Written by Yanis Kharchafi

Written by Yanis KharchafiThe main 17 tax deductions in the canton of Vaud in 2025

Introduction: Tax season has officially begun!

Here we go! February is over, the envelope from the “Canton of Vaud” is proudly sitting on your desk, and that familiar feeling returns: it’s time to block out an entire morning to complete your tax return.

And, as always, the same questions pop up again and again:

What can I deduct?

Did I miss anything last year?

Should I really go through the entire Vaud tax law to make sure I understand everything perfectly?

Honestly… I’m not sure.

But here’s what I do know: just like every year, and yes, even in 2026, FBKConseils has updated its guide summarizing the main deductions available to all Vaud residents for the 2025 tax return.

And this year, we’ve gone a step further:

We listed all deductions in the exact order used in the VaudTax software,

And added a “New in 2026” label to highlight any elements that may change or evolve for your 2025 return.

As always, we added extra clarifications and included the most frequent questions our clients asked us throughout the previous fiscal year.

So take a deep breath, summon a bit of courage… and your tax return will be done before you know it!

One last reminder before we begin:

This list of deductions applies both to employees and to self-employed individuals.

The only exception: professional expenses (meals, transport, other work-related costs), which apply only to employees.

The line-up:

Professional expenses: meals, transport, and other work-related costs

This first section is crucial and applies only to salaried taxpayers. Once you have entered all household information and uploaded your salary certificate in the VaudTax system, the first deductions that appear are those directly linked to your professional activity.

Who can benefit from professional expense deductions?

These deductions can be claimed only if you were employed as a salaried employee during the 2025 tax year.

If you were unemployed or if you operate a self-employed activity, you can move directly to the next section.

General principle of professional expenses

These deductions are designed to account for all expenses you personally incurred and that were not reimbursed by your employer in order to carry out your job.

For the 2025 tax year, as in previous years, you are generally not required to calculate the exact number of days worked yourself. The canton applies a standard number of working days for a full-time position, set at 240 days per year, or 20 days per month.

Practical example:

If you started your job in February (and therefore did not work in January), you may deduct:

240 days − 20 days = 220 working days.

Among these deductible expenses, we notably find:

Deduction 1: Transport expenses

First very good news: there is no maximum cap in the canton of Vaud for transport expenses!

However, the deductible amount depends on the means of transport you use on a daily basis.

You’re adventurous and commute to work on a motorbike or scooter

The deduction for using a two-wheeled motor vehicle is based on a flat rate of CHF 0.40 per kilometer travelled. You simply need to enter the number of working days (maximum 240) and the distance in kilometers between your home and your workplace. The VaudTax software will then automatically calculate the deduction.

Example:

If you live in Pully and work in Lausanne, and it takes 3 km to get to work each day:

3 km × 2 (round trip) × 240 × CHF 0.40 = CHF 576 deductible.

A busy schedule, no suitable public transport? When the car is the only option

If you’re like most Swiss workers, your morning routine probably consists of having breakfast, grabbing a coffee, and turning the key to start your car. But how many kilometers do you actually drive each year to commute between home and work?

- The first 15,000 kilometers are deductible at CHF 0.70 per kilometer

- Any additional kilometers are deductible at CHF 0.35 per kilometer

If you drive 10,000 kilometers per year, the calculation is straightforward:

CHF 0.70 × 10,000 = CHF 7,000 deductible per year. Generous!

If you drive 20,000 kilometers per year, the calculation is as follows:

(CHF 0.70 × 15,000) + (CHF 0.35 × 5,000)

= CHF 10,500 + CHF 1,750

= CHF 12,250 deductible per year.

Important warning:

This year, we decided to add a crucial clarification regarding deductions for the use of a private vehicle. Many taxpayers wrongly believe that they can freely deduct these expenses, but the canton of Vaud applies strict rules. Saving time alone is not a valid justification.

For the tax authorities to accept this deduction, you must be able to demonstrate a legitimate reason, such as difficult access to your workplace, mandatory travel during the working day, irregular working hours, a disability, or the need to transport bulky equipment.

While car-related transport expenses can lead to attractive deductions, they are by no means guaranteed.

