Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on December, 3rd 2025.

How can I maximise my tax savings in Geneva?

Introduction

Optimising tax should be a major concern for many residents of the canton of Geneva. At FBKConseils, we see every year that many individuals, families, property owners and the self-employed can find it difficult to understand the tax mechanisms and possible deductions, resulting in a tax burden that is far too heavy.

Understanding the Swiss tax system, and in particular tax in Geneva, can lead to significant savings.

In this article, we’ll explore the different tax optimisation strategies available to Geneva taxpayers in 2025. Get ready to discover practical tips and useful resources for lightening your tax burden and maximising your savings.

The line-up:

Step 1: Understanding the progressive nature of income tax in Switzerland and Geneva

It’s no secret, and this principle is valid in all countries: the higher the taxable income, the higher the tax.

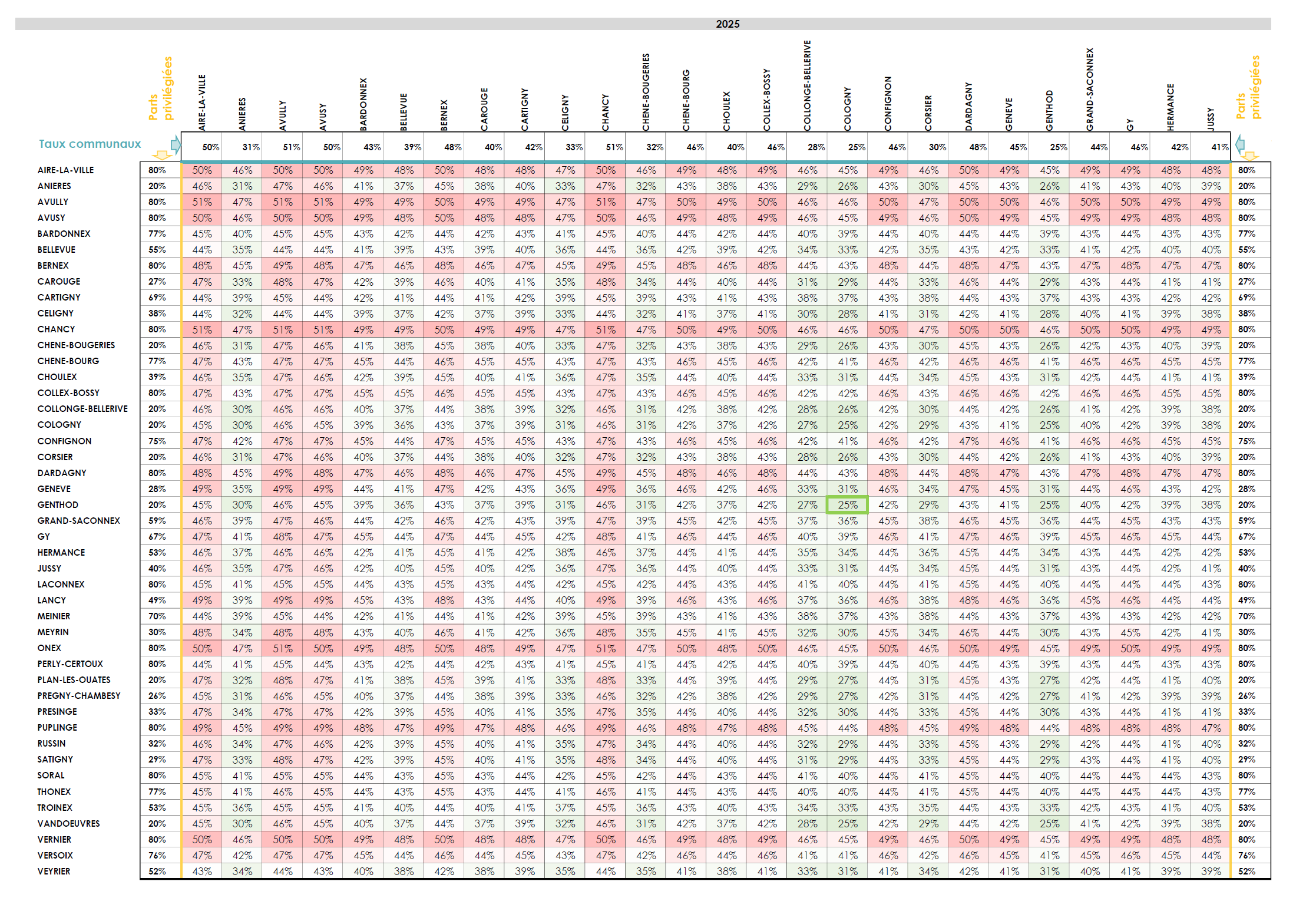

In Geneva, here’s what the tax rates will look like in 2025, depending on your income and marital status.

