Written by Yanis Kharchafi

Written by Yanis KharchafiThe EPL withdrawal – Or withdraw your 2nd pillar to buy your home in 2026

Introduction

There are several reasons to withdraw your pillar 2 but at the moment the one we are looking at is very special and can drastically increase your chances of becoming a home owner.

If, just like me, you are not the best at irreprochably saving money with the ultimate goal of being able to afford buying your own home, remember it is highly likely that the biggest part of your savings is in your pillar 2 thanks to your contributions and those of your employer.

The icing on the cake is that the savings can be used for this purchase.

Let’s have a look at this in greater detail!

The line-up:

Who can withdraw their 2nd pillar to by their home property?

The short answer is straightforward: if you have a second pillar or had one in the past, you should be able to use it to finance part of your future real estate purchase, whether it remains within a pension fund or has been transferred to a vested benefits account.

However, as is often the case, there are conditions. Three small rules could complicate your plan:

- The amount withdrawn must, in principle, be at least CHF 20,000.

- A withdrawal request can only be made at least five years after a previous request.

- A withdrawal request cannot be made within three years following a buyback of contribution years in your second pillar.

Other than these restrictions, everything is straightforward: you are free to withdraw your second pillar for your real estate purchase.

For what kind of housing can I withdraw my pillar 2?

You want to take out a mortgage loan for a rental property? Bad news: you cannot count on your pillar 2.

Same thing for a secondary residence. No little chalet at the top of a mountain thanks to your LPP assets. Unless you decide to go live at the top of one of our beautiful full snowy peaks.

Your second pillar can only be used for the following purposes:

- To finance part of your primary residence in Switzerland or abroad.

- To repay all or part of the mortgage (loan) on your primary residence.

- To carry out significant maintenance work to preserve the value of your primary residence.

What part of my property can be financed by an EPL withdrawal?

Unfortunately, the second pillar can never be the sole financial source for purchasing a property.

The share of your second pillar can represent anywhere between 10% and 90% of the total price. In other words, it can fund a significant portion of your home, but never the entirety.

At least 10% of the price must come from other private financial sources outside of the second pillar.

