Written by Yanis Kharchafi

Written by Yanis KharchafiHow will marriage affect your taxes in the canton of Vaud?

Introduction: Marriage — a love story… and a tax story?

“Will you marry me?” — “Yes, but wait, let me first check whether it works out tax-wise!”

There, it’s said. That’s the answer every future couple should theoretically give before making the most obvious decision of their lives. Of course, it’s a joke (well… sort of). Marriage should obviously not depend solely on purely material considerations. But honestly, in Switzerland, getting married can have major consequences, particularly from a tax perspective — and it would be a shame to ignore them entirely.

In this article, we will focus exclusively on taxes in the canton of Vaud. For our friends in Geneva who are asking themselves the same legitimate question, we have prepared a dedicated article for your canton:

Taxes and marriage in the canton of Geneva: Is it a good idea?

Before answering the central question — “marriage = tax advantage or tax trap?” — a few important clarifications need to be highlighted upfront:

- Tax scope: Here, we are focusing purely on income tax and wealth tax. These are far from being the only tax-related aspects of marriage.

- Gifts and inheritance: Marriage can offer significant tax advantages when it comes to gifts and inheritance (often full exemptions between spouses in most cantons). This topic alone would deserve an entire article.

- Social protection: Beyond taxation, marriage also provides legal protection for your spouse in the event of an accident, illness, or death (AVS survivor’s pensions, residence rights for foreign spouses, etc.).

In short, yes — getting married will have an impact on your taxes, and we will explore this throughout the article. But please, don’t forget that marriage is much more than just a tax return.

The line-up:

How is tax calculated in the canton of Vaud?

If it’s clarification you’re after, then don’t waste your time here – go straight to our guide to calculating tax in the canton of Vaud. Here, we will focus only on what really matters for our explanation. In a nutshell, the canton of Vaud has its well-known family quotient system: it is a factor that divides your income in order to determine the tax rate at which you will be taxed.

This quotient equals :

- 1 if you are single,

- 1,8 if you are married,

- And we can add 0.5 per dependent child to this figure.

Incidentally, cohabitees are people who have decided to live together but not to marry. For you, the quotient remains at 1 and you can add 0.25 per child if you have joint custody. You will therefore have a quotient of 1.25.

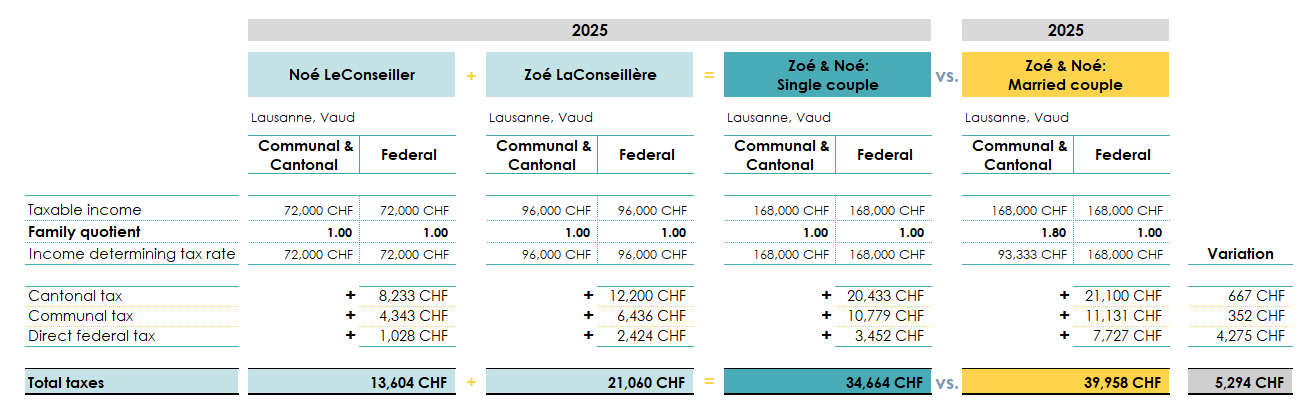

Let’s get back to business. My name is Noé and I have a taxable salary of CHF 72,000 and my wife Zoé has a taxable salary of CHF 96,000:

- As a single person with a family quotient of 1, I will be taxed on CHF 72,000, at the tax rate corresponding to CHF 72,000 (CHF 72,000 divided by 1).

- As a single person, Zoé would be taxed on CHF 96,000 at the rate of CHF 96,000.

- If we were married, we would be taxed on CHF 72,000 + 96,000 = CHF 168,000 at a rate of 168,000 divided by 1.8 = 93,300.

