Written by Yanis Kharchafi

Written by Yanis KharchafiThe complete guide to Swiss tax returns

Introduction

Ah, the Swiss tax return! You’re here, which probably means you’re not in the middle of your favourite activity. Whether you’re in the middle of filling out your return, wondering whether you should fill one out, or have a burning unanswered question you’ve come to the right place. At FBKConseils, not only do we find tax very interesting, we try our best to make it as unboring as possible for you.

In this article, we take an in-depth look at the intricacies of Swiss taxation: What taxes do we pay? How does it work? Who has to pay tax? How do you file your tax return, and what documents do you need? As every situation is unique, we’ll also be looking at individual cases. And, who knows, if you stick with us to the end of this article, we might just answer the thorny question: do the Swiss pay a lot of tax?

Get your calculator and notepad ready, and let’s set off on a tax journey that’s as instructive as it is fun!

The line-up:

What are the taxes in Switzerland?

Tax returns are an annual ritual in Switzerland, but do you really understand the ins and outs of what you pay? Every country has its own tax peculiarities, and Switzerland is certainly no exception. So here’s an overview of the different types of tax you may encounter in Switzerland, divided into two main categories: those you declare when you file your annual tax return, and those that are taxed separately.

Taxes to declare on your annual tax return

In Switzerland, only two types of tax need to be declared on your annual tax return. The others are taxed separately and will be dealt with in separate articles.

Income tax

Although not particularly original, with the exception of a few countries with ‘not so inexhaustible’ resources, most countries tax their residents’ income (salary, commission, allowances, pensions, rent and interest). In Switzerland, this practice is adapted to the country’s federal structure, which is divided into cantons that enjoy considerable autonomy in terms of tax rates and deductions.

Swiss taxpayers pay income tax at three levels: cantonal, municipal and federal. Cantonal, municipal and direct federal taxes are separate, and each canton sets its own rates, which can vary significantly. For example, in the French-speaking cantons, income tax rates can range from 0% to over 40% for the highest incomes. Conversely, some German-speaking cantons offer much more favourable tax conditions.

To find out more about income tax by canton, including rates, calculation and optimisation strategies, please consult our dedicated articles:

- Cantonal and municipal taxes in the canton of Vaud

- Cantonal and communal taxes in the canton of Geneva

- Cantonal and communal taxes in the canton of Valais

- Direct federal taxation (DFI) in Switzerland

Wealth tax

Unlike many countries that have phased out wealth tax (and which, depending on current political changes, might be tempted to bring it back), Switzerland retains a comprehensive wealth tax, including both movable and immovable assets. This contrasts with countries such as France, which, until 2025, imposes only a tax on real estate wealth, or others that have abolished this tax altogether.

In Switzerland, wealth tax is levied exclusively at cantonal and municipal level; the Confederation does not impose any levies on wealth. We will take the time later in this article to draw up a more or less exhaustive list of the wealth items that need to be declared.

Wealth tax rates vary considerably from canton to canton. For example, some cantons, such as Vaud, apply higher rates than others. For a more detailed analysis of wealth tax by canton, see our specific articles :

- Wealth tax in the canton of Vaud

- Wealth tax in the canton of Geneva

- Wealth tax in the canton of Valais

For your tax return, no other tax will be deducted or declared. All other taxes will be deducted separately or indirectly:

Taxes not covered by your tax return

Life would be simpler if wealth tax and income tax were the only two forms of tax levied, but this is obviously not the case. Without getting bogged down and leaving room for other fascinating articles, here are a few examples of taxes to be paid:

Tax on 2nd pillar (LPP) withdrawals

When you need to withdraw capital from your 2nd pillar, whether to buy a principal residence, to leave Switzerland or simply to enjoy your retirement, you will have to pay tax on the amount withdrawn.

Tax on 3rd pillar A withdrawals

What applies to the 2nd pillar also applies to the 3rd pillar. Tax on 3rd pillar withdrawals is calculated using the same rules as for 2nd pillar withdrawals.