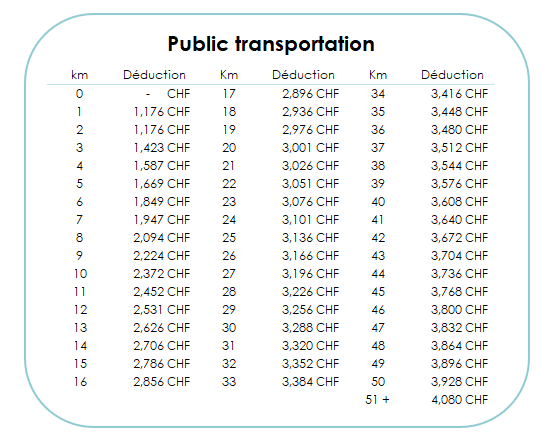

Have you chosen to use public transport?

This is the final option for those who do not use a private means of transport and instead rely on public transportation. Once again, the deduction is based on kilometer-based flat rates.

There is no need to keep the invoice for your general travel pass or your local public transport subscription. Once again, only the distance in kilometers between your home and your workplace will be used to determine the deductible amount.

How many kilometers separate your home from your workplace?

4 short kilometers? You can deduct CHF 1,587 from your taxable income per year.

42 kilometers? You can deduct CHF 3,672.

51 kilometers? CHF 4,080.

100 kilometers? The same amount — CHF 4,080 (this is the maximum).

For this last option, no supporting documents or proof of use are required. The Vaud tax authorities assume that the distance between your home and your workplace necessarily implies a need for transportation. If you do not claim, or are unable to justify, the use of a private vehicle, the administration will simply assume that you use public transportation.

Deduction 3.1 – Other lump-sum professional expenses

Second piece of good news: once again, the canton of Vaud stands out for its rather generous approach to professional expense deductions. In addition to meal and transport costs, the tax authorities assume that all employees incur certain unavoidable expenses in order to perform their job.

For this reason, a lump-sum deduction is granted without any supporting documents, intended to cover expenses such as work clothing, tools, and other miscellaneous professional costs.

This lump sum is easy to calculate: you may deduct 3% of your net salary (as shown in box 11 of your salary certificate), subject to a maximum of CHF 4,000 and a minimum of CHF 2,000.

Deduction 3.2 – Other actual professional expenses

In very specific cases, and I can assure you this remains rather rare in practice, it is possible to demonstrate to the Vaud tax authorities that the 3% lump-sum deduction is not sufficient to cover all the professional expenses you actually had to pay out of your own pocket during the year.

These actual professional expenses may include unreimbursed business travel, professional meals taken away from home, specialized tools required for your work, mandatory professional clothing (uniforms, safety gear), or any other expense directly related to your professional activity.

The fundamental rule is fairly simple to understand: if you can establish a clear and demonstrable link between a specific expense and your income (salary), that expense is, in principle, tax-deductible.

Of course, this requires you to carefully keep all invoices, receipts, and supporting documents throughout the year, which represents a non-negligible administrative burden.

The special case of remote work and home office

One specific situation that deserves special attention is remote work or home office. While still relatively uncommon a few years ago, this way of working has become increasingly widespread following the recent health-related events we are all familiar with.

If your employer no longer provides you with a permanent workspace on their premises, or if your employment contract explicitly states that a significant part of your activity must be carried out from your private home, it may then be possible to deduct a proportional share of your rent, as well as household-related expenses such as electricity, heating, water, internet, and similar costs.

This is undeniably good news for regular remote workers. However, caution is required: this deduction must be thoroughly justified with solid documentation (employment contract mentioning remote work, employer confirmation, precise calculation of the area used exclusively for professional purposes, etc.), and it remains rather rarely accepted without challenge by the Vaud tax authorities.

End of employee-specific professional expenses

At this stage of our guide, we have covered all professional expenses that salaried employees can legitimately claim in their Vaud tax return.

We can now move on to the other categories of deductions, which apply universally—whether you are self-employed, an employee, or even without professional activity. The notable exception is the third pillar A, which we will discuss later and which strictly requires income subject to AHV contributions.

Deduction 4 – Health insurance premiums (mandatory + supplementary) – New in 2026

In the canton of Vaud, as in all other cantons, health insurance premiums are deductible, but in a rather limited way. Although the tax authorities have gradually increased the maximum deductible amounts over the past two years, these ceilings are still far below what Vaud taxpayers actually pay in reality.

For the 2025 tax year, the deduction limits for health insurance premiums are set as follows:

- CHF 5,000 for single taxpayers (up from CHF 4,900 in 2024),

- CHF 9,900 for married couples (up from CHF 9,800 in 2024). Why not CHF 10,000, i.e. 2 × CHF 5,000? Good question. We don’t have an answer either!

