Written by Yanis Kharchafi

Written by Yanis KharchafiUnderstanding your income taxes in the canton of Vaud

Introduction

Welcome to this new article, the main aim of which is to help you better understand how income tax works in the canton of Vaud. We will answer key questions such as: What income is taxable? What are the income tax rates in the canton of Vaud? What can be deducted from tax? And most importantly, how is tax calculated, taking into account our local speciality, the family quotient?

At FBKConseils, we find that, year after year, our clients who take the time to learn at least the basics of the Swiss tax system have a better view of their budget. They have a better grasp of the impact that a life change can have on their tax situation, and are able to consider strategies for optimising their tax burden. In this way, they can determine whether their annual tax assessment has been carried out correctly or whether, on the contrary, it is necessary to investigate.

The line-up:

What are the income tax rates in the canton of Vaud?

The first thing to understand is that in the canton of Vaud, the tax rate depends on your family situation and on what we Vaudois call the “family quotient” (quotient familial). This system, while specific to our canton, is fairly similar to the one used by our French neighbours and is based on a comparable principle: a progressive reduction of the tax rate depending on the composition and size of the tax household.

The fundamental principle – the larger your household, the less tax you pay

Before diving into the technical details of this somewhat complex mechanism, keep this basic rule in mind: the larger your household (marriage, dependent children, etc.), the lower the effective tax rate applied to your taxable income will be. This is the underlying philosophy of the Vaud system: to provide tax advantages to larger families.

Municipal variations – up to a 5% difference!

In addition, each municipality in the canton of Vaud has a certain degree of autonomy to set its own tax rate through its municipal coefficient. Tax differences between municipalities can be significant, ranging from 0% to as much as a 5% gap between the most heavily taxed municipality and the most lenient one. This is therefore far from negligible when choosing where to live.

Our reference example – Lausanne 2025

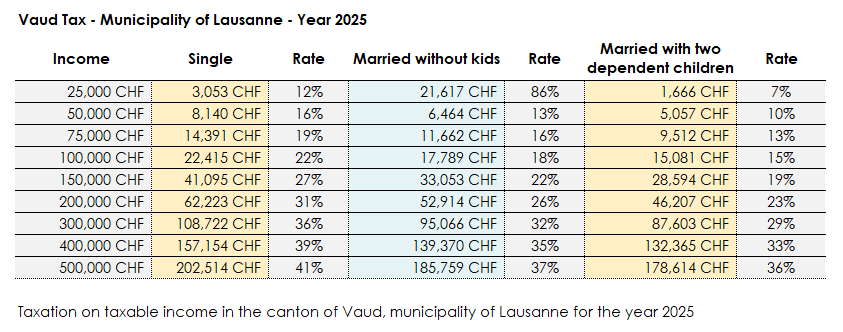

To give you a concrete, numerical illustration of income tax rates in the canton of Vaud, we offer a detailed overview for the year 2025, based on a situation in the municipality of Lausanne. We chose Lausanne because it is the economic capital of the canton and a common point of reference. However, keep in mind that many other Vaud municipalities may offer much more favourable tax conditions. Comparing municipalities before choosing your place of residence can therefore be very worthwhile.

If this topic interests you, we have also written an article on tax optimisation for residents of the canton of Vaud, where we explain in detail the impact municipalities can have on your overall tax burden.

What does this table tell us? After deducting your employer’s social security contributions and applying all authorised tax deductions, your gross income will be taxed at a rate ranging from 7% to 41%. This illustration takes into account all taxes – cantonal, municipal and federal.

Step 1: Determining your taxable income in the canton of Vaud

The first step in any tax calculation in Switzerland (and not only in the canton of Vaud!) is to add up all the income received during the previous tax year. After that, the process differs slightly depending on your professional status:

If you are an employee:

You must deduct all mandatory social security contributions (AHV/AVS, IV/AI, EO/APG, unemployment insurance, pension fund/LPP, accident insurance/LAA, etc.) from your gross salary in order to obtain your net income.

If you are self-employed:

You must keep full accounts in order to deduct all operating expenses from your gross income and thus calculate your taxable net profit.

For everyone, regardless of their situation:

Once your net income has been determined, you can then claim all allowable tax deductions (health insurance premiums, third pillar contributions, childcare costs, mortgage interest, etc.) to arrive at your final taxable income.

To go further: our in-depth articles

As we do not wish to dwell unnecessarily on topics that are already covered in detail elsewhere, we strongly encourage you to consult our articles specifically designed to explain these mechanisms in depth:

Understanding how to move from your gross income to your taxable income in Switzerland

Which deductions are allowed in the canton of Vaud

We recommend continuing with this article once these two points are perfectly understood, as they form the essential foundation of any tax calculation.

Step 2: Define your qualifying income for the rate

This is where things get complicated. In Switzerland, once you have defined your taxable income (the income that will actually be taxed, as mentioned in the previous paragraph), you need to determine the rate at which that income will be taxed. This is precisely where the special Vaud feature comes into play: the family quotient. This is a factor that varies according to the size of your household and will be used to divide your taxable income, directly influencing the rate of tax applied.