Gift and inheritance tax

Switzerland applies specific rules for gift and inheritance tax, which vary considerably depending on the degree of kinship between the donor and the beneficiary and the amount transferred. These taxes are governed by the cantons rather than the Confederation, resulting in a wide variety of regulations. In some cantons, there is no inheritance or gift tax for direct relatives, such as children or spouses, where rates may be zero. However, these rates can increase significantly for more distant beneficiaries. For example, a nephew or niece could be taxed at a much higher rate than a direct child.

Property tax

In Switzerland, property tax is an annual levy imposed on the owners of real estate. This tax is calculated on the basis of the tax value of the property, which may differ from the property’s market value. This tax value is often determined by the cantonal authorities and may be adjusted periodically to reflect changes in the property market.

Property transfers or transfer duties

Transfer duties are taxes levied on property transactions in Switzerland, affecting both buyers and sellers in property transactions. This tax is generally proportional to the value of the transaction and is intended to cover the administrative costs associated with the transfer of ownership as well as contributing to the revenues of the cantons.

Tax on property gains

Property gains tax is a major tax consideration in Switzerland, affecting sellers of real estate. This type of tax is levied on the capital gain realised when a property is sold, i.e. the difference between the sale price and the initial purchase price.

Tax on dogs

In Switzerland, owning a dog entails not only responsibilities in terms of care and welfare, but also tax obligations. Depending on the municipality and canton, dog owners are required to pay an annual dog tax. This tax helps fund local services such as dog waste facilities, dog parks and campaigns to raise awareness of responsible pet ownership.

Taxes on motor vehicles

Tax stamps

Tax stamps are a type of tax levied on certain types of investments or financial products in Switzerland. These taxes are generally associated with documents that require official validation or with specific financial transactions.

That’s all there is to it, and let’s get back to the subject at hand: the Swiss tax return. Let’s continue with the question: Who has to file a tax return in Switzerland?

Who has to file a tax return in Switzerland?

Many people have to file a tax return in Switzerland, and surprisingly, many are unaware of this. To clarify, we’re going to divide taxpayers according to where they live and where they work. Let’s start with those who do not live in Switzerland.

Tax declaration obligation for non-residents

There are two main categories of non-residents who could be required to file a tax return in Switzerland: cross-border commuters and people with significant economic interests in Switzerland.

Non-residents who work in Switzerland and live abroad: cross-border commuters

Cross-border commuters, i.e. people who work in Switzerland but live in a neighbouring country, are never required to file a tax return in Switzerland because their income tax is deducted at source. However, in certain cases and depending on the canton (e.g. Geneva), it may be advantageous for cross-border commuters to request optional subsequent ordinary taxation. This option allows them to benefit from certain deductions not taken into account when tax is deducted at source. However, this approach is not systematically recommended, so it is essential to be well informed before taking such a decision. Articles dedicated to this subject are available:

For foreign nationals who do not work or live in Switzerland (limited liability)

A second category of taxpayers includes those who, although they neither live nor work in Switzerland, have created economic ties with the country. Under tax treaties between Switzerland and most other countries, these ties justify taxation in Switzerland, despite tax residence abroad. Typical situations include :

- Gainful activity carried out from Swiss soil: This concerns persons who carry out an economic activity or have a permanent establishment in Switzerland.

- Ownership of real estate assets in Switzerland: This includes real estate owned in Switzerland.

At FBKConseils, we place particular emphasis on the ownership of real estate, which represents a specific case of limited taxation. In this case, only the income and value of the property is taxable in Switzerland. All other income and all your assets remain taxable in your country of residence. We will be devoting a full article to this subject to explore these specific features in more detail.

For people living in Switzerland

The tax rules for those living in Switzerland are varied. Living and working in Switzerland does not necessarily mean that you are obliged to file a tax return. However, all residents should have the option of filing if they feel it would be economically beneficial for them to do so.