Income tax rates for single taxpayers in Geneva

Visually, the conclusion is already clear. But if we look at the numbers, here is what stands out. A single taxpayer in Geneva will see their tax rate range from 0 percent for the lowest incomes to around 40 percent for the highest. This certainly puts into perspective the common belief that Switzerland, and Geneva in particular, is a tax haven.

Another striking point is the shape of the curve itself. It starts at 0 percent, then the rates rise very quickly up to 30 percent, before flattening out gradually. In other words, the progression of the tax is particularly pronounced between CHF 0 and CHF 300,000 of taxable income, a range in which the tax burden increases most sharply.

Income tax rates for married couples in Geneva

Visually, the curves are very similar to those observed for single taxpayers. The main difference is that the tax rate is consistently about 5 to 7 percent lower for a married couple with an equivalent income.

To be honest, even after writing an entire article on the taxation of married couples in Geneva, I did not expect the difference to be so small. It is important to keep in mind that as a married couple, it is the combined income that is taxed. And all of this results in roughly a 6 percent reduction in the overall tax rate, which is not exactly a fiscal dream.

In summary, a married couple in Geneva will see their tax rate range from 0 percent for modest incomes to more than 35 percent for incomes exceeding CHF 900,000 per year.

Step 2: A closer look at the special tax features of the canton of Geneva.

Before diving into the various tax optimisation strategies, let’s take a moment to understand the specific tax situation of Geneva compared to its neighbours. Although Switzerland is striving to standardise taxes between cantons, each canton retains a certain amount of freedom. This autonomy can lead to significant variations in your tax burden, depending on your situation.

Health insurance: Significant deduction from annual premiums

The canton of Geneva offers significant advantages when it comes to deducting health insurance premiums, unlike its neighbours Vaud and Valais. By 2025, Geneva will be able to deduct up to twice the average cantonal premium for both compulsory and supplementary health insurance:

- For children aged 0 to 18: CHF 3’965 per year

- For young adults aged 19 to 26: CHF 12’842 per year

- For adults over 26: CHF 17’122 per year

This deduction policy is particularly advantageous for large families, such as a married couple with two children, since it provides a substantial reduction in their annual tax burden. In comparison, the other French-speaking cantons generally offer far less generous deductions and often do not even allow taxpayers to deduct the full amount of the premiums actually paid.

Medical expenses

Under cantonal rules, a limit is generally set before medical expenses actually incurred by taxpayers become deductible. In Geneva, this ‘deductible’ is set at a particularly low threshold: as soon as medical expenses exceed 0.5% of your income, the full amount can be declared and deducted from your taxable income. This advantageous measure in Geneva is distinguished by its ease of access, unlike practices in other cantons.

Childcare expenses

Like its health insurance policy, the canton of Geneva stands out for its support for families, allowing taxpayers responsible for looking after their children to deduct up to CHF 26’320 per child under the age of 14 in 2025. In addition, Geneva is unique in that childcare costs including various types of holiday camp are deductible, an approach not generally adopted in other cantons. This measure highlights the canton’s commitment to supporting families and easing the tax burden for parents who bear these costs.

3rd pillar B: Life insurance

The insurance premiums under this type of contract, which is similar in many ways to the third-pillar A, are also deductible in Geneva, a feature that is not common in most other French-speaking cantons. In Geneva, each year, depending on your family situation, you can take out a life insurance policy, whether risk based, savings based, or mixed, and benefit from deductions on the premiums you pay.