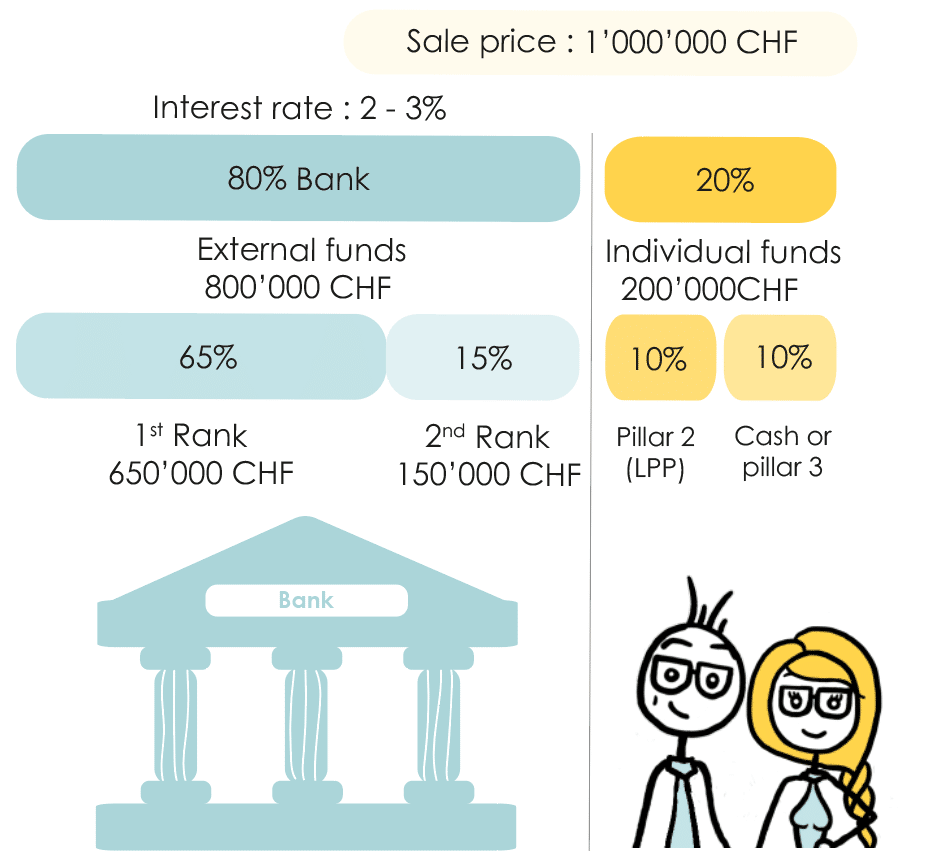

For example, let’s imagine you’ve found a charming house in the hills of Lausanne priced at CHF 1,000,000. Based on this sale price, here are the three key rules:

- The bank can finance a maximum of 90% of the price (and more commonly 80%).

- Equity funds, excluding the second pillar, must represent at least 10%.

What are these so-called “own funds” for the remaining 10%? Zoé has several options.

- Using the funds in her bank accounts, or liquidating her investments.

- Withdrawing her pillar 3 or putting up a life insurance as a guarantee

- Asking for a donation or an advance on her inheritance

- Borrowing the amount or part of the amount from a relative, provided that the loan is subordinated.

Are you wondering about your capacity to borrow? Calculate it here.

This illustration shows the standard mortgage financing with the use of the 2nd pillar:

- Own funds (excluding 2nd pillar): 10%

- EPL withdrawal – 2nd pillar: 10%

- Bank loan: 80%

However, keep in mind that there are countless possible variations, as long as the two rules described above are respected. For example:

- Own funds: 25%

- EPL withdrawal: 25%

- Bank loan: 50%

Or:

- Own funds: 50%

- EPL withdrawal: 50%

Of course, we won’t cover all of them, but it’s crucial to understand that the standard scenario is not the only possible option. Depending on your personal situation, other options may be “more” advantageous.

