Written by Yanis Kharchafi

Written by Yanis KharchafiHow will marriage affect your taxes in Geneva?

Introduction :

Have you found your soul mate and are about to put the ring on her (or his) finger? A little voice in your head has reminded you that tax isn’t cool and you’ve come to the conclusion that even if marriage isn’t linked to tax, it might be a good idea to check?

I’m here to answer the question: will my taxes go up, down or perhaps stay the same after this major step? Oh, and if you’re not from Geneva, please note that taxes are specific to each canton. For the people of Vaud, we asked ourselves the same question: Tax and marriage in the canton of Vaud: is it a good idea?

To give you a clear and concise answer, I suggest we tackle the question as follows:

- A brief reminder of how tax works in the canton of Geneva

- Understanding the changes in calculating tax once you’re married

- Determine whether certain deductions will change after the marriage.

Then mix the last two points to conclude.

The line-up:

How income tax works in Geneva once you’re married?

Unlike the way tax is calculated in the canton of Vaud, the canton of Geneva did not want to make things easy. We have taken the time to provide all the necessary details in our dedicated article, but here we will focus on the difference between a single couple and a married couple.

The first thing to know is that you need to determine two very important things:

Step 1: Determine the taxable income

This is the income that will actually be taxed in Switzerland. It includes your salary, pensions, annuities, as well as any interest and dividends, minus all deductions allowed by the Canton of Geneva and by the federal authorities. This is generally the figure our clients are more or less familiar with.

Step 2: Determine the income relevant for the tax rate

This is where things start to get more complex, as very few of our clients are aware of the existence of a second key figure: the income used to determine the tax rate applied to your taxable income. Stated like this, it may sound a bit confusing, but give me a moment and it will become much clearer.

When you are single, with no real estate and no specific tax considerations, your taxable income is identical to the income used to determine the tax rate. However, things become more complex when, for example, you own property abroad which, under applicable tax treaties, is not taxable in Switzerland.

In this situation, the foreign income, although exempt from tax in Switzerland, will still increase the income used to determine the tax rate, without affecting your taxable income. As a result, you will be taxed at a higher rate than the one corresponding to your actual taxable income. The same principle applies to married couples in Geneva. Once the ring is on your finger and the paperwork is signed, your incomes are combined to calculate the couple’s taxable income and divided by two to determine the applicable tax rate.

In short, if this still feels a bit unclear, let us look at a numerical example.

Let us imagine that I am living in a domestic partnership, that my taxable income amounts to CHF 58,100, and that my partner is not working at the moment.

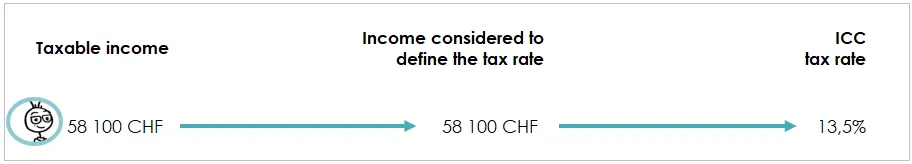

Here is what my tax return would look like as a single taxpayer:

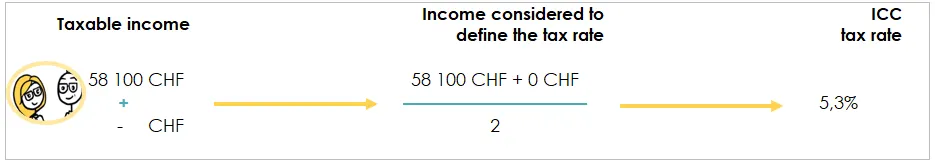

Now let us imagine that we decide to get married. The Canton of Geneva applies what is known as full splitting of income. This means that the household incomes are combined and divided by two to determine the applicable tax rate.

In this example, the same income of CHF 58,100 would no longer be taxed at CHF 13.5% but at 3.3%, what a bargain!

In reality, it is quite common for both taxpayers to work, and this changes the situation. By dividing the total income by two, the higher salary will be taxed at a lower rate, while the lower income will be taxed at a higher rate.

What conclusion can we draw from all this?