- CHF 1,300 per dependent child, unchanged for several years now.

Important clarifications regarding the deduction of insurance premiums

We would like to highlight two crucial clarifications at this point, as we regularly notice mistakes in our clients’ tax returns.

- First clarification: Health insurance premiums include, for the entire household, both mandatory basic insurance (LAMal) and supplementary health insurance premiums. These two categories must be added together to determine the total amount to be declared. Many taxpayers forget to include their supplementary insurance, which causes them to miss out on part of the deduction.

- Second clarification: Actual medical expenses (consultations, medication, treatments) have nothing to do with insurance premiums. While both may indeed be deductible, they are declared in different sections of the tax return and are subject to very different calculation rules. We will explain later in this article how medical expense deductions work, as they follow an entirely different logic.

Deduction 5 – Private pension savings: the 3rd pillar A

For reasons only the canton of Vaud truly understands, contributions to the 3rd pillar A are declared in the same section as health insurance. I have no control over that—but that’s exactly where you’ll need to enter it in VaudTax!

The goal here is not to go into detail about how the 3rd pillar works, as we’ve already covered that topic extensively in other articles and videos. What matters in this section is that, depending on your professional status, you are allowed to contribute, and deduct, up to a specific maximum amount each year.

- For employees affiliated with a pension fund (LPP/BVG), the maximum deductible amount is CHF 7,258 for the 2025 tax year. This cap is fixed and applies equally to all employees, whether they earn CHF 50,000 or CHF 200,000 per year.

- For self-employed individuals or anyone not affiliated with a second pillar (LPP/BVG), the rule is slightly more complex: you may deduct the lower of 20% of your self-employed income (as shown in your accounting profit) and CHF 36,288.

Practical example:

I am a self-employed physician with an annual profit of CHF 150,000. The maximum deductible amount will be the lower of CHF 36,288 and 20% of CHF 150,000, i.e. CHF 30,000.

Final result: the maximum amount I can deduct is CHF 30,000, as it is the lower of the two calculations.

A non-negotiable condition: having income subject to AHV contributions

One important clarification: we still regularly see taxpayers who have taken a break in their career and nevertheless decided to pay money into a 3rd pillar A. Let me be very clear: stop doing this—it does not work from a tax perspective.

The fundamental rule to remember is that, regardless of your professional status, the absolute prerequisite for any 3rd pillar A deduction is that you must have income subject to AHV (AVS) contributions.

The following individuals therefore may NOT contribute to a 3rd pillar A:

- A person who rents out real estate and lives solely from rental income (income from assets),

- A student with no gainful employment,

- A stay-at-home spouse with no personal income,

- Or a retiree who only receives an AHV pension.

None of these individuals is entitled to contribute to a 3rd pillar A and, consequently, to deduct the contributions from their tax return, even if a bank or an insurance company has agreed to open the account.

Deduction 6 – Buybacks into your private pension savings: the 3rd pillar A – New in 2026

Most people are familiar with buybacks into the 2nd pillar, which we will discuss just below this section. However, far fewer are aware of the possibility to make buybacks into the 3rd pillar A. This is a major new tax development, and it comes into effect starting in 2026.

If, over the past 10 years, you were unable or unwilling to contribute the maximum allowed amount to your 3rd pillar A, you will now have the opportunity to “reopen” those past years and add the missing amounts in order to complete them retroactively. These additional contributions will also be fully deductible from your taxable income, which may represent a significant tax optimization opportunity for some taxpayers.

Important – two key conditions must be met:

- First condition: The 10-year buyback window applies only to years starting from 2026 onward. This means that in 2026, only the year 2025 would technically be “buyback-eligible” if you did not contribute the maximum. The system works progressively:

- In 2027, you will be able to buy back 2025 and 2026,

- In 2028, you will be able to buy back 2025, 2026, and 2027,

- And so on, until you reach a rolling window of 10 buyback-eligible years.

- Second condition (crucial): Before you can buy back any previous years, you must first have contributed the maximum deductible amount for the current year. In other words, you cannot buy back 2026 in 2027 if you have not already paid the full 2027 contribution during that year.

