Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on December, 12th 2025.

How can I maximise my tax savings in the canton of Vaud?

Introduction

Optimizing tax should be a major concern for many residents of the canton of Vaud. At FBKConseils, we see every year that many individuals, families, property owners and the self-employed can find it difficult to understand the tax mechanisms and possible deductions, resulting in a tax burden that is far too heavy.

Understanding the Swiss tax system, and tax in the canton of Vaud, can help you make significant savings.

In this article, we’ll explore the various tax optimization strategies available to Vaud taxpayers in 2024. Get ready to discover practical tips and useful resources for lightening your tax burden and maximizing your savings.

The line-up:

Step one: Understand the progressive nature of income tax in Switzerland and the canton of Vaud.

It’s no secret, and this principle is valid in all countries: the higher the taxable income, the higher the tax. However, in Switzerland, unlike in countries like France, you cannot move from a lower tax bracket to a higher one. In Switzerland, each income corresponds to a fixed tax rate.

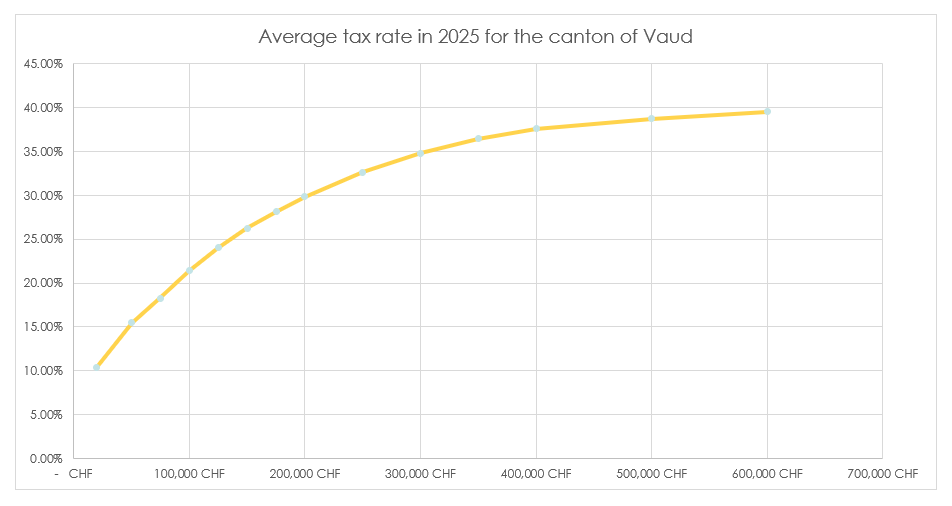

In the canton of Vaud, here’s what the tax rates will look like in 2024, depending on your income. The rates range from 10% for the lowest incomes to around 40% for the highest incomes.

But beware: rates do not rise steadily. They rise rapidly at first, then ease off.

This detail is crucial: strategies to reduce your tax bill are particularly effective where the yield curve is rising fastest.

Step two: A closer look at the special tax features of the canton of Vaud

Before diving into the various tax optimisation strategies, let’s take a moment to understand the specific tax situation of the canton of Vaud compared with its neighbours. Although Switzerland is striving to standardise taxes between cantons, each canton retains a certain amount of freedom. This autonomy can lead to significant variations in your tax burden, depending on your situation.

Travel expenses – Transport from home to work

Unlike Geneva or Valais, the canton of Vaud allows a substantial deduction for commuting, regardless of the means of transport used. It even offers an almost unlimited deduction for taxpayers using a private vehicle.

- Up to CHF 4,080 for public transport, depending on the number of kilometres travelled

- CHF 700 for people who do not use motorised transport (bicycle)

- There is no limit for taxpayers who can prove the need to use their private vehicle.

Business expenses

The canton of Vaud authorises an automatic and fairly generous deduction of 3% of your net salary without justification.

On the other hand, the canton of Vaud is more restrictive in other respects:

Medical expenses

In the canton of Vaud, you need to spend more than 5% of your income before you can deduct additional medical expenses.

Health insurance premiums

The canton of Vaud offers some of the lowest deductions for health insurance premiums, which are often insufficient to cover actual annual outgoings.