Residents with a B permit

Many people reside in Switzerland without Swiss nationality and with a B permit, a medium-term but renewable residence permit. If you fall into this category, your professional income will generally be taxed at source. However, under certain conditions, you may be required to submit a tax return:

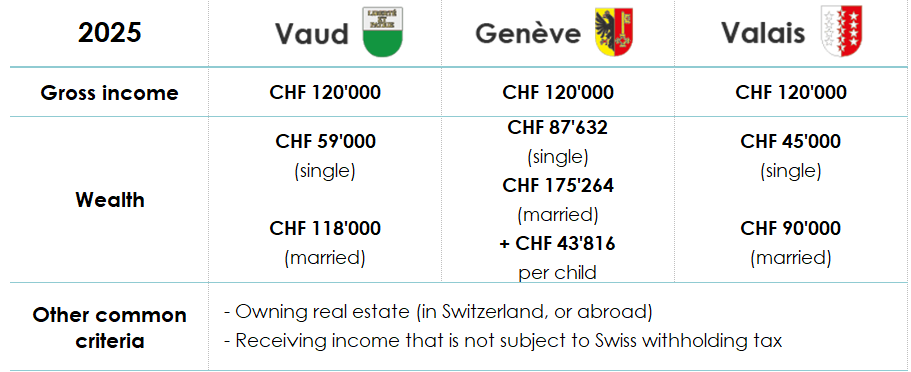

Annual income in excess of CHF 120,000

If your annual income exceeds this threshold, you will be obliged to file a tax return, regardless of whether this is advantageous for you or not. You will need to request login codes to access the online tax return system.

Taxable assets according to cantonal criteria

Each canton defines what it considers to be taxable wealth. For example, the canton of Vaud taxes wealth from CHF 60,000 for a single person in 2026, while the criteria may vary in Geneva depending on the composition of the household. If you have assets above this threshold, however small, you will have to declare them, as the tax deducted at source does not cover this taxation.

Other self-employed income

Withholding tax only covers income from employment. If you receive income from property, maintenance payments or are self-employed, you must declare this income.

No income

Surprisingly, even if you have no income, you may be required to submit a tax return if you live in Switzerland, in order to clarify your financial situation to the tax authorities.

It is crucial to understand the tax obligations specific to your canton and your personal situation, as the rules can vary significantly from one canton to another.

For taxpayers of Swiss nationality

For Swiss citizens, the tax obligation is clear: as soon as they reach the age of majority, every citizen is obliged to file their own tax return, regardless of whether or not they still live with their parents. This rule applies uniformly, underlining the importance of individual fiscal responsibility from the age of majority.

For holders of a C permit

The situation for C permit holders is similar to that for Swiss citizens. Once permanent residence permit C has been obtained, withholding tax should no longer be applied. Taxpayers with this residence permit must then pay tax instalments for the current year and prepare a tax return for the following year. This transition marks an important stage in tax integration, as it brings C permit holders into line with Swiss citizens in terms of tax obligations.

Conclusion

With this information, you should be able to determine whether you are required to submit a tax return in Switzerland, regardless of your circumstances. It is important to note that once you have started submitting tax returns, you must continue to do so for each subsequent tax year, unless the circumstances that triggered this obligation no longer exist (for example, a change in residence status or income).

When do I have to file my tax return in Switzerland?

Before you start filing your tax return, you may need to take certain preliminary steps (see steps below), such as submitting a TOU form. Once you have received your identifiers, you must comply with the legal deadlines imposed by your canton. For people who are taxed at source and who are making a TOU request for the first time, the deadlines may be different and are in principle always indicated on the transmission form received.

Canton of Vaud

The deadlines for submitting tax returns in the canton of Vaud vary slightly from year to year. For the 2025 tax year, the first deadline was 15 March 2026. However, a tolerance period is generally granted until 30 June 2026. For those who need even more time, the canton offers the possibility of requesting an extension until September at no extra cost, and for this year, no justification is required.

Canton of Geneva

The canton of Geneva sets the initial deadline for tax returns at 31 March 2026. However, it offers the possibility of extending this deadline for a fee:

- Extension to 30 June: CHF 20

- Extension until 31 August: CHF 40

- Extension of more than 5 months: CHF 60

Canton of Valais

The canton of Valais is aligning its first declaration deadline with that of Geneva, i.e. 31 March. However, it also allows extensions to the deadline on similar terms to the other cantons:

- First extension to 31 July.

- Second extension to 31 August.

- Under certain conditions, it is possible to request an extension to the end of the calendar year.

How do I file a tax return in Switzerland?