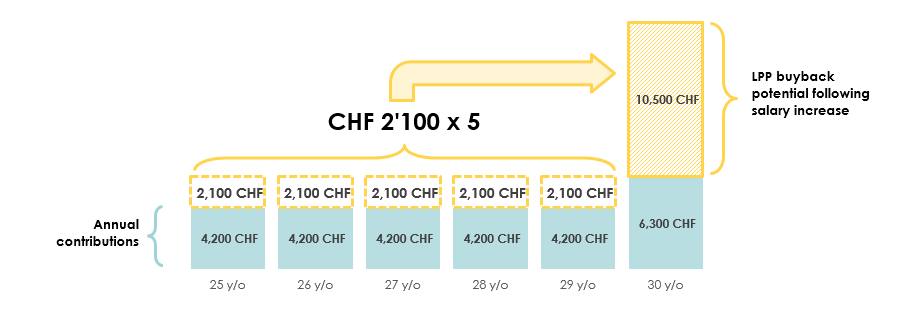

Deduction 7 – Buying back years in your 2nd pillar (LPP/BVG)

Right after health insurance premiums and the 3rd pillar A—on the same page of your VaudTax return—you will find the section dedicated to buybacks into your pension fund, commonly known as LPP/BVG buybacks.

This is a highly complex topic, and if I were you, I would strongly recommend conducting more in-depth research and seeking personalized advice, as the amounts involved can be very substantial.

The concept, in a nutshell, is as follows: if you have contribution gaps in your personal retirement fund—which commonly occur after long periods of study, time spent working abroad, years of part-time employment, or significant salary increases—your pension fund allows you to use part of your personal savings to fill these gaps.

As long as contribution gaps exist in your pension fund and you have the financial capacity to make these buybacks, any amount you contribute will be fully deductible from your cantonal, municipal, and federal income taxes.

This so-called “buyback-eligible” amount is clearly indicated on your LPP/BVG certificate, which is provided once a year by your employer or upon request.

Ultimately, from a tax perspective, buybacks into the 2nd pillar are a bit like having a 3rd pillar A on steroids, with deductible amounts that can be far more substantial. While the 3rd pillar A is capped at CHF 7,258 for employees, LPP buybacks can sometimes reach tens or even hundreds of thousands of Swiss francs, depending on your professional situation and the contribution gaps you have accumulated.

Deduction 8 – Bank fees – New in 2026

Despite the mention “New in 2026” in the title, there is actually no legal change compared to previous years. We simply decided to add this deduction to our guide, even though it was not included before. The reason is simple: although the amounts involved are often modest, this deduction is very frequently overlooked or forgotten by our clients, causing them to miss out on a perfectly legitimate tax optimisation.

The bank fees deduction applies only to fees charged by your bank for maintaining your current and savings accounts (account maintenance fees). It does not include wealth management fees or foreign currency exchange fees. In Switzerland, the annual tax statements sent by banks (usually in January) clearly indicate the total bank fees charged during the year.

If, by chance, your bank fees are very low, or appear to be nonexistent, keep in mind that you may still claim a standard lump-sum deduction of 1.5‰ (one and a half per thousand). In practical terms, this means that for every CHF 1,000 held in a bank account, you may deduct CHF 1.50.

For example, if you held an average balance of CHF 50,000 on your accounts during the year, you may deduct CHF 75 in bank fees on a lump-sum basis, even if your bank did not explicitly charge you anything.

Deduction 9 – Interest on debts – New in 2026

It is common to hear that becoming a homeowner is tax-efficient, and this “somewhat true” idea often comes up in conversations. What is much less frequently mentioned, however, is that all debts and their related interest, regardless of their nature, are currently deductible from your taxable income in the canton of Vaud. This applies to a wide range of debts, including:

- Mortgage debt, of course,

- Consumer loans,

- Student loans,

- Credit card interest,

- Loans between private individuals (for example, if your parents lent you money with interest to finance a project).

As soon as you enter into a debt agreement with a financial institution or a private individual, that debt will almost always generate annual interest paid to the lender. It is precisely these interest payments made during the tax year that are fully deductible from your taxable income, both at the cantonal/communal level and at the federal level.

Important warning, Major change coming in 2028 : In 2026, the Swiss population voted at the ballot box for the abolition of the imputed rental value, thereby temporarily maintaining the deduction of interest on non-income-producing debt. However, a transitional reform is planned.

If your debts are not linked to rental properties generating income (i.e. properties rented out to third parties), but instead relate to properties used for your own housing purposes, whether a primary residence or a secondary residence, then interest on these debts will no longer be deductible as of 2028.