Step 3: Determine your family quotient in the canton of Vaud

« My what now ? »

Your family quotient.

And if you are wondering whether this term refers to an IQ test your whole family will have to take… No, that’s not it.

As you probably know, tax returns are done per household. Therefore, each household gets a family quotient to determine their tax rate. The more people you have in your household, the higher the family quotient will be and the lower the tax rate. This is a key step before you start calculating tax.

- Single, divorced, widow(er), or taxed separately: your family quotient is of 1: Your taxable income will be taxed at the same rate.

- married couple without children or registered partnership without children: your family quotient is of 1.8: Your taxable income will be divided by 1.8 to determine the tax rate.

- Single-parent household: your family quotient is of 1.3

Then, add 0.5 points for each dependent child.

Example…

You are a young married couple without children, your family quotient is of 1.8.

You are a young married couple with one child, your family quotient is of 2.3. Two children? Your family quotient is of 2.8.

You are a young non-married couple with one child (it goes by the sweet name of concubine), your family quotient is of 1+0.5=1.5. Two children? Your family quotient is of 1+0.5+0.5=2.

You are a single mother with a dependent child, your family quotient is of 1.3+0.5=1.8. Two dependant children? Your family quotient is of 1.3+0.5+0.5=2.3.

What does this mean in concrete terms?

Imagine, your household has a taxable income of 100,000 CHF with a 2.3 quotient (married with one child).

You divide 100,000 by 2.3 and you get the relevant income for the calculation of the final taxation rate of 43,400 CHF.

The people in charge of determining your taxes will look for the rates corresponding to 43,400 CHF (in the table below) and then apply it to your total income of 100,000 CHF.

You are single, without any children (quotient 1) and your taxable income is 100,000 CHF? in this case, your final taxable income remain unchanged: 100,000 CHF.

Please note: This quotient system only works like this if your household is not considered a privileged household. If your income exceeds a certain level, you will no longer be able to increase your family quotient for each child. But they will allow you to deduct a fixed amount while keeping your previous family quotient.

Remember that you can minimise your taxable income by taking into account all the tax deductions you are entitled to.

Great news: the heavy lifting is done!

Step 4: Applicable scale in the canton of Vaud : how does it work?

At this stage of the article, we’ve already done half the work: we’ve established :

- Your taxable income, the income that will be taxed.

- The income that determines the rate thanks to the family quotient.

Now we need to use the Vaud tax scales available to us to calculate the tax that will be due.

What is a scale?

Put simply, it is the bracket within which your determining income is calculated using your family quotient.

Let’s take two simple examples:

Example 1: single person, without children and with a taxable income of 50’200 CHF, then we divide by 1, which gives again 50’200 CHF… obviously… After calculating discussions, you determined, for instance, that the taxable amount is 50’200 CHF.

Example 2: Married couple with one child, and a taxable income of 115,500 CHF, then we divide by 2.3 (1.8 + 0.5), which gives 50,217 CHF (this way, we keep the same rate of the 50,200 CHF bracket, but not the same tax amount!)

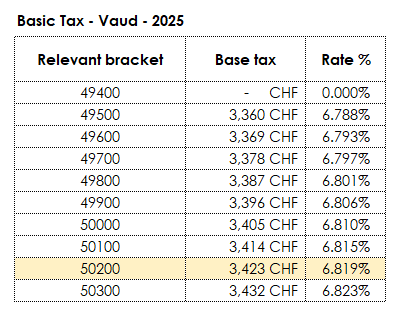

At this stage, you have to refer to the table listing the various income brackets.

Each canton has its own tax table, and in order to complete our two examples, we have taken an excerpt from the 2025 table, which you will find below:

In Example 1 (single person with no children):

With a taxable income of CHF 50,200, you can see that the base tax amounts to CHF 3,423, which corresponds to a tax rate of 6.819%.

In Example 2 (married couple with one child):

With a taxable income of CHF 115,500 and a rate-determining income of CHF 50,200, we apply the corresponding rate, i.e. 6.819%, to the household’s taxable income of CHF 115,500.

This results in a base tax of:

115,500 × 0.06819 = CHF 7,875.95.

Little by little, the bird makes its nest. After the above calculation, we arrive at what is known in the canton of Vaud as the basic tax. For example, for the first scenario, the basic tax is CHF 3’423, and for the second example, it is CHF 7’875.95. It is from this basic tax that we will finally be able to calculate the Vaud cantonal tax as well as the municipal tax.

Keep those base taxes in mind and move on to the next step.

Feeling lazy? Check out our fiscal calculator!

Step 5: Calculate cantonal and municipal tax in the canton of Vaud

Phew! We are reaching final stages.

Now we have the most important figure: Basic tax.

Basically, we will simply take the basic tax and multiply it by the cantonal rate, then in a second step by the communal rate. The addition of the two results will give us our total ICC tax.