If we had to write an article on how to file your tax return, you’d still be here in a week. Depending on the complexity of your situation, it could be endless and we’d run out of work. Instead, in this chapter we’re going to take a look at the ways in which you can file your tax return, depending on which canton you live in.

How do I file a tax return in the canton of Vaud?

It should be possible to fill in a tax return on paper, but in all honesty, I’m not sure anyone uses this method any more. The canton of Vaud offers two more traditional methods with almost the same name:

VaudTax software

This software can be downloaded locally onto your computer and allows you to enter all the necessary information and then save it so that you can return to it if necessary. For subsequent years, this software also allows you to start from the previous version, so you don’t have to start from scratch. Today, this version is quite old and does not offer maximum ease of use.

The “Prestation VaudTax” website

Almost the same name, but quite different in use: this time there’s no software to download, just a more up-to-date website for entering information. In the same way, you can save a file on your computer that can be imported from anywhere and kept for future years. This version should gradually replace the VaudTax software completely.

How do I file a tax return in the canton of Geneva?

In the same way as the canton of Vaud, it should be possible in Geneva to keep a paper version of your tax return, even if this no longer seems very up-to-date. Geneva offers taxpayers two ways of doing this:

E-services

This is access to a secure platform which, thanks to your login details, will be accessible at all times and will enable you to complete your tax return correctly. The advantage of this moderately sexy platform is that you don’t have to download any software.

GETax software

All the cantons have created software which, like their platform, makes it more or less easy to complete your tax return. This software is perhaps a little simpler to use but is still fairly old-fashioned in terms of navigation.

How do I file a tax return in the canton of Valais?

As far as we know, until 2024, the canton of Valais will only allow submissions on paper or via its cantonal VSTax software. From our point of view, the canton of Valais continues to make the fewest improvements from year to year. Generally speaking, VSTax is not an easy software to learn to use, and its design makes it complicated to use. Whether you like it or not, if you have to fill in a tax return in the canton of Valais you’ll have to abide by their rules.

What should I declare on my tax return?

As with the previous chapter, it would be far too much work to list all the items that need to be declared and give all the tricks for declaring them correctly. Nevertheless, we will do our best to highlight the main income items to be declared and the wealth items that need to be entered on your tax return.

What income must be declared in Switzerland?

Although the tax rules are generally consistent from one canton to another in Switzerland, there may be some peculiarities. Here is an overview of the types of income you must declare, regardless of your canton of residence.

Income from salaried activities

Every year, employees receive a salary certificate which summarises all the income paid by the employer during the past year. This document also shows the social security contributions and tax already deducted at source. It is crucial for completing your tax return correctly, as it provides the exact amounts to be declared.

To find out more about your salary certificate, here’s a complete article: Understanding your salary certificate.

Income from self-employed activities

Whether you have turned a hobby into an alternative source of income or you are 100% self-employed, both types of income will have to appear on your tax return.

At FBKConseils, we have also taken the time to explain to you in simple terms how to keep accounts as a self-employed person: How to keep accounts as a self-employed person?

Retirement pensions: AHV pensions, BVG pensions and other foreign pensions

Even when you retire, you must declare all the pensions you receive.

Maintenance pensions: Pensions for children or former spouses

Maintenance payments, whether to a child or an ex-spouse, are a complex matter when it comes to tax returns. In general, the rules are as follows:

- Declaration by the recipient: Pensions received must be declared as income by the recipient. This means that if you receive a maintenance pension for your child or from your ex-spouse, you must include it in your tax return.

- Deduction by the person paying the pension: For the taxpayer paying the pension, it is generally deductible from taxable income. This reduces the amount of tax due by recognising the financial burden represented by the pension.

Potential complications

However, the situation can become more complex depending on the age of the child and the specific characteristics of each canton:

- Age limits: In some cases, once a child reaches a certain age (often the age of majority or the end of their initial education), maintenance payments are no longer considered deductible for the payer.

- Implications for the beneficiary: Similarly, these pensions may cease to be considered taxable for the beneficiary once the child reaches this age limit.