- For a single taxpayer: up to CHF 2’345 per year

- For a married couple: up to a maximum of CHF 3’518 per year

- For each dependant or child : CHF 959 per year

Be cautious with these insurance contracts, whether they fall under the 3rd pillar A or B. When signing an insurance policy, you should take into account the management fees, the commissions paid to brokers, and the quality of the underlying investments, which may not always be financially advantageous. Before signing anything, take the time to ask the right questions and to properly inform yourself, particularly regarding the surrender values of these contracts.

To sum up, Geneva’s tax policy offers significant advantages to married couples and families with children thanks to very generous deductions that clearly stand out from those offered in other cantons in French-speaking Switzerland. However, Geneva is sometimes more rigid when it comes to certain other deductions that are often recognised by its neighbours, notably :

Business expenses (meals, transport, etc.)

In Geneva, it is particularly difficult to justify high business expenses. On the one hand, flat-rate deductions are extremely limited or non-existent, and on the other, even with good reasons, justifying them remains complicated. While meal expenses are relatively similar to those in other cantons, travel and other business expenses are almost non-deductible.

Banking fees

In Geneva, it is possible to declare actual account-keeping costs and a proportion of investment management costs, provided they can be justified.However, unlike other cantons, there is no flat-rate deduction for these costs if you cannot prove they exist.

Your rent

When you file your Geneva tax return, although you must indicate the amount of your annual rent, this information is used for statistical purposes.It doesn’t matter whether your rent is CHF 15,000 or CHF 50,000, or whether you are single or the parent of six children, no rent deduction is accepted.

These specific tax issues in Geneva underline the importance of understanding the local rules before making any tax declarations or planning.

Step 3: Possible tax optimisations in Geneva

First optimisation: Choosing your commune of residence

Before we tell you which commune in Geneva is the least advantageous from a tax point of view, it’s crucial to understand Geneva’s municipal tax system, which may seem illogical. In Geneva, you don’t just pay tax in your commune of residence. Part of your council tax also goes to your commune of work. This complex system makes it difficult to simply recommend a place of residence to optimise your taxes. The most advantageous tax choice will depend on the combination of your home and work municipalities. If you haven’t yet read our article on calculating municipal tax in Geneva, we recommend that you do so to gain a better understanding of these optimisations.

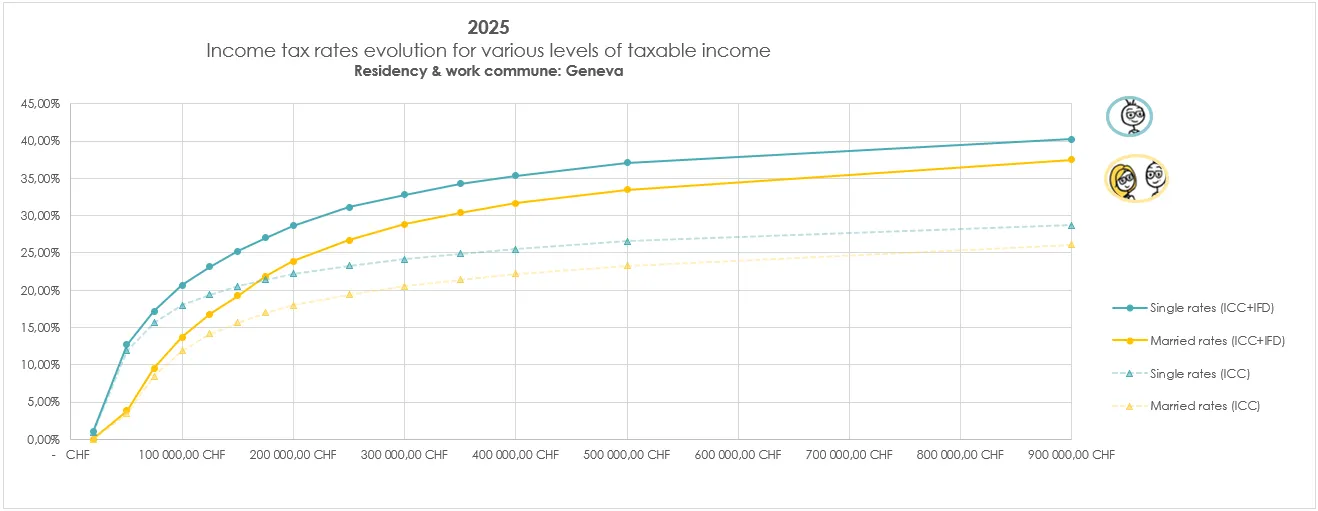

So now, here’s this famous table.