This means that my salary of CHF 72,000 is taxed at a higher rate than if I was single, while my wife’s salary is taxed at a lower rate than her real salary…. You’ll agree with me that, on the face of it, this story doesn’t smell very good.

To put a value on it, we’re going to say that we live in the commune of Lausanne and that for the moment we have no assets or other income.

In conclusion, if after marriage our tax burden increases to around CHF 40,000, whereas as single people we paid a total of CHF 34,700, it goes without saying that when you love someone, you don’t count the cost… CHF 5,300 more in tax!

But beware of those who draw conclusions based on a single example! Because even if this example is correct, it does not accurately represent reality.

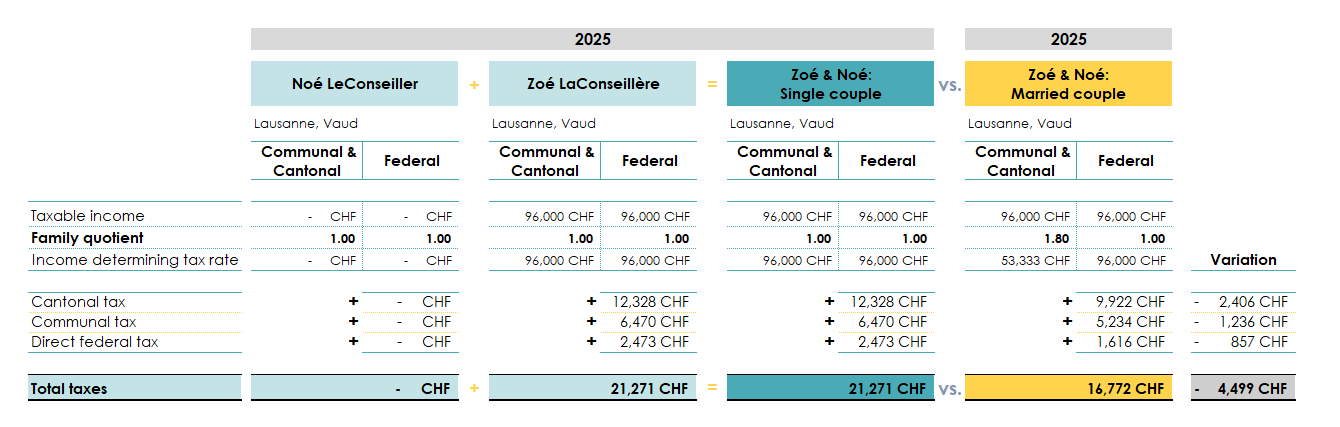

Let’s do the same exercise again, but this time assuming that because of all the texts I write I no longer have time to take care of clients and therefore my income drops from CHF 72,000 to CHF 0 for the year 2025…

There you go, you’ve come to conclusions too early… Being married here would save you almost CHF 4,500.

What conclusion can we draw about marriage and taxes in the canton of Vaud?

For a long time, I mistakenly believed that the biggest tax difference for married couples came from the famous family quotient of 1.8 in the canton of Vaud. In my view, it should logically have been 2.0 to ensure true tax fairness.

Admittedly, my intuition wasn’t entirely wrong, since our simulations do show that cantonal and communal taxes increase by around CHF 1,000 for married couples in our example, precisely because the income is divided by 1.8 instead of 2.0.

But here comes the real surprise: the majority of the tax penalty resulting from marriage, CHF 4,275 in our example, actually comes from the direct federal tax! That’s where the real tax trap lies.

Why this difference? In the calculation of federal tax, there is simply no income-splitting mechanism like at the cantonal level. The Confederation has chosen a radically different approach: two completely separate tax scales, one for single individuals and one for married couples. And without any clear explanation of the legislator’s motivations, the reality is that this system has created a much less favorable tax scale for married couples than for two single people living together.

The title of this section is intentionally provocative. We could stop here and conclude that on average, getting married costs more in taxes, and that only in rare cases (when the spouses’ incomes differ significantly) might the overall tax burden decrease slightly. But that would be an incomplete picture and would miss a key part of the Swiss tax system.

Because in Switzerland, when we try to accurately simulate a tax burden, there is not only the calculation of rates and tax scales discussed above, but also—and above all—the authorized tax deductions, which directly reduce your taxable income before the tax scales are even applied. And that’s where things can either become more complicated… or significantly improve.