How to calculate cantonal tax?

Each year, the canton publishes its tax rate, which is valid for the entire year and applies to all municipalities. The cantonal tax rate in Vaud has been set at 155% since 2021, and this rate remains in force through 2025 inclusive.

Which means that:

- In example 1: I owe CHF 3,423 × 155% = CHF 5,305.65 in cantonal taxes to the canton of Vaud. But surprise! For 2024 and 2025, the canton of Vaud grants an additional tax reduction (applicable only to income tax, only at the cantonal level, not at the municipal level—but still, better than nothing): 4% in 2025 compared to 3.5% in 2024.

- In example 1, this results in a reduction of CHF 5,305.65 × 4% = CHF 212.20, giving a final cantonal tax for 2025 of CHF 5,093.45.

- In example 2: The cantonal tax amounts to CHF 7,875.95 × 155% = CHF 12,207.70. Applying the same 4% reduction, we obtain a final cantonal tax of CHF 11,719.

How is municipal tax calculated?

Unlike the cantonal rate, which applies to all communes, the municipal tax rate varies from one commune to the other.

In Lausanne, it is 78.5% for the 2025 tax return.

Which means:

- In example 1: I owe 3,423 CHF * 78.5% = 2’687 CHF in taxes to my commune. In total, I therefore owe (5’093.45 + 2’687) 7’780.50 CHF in taxes to which I still have to add the federal tax.

- In example 2: We owe 7’875.95 CHF * 78.5% = 6’182.60 CHF in taxes to the commune. Which makes a total of 17’901.60 CHF in ICC taxes.

Here is how we calculate, from A to Z, the annual tax at the cantonal and communal level, with the family quotient.

Before moving on to the final stage, it is important to highlight the variations in tax rates between the various communes in the canton of Vaud.

Vaud municipalities with the lowest tax rates in 2025

- Eclépens : Communal rate of 46%

- Coinsins: Communal rate of 49%

- Genolier: Communal rate of 52%.

- Dully: Communal rate of 53%

- Lutry: Communal rate of 54%.

Vaud municipalities with the highest tax rates in 2025

- Rossinière: Communal rate of 81%.

- Saubraz : Communal rate of 80%.

- Château d’Ôex and Tartegnin: Communal rate of 79.5%

- Lausanne: Communal rate of 78.5%

- Renens : Communal rate of 77%

To illustrate the difference in tax rates, let’s reconsider the example of a single person deciding whether to set up home in the commune of Coinsins or in Rossinière. Here’s the calculation:

- Communal tax in Coinsins: Basic tax CHF 3’423 multiplied by 49% = CHF 1’677.30

- Rossinière municipal tax: Basic tax CHF 3’423 multiplied by 81% = CHF 2’772.65

The difference in cost between these two communes is more than 65%, highlighting the significant impact of the commune’s choice on the tax burden.

End of parenthesis, let’s move on to the last stage.

Step 6: Calculate your total cantonal and municipal tax (ICC)

We’re nearing the end of this article. Now that we’ve worked out the cantonal and communal taxes, all you have to do is add them up to find out what you have to pay to the canton of Vaud.

However, there is some bad news at the end of this article: in addition to this tax, Switzerland and the Confederation also reserve the right to levy a tax on your income. Another complication is that the Confederation does not apply the same rules for deductions, family quotient and tax calculation. To establish your precise annual tax burden, you will therefore also need to take the time to calculate direct federal tax.

How can FBKConseils help you with your taxes in the canton of Vaud?

FBKConseils is a company specialising in financial advice for private individuals and self-employed professionals in Switzerland, with particular expertise in taxation. We are delighted to offer you the following services:

Free introductory meeting

At FBK Conseils, we always like to complement the information available on our website with a first free consultation lasting 20 minutes. This initial discussion, with no obligation on your part, is primarily intended to answer your specific questions and, if necessary, to explain in concrete terms how our firm could support you with all your tax and wealth-management matters.

Delegating your tax return

We can help you manage your tax return from A to Z. All you have to do is provide us with your documents and we’ll take care of everything: from receiving and entering the information, answering your questions, and finally forwarding your return to the tax authorities. We also offer a follow-up service once your tax ruling has been received, to ensure that everything is in order.

Tax return training

For the past two years, FBKConseils has been offering training sessions in our Lausanne offices to teach you everything there is to know about tax returns. This service allows you to get personalised answers to your questions and to create a reliable example that can be used as a reference for years to come.

Challenging a taxation decision

Sometimes certain deductions are not accepted or the tax authorities dispute your return. FBKConseils can help you understand the decision and assist you in drawing up a dispute, ensuring that your rights are fully exercised.

Simulations of changes in situation and advance payment adjustments

We also offer a simulation service for any change in your personal situation, whether it’s a wedding, a birth, a property purchase, a move or a change in salary. By simulating the tax impact in advance, you can better plan your budget and explore tax optimisation strategies.