Recommendation

It is vital to find out about the specific rules in your canton concerning maintenance payments. Regulations can vary significantly from one canton to another, affecting both deductibility for the payer and taxation for the recipient. Before declaring or deducting these amounts, take the time to consult local regulations or speak to a tax adviser who can provide you with advice tailored to your situation.

Replacement income: unemployment, family allowances and other benefits

In Switzerland, replacement income, such as unemployment benefit, family allowance and similar benefits, is generally taxable and must be declared. This includes most forms of financial support received from the government or other entities as a replacement for usual income.

Details of taxable replacement income:

- Unemployment benefits: These benefits are received by individuals looking for work and are taxable. They must be included in the annual tax return.

- Family allowances: These allowances, intended to help families with children, are also considered as income and must be declared.

- Other benefits: Other forms of replacement income, such as disability benefits or certain study grants, may also be subject to tax, depending on their nature and the specific regulations applied.

With the notable exception of supplementary benefits

Some benefits, such as supplementary benefits, are designed to cover vital needs and are generally not taxable. This means that these types of income may be exempt from tax, depending on specific cantonal guidelines.

What assets must be declared on your tax return?

If I had to give you just one piece of advice, it would be: if you own something that has a market value, then you have to declare it. It’s as simple as that and to make your life easier here’s a more or less exhaustive list:

Moveable assets to be declared

- Bank accounts

- Investments

- Life insurance (3rd pillar B type)

- Bonds

- Cash

- Various currencies, including cryptoassets

- Artworks of art Securities

- Etc.

Property assets to be declared

In addition to movable assets, property wealth is also taxed and includes :

- Dwellings (principal residence, secondary residence and investment property)

- Businesses

- Farms

- Forests and bare land

Exceptions to the general reporting rule

Retirement funds

- 2nd pillar (pension fund, vested benefits): These funds do not have to be declared in your taxable assets. 2nd pillar funds will not be taxed until they are withdrawn.

- 3rd pillar A (private pension provision): Similarly, capital accumulated as part of 3rd pillar A private pension provision does not have to be declared until it is withdrawn.

Insurance contracts

- 3rd pillar B: For 3rd pillar B insurance policies, it is the surrender value that must be declared, not the total contributions paid. This distinction is crucial to the correct calculation of taxable assets.

Foreign property values

It is important not to simply declare the purchase price of your property abroad. Depending on your canton of residence, it may be possible to deduct certain charges or apply specific conversion rates to reflect the true tax value of these assets.

Bare ownership and usufruct of property

A question frequently asked by our customers and readers concerns the need to declare a property when full ownership is divided between bare ownership and usufruct. In Switzerland, the rule is clear: only the usufructuary must declare the property on his or her tax return. The bare owner, who owns the property but has no immediate enjoyment of it, is under no obligation to declare it. This distinction is important because the usufructuary benefits from the use of the property and potential income (such as rents), whereas the bare owner will only benefit fully when the usufruct expires.

What tax deductions are allowed in Switzerland?