3rd pillar B

No deductions are accepted for this type of life insurance policy.

Construction interest

Construction interest is not deductible during the construction period of your property. The canton of Vaud considers that this interest increases the value of your property and therefore cannot be treated as an expense.

Step three: Possible tax optimisations in the canton of Vaud?

First optimisation: Choosing your commune of residence

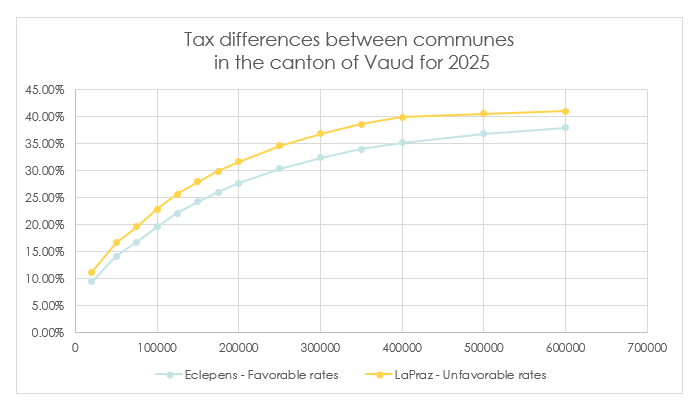

This principle is true not only in the canton of Vaud, but also in the other Swiss cantons. Each commune is free to choose its tax rate, which means that the commune where you decide to live will have a significant impact on your annual tax burden, varying from 2% to more than 5% for the least sympathetic communes.

Second optimisation: Fill in your tax return correctly

Although it may seem obvious, this second optimisation is crucial. Every year, many clients come to us with tax returns containing errors or omissions. Unlike other cantons, Vaud will always correct errors that are unfavourable to it, but very rarely those that are in your favour, however gross they may be.

That’s why it’s essential to fill in your return correctly or to have it done by a specialist at least once, so that you can draw up a reliable example for future years. Common omissions include :

Teleworking costs

In certain situations, it is possible to apply to the canton of Vaud to pay part of your rent and other household expenses if you work from home. This includes heating, electricity and maintenance costs, in proportion to the space used for work.

Bank charges

The canton of Vaud allows a flat-rate deduction of 0.1% of your declared assets for account-keeping costs. If you can prove that your actual bank charges are higher, you can change this flat-rate deduction to claim a higher effective deduction.

Meals or nights away from home

Depending on your type of employment, you may be able to deduct certain meal or accommodation expenses that have not been reimbursed by your employer. These deductions relate to expenses incurred when travelling on business or on extended assignments away from home.

Declaring property abroad

The canton of Vaud grants a greater or lesser discount depending on the location of your property abroad and the type of rental you make (furnished accommodation, second home, property under construction, etc.). This can significantly reduce your tax burden if you own property abroad.

Daily sickness benefit (DSP) premiums

Insurance premiums for loss of earnings due to illness, which are shown on your salary certificate (number 15), are often not deducted correctly. Make sure you check these amounts carefully to maximise your tax deductions.

Check your tax decision

Once you have submitted your tax return, the canton of Vaud takes some time to check it, correct it and send you a revised version. This tax decision may be less advantageous than your initial return. You then have 30 days to contest the decision and claim your deductions. Take the time to compare line by line what you have declared and what has been retained, so that you can draw up an appeal with the supporting documents needed to reinstate the deductions that were initially refused.

Contribute ‘the right way’ to one or more 3rd pillar A schemes – News 2026

You’ve probably been contacted by a financial adviser offering you the chance to reduce your tax thanks to the 3rd Pillar A. Here are two important pieces of advice:

- Don’t blindly follow his advice: Although the 3rd pillar A is indeed deductible, the contracts on offer are not always financially advantageous.

- Be well informed: The 3rd pillar A may be an excellent tool for optimising tax and building up assets, but it must be entered into with full knowledge of the facts: guaranteed or invested? Insurance or bank? What commission is charged? What charges apply? Should I open one or several? What happens if I leave Switzerland? If I can no longer pay? If I simply want to stop…

In all cases, you will be able to deduct from your income up to CHF 7,258 per year (from 2025 onward) as an employee through your pillar 3a, and up to CHF 36,288 if the profit from your self-employed activity allows it.