At FBKConseils, we favour precise, quantified answers based on current tax rates and legislation. We have analysed the tax rates of each municipality and created a ‘matrix’ revealing the best and worst tax combinations. Although our table isn’t the most aesthetically pleasing or the easiest to interpret, it clearly identifies which options are fiscally advantageous and which aren’t, thanks to columns coloured green and red.

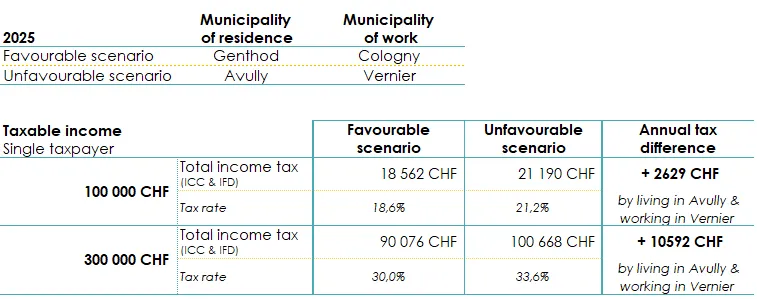

Here is, in summary, how your municipality of residence can affect your tax burden when comparing the best and worst possible scenarios, followed by our conclusions:

Communes with an advantageous tax system in 2025

Collonge-Bellerive, Cologny, Chêne-Bougeries, Anières, Pregny-Chambesy and especially Genthod offer significant tax advantages.

Communes with less favourable taxation in 2025

For tax reasons, it would be wise to avoid Chancy, Avusy, Onex and Vernier, although there are surely other excellent reasons to live there.

In short, your choice of municipality of residence in the canton of Geneva can vary your total tax burden by between 2,6% and 3,5% between the best and worst combinations.

Second optimisation: Fill in your tax return correctly

Although it may seem obvious, this second part is crucial. Every year, many clients come to us with tax returns containing errors or omissions.

That’s why it’s essential to fill in your return properly or to have it done by a specialist at least once, so that you can draw up a reliable example for future years. Common omissions include :

Understanding withholding tax and/or foreign withholding tax

Investing part of your savings can generate income, such as interest, dividends or bond coupons. These earnings are often partially withheld at source by tax authorities to ensure they are properly declared. It is therefore essential to report them in your tax return; failing to do so can lead to double taxation – a trap that many investors still fall into.

We will be publishing a full article on this topic soon, but here are the key points for now: when you receive income from your movable assets, whether in Switzerland or abroad, the countries involved have agreed to withhold a certain percentage at source before paying you the remaining amount.

Two situations may then arise:

- If you declare the income but not the tax already paid, you end up paying the same tax twice, once when the funds are paid out and again in your tax return.

- If you fail to declare both the income and the tax already paid, the situation becomes even more problematic, as you expose yourself to potential tax evasion issues, and even if it goes unnoticed, you would still be left with withholding tax that is often higher than what you should actually have paid.

In summary, always make sure to declare your investment income, and for Swiss-sourced income, report the withholding tax deducted, while for foreign-sourced income, request the foreign tax credit using the DA-1 form (and the R-US form for income from the United States).

Let’s stop here for today, a full article on this topic is coming next year. Now let’s move on to the other tax optimisation strategies!

Beware of bank charges

Our customers often declare the balances of their accounts or investments in accordance with tax laws. However, many forget to ask their bank for a tax certificate detailing the charges levied annually. These charges are often deductible, so it is essential to obtain the right documents to maximise your tax deductions.

IFD business expenses

The rules can vary significantly between the cantons and the Confederation. For example, while the canton of Geneva limits the deduction for transport costs to CHF 534 in 2025, the Confederation allows up to CHF 3,300. This difference also applies to other types of business expenses, so it is important to claim the possible deductions at each level.In Geneva, you need to be particularly careful, because even though you are limited to the flat-rate deduction at the cantonal and communal level, you can, and should, claim additional professional expense deductions at the federal level, including the flat rate, but also the actual costs for meals and transport, and yes, both can be combined.