Tax deductions for married couples in the canton of Vaud

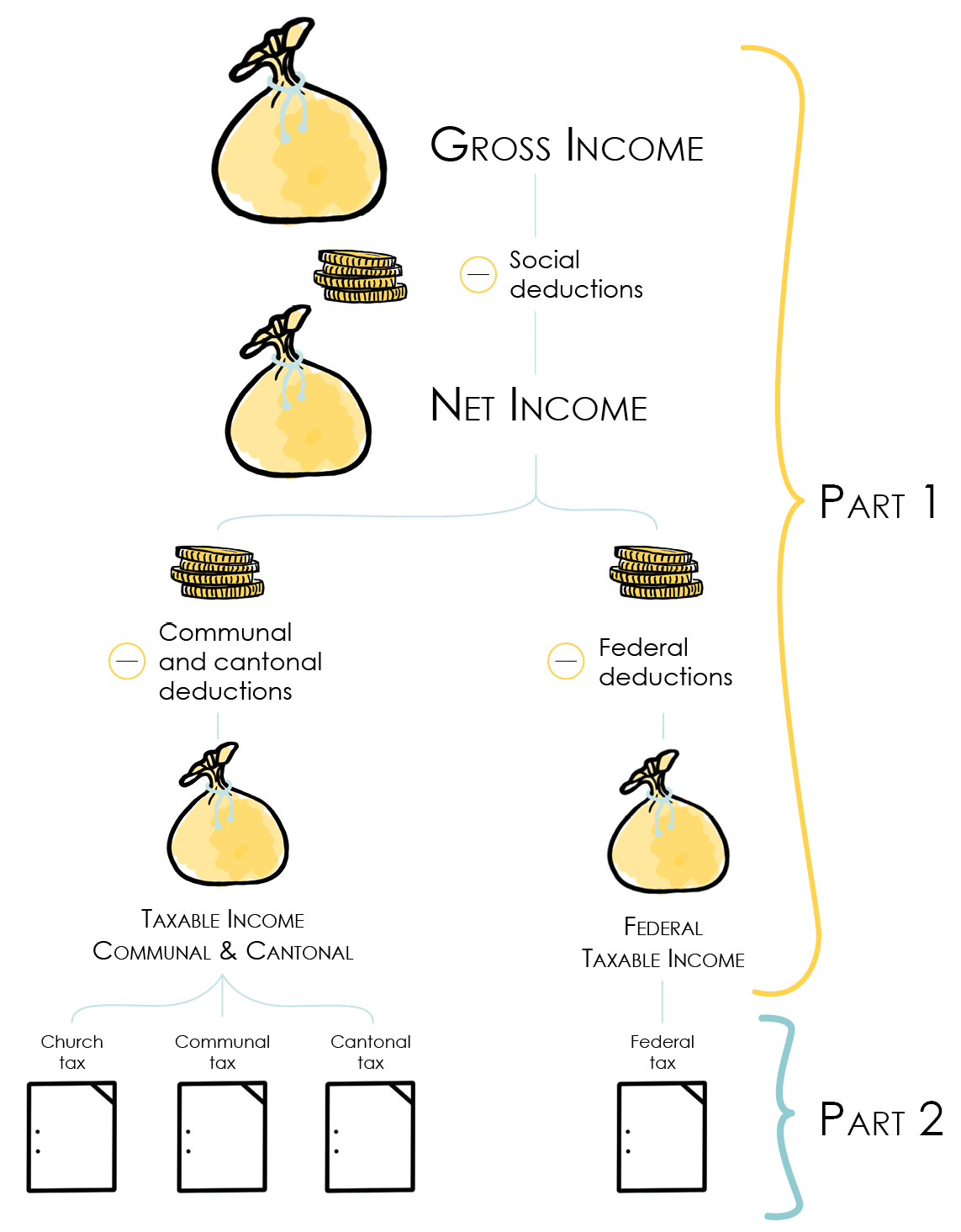

Even if you’ve already got a fairly clear idea of the situation, there are still a few points to be clarified because, as I like to remind you, tax is made up of two parts:

- Determine your taxable income using the tax deductions (which we are about to determine now)

- Calculate cantonal, communal, and federal taxes (a calculation we have carried out up to this point)

So, what about these deductions?

You will probably be a little disappointed, because yes, you will be entitled to a few deductions, but make no mistake, we are not talking about very large amounts…

There are 4 deductions in all, two for cantonal and municipal tax and two for direct federal tax:

Tax deductions at cantonal and municipal level (ICC)

The deduction for double employment for spouses or registered partners

It allows you to deduct CHF 1,700 from your taxable income if both spouses are working. This deduction did not change between 2024 and 2025.