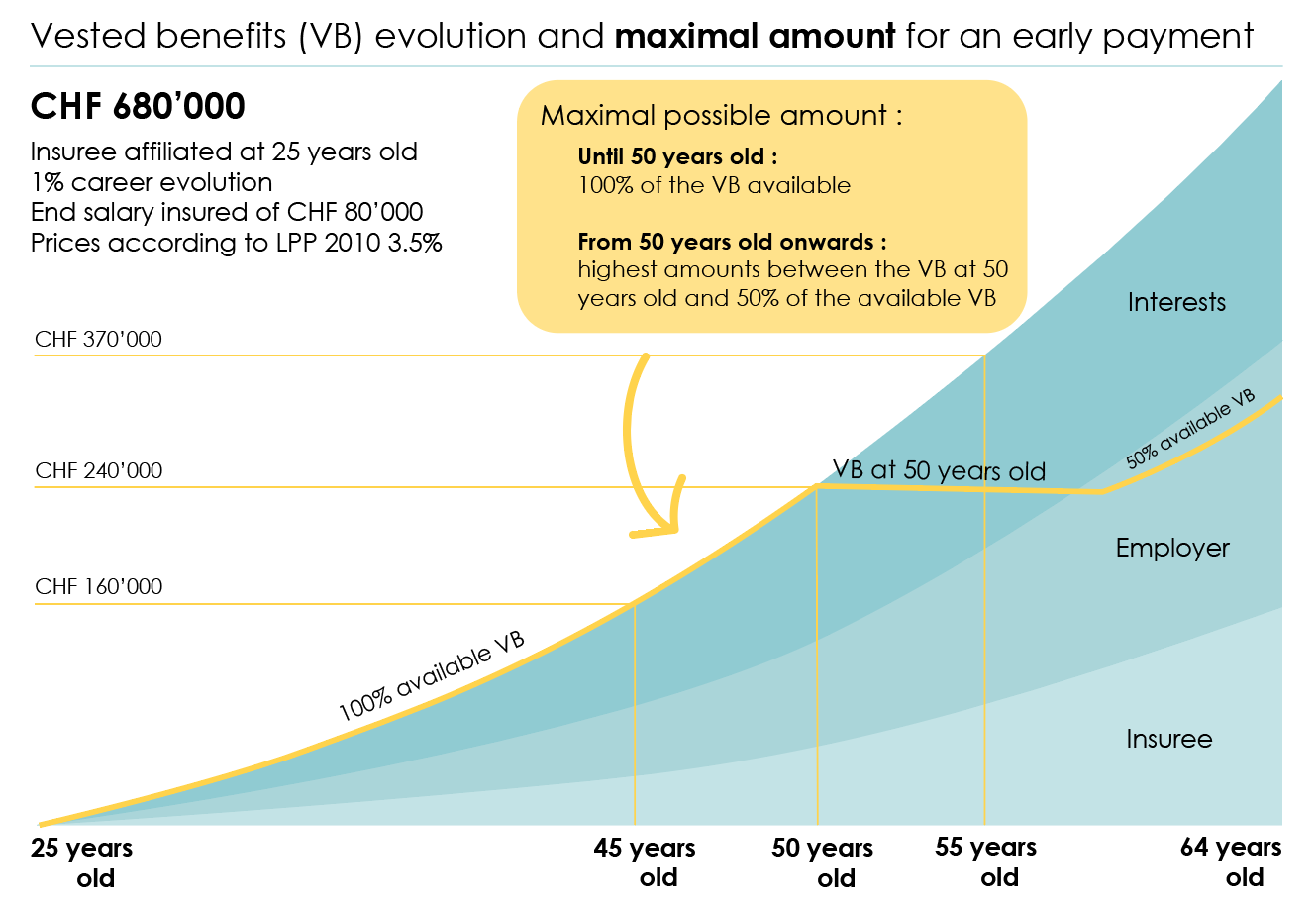

When can I withdraw my 2nd pillar? The 50-year rule

You have the right to access your pension assets (LPP) for the purchase of your primary residence in full throughout your professional life… or almost.

The only exception appears when you turn 50. At that point, you can withdraw either the amount available at the time of your 50th birthday or half of your current available assets.

If you are less than 50 years old, there is no maximal withdrawal.

Since Zoé just turned 37 years old, she can have free access to her pillar 2, as long as the amount is higher than 20,000 CHF.

But if Zoé’s mom, who is 62 years old, wanted to purchase the same property, the situation would be different. She would not be able to benefit from the LPP contributions she made between her 51st and 62nd year of life, but only those she made up until she turned 50 years old. Or else, she could decide to withdraw half of her current assets.

Do we have to pay taxes on EPL withdrawals?

You are starting to understand the system… Everything, or almost everything, is subject to tax. And withdrawals from the second pillar are no exception. To avoid mixing things up, we’ve written other articles dedicated to the taxation of second pillar withdrawals. But if you want an overview of what awaits you, here are some important points:

Purchase of a primary residence in Switzerland

If you withdraw part of your second pillar to finance a property in Switzerland, Swiss tax rules will apply. In other words, the federal government, then your canton and municipality of residence, will send you a bill.The amount? It’s impossible to estimate precisely, as it all depends on where you live. And believe me, the differences between two cantons can be vast!

Purchase of a primary residence abroad

Since the second pillar can also be withdrawn to finance property abroad, tax questions must be clarified before proceeding. With a few exceptions, Switzerland has signed tax agreements with many countries. These agreements determine which country has the right to tax the withdrawn capital:

- Switzerland: In this case, a withholding tax will be deducted directly from the withdrawn amount.

- The country where your new residence is located: Here, it depends on the local tax laws. Some countries tax foreign retirement capital very little, or not at all. Others, however, may impose taxes of up to 40% or more.

In summary, the second pillar can be an important lever for purchasing property, but be very cautious about the taxes associated with this withdrawal!

When should I repay my LPP withdrawal?

Reimbursing money you duly earned over the years? What a strange idea! And yet…

It is important to know that if you apply for a withdrawal from the 2nd pillar (EPL withdrawal) in order to finance your home, the land registry in your canton will have to make an annotation stating that you have used pension funds to enable you to buy this home.

