of CHF 100,000, here’s what you might pay in taxes depending on where you live:

- At the minimum: CHF 19,053 in municipalities like Verbier (Val de Bagnes).

- At the maximum: CHF 23,511 in municipalities like Grächen (which, let’s admit, is less famous).

- For all other Valais municipalities, your taxes will fall somewhere between these two amounts.

What can we conclude from these figures?

This brief introduction provides a glimpse into the tax rates you might encounter in Valais and highlights that, depending on the municipality you choose, your tax burden can vary by around ±5%, which is not insignificant.

Now, let’s break down the CHF 19,053 (the minimum amount for Verbier):

- The canton of Valais takes 47.11% of the total tax, which amounts to CHF 8,976.

- The municipality of Verbier takes 38.78%, equaling CHF 7,389.

- The Confederation collects the remaining 14.11%, or CHF 2,688.

At this point, you should have a clearer understanding of the purpose of this article: to provide the necessary information to calculate the cantonal portion of your taxes (in this case, CHF 8,976 for an income of CHF 100,000 in Verbier) and thereby help you better anticipate your overall tax burden.

Calculating cantonal income tax in four steps

Let’s be honest. When you read this title, you felt a small wave of relief. So did we… until we dove into the unforgiving machinery of the Valais tax administration. You were expecting a clear tax scale, a taxable income, and then, just like that, your final tax? Think again. Since last year, the administration no longer publishes the scales, since this would apparently “no longer be allowed”. So we rolled up our sleeves and worked with the information that is still available. The good news is that our method produces the same results for 2025. Here is how to proceed.