Property income and expenses in Switzerland and abroad

Buying real estate is often a source of stress for many clients, and filing errors are common. In Swiss taxation, whether your properties are located in Switzerland or abroad, it is essential to declare them correctly, both in terms of wealth tax through their fiscal value and in terms of the income they generate, whether this comes from rental income or, for properties you occupy yourself, from the deemed rental value.

For properties located in Switzerland, the documents provided by the authorities are generally clear enough to avoid most mistakes, except perhaps when it comes to distinguishing between what is deductible and what is not. For properties located abroad, however, things get more complicated. Fiscal valuations are often overestimated, income is overstated, and deductions are… simply forgotten.

Check your tax decision

Once you have submitted your tax return, the canton of Geneva takes some time to review it, make adjustments and send you a revised assessment. This tax decision may be less favourable than your initial return. You then have 30 days to challenge it and claim your deductions. Take the time to compare, line by line, what you declared with what has been accepted, so that you can prepare an objection with the necessary supporting documents in order to restore the deductions that were initially refused, where they are justified, with evidence to back them up.

The canton of Geneva makes it easier for taxpayers: in your tax assessment decision, you will find a clear indication of the deduction you have claimed and the one that has actually been granted, enabling a direct and transparent comparison.

Contribute ‘the right way’ to one or more 3rd pillar A schemes

You’ve probably been contacted by a financial adviser offering you the chance to reduce your tax thanks to the 3rd Pillar A. Here are two important pieces of advice:

- Don’t blindly follow this advice: Although the 3rd pillar A is indeed deductible, the contracts on offer are not always financially advantageous.

- Take the time to get informed, pillar 3a can be an excellent tool for tax optimisation and long-term wealth building, but it should be chosen with a clear understanding of how it works. Before committing, ask yourself a few key questions, guaranteed or invested, insurance or bank, what commissions and fees apply, especially with insurance products, should you open one account or several, what happens if you leave Switzerland, if you can no longer make contributions, or if you simply wish to stop the plan.

In every case, an employee can deduct up to CHF 7,258 per year in 2025 through pillar 3a. A self-employed person who is not affiliated with the second pillar can deduct up to CHF 36,288.

BVG/LPP purchases in your pension fund

The second pillar in Switzerland is a broad and complex topic. Buying back missing contribution years is an effective, and for many employees the most effective, way to reduce your tax burden while strengthening your retirement security. For more details, see our article on BVG buy-backs.

How do you choose between investing in your 3rd pillar and making BVG/LPP purchases?

Until 2025, we generally advised our clients to contribute the maximum amount to their pillar 3a each year, as missed contributions could not be made up later. Starting in 2026, the rules change. It will now be possible to make retroactive contributions to your pillar 3a, under certain conditions. The first year eligible for a “catch-up” contribution will be 2025.

In practice, if you did not pay the full authorised amount of CHF 7,258 in 2025, even though you were eligible, you will be able in 2026 to pay both the contribution for the current year and the missed contribution from the previous year.

Let’s take an example:

- In 2025, the person is an employee who contributed CHF 1,000 to their pillar 3a.

- In 2026, they are still employed.

In 2026, after making the full annual contribution of CHF 7,258, you will be able to pay an additional amount to make up for the shortfall from the previous year. This means CHF 7,258 minus CHF 1,000, which corresponds to CHF 6,258. In total, CHF 7,258 plus CHF 6,258 equals CHF 13,516 that can be deducted from your taxable income in 2026.

Whatever amount you contributed in 2025, whether CHF 0, CHF 7,257 or anything in between, a catch-up payment in 2026 will still be possible, provided you earned income subject to AHV in both years. And if you miss this opportunity in 2026, no worries, you will be able to make up the 2025 shortfall over the following ten years. It is worth noting that, unlike pillar 3a, buy-backs in the second pillar can be carried forward indefinitely, as long as your pension conditions remain unchanged. Both systems offer similar tax advantages, although their withdrawal rules differ.