This major legislative change will come into effect precisely in 2028 and will, of course, be covered in detail on our website through dedicated articles explaining the concrete implications for property owners in the canton of Vaud.

Deduction 10 – Renovation and maintenance costs

For property owners, this is one of the most significant deductions, yet it is often poorly understood. Yes, it is possible to deduct maintenance costs for your properties, whether they are located in Switzerland or abroad. However, digging a hole to build a swimming pool unfortunately does not qualify as maintenance, but rather as a property improvement.

In the canton of Vaud—and fairly consistently throughout Switzerland—deductible works generally fall into two main categories:

- Maintenance work: These are works that do not increase the value of the property, but simply allow it to be kept in good condition. This includes repainting, replacing sanitary installations after several years of use, or repairing water infiltration, for example.

- Energy-efficiency improvements: All works aimed at making your home more energy-efficient or environmentally friendly may be deductible from your taxable income in the year the work is carried out. Moreover, if these deductions cannot be fully offset in the year concerned, they may be carried forward to the following year.

In conclusion, improvements such as installing a new swimming pool, opening up a living room into a kitchen, or any other major structural transformation will most likely be rejected by the tax authorities as an annual income deduction. That said, this does not mean these expenses are lost from a tax perspective.

Non-deductible renovation costs may instead be taken into account when the property is sold, reducing the real estate capital gains tax. Depending on how long the property has been held, the resulting tax savings can be just as substantial.

Deduction 11 – Training and education expenses

For your training or education costs to be tax-deductible, they must correspond to a level equal to or higher than a Swiss federal maturity certificate (or equivalent).

The maximum deductible amount is CHF 12,000 per year.

This deduction generally applies to continuing education and professional development aimed at maintaining or improving your employability, rather than initial basic training.

Deduction 12 – Medical expenses

In addition to health insurance premiums, you may deduct medical expenses that exceed 5% of your intermediate income.

Example: Let’s assume the following situation:

- Gross salary: CHF 100,000

- Intermediate income: CHF 70,000

- Medical expenses incurred during the year: CHF 5,000

First, calculate the deductible threshold:

CHF 70,000 × 5% = CHF 3,500

Only the portion of medical expenses exceeding CHF 3,500 is deductible.

In this case:

CHF 5,000 – CHF 3,500 = CHF 1,500 deductible

What exactly is “intermediate income”? Based on feedback from many readers, we realized that the term “intermediate income” is not very intuitive, and you’re absolutely right.

In practice, intermediate income corresponds to your net income after almost all deductions, with the exception of certain social deductions, donations, and dependents. In other words, it is very close to your taxable income.

To find it easily, simply consult your tax return and look for box 700.

Deduction 13 – Family deductions

If you have children, you are entitled to an additional tax deduction.

- For married couples, the deduction amounts to CHF 1,300 per household, plus CHF 1,000 for each dependent child, deducted from your net income.

- For single-parent households, the deduction is higher: CHF 2,800, plus CHF 1,000 for each dependent child.

These family-related deductions are designed to reflect the additional financial burden borne by households with dependents and can have a meaningful impact on your taxable income.

Deduction 14 – Childcare and dependent care costs – New for 2026

Upon presentation of supporting documents, you may deduct CHF 2,000 more than in 2023, bringing the maximum deductible amount to CHF 15,200 per year, per child under the age of 14 or per dependent person requiring care, in your 2025 tax return.

This increase reflects the growing cost of childcare and dependent care and offers meaningful tax relief for households concerned.

Deduction 15 – Low-income taxpayer deduction

The canton of Vaud is the only canton we regularly work with that has chosen a strongly socially oriented tax policy. What we mean by this is that, despite relatively high average income tax rates compared to other Swiss cantons, Vaud clearly stands out thanks to flat-rate deductions specifically granted to households with modest incomes. The underlying philosophy is to ease the tax burden on lower-income taxpayers.

The low-income taxpayer deduction is calculated based on your net income after all the deductions described earlier in this article. Once this intermediate income has been determined and the number of people in your tax household established, an additional deduction is automatically applied by the VaudTax software, with no action required on your part.

Important point to note: This deduction takes into account neither gross income nor total wealth, which—let’s be honest—can seem rather absurd in certain situations. Put differently, it creates some interesting side effects.