Family allowance

Once you are married, you will be considered a household, and to congratulate you… each year you will be entitled to deduct an additional CHF 1,300 from your income. This deduction did not change between 2024 and 2025.

And that’s it! At least, for the taxes of the canton of Vaud, there’s still the confederation.

Tax deductions at federal level (IFD) – News 2026

No matter how hard we look, only two deductions stand out. They are called:

- The deduction for spouses or registered partners living in the same household. The amount of this deduction is CHF 2,800 in 2025, compared to CHF 2,600 in 2024.

- The deduction for double-income spouses or registered partners: This amounts to at least CHF 8,600 (up from CHF 8,500 in 2024) and can increase up to CHF 14,100 (up from CHF 13,900 in 2024), depending on the income of both taxpayers (art. 33 of the Federal Direct Tax Act – LIFD).

That’s it… We’re done… Let’s conclude by mixing up tax calculation and deduction, and then you can make up your own mind on the matter.

Finally, do Vaud taxes encourage marriage?

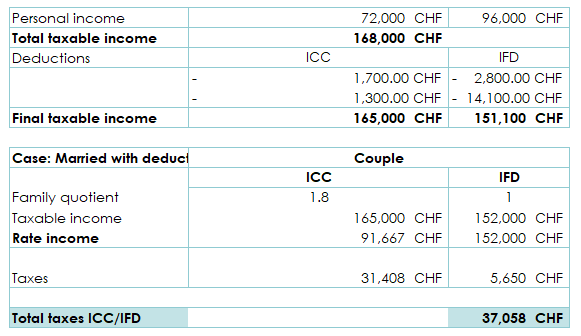

If we go back to our example, which was not in favour of marriage with my CHF 72,000 income and my wife’s CHF 96,000, would the situation change if we included the 3 deductions?

The new situation including deductions

Before applying the additional deductions related to marriage, the tax balance was almost CHF 40,000, compared with CHF 37,000 now. It is therefore clear that applying these tax deductions specific to married couples has genuinely and significantly improved the tax situation of our married couple.

Nevertheless, CHF 37,000 for a married couple compared with CHF 34,600 had we remained unmarried is still not in favor of marriage from a purely tax perspective. There therefore remains a penalty of around CHF 2,400 per year, even after applying all available deductions. Does this annual difference of CHF 2,400 really deserve to be considered a decisive criterion for such an important and personal decision as whether or not to get married?

Keep in mind that every situation is different—children, income levels, deductions, and so on. It is impossible to give a single, precise answer that applies to everyone. But even though marriage should never be reduced to tax considerations alone, it is certainly not a bad idea to run this kind of simulation before saying “yes” for life.

How can FBKConseils help you with taxes and marriage?

A free initial meeting to get started

That’s right! At FBK Conseils, in addition to writing all these articles and creating videos on the economic and tax topics you’re interested in (or at least we hope you are!), we are committed to offering a first discussion free of charge, lasting around 20 minutes. This meeting can take place either in our offices in Lausanne or by video conference, in French or English, depending on your preference.

Carrying out a personalized tax simulation

At FBK Conseils, we help you anticipate major life changes: marriage, of course, but also the arrival of a child, a move to another canton, a change in professional status, or the purchase of real estate—whether in Switzerland or abroad. We firmly believe that anticipation leads to better management of your overall financial situation and helps avoid unpleasant tax surprises. That’s why we offer detailed and personalized tax simulations to help you accurately forecast the future impact of these events on your annual tax burden.

Full delegation of your tax return

While we aim to modernize the fiduciary profession, we are first and foremost a fiduciary firm! And like any professional practice, we offer our clients the option to send us all the required documents (salary certificates, bank statements, supporting documents, etc.), after which we take care of your entire tax return. We then share successive drafts with you, along with any questions we may have, until we are able to submit the final version on your behalf to the Vaud tax authorities. Simple, efficient, and hassle-free.

Training to learn how to file your own tax return

In a less traditional but equally popular approach, we also offer clients who wish to learn more about the Swiss tax system the opportunity to be actively involved in the process. The goal? To understand what needs to be declared, at what value, what can be deducted, and to what extent. In short, to grasp the mechanics of taxation in order to better plan for the future and gain autonomy. With this option, we complete your tax return together, step by step, from start to finish. While the time savings for you are less than with full delegation, your tax knowledge and long-term independence will be significantly enhanced. In a way, it’s an investment in your financial education.