Step 1 : From gross income to taxable income

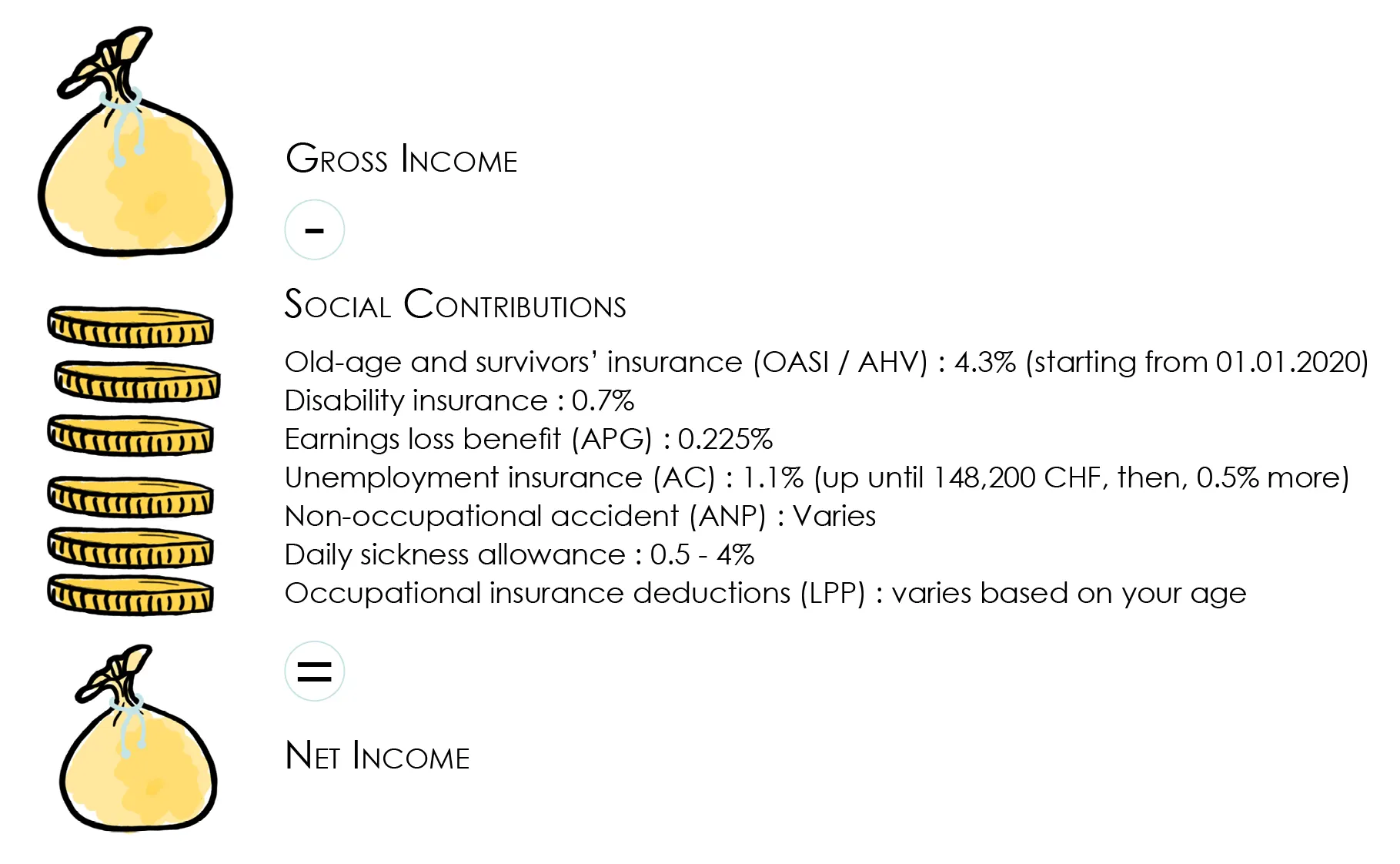

This paragraph was added in the 2026 update because far too many taxpayers still mix up the basic concepts. Before talking about rates and tax calculations, you first need to turn your gross income into taxable income, since this is the figure that will be used for everything that follows. Without overlapping with our article dedicated to taxable income, here is the condensed version.

From gross income to net income

For employees, it happens automatically. Your employer’s accounting department withholds the social insurance contributions, including accident insurance LAA, daily allowance insurance, AVS for the first pillar, LPP for occupational pension, and so on.

- If you are Swiss or hold a C permit, your net salary is paid directly into your bank account.

- With a B permit, a withholding tax is generally deducted in addition to the social insurance contributions.

From net income to taxable income

At this stage, it is no longer your employer’s responsibility but yours, through the annual tax return. Starting from the net salary shown on your salary certificate, you claim the deductions allowed for tax purposes, including professional expenses, insurance premiums, the third pillar, and others, in order to reduce your base. Once all deductions have been applied, you finally arrive at your taxable income.

With this framework in place, we can now use your taxable income within the Valais calculation system for the next steps.

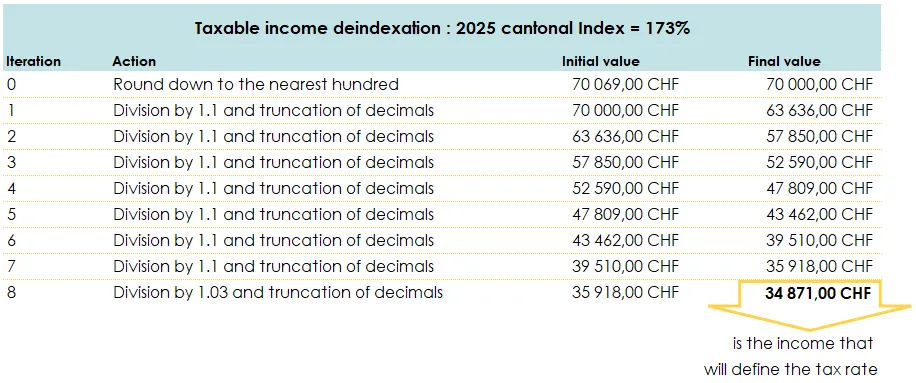

Step 2: De-index your taxable income

Alright, fair warning: this is where things get messy. Even if everything is not crystal clear, keep in mind that we worked with the best tools available and, honestly, not even in our worst nightmare would we have imagined such a system. The first thing you need to understand is that each year, the canton of Valais provides a cantonal “index”, a number somewhere between 1 and 2. This index sets the level of taxation the canton intends to apply for the coming year.