If later you resell or transfer your property, like everything was noted, your pension fund will ask you for the withdrawn amount back.

Recovering the tax paid on the withdrawal after repayment

This mechanism, often unknown to our clients, is nevertheless essential, which is why we decided to add this paragraph this year to better inform you!

When you repay your pension fund, for example, after selling the property financed with your 2nd pillar, you have a period of time to request a refund of the tax initially paid on the withdrawal. Don’t miss out on this opportunity: remember to do it!

Landmark example

A pension fund lost a case against an insured person who decided to rent out her home financed by her 2nd pillar. She had lived there for a long time and, after 13 years, decided to rent it out. Until then, the fact that she wanted to rent out her home was synonymous with reimbursement in the same way as selling the property, since the insured person was no longer using it as her main home. However, she was able to demonstrate that after having occupied her property for a relatively long period of time, generating an annuity from the rent received did not in any way contradict the wishes of the law on occupational pensions. This law should protect the insured and ensure their retirement. After a long procedure, the court ruled in favour of the insuree. Here is the link to the full article, from the Tribune de Genève.

Generally speaking, if you live in your property, you will not need to reimbursed the amount withdrawn.

And if you sell your property in view of purchasing a new one in the near future, put the amount on a policy or a vested benefits account. Here’s a good way of keeping it warm and, who knows, perhaps yielding profit well you look for your dream home.

To sum up, as long as Zoé lives in her cozy nest, she will not need to reimburse the 100,000 CHF coming from her LPP savings.

What if she wants to reimburse it anyway? The idea is worth considering for the three following reasons:

- Zoé will recover the taxes she paid on the withdral.

- She can repurchase her contribution years, deductible from the taxable income as soon as she reimbursed what she had taken out in full

- Her pension fund’s services will go back to normal.

In short, taking out your pillar 2 to finance your property, is… good. But…

There is always a but… but you are in luck, I also took the time to prepare an article explaining in detail all of the consequences of this withdrawal.

What are the administrative steps for making an EPL withdrawal?

Buying a property using your 2nd pillar requires some organization and breaks down into several key steps:

Obtain a draft deed of sale

After conducting your visits (and re-visits) and confirming your purchase decision with all concerned parties – your spouse, your banker, and of course, your notary – the notary will need to draft a deed of sale. This document will legally formalize the terms of the purchase and will be essential for subsequent procedures.

Obtain an IBAN (other than your own)

Since the amount withdrawn from your 2nd pillar is strictly reserved for purchasing the property, it can never be paid directly into your bank account. The financial institution will require a third-party IBAN, belonging to a trusted person or entity, to hold the funds. This could be:

- Your notary;

- A general contractor;

- Or directly your bank.

Complete the forms and gather the necessary documents

In addition to the draft deed of sale and the IBAN, you will need to provide the following documents to your financial institution:

- Your family record book;

- A copy of your ID card;

- The EPL withdrawal request form, provided by your financial institution;

- The sales brochure of the property.

There you go, you’re now (almost) ready to make a withdrawal for the encouragement of home ownership. Follow these steps, and you’ll soon be settled into your new home!

How can FBKConseils help with your real estate purchase project?

Introductory meeting

At FBKConseils, we offer you a free initial discussion of around 20 minutes, either in person at our offices or via video conference. The goal of this meeting is to address your initial questions and give you an overview of your real estate project.

Personalized advisory meeting

Twenty minutes is a good start, but a real estate project is often much more complex than it appears. If the first meeting doesn’t answer all your questions, we offer a customized advisory session. The duration of this meeting is flexible and tailored to your needs. This allows us to conduct all necessary research, as well as detailed tax and financial simulations to guide your decisions.

Assistance with administrative procedures

A real estate purchase is not just about numbers; it also involves a lot of administrative steps. Between document gathering, negotiations with banks, and choosing a notary or architect, the workload can quickly become overwhelming. At FBKConseils, we guide you through each step, helping you manage this “paperwork” and move forward efficiently with your project.