If there is only one thing you should take away from all this, it is that with full splitting the rule is simple. The greater the difference in income between the two taxpayers, the more financially advantageous marriage becomes. Conversely, the closer the two incomes are, the smaller this advantage will be.

The tax rate is a large part of the answer, but there is another component that can change the picture somewhat: tax deductions in Geneva.

What tax deductions will change once I’m married?

In addition to the Geneva splitting, the canton, commune and Confederation offer certain deductions for married couples.

Cantonal and communal deductions in Geneva

At commune and canton level, only one deduction should be noted:

Deduction from the earnings of one of the spouses/partners

This deduction amounts to CHF 1,051 for the 2025 tax year when both spouses are gainfully employed.

Federal deductions

Regardless of whether you live in Geneva or not, once you are married, you are entitled to two additional federal deductions.

Deduction from one spouse’s earnings

It works in the same way as the cantonal deduction, although it is calculated as a percentage of the lower income and can reach a significantly higher amount, up to CHF 14,100.

Deduction for married couples

You are also entitled to a standard deduction of CHF 2,800. We are beginning to cover the full picture. Let me offer one last thing. We will take our example and show you exactly how the figures change before and after marriage, taking all our explanations into account.

Example of a Genevan couple before and after marriage in 2025 :

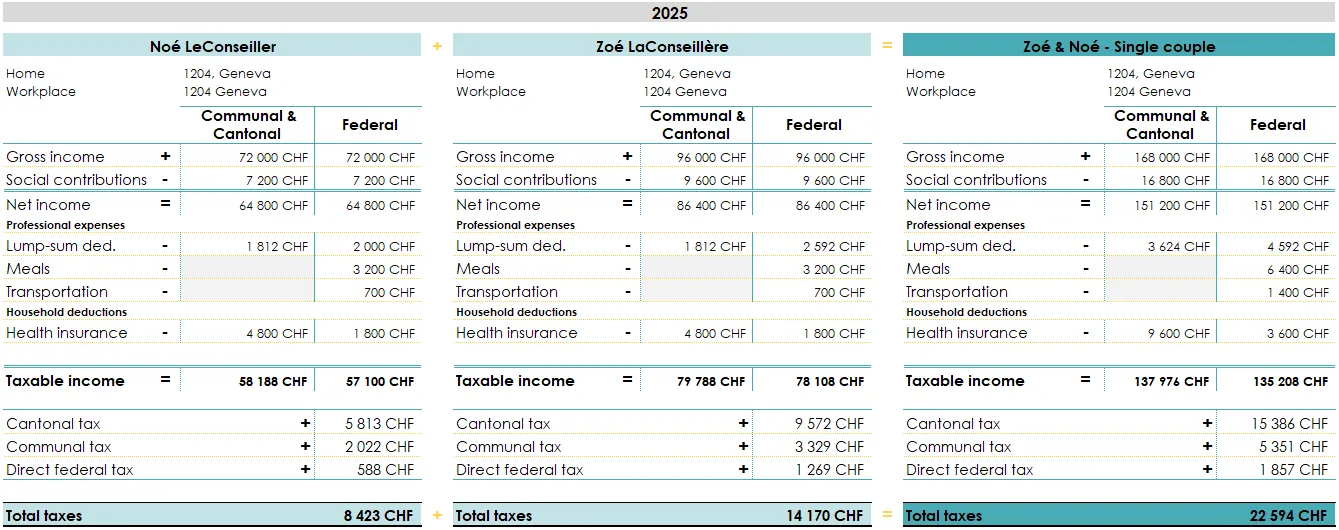

In this final section, I suggest taking a look at my situation and my wife Zoé’s. We both live in Geneva, my wife earns a gross salary of CHF 96,000, and my own salary amounts to CHF 72,000.