Let’s imagine that in early 2026 I complete my 2025 tax return and that my taxable income after deductions comes to exactly CHF 70,000. When I look up the 2025 index, I see that it is 1.73. What am I supposed to do with that information?

You then “simply”, if I may say so, divide seven times by 1.10 and once by 1.03. Why? Because 1.73 is a “7” and a “3”, which means 7 multipliers of 1.10 and 1 multiplier of 1.03. Honestly, don’t look for too much meaning here. You, me, and even they don’t really understand how we ended up with this logic, but that’s the way it is.

So let’s go back to our example and work through these iterations together :

- Iteration 1: 70,000 / 1.10 = 63,636.3636… we keep only 63,636 to perform the second iteration. It does not matter whether the result is 63,636.36 or 63,636.99, we cut just before the first decimal without rounding. So,

- Iteration 2: 63,636 ÷ 1.1 = 57,850.9 (again, cut off the decimals and keep 57,850 for the next iteration).

- Iteration 3: 57,850 ÷ 1.1 = 52,590.

- Iteration 4: 52,590 ÷ 1.1 = 47,809.

- Iteration 5: 47,809 ÷ 1.1 = 43,642.

- Iteration 6: 43,642 ÷ 1.1 = 39,510.

- Iteration 7: 39,510 / 1.10 = CHF 35,918

- Final iteration (the eighth in this case): divide 35,918 / 1.03

Summary table of values for the example:

After this somewhat bizarre methodology, we finally obtain a de-indexed income that will serve as the basis for calculating the tax rate: CHF 34,871. This rate, as its name suggests, will determine the percentage applicable to your taxable income. In other words, we will have to calculate the tax rate for an income of CHF 34,871 and apply that rate to our CHF 70,000.

If, by miracle, you are still with us, don’t lose hope! There is only one more step of this kind before finally seeing the light at the end of the tunnel.

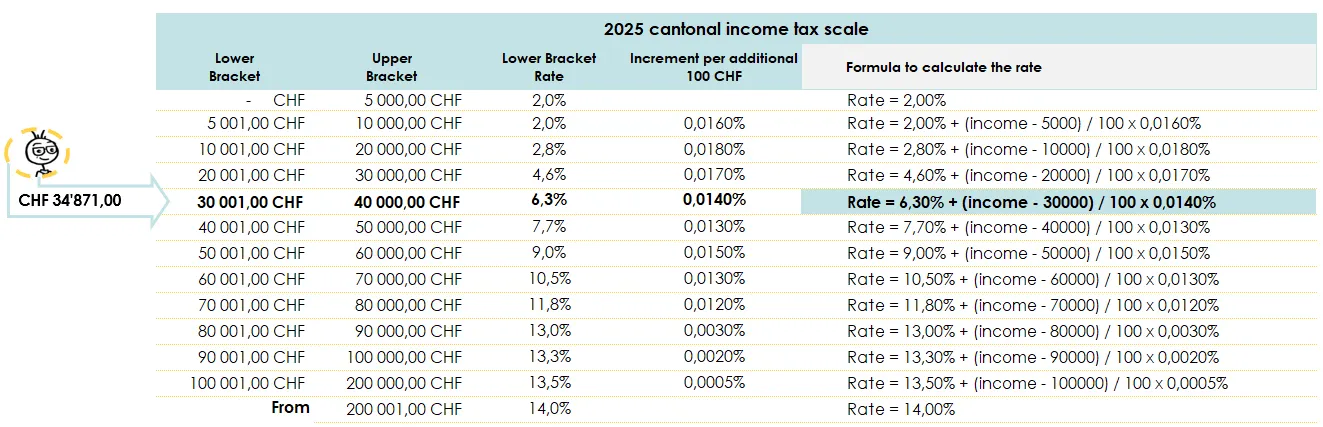

Step 3: Searching for the Valais tax rate

Let’s recap. This step is about determining the tax rate that applies to your income. But how do you do that? By using your freshly de-indexed income together with the cantonal income tax scale.