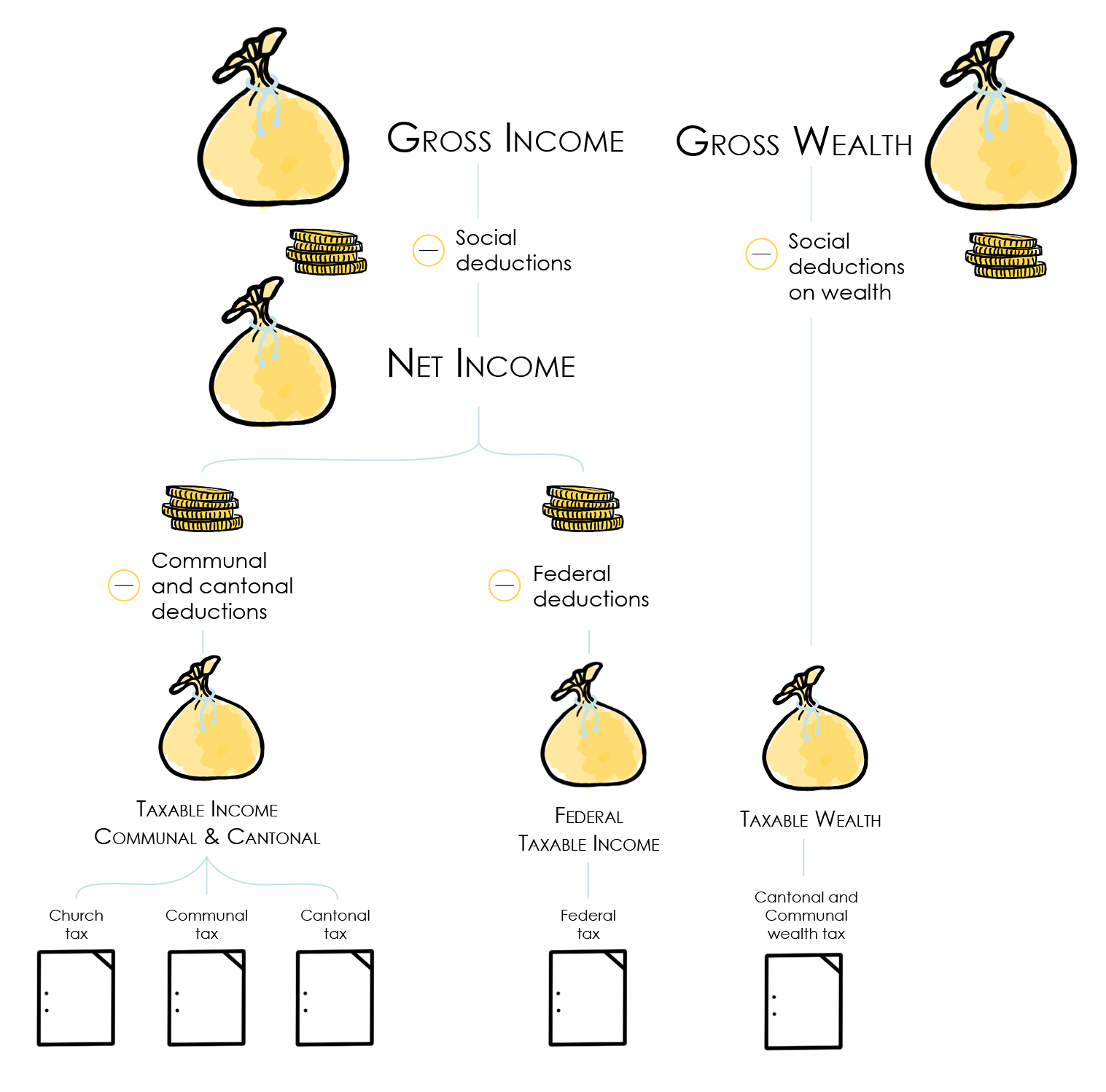

Once you have declared all the net income described above and entered all your assets, you will be able to claim a number of deductions. These deductions will be separated into 3 levels:

- Income deductions at cantonal and municipal level (ICC) :

- Deductions from income at federal level (IFD)

- Deductions from assets (ICC)

For greater clarity, here is a slightly modified diagram taken from our article on taxable income:

As with income, deductions are classified by category: For employees, the first deductions you will need to claim are those directly related to your professional activity:

First category: Business expenses

In Switzerland, as always, deductible business expenses can vary significantly depending on your canton of residence. Nevertheless, here are the main categories of business expenses that you can generally deduct:

Meal expenses

Although fairly stable from canton to canton, the cost of meals during working hours is not uniformly deductible throughout Switzerland. Each canton determines the deductible amount, which can vary considerably.

Transport costs

Travel costs to work can also be deducted, although the limits vary from canton to canton. Geneva, for example, places a ceiling on such deductions, while other cantons may offer more generous deductions.

Other business expenses

Flat-rate deductions: Some cantons allow flat-rate deductions to cover various other professional expenses, such as special work clothes, tools and other expenses required to carry out your profession.

Second category: Insurance and pension contributions

Swiss taxpayers can also benefit from significant deductions for certain insurance and pension contributions:

Health insurance premiums

Variable limits: The deduction of health insurance premiums is limited to a maximum that varies from canton to canton, ranging from CHF 3,000 in the canton of Valais to over CHF 15,000 in the canton of Geneva.