ChatGPT said:

Making catch-up contributions to your Pillar 3a – New in 2026

Here is a new tax optimization opportunity available from the 2026 tax year that may interest many taxpayers in the canton of Vaud. This change allows you to retroactively make up for underpaid contributions to your Pillar 3a in previous years if, during those years, you did not reach the maximum deductible contribution.

Concrete example:

If in 2026 you contributed only CHF 1,000 to your Pillar 3a (because you were a student, unemployed, or simply did not have the financial means), while the maximum deductible amount at the time was CHF 7,258, then in 2027 you will be able not only to contribute the full 2027 maximum, but also to add a catch-up contribution for 2026 of CHF 6,258 (i.e. CHF 7,258 maximum − CHF 1,000 already contributed).

Tax advantage:

These catch-up contributions will be fully deductible from your taxable income, exactly like regular Pillar 3a contributions. This can represent a significant tax optimization if you have accumulated several years of contribution gaps.

BVG/LPP purchases in your pension fund

The 2nd pillar in Switzerland is a vast and complex subject. Buying back BVG years is an effective way of reducing your tax bill while securing your retirement. For more details, see our article on BVG buy-backs.

How to choose between investing in your third pillar and making BVG redemptions?

We generally advise our customers to contribute as much as possible to their 3rd pillar first, as any contributions not made during the year cannot be made up (at least for the time being, as the law may change in the future).

On the other hand, amounts not purchased under the 2nd pillar can be carried forward to subsequent years. As both provide similar tax advantages, it is strategic to maximise 3rd pillar contributions before carefully planning BVG purchases to optimise your taxes even further.

Third optimisation: your property purchase in the canton of Vaud

Through various videos and articles, we have tried to highlight the tax and economic differences between a tenant and a landlord:

Here we will concentrate on taxpayers who already own a property and wish to optimise their situation.

Planning maintenance costs over several years – New in 2026

This is a tax optimization tip that comes up frequently in our recommendations, yet it is still far too rarely used by homeowners in the canton of Vaud. When purchasing a home, it is perfectly normal to want to carry out major works so that the property better reflects your personal and family preferences.

However, carrying out as much maintenance work as possible in a single year will indeed significantly reduce your tax burden for that year (which is very pleasant!), but unfortunately, it will inevitably rise again to its highest level in the following years, creating a long-term tax “yo-yo” effect that is far from optimal.

Important change ahead: At the end of 2025, Swiss voters decided not to abolish the imputed rental value, which has the knock-on effect of eliminating the deductibility of maintenance costs for owner-occupied, non-rented properties as of 2028. This clarification is absolutely crucial, because the planning strategy discussed in this article now means that you will most likely have only three years (2026, 2027, and 2028) to carry out maintenance work that is still tax-deductible. After the critical year of 2028, invoices for such work will no longer be deductible from your tax return.

Concrete example: If your kitchen objectively needs to be replaced within the next five years (say, in 2029), and you have the financial means to do so today or by 2028, simply bringing this expense forward could reduce the real net cost of your new kitchen by 15% to 35%, thanks to the tax savings achieved. Not insignificant, is it?

Our strategic recommendation: Start preparing a multi-year maintenance plan now for the period 2026–2028 in order to optimize your expenses from a tax perspective before this window of opportunity closes.

Important note: Many taxpayers mistakenly believe that all invoices related to their property are deductible from their income. This is not true. Only maintenance costs intended to preserve the value of the property—that is, its resale value—are deductible from income. Other works, such as improvements or major renovations, are instead deductible for capital gains tax purposes at the time of sale.

Managing your debt ratio – News 2026

If paying mortgage interest were a good idea, no one would bother negotiating their loan and everyone would try to pay as much interest as possible to reduce their taxable income and taxable wealth. However, it’s not that simple. Paying interest always costs more than the tax savings it generates. So does that mean you should have no debt at all? Not necessarily. Having debt allows you not to tie up all your capital in the walls of your property and instead invest it in projects that may be more profitable than the cost of the debt.