Don’t worry, once again we’ve taken care to provide you with this scale on a silver platter. However, let’s be honest: even if it’s presented here without explanation, it might not be immediately useful. But don’t panic, we’ll break it down together.

Here is the famous table of Valais tax rates:

We have already highlighted the line of the tax scale that interests us for our example:

Noé has a taxable income of CHF 70,000, which after de-indexation, becomes CHF 34,871. Therefore, we focus on the range CHF 30,001 – CHF 40,000, as CHF 34,871 falls between these two values.

To calculate Noé’s cantonal income tax rate, I suggest we go straight to the formula that we’ve carefully checked and apply it:

2025 Rate for Noé = 6.3% + (34,871 – 30,000) / 100 * 0.014% = 0.0698194, which is 6.9819% (rounded to 4 decimal places).

Step 4: Calculation of cantonal income tax

Here we are, finally! The last step: calculating the cantonal income tax. To wrap things up nicely, forget everything we did in the first step. This time, we simply focus on one basic operation: multiplying your income (CHF 70,000) by the applicable tax rate.

Here’s the calculation:

CHF 70,000 × 6.9819% = CHF 4,887.35

So, CHF 4,887.35 is the cantonal income tax to be paid for the year 2025!

Crazy, right? Mission accomplished!

How does the Valaisan income tax work when married?

Perhaps you’ve already found your soulmate, or perhaps not yet? In any case, it seems relevant to examine the impact of marriage on the amount of taxes to be paid.

This is where the term “deduction” comes into play. It’s a flat sum that the Valaisan tax administration will subtract from the taxes due by the married couple.

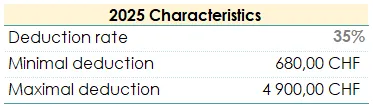

As a married taxpayer, you can subtract 35 percent of the tax you would have paid if you were not married. However, for the 2025 tax year, this reduction cannot be lower than CHF 680 and cannot exceed CHF 4,900. In other words, you start with the tax you would have paid as a single person, using the total household income and deductions, then you calculate 35 percent of that amount. If the result is lower than CHF 680, you still deduct CHF 680, and if it exceeds CHF 4,900, you keep the CHF 4,900 limit. Any amount that falls between these two boundaries can be deducted from your tax as it is.

If this wasn’t perfectly clear, for once, the Valaisans have been “chill.” Instead of spending an afternoon trying to make something simple more complicated, they simply decided to keep everything the same for singles but allow a small 35% deduction that cannot be less than CHF 680 nor more than CHF 4,900.

Let’s take several examples.

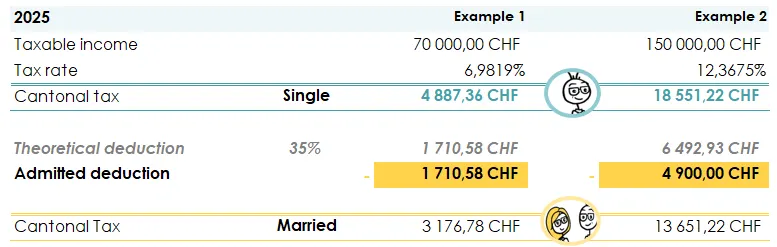

Married couple with a taxable income of CHF 70,000

As a single individual with the same income, you would have had to pay the canton the hefty sum of CHF 4,887.36, but since you are married, you can subtract 35% of the tax. This results in a reduction of CHF 1,710.58. Since this amount falls between CHF 680 and CHF 4,900, it will be accepted as is.

You will therefore pay a final cantonal tax of CHF 3,176.78.

Married couple with a taxable income of CHF 150,000

The same principle applies: first, consider the tax as if you were single with a taxable income of CHF 150,000. In this case, the tax would have been CHF 18,551.22. If we subtract 35% from this amount, we get CHF 6,492.93, which exceeds the maximum limit of CHF 4,900. Therefore, the deduction applied will be CHF 4,900, resulting in a final tax of CHF 13,651.22.

