Written by Yanis Kharchafi

Written by Yanis KharchafiCross-border worker: The quasi-resident status in Geneva

To all the cross-border workers who have decided to change their lives and have found a job in Geneva, this article might concern you. Today, we are going to explain a special tax status that applies to certain cross-border workers in Geneva: the quasi-resident status.

This unique status allows you to, in a way, change your tax residence for a given year. The goal? To enable you to bypass the withholding tax by filling out a proper Geneva tax return, so you can reflect your real situation, including all the related tax deductions. It sounds too good to be true… But then why this article? Why hesitate?

Not all cross-border workers are eligible for quasi-resident status, and in some cases, this status might not be as advantageous as it seems.

The line-up:

What is the quasi-resident status?

In principle, tax rules state that you pay your taxes where you live, which, in your case, would be France. However, in certain specific situations, the rules can be adjusted if your economic ties with another region are particularly strong (such as self-employment, real estate ownership, etc.), and this is also the case for cross-border workers in Geneva. Since you spend a large part of your time in Switzerland and your income comes partially from this country, France and Switzerland have established a unique status. This status allows you to be almost considered a Swiss resident, with the same tax rights, but only for your taxable income earned in Switzerland.

Understanding the Taxes for Geneva Cross-Border Workers

Although the goal of this article is not to go into detail about withholding tax, it is important to understand how it works. When you work in the canton of Geneva while remaining a resident of France, your employer will be responsible for withholding a portion (more or less) of your gross salary to cover Swiss taxes.

This withholding will be done at the source, meaning you do not need to handle the payment of Swiss taxes directly. After this deduction, you will receive your net salary, with Swiss taxes already deducted, but the Swiss tax is limited to the income you generate in Switzerland.

This system may have implications for your tax situation in France, where you may need to complete your tax return to avoid double taxation. In other words, even though tax is already withheld at source in Switzerland, you will need to ensure that this situation is properly accounted for in your French tax return.

If you stopped there, you might think: “Why look any further? One salary, one tax, everything seems fine.” That’s true, but what you may not realize is that withholding tax rates only take into account your civil status (married, single, with or without children), but they do not consider your actual expenses. For example, childcare costs, funds invested in your 3rd pillar A or B, or medical expenses incurred during the year 2024 are not taken into account. This is where the benefit of the quasi-resident status comes into play.

Is it always beneficial to apply for quasi-resident status?

If the answer were always “yes,” this article would lose its purpose. So, let’s start with this truth: no, it is not always advantageous to be taxed as a Swiss resident, and it will depend on your personal situation.

As mentioned earlier, withholding tax rates take into account “average deductions” applied to a person with a standard family situation. In other words, if you have more deductions than average, filing a tax return could reduce your tax liability. On the other hand, if your situation is simpler or “more basic” than what the Geneva tax authorities anticipated, obtaining quasi-resident status could increase your tax bill.

One piece of advice we will likely repeat throughout this article: don’t ask for anything from anyone until you have taken the time to perform a mock tax return simulation.

This simulation will allow you to compare the ordinary tax with the withholding tax already deducted during the year in question. Three scenarios can then unfold:

The withholding tax is lower than the ordinary tax

No debate here. If this is your situation, stop right there and get back to your life as if nothing happened.

The ordinary tax seems to show an advantage over the withholding tax

No question either. Before March 31, 2025, you must submit your application to obtain your identification details in order to fill out your tax return and potentially receive a refund.

A status that is more or less equivalent

This is the least desirable case: a few hundred francs of difference in favor of the quasi-resident status. Should you take the chance? To make your decision, revisit your tax return and check the deductions applied. If some of them can be contested, reduced, or even removed, it would be better not to take any risks. The gamble could end up costing you dearly.

Who can benefit from quasi-resident status?