The same clarification applies as for maintenance work: following the vote on the abolition of the imputed rental value, mortgage interest paid on a residence used for private purposes will no longer be deductible from taxable income as of 2028. After that date, it will be worth revisiting your calculations and reassessing what the optimal level of debt should be.

Three factors will influence your level of debt:

Your household’s marginal tax rate

The higher your household income, the higher the tax rate. So every franc spent on mortgage interest can have a significant impact on your tax bill. For the same franc of interest paid, a household can save between 10% and 40% in tax.

Mortgage interest rate

This advice applies to all homeowners, whatever their income. The higher mortgage rates are, the less attractive it is economically to be in debt. In times of rising interest rates, it may be preferable to reduce your level of debt if possible.

Your ability to generate a return

If you are close to retirement and want to calculate your budget accurately without taking any risks, you should generally consider paying down debt as a good option. This will reduce their annual interest bill and slightly increase their tax bill. On the other hand, a person with a lower risk aversion, who is able to manage his savings well, could keep a high level of debt in order to invest this money and generate a return higher than the cost of the debt while keeping his tax burden lower.

Step four: Marrying or remaining single can also affect your taxes

Choosing whether or not to marry should not be influenced by tax considerations. However, it is essential to understand that marriage will have a significant impact on the calculation of your tax liability and the deductions that apply.

In the canton of Vaud, the family quotient system can often create an unfavourable difference between married couples. Adding the two incomes and dividing them by 1.8 (instead of 2) generally results in a higher tax rate than if the two partners had remained single.

However, there are exceptions. If one spouse has a significantly higher income than the other, marriage can lower the overall household tax rate, thereby reducing the couple’s tax burden.

Although the decision to marry should not be dictated by tax considerations, it is always wise to simulate tax changes to anticipate and plan your budget as well as possible.

For further explanations, we recommend our video on this subject.

Conclusion: How can I maximise my tax savings in the canton of Vaud?

Having written this article, let’s take a moment to recap the steps you need to take to ensure that your tax burden is as optimal as possible.

Step 1: Ensuring a perfect tax return

Probably the most important step: making sure that your tax return is perfectly executed and that no deductions are missed.

Step 2: Check the tax decision

Examine the tax ruling carefully to ensure that the tax authorities have not made any errors or been deliberately too severe.

Step 3: Simulate the tax tools available

On the basis of your tax return, take the time to simulate the impact of certain tax tools made available by the canton of Vaud, such as buying back LPP years and/or the 3rd pillar. Assess their relevance, and the duration and proportion appropriate to your situation.

Step 4: Optimising your property and financial investments

If you own property or other investments, explore financial structures or products that can significantly reduce your tax burden over the long term.

Step 5: Simulate the impact of life changes

Before making a major life change (such as moving house, getting married, having a child, changing jobs or starting up a self-employed business), always take the time to simulate and calculate the tax impact to better predict the repercussions on your finances.

How can FBKConseils help you optimise your taxes?

At FBKConseils, we offer a number of services to help you manage your annual taxes as effectively as possible

A first introductory meeting

At FBK Conseils, we offer a first 20-minute discussion free of charge, either by video conference or directly at our offices in Lausanne. This initial meeting is primarily intended to answer all your questions about wealth tax, optimisation strategies, or any other tax-related topic that may concern you. If needed, we can also explain in practical terms how our fiduciary firm could support you with all of your tax and financial matters.

Advice meetings

You can choose the length of the appointment, and we’ll take the time to answer all your questions, run live simulations and suggest ways of optimising your business.

Tax return

Entrust us with your tax return to ensure that no tax deduction is overlooked, guaranteeing a fair and optimised tax burden.

Learn how to file your tax return

We offer face-to-face training sessions in our offices or by videoconference to teach you how to declare your income and assets accurately. This enables our customers to become more independent while being sure that their tax return is completed correctly.

Tax and economic simulation

If you are considering a life project, whether professional or private (moving house, getting married, having children, changing jobs, starting a self-employed business or buying property), we can provide you with a precise analysis of the tax and economic implications of these changes.