For example:

- A person earning a gross income of CHF 500,000 is objectively not “modest” from a financial standpoint. However, if that person strategically decides to make CHF 450,000 in buy-ins to their second pillar (LPP) during the year, they would mathematically qualify as a low-income taxpayer and could end up paying very little—or even no—income tax at all. This principle applies to everyone: you can technically “play” with legal deductions (notably large LPP buy-ins) to artificially qualify for this deduction and significantly increase your total deductions.

- A person with a personal fortune of CHF 10 million, but generating almost no taxable income (for example, a retiree living off their capital), would also be fully entitled to this “low-income taxpayer” deduction. As a result, their income tax burden could be reduced to nearly zero, despite the fact that they are objectively very wealthy.

Deduction 16 – Social housing deduction

This second and final social deduction works broadly on the same principle as the low-income taxpayer deduction. Unfortunately, however, it is only calculated automatically if the taxpayer has remembered to enter their rent in a section of VaudTax that is often hidden or overlooked, titled:

“Special income deduction (codes 618 to 720) – Social housing deduction.”

Many of our clients forget this crucial step!

You must enter the net annual rent paid during the 2025 tax year. If this rent is considered “excessive” according to the criteria set by the Vaud tax authorities, relative to your net income and the size of your household, the system may then generate an additional automatically calculated deduction, further reducing your final taxable income.

For homeowners, good news: this deduction is fully automatic. It is calculated directly based on your principal residence and its declared rental value, with no action required on your part. The VaudTax system automatically detects whether you are a property owner.

Deduction 17 – The “dual-income spouses” flat-rate deduction

We all know that getting married often means paying more tax. What is less well known is that when both spouses are engaged in gainful employment, they are entitled to an additional tax deduction of CHF 1,700 per year.

This deduction is granted automatically when both spouses declare taxable income from employment or self-employment, and it is intended to partially offset the so-called “marriage penalty” in the Swiss tax system.

FBKConseils tips for optimising your tax deductions

Tip 1: Explore all possible deductions

The canton of Vaud offers a multitude of tax deductions, some of which are specifically linked to your personal situation. In this article, we have only touched on the main ones, but there are many others. Take the time to find out more and, if necessary, don’t hesitate to ask us questions to find out more.

Tip 2: Check your tax ruling

Many taxpayers simply send in their tax return and wait for the bill without even checking the tax ruling. Yet this is a crucial step. Always compare what you have declared with what has finally been withheld by the tax authorities to avoid any errors.

Tip 3: Contest if necessary

Sometimes the taxman does not understand your return, changes certain deductions or deletes them. This does not necessarily mean that you are wrong. You have 30 days in which to contest a decision by explaining and justifying your deductions. Don’t miss this opportunity if you believe the decision is wrong.

Tip 4: Theory versus practice

In the canton of Vaud, certain tax rules can be interpreted in different ways depending on the situation. With solid arguments and a clear presentation, it is sometimes possible to obtain deductions that, without a detailed context, would have been refused. Don’t hesitate to contact us to help you adapt your situation to the legislation in force.

How FBKConseils can help you with your taxes in the Canton of Vaud?

A free initial consultation

At FBKConseils, we are committed to offering everyone a free initial consultation lasting 20 minutes, either by video conference or directly at our offices in Lausanne. This meeting usually allows us to validate and complete the information presented on our website, and to answer your specific questions regarding your personal tax situation. If time allows, we can also explain concretely how our fiduciary firm could support you in managing your tax obligations.

Delegate your tax return

Like any fiduciary, FBKConseils offers you the option of entrusting us with all your tax documents, so that we can take charge of the entire process, from A to Z. Once we have finalised a first version of your return, we will present it to you, answer any questions you may have and make any necessary changes until we have a final version that meets all your expectations. We will then submit this final version to the Vaud tax authorities, and provide you with proof of submission and a copy of the submitted return.

Learn how to file your tax returns on your own

For the past 2 years, FBKConseils has been offering a personalised training service. For 2 hours, we welcome you to our office to complete your tax return together. At the end of this appointment, not only will your return be sent, but you will also have received answers to your questions, a template for future years, and you will gain greater autonomy in managing your future returns.

Check or contest your tax decision

You’ve sent in your tax return, but the tax authorities haven’t returned it as you expected? Have some of the headings been changed? Let us check your tax decision, explain the changes that have been made and the reasons for the adjustments, and help you draw up any appeals that may be necessary.