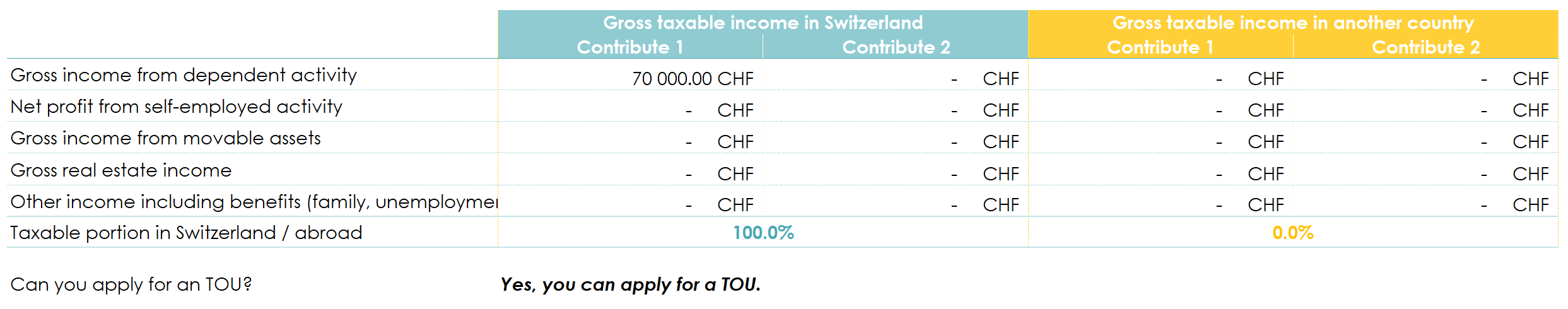

That’s a great question—who can benefit from this status? There is one simple rule to know if you are eligible: 90% of the household’s income must be taxable in Switzerland. This is what is referred to as having quasi-resident status.

What does that mean? You must be able to prove that the total income of the household: • Income from the couple • Income from movable wealth • Income from real estate • Etc.

Is 90% taxable in Switzerland and not from outside Switzerland. The difference may not seem very large, but in reality, it is a significant distinction.

French Resident – Cross-border Worker – Single Without Children

Easy in this scenario, as the only source of income taxable in Switzerland (your salary), it will be entirely possible to request a subsequent ordinary taxation (TOU).

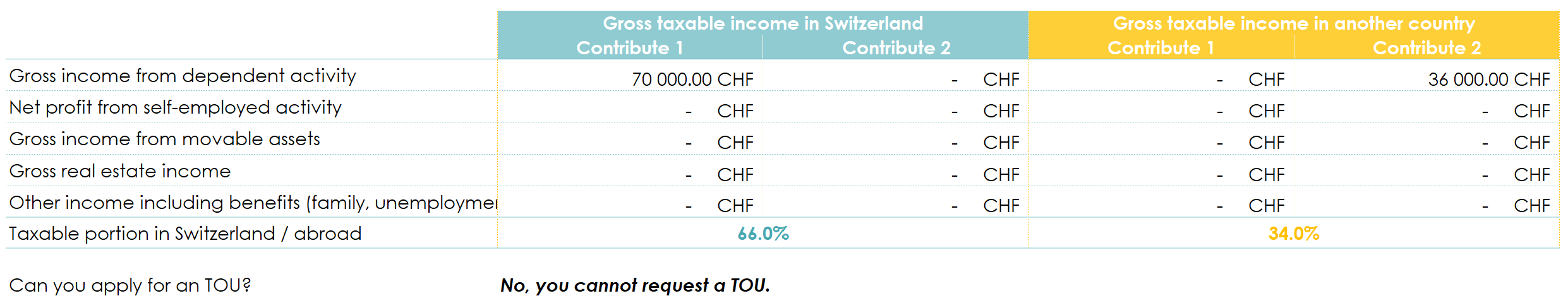

French Resident – Cross-border Worker – Married to someone working in France

Much more complicated. Even though it is well-known that Swiss salaries are higher than French salaries, the latter will easily represent more than 10%.

In this case… it’s impossible to ask for a TOU.