It can therefore be strategically advantageous to maximise your pillar 3a contributions before considering any second pillar buy-backs, allowing you to optimise your tax situation even further.

Step 4: optimizing your property purchase in Geneva

We have, through several videos and articles, tried to highlight the fiscal and economic differences between being a tenant and being a homeowner :

Although the vote of 28 September 2025, which resulted in the abolition of the deemed rental value, has reshuffled the deck, the following points should remain valid until 2028. Here, we will focus on taxpayers who already own property and wish to optimise their situation until 2027, at least in principle. Yes, things are still a little unclear.

Planning maintenance costs over several years

This is advice we often repeat, yet many homeowners still fail to apply it. When purchasing a property, it is perfectly normal to want to carry out major work to adapt the home to your tastes or needs. However, doing all the maintenance work in the same year will indeed significantly reduce your tax burden for that specific year, but it will inevitably rise again the following year.

Our recommendation is to spread your maintenance work over several years, for example 2025, 2026 and 2027, in order to smooth the tax benefit over time. From 2028 onwards, only certain types of work, in particular those aimed at improving the energy efficiency of your property, may remain deductible for Geneva residents. And even then, this exception still needs to be confirmed.

Be careful, many taxpayers wrongly believe that all invoices related to their property are deductible from their income. This is incorrect. Only maintenance expenses aimed at preserving the value of the property, in other words its sale price, are deductible from income under the current legislation. Other types of work, such as improvements or major renovations, will be deductible from real estate capital gains tax, but only at the time of sale.

Managing your debt ratio

If paying mortgage interest were a good idea, no one would be negotiating their mortgage and everyone would be looking to pay as much interest as possible to reduce their income and taxable wealth. But it’s not that simple. Paying interest always costs more than the tax saving. So should you have no debt at all? Not necessarily. Having debts means that you don’t tie up all your money in the walls of your property and can invest it in projects that are more profitable than the cost of the debt.

Three factors will influence your level of debt in the remaining years before the new law comes into effect:

Your household’s marginal tax rate

The higher your household income, the higher your tax rate. As a result, every franc spent on mortgage interest can have a significant impact on your tax bill. For the same franc of interest paid, a household may save anywhere between 10 percent and 40 percent in taxes. However, it is important to remember that interest is a real expense for everyone, meaning money that is actually spent. What is advantageous from a tax perspective may not be advantageous for your budget.

Mortgage interest rate

This advice applies to all homeowners, regardless of their income level. The higher mortgage rates are, the less financially attractive it becomes to remain heavily indebted. In a period of rising interest rates, it may therefore be wise, if your situation allows it, to reduce your level of debt, even if your overall tax burden may increase as a result.

This will be even more true from 2026 onwards. Following the vote on the deemed rental value, which is scheduled to be abolished in 2028, maintenance costs will no longer be deductible, and mortgage interest will no longer be deductible either, except for rental properties. In other words, from 2028, taking on debt to reduce your taxes will no longer be possible. Interest payments will become a purely budgetary expense. It will therefore be crucial to anticipate the end of a mortgage contract or its repayment, as these decisions need to be planned several years in advance. The real question to ask yourself will then be, do the interest payments I am making today allow me to generate a return that exceeds their cost?

Step 5: Marrying or remaining single can also affect your taxes

Deciding to get married should never be based solely on tax considerations, but it is essential to understand how marriage affects your taxes. In Geneva, the incomes of married couples are combined and then divided by two to determine the tax rate applied to the household’s taxable income. This mechanism is known as full splitting. Its purpose is to keep the average tax rate similar to that of two single individuals. However, this system has its nuances, due to the non-linear progression of tax rates, which rise quickly before levelling off. If one spouse earns significantly more than the other, this division can substantially reduce the couple’s average tax rate, and therefore the overall tax burden. If both spouses earn similar incomes, the effect may be minimal or even negative, often because of the federal layer of taxation.

To alleviate this disadvantage, the canton of Geneva offers additional lump-sum deductions to married couples, thus levelling the tax playing field between married and single people.