Contributions to 3rd pillar A

Identical for all cantons: Contributions to the 3rd pillar A are deductible up to a limit of CHF 7’258 for employees in 2025 and 2026. For self-employed persons not affiliated to the 2nd pillar, this limit rises to CHF 36’288. These deductions are intended to encourage personal provision for retirement.

3rd Pillar B contributions

No consistency between cantons: The 3rd pillar B represents the part of your private pension provision that is not linked to your retirement. Unlike Pillar A, which is strictly regulated, Pillar B works like a flexible life insurance contract that can be taken out and broken without reason. Premiums and contributions are tax-deductible only in 3 Swiss cantons, including Geneva.

Buying back BVG years

Buying back years of 2nd pillar (BVG) contributions is an effective way of increasing your future retirement pension while enjoying immediate tax benefits. By buying back BVG/LPP years, you can compensate for periods during which you have not paid contributions, such as career breaks, higher education, divorce or salary increases.

Third category: Bank charges

Account management

Account management fees, which are clearly indicated on your tax certificate provided by your bank, are tax deductible in all cantons. These charges relate to the day-to-day administration of your bank accounts.

Management fees

If you have invested part of your savings via fund managers or brokers, the possibility of deducting these fees may vary depending on your canton of residence. In Geneva, for example, some of these costs can be deducted, whereas in Vaud they cannot.

Interest on your loans

In the case of credit cards, which are a form of consumer debt, the interest generated by late payments can be as much as 12%. This interest, as well as the amount of the debt itself, can potentially be deducted, depending on the tax rules in your canton.

Interest on savings capital

Savings capital, or the income generated by low-risk financial investments, plays an important role in Swiss tax and financial planning. These investments generally include products such as guaranteed-rate savings accounts, government bonds and other conservative investments.

Deductions linked to your household

Childcare costs

The deductibility of childcare costs can vary considerably, sometimes doubling from one canton to another. However, all cantons allow a deduction for payments made to third parties for the care of children under the age of 14. To qualify for this deduction, both parents must generally work at a rate of at least 80%.

Various other deductions

- Donations

- Training costs

- Maintenance payments

- Medical expenses

- Property-related costs (flat-rate or actual)

How do I complete a tax return for married couples in Switzerland?

In Switzerland, married couples are required to file a single joint tax return for the couple and any minor children, a practice that seems unlikely to change despite some proposed legislation. This obligation does not allow for separate taxation, which can have a considerable impact on the tax burden, sometimes favourably, sometimes less so. The joint taxation system also does not facilitate a clear allocation of individual contributions within the couple, sometimes making it difficult to share the tax burden fairly between partners.

At FBKConseils, we have explored the tax implications of marriage in detail, producing several articles dedicated to the specific impacts in various cantons, such as :

- What are the tax implications of getting married in the canton of Vaud?

- What are the tax implications of getting married in the canton of Geneva?

What documents do I need to complete my tax return in Switzerland?

Preparing your tax return in Switzerland requires the collection of various supporting documents, which can vary from canton to canton. Although it is difficult to provide an exhaustive list of compulsory documents due to these variations, it is crucial to be able to justify all the information reported on your return. Here are the types of documents generally required:

- Salary or pension certificate : Essential for employees and recipients of AVS and LPP pensions.

- Personal accounting: Necessary for the self-employed to justify their income and expenditure.

- Official certificate of unemployment: For those who have received unemployment benefit.

- Bank documents or legal agreements: Required to justify maintenance payments made or received.

- Health insurance tax receipts: To show the health insurance premiums paid and medical expenses.

- Tax certificates for 3rd pillars A and B: Important for proving annual contributions and, for 3rd pillar B, to be able to declare the surrender value of your policies.

- BVG/LPP tax certificates for voluntary 2nd pillar contributions.

- Tax certificates for your bank accounts: so that you can carry forward the balance at 31.12, the interest earned during the year and, finally, bank charges.

- Investment tax statements : Details of all financial investments: income, tax and balance at 31.12.

- Donation receipts : Proof of donations made during the year.

- Training costs: Proof of payment for training or examinations.