Before getting married, this is what our taxes looked like:

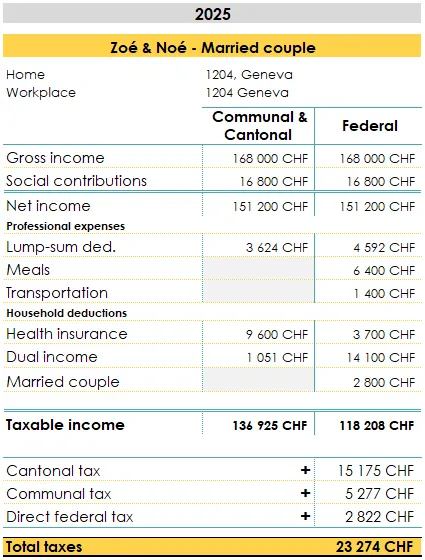

And this is what our taxes will look like after the wedding:

How to conclude? After all the research, calculations and writing, we reluctantly reach the conclusion that in Geneva, unless there is a very significant difference in income, being married or unmarried leads to almost the same result. I am a bit disappointed myself, but it was still worth asking the question. We can note, however, that if marriage is slightly disadvantageous in our example, it is clearly due to the federal layer of taxation. Being married leads here to the following:

- A decrease of CHF 285 in our cantonal and communal income tax (ICC)

- An increase of CHF 965 in our federal income tax (IFD)

In the end, the tax cost of our marriage is CHF 681, so it is not such a bad outcome.

Remember, the situation here is simple:

- No children, no childcare costs

- No assets

- No property

- etc.

We cannot guarantee that our theory will be applicable to your situation if it is more complicated than ours. Please do not hesitate to contact us for a quick tax simulation specific to your situation.

Wealth tax in Geneva, what happens after marriage?

This is a new section we decided to add for the year 2026, since it is true that most people tend to focus on income tax, although some of our clients also face a significant tax burden on their wealth in Switzerland. So what happens when you get married?

- Does the matrimonial regime have any impact on wealth tax in Geneva?

- And is full splitting available, as it is for income tax?

Before we answer, let us review a bit of theory. In Geneva, as in the rest of Switzerland, there is indeed a tax on an individual’s net wealth. The Canton of Geneva, in its great generosity, grants an exemption on the first several tens of thousands of francs before taxation begins.

Here are the amounts applicable in 2025:

- A single taxpayer may deduct up to CHF 87,632 as a social deduction on wealth

- A married couple can deduct twice that amount, which corresponds to CHF 175,264

- Anyone with a dependent child is entitled to an additional deduction of CHF 43,816.

In principle, these few lines are enough to answer everything:

- No, the matrimonial regime has no impact on wealth tax.

- No, there is no splitting mechanism for determining the applicable tax rate.

In summary, once you are married, your respective assets are combined, and you then deduct the social allowance you are entitled to. The remaining amount is taxed according to the same scale, whether you are married or single.

So, is it financially attractive? The answer is simple, no. Getting married generally leads to a higher tax burden when we look only at wealth tax. Since both assets are combined and the deduction does not double proportionally, the tax rate can increase quite quickly. In the end, you keep the same level of wealth as before, but it is taxed at a higher rate. Not very romantic, I know, but this is the reality of wealth taxation in Geneva.

Before ending on a bitter note, it is important to remember one of the major advantages of marriage. Even though the assets are combined, marriage allows you to transfer or bequeath your estate to your spouse with no tax at all, whether during your lifetime or upon death. By contrast, for unmarried partners who choose not to marry, gift or inheritance taxes can be extremely high.

How can FBKConseils help you?

Tax simulation

In this article, we’re talking about marriage, but that’s not all there is to life! Many events can have an impact on your tax situation: the birth of a child, moving house, buying a property in Switzerland or abroad, or a change in salary. All these changes can affect your annual tax bill. If you have any questions or doubts, FBKConseils is there to support you and help you anticipate the impact of your future projects.

Not just taxation

Marriage affects your taxes, of course, but it also touches on other essential aspects of your life, such as your pension, inheritance rights and protection between spouses. Although in some cases the tax impact of marriage may seem limited, it can have much wider repercussions.

Tax return

At FBKConseils, our core business is helping our clients file their tax returns. There are two options. Either we take care of the entire process, from A to Z, and all you have to do is validate the finalised version before submitting it. Or you want to learn how to complete your return yourself, so that you have a better understanding of what needs to be declared and what can be deducted. In this case, we will guide you during a meeting, and you will complete your return with our assistance.