A special case, tax optimisation strategies for the self-employed

Let us say that almost everything discussed in this article also applies to self-employed individuals in Geneva. However, this particular status also opens up additional optimisation opportunities, which we explore in more detail in our articles dedicated to self-employed accounting. A self-employed person in Switzerland does not receive a salary certificate. They must declare their own income and expenses, and then determine their taxable profit, which forms the basis for their taxation.

Here are a few tax optimisation strategies specific to self-employed individuals:

- Affiliating voluntarily to the second pillar or paying the “large contribution” into a pillar 3a is a complex choice that cannot be summarised in a few lines and will be the subject of a dedicated article. What matters for now is this, after many hours of discussion with our clients, we have found that there is rarely a perfect choice. Yet understanding how this mechanism works is one of the most important things for any self-employed person, and not only from a tax perspective.

- Deducting all expenses allowed under commercial use is another key optimisation. Many self-employed individuals choose to manage their bookkeeping themselves. And believe me, if I write these articles, it is because I am genuinely convinced that no one looks after your interests better than you do. But when you try to handle everything on your own, accounting can quickly slip into the background and with it the tax opportunities it allows you to capture.

- Converting a sole proprietorship into a corporation is not an easy decision and, depending on the situation, it can be complex or costly. However, from a financial and tax perspective, a corporation can offer a degree of comfort and planning flexibility that self-employment does not always provide.

Conclusion: How can I maximise my tax savings in the canton of Geneva?

Having written this article, let’s take a moment to recap the steps you need to take to ensure that your tax burden is as optimised as possible:

Step 1: Ensuring a perfect tax return

Probably the most important step is to ensure that your tax return is prepared flawlessly and that no deduction is overlooked. A solid foundation is essential before considering any additional optimisation strategies.

Step 2: Check the tax decision

Examine the tax ruling carefully to ensure that the tax authorities have not made any errors or been deliberately too severe.

Step 3: Simulate the impact using available tax tools

Based on your tax return, take the time to simulate the impact of certain tax optimisation tools available in the canton of Geneva, such as second pillar buy-backs and pillar 3a contributions. Assess their relevance, their duration and the appropriate amounts for your situation. Never assume that what works for your neighbour will work for you, or in the same proportions. Every situation is unique.

Step 4: Optimising your property and financial investments

If you own property or other investments, explore financial structures or products that can significantly reduce your tax burden over the long term.

Step 5: Simulate the impact of life changes

Before making a major life change (such as moving house, getting married, having a child, changing jobs or starting up a self-employed business), always take the time to simulate and calculate the tax impact to better predict the repercussions on your finances.

How FBKConseils can help you optimise your taxes?

At FBKConseils, we offer a number of services to help you manage your annual taxes:

Introductory meeting

The first thing we offer our readers is a free twenty minute introductory call, which in most cases is enough to answer your main questions. If more time is needed, we explain how our firm can support you with your financial and tax projects and propose the most relevant next steps.

Advice meetings

You can choose the length of the appointment, and we’ll take the time to answer all your questions, run live simulations and suggest ways of optimising your business.

Tax return

Entrust us with your tax return to ensure that no tax deduction is overlooked, guaranteeing a fair and optimised tax burden.

Learn how to complete your tax return

We offer face-to-face training sessions in our offices or by videoconference to teach you how to declare your income and assets accurately. This enables our customers to become more independent while being sure that their tax return is completed correctly.

Tax and economic simulation

If you are considering a life project, whether professional or private (moving house, getting married, having children, changing jobs, starting a self-employed business or buying property), we can provide you with a precise analysis of the tax and economic implications of these changes.

Links to official resources for more information

The canton of Geneva offers a number of useful resources and simulators to help you better understand your tax situation:

The Geneva tax guide

Published every year between January and February, it details the mechanisms, deductions and methods for completing your tax return: The Geneva Tax Guide (2024).

Geneva tax simulator

Although it does not simulate deductions and does not distinguish between the municipality in which you live and the municipality in which you work, this simulator allows you to calculate your wealth tax or income tax balance ‘fairly accurately’ on the basis of your taxable income.

Municipal tax rates in Geneva

If you wish to determine the tax rate for each of Geneva’s communes for 2025.

Privileged share in Geneva

These scales are used to determine how your income will be distributed between the municipality where you live and the municipality where you work in the canton of Geneva in 2025.