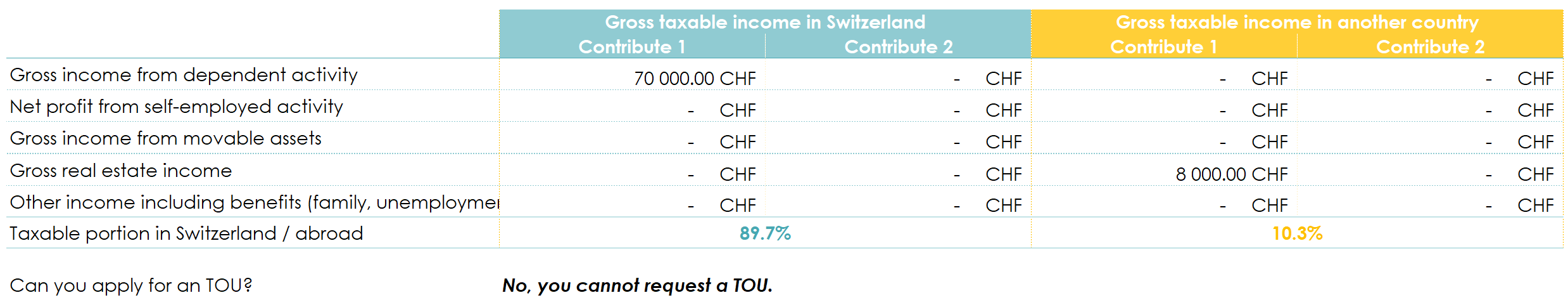

Single without children, resident in France, and owner of real estate in France

If the property is rented, the rental income received during the year must be considered. However, if the property is not rented, the imputed rental value will apply.

To finish on a reassuring note: unlike Swiss residents, a subsequent ordinary taxation (TOU) will never be final as long as you maintain your cross-border worker status.

A piece of advice: if you are eligible for a TOU request, start by doing a simulation to ensure it is fiscally advantageous, or ask us to do it for you.

The steps to take to obtain quasi-resident status

You have confirmed that 90% of your household’s global income is taxable in Switzerland and that, after simulating your tax burden via ordinary taxation, the result is in your favor? Final step: You need to contact your employer, who should have received the DRIS/TOU form.

Please note that the tax authorities do not usually send this document abroad: you need to go through your employer. This DRIS/TOU form must be completed and sent to the Geneva tax office by March 31, 2025.

Caution: Once the form is submitted, no immediate verification will be done. You will soon receive your GETax identifiers, and you can begin declaring what needs to be declared.

Once your declaration is submitted, the administration will take the time to review it. Based on this review, three scenarios may occur:

- A request for additional documents: Some elements of your declaration require further proof.

- A tax decision: This means that the tax authorities have been able to proceed with taxation based on the declaration you submitted. Take the time to check it carefully and contest it if necessary.

- Rejection of your declaration: After reviewing all the elements, the administration recalculated your eligibility for quasi-resident status and concluded that you are not eligible.

Some useful internal sources and external links

At FBKConseils, we have written numerous articles directly related to the quasi-resident status and ordinary subsequent taxation:

- Understanding the withholding tax in Switzerland

- What is ordinary subsequent taxation (TOU)

- Key deductions in the canton of Geneva

To make your life easier, here are two direct links to the canton of Geneva:

- Simulate your quasi-resident status: https://www.ge.ch/demande-rectification-taxation-ordinaire-ulterieure/determiner-statut-quasi-resident

- Obtain the DRIS/TOU form: https://www.ge.ch/obtenir-copie-document-attestation-fiscale/copie-du-formulaire-dris/tou

How FBKConseils can help you with the quasi-resident status?

A free first consultation

This year again, FBKConseils offers a 15 to 30-minute free consultation to anyone with questions about this particular status. Take advantage of this opportunity to get answers to your tax questions.

Simulate your quasi-resident status

Before making a decision, FBKConseils offers to simulate the impact of this status on your tax burden. This simulation will allow you to accurately assess the advantages or disadvantages of this status based on your personal situation and make the best decision.

Complete your ordinary subsequent taxation (TOU)

Once you have obtained the quasi-resident status, you will need to fill out a tax return called ordinary subsequent taxation (TOU). If you prefer assistance with this process, FBKConseils can take care of the entire procedure, from assistance to submission of your declaration.

Teach you how to declare your taxes in Switzerland

For the year 2025, FBKConseils offers a two-hour training session, during which we will guide you through Swiss tax rules. You will leave with the knowledge and tools needed to declare your taxes independently for the years to come.