The tax deduction in a more general way

We now know that you cannot deduct less than 680 CHF, and you cannot deduct more than 4,900 CHF.

Here, we will approach the problem from the reverse angle by finding what taxable income is needed to fall within these different scenarios.

The minimum deduction of 680 CHF

To find the amount of tax that, when multiplied by 35%, gives 680 CHF, we calculate 1,942.86 CHF. Then, we find what taxable income corresponds to a tax of 1,942.86 CHF, and that amount is 41,400 CHF.

What this tells us is that if the taxable income of the household is between 0 CHF and 41,400 CHF, then you will be able to deduct 680 CHF from your taxes as a married couple.

The maximum deduction of 4,900 CHF

Here, we do the same thing but in the opposite direction. We need to find what amount of tax, when multiplied by 35%, gives 4,900 CHF, and that amount is 14,000 CHF. Then, we find what taxable income corresponds to a tax of 14,000 CHF, and that amount is 127,700 CHF.

So, once your taxable income equals or exceeds 127,700 CHF, you will be able to deduct 4,900 CHF from your taxes.

The standard 35% deduction

No more calculations needed. As we know, below 41,400 CHF, you will deduct 680 CHF, and above 127,700 CHF, you will deduct 4,900 CHF. So, for taxable incomes between these two amounts, you will be able to subtract 35% of your cantonal taxes.

The impact of children on your tax burden

Having a dependent child gives you the same tax rights as being married. In other words, once you have a child dependent on you, you will have the right to deduct from your taxes the same tax deduction explained in the previous section, and in addition, you can benefit from a tax savings of 300 CHF per child.

Let’s take a closer look at the impact for a single person with a dependent child, and then the impact for a married couple.

The impact of children if you are not married.

Even if it means that you are not or no longer married, you will still be entitled to keep (or register) the tax deduction related to the allowance, and on top of that, you will receive an additional reduction of 300 CHF per child.

The impact of children if you are married.

I have to break it to you: your child will not translate into a significant tax saving and fortunately, that is not why we have children in the first place. Since you already benefit from a tax reduction through your marital status, you can only claim an additional reduction of CHF 300, on top of the standard child allowance applied to your tax bill. In other words, the same reduction that single parents with children receive.

Calculating your total taxes in Valais: ICC + IFD

For those who had the courage to read this entire article and who are still with us at this point, well done. However, keep in mind that everything we have covered so far does not even represent half of your income tax. The largest portion still needs to be calculated, and it is split between the municipality and the Confederation.

Don’t worry, FBKConseils is here to make your life easier. So, feel free to read the other relevant articles.

Oh, and before we dive into our services, don’t forget that we’ve only discussed income tax so far. In Switzerland, unlike many other countries, there is also a wealth tax. Yes, all your wealth, whether movable or immovable, is taken into account. Once you’ve calculated your taxes for the municipality and the Confederation, a quick detour to wealth tax is a good idea to wrap things up nicely.

How FBKConseils can help you?

A Free initial meeting

Whether you’ve read the entire article or simply scrolled to this section, know that we offer a free initial meeting lasting 15 to 30 minutes. This is a great opportunity to get to know each other, understand your situation and needs, and, most importantly, answer any of your initial questions.

Tax simulation

You may have heard that the canton of Valais is some sort of not-so-secret tax haven? Beware of preconceived ideas! A good tax simulation will quickly show you that this reputation doesn’t always reflect reality. With a few exceptions, taxes in Valais are not much different from the rest of French-speaking Switzerland.

FBKConseils is here to help you clarify the situation and avoid any unpleasant surprises.

2025 Tax Return – Full Delegation

Whether you want to learn how to fill out your tax declaration or prefer to delegate it entirely, FBKConseils is by your side to assist you with your 2025 tax declaration.

2025 Tax Return – Learn how to complete your return with us

For those who prefer to prepare their own tax return without going through a firm, FBKConseils can guide you step by step. We complete the return with you, answer all your questions, and provide the explanations you need so that you can become more independent and make the process easier in the following years.