- Documents relating to property: Information on properties in Switzerland or abroad, including maintenance costs and co-ownership charges.

At FBKConseils, we make it easy to prepare your tax return by offering a personalised service via our platform. You can start by clicking on ‘prepare your tax return’, completing our questionnaire, and submitting your request. An email will then be automatically sent to you containing a personalised list of all the documents you need, at no extra cost.

Quelles sont les étapes d’une déclaration d’impôt en Suisse ?

There are several key stages in the Swiss tax return procedure, both for those paying tax in instalments and for those subject to withholding tax. Here’s how it works:

Step 1: Paying tax on account or withholding tax

During the year, you must either pay tax directly from your salary (in the case of B permits or certain cross-border commuters), or pay monthly instalments if you have a C permit or Swiss nationality.

Step 2: Obtaining identifiers and assembling documents

If you are taxed at source and this is your first tax return in Switzerland, you will first need to obtain your identification details from your cantonal tax office. Next, gather all the documents you need for your tax return.

Step 3: Choose the declaration method

If several options are available in your canton, you will need to download the software or choose the option that suits you best.

Step 4: Completing and sending the declaration

Complete your return, including all your income, assets and deductions. Once completed, send in your return together with the necessary supporting documents.

Step 5: Receiving and checking the tax decision

Once you have submitted your tax return, you will receive a tax ruling from the tax authorities detailing which items have been accepted or adjusted. Examine this decision carefully to ensure that everything is correct.

Step 6: Claim if necessary

If you do not agree with the tax decision, you have 30 days to draw up and send in a claim. This must include an explanatory letter and all the supporting documents needed to substantiate your case.

These steps constitute the basic process for filing a tax return in Switzerland, enabling every taxpayer to ensure that his or her tax situation is correctly assessed and dealt with by the tax authorities.

All other questions about your tax return in Switzerland

Do I have to declare my property abroad?

Yes, you must declare all your property and assets located abroad. Although your property is taxed in the country where it is located, Switzerland requires you to declare its tax value, i.e. the value of the assets, as well as the income it generates. In the case of second homes or properties that are not rented out, this is the rental value; in the case of investment properties, it is the rents received. This information is used to adjust the tax rate on your taxable income and wealth in Switzerland, ensuring fair taxation that complies with Swiss and international tax regulations.

For more information, we have written an article dedicated to property abroad.

What should I do if I make a mistake or forget to file my tax return?

In Switzerland, an initial error on the tax return, if reported honestly, generally does not lead to any penalties or fines. The tax authorities are aware of the complexity of tax returns and apply a certain margin of tolerance. Here’s what you can do if you make an error or omission:

Correcting a declaration already submitted

If you quickly notice an error after submitting your declaration, you can submit a corrected version. This can be done via the declaration software if the delay since the initial submission is short, or by post if the delay is longer.

Spontaneous disclosure

If your return has already been processed and taxed, but you notice an omission, you can fill in a spontaneous denunciation form. This process allows the tax authorities to re-examine your file and adjust the amounts if necessary.

Responding to a suspicion of tax fraud

If the tax authorities suspect fraud and contact you, it is crucial that you respond fully to all requests for information. The authorities may not reveal the evidence in their possession and will ask you to clarify any missing or ambiguous elements. It is essential to be transparent and to follow the instructions provided scrupulously.

Consequences of a delay in filing your tax return: automatic taxation

In Switzerland, the consequences of a delay in filing a tax return depend on the length of the delay. As mentioned above, the cantons offer the possibility of obtaining extensions to the filing deadline, some free of charge and others against payment. If you miss these deadlines without filing your return or requesting an extension, you risk not only interest for late filing but also fines, which vary in severity.

If you persistently fail to file a tax return, the tax authorities may proceed with an automatic tax assessment. This procedure allows the tax authorities to complete a return on your behalf, based on previously collected information such as your previous returns. In addition, an unfavourable security margin is often added to compensate for the lack of up-to-date information. This approach generally results in higher taxation, prompting the taxpayer to regularise his situation.

It is important to note that you can contest an automatic assessment by subsequently submitting your tax return within 30 days, which may overturn the initial decision. However, if you do not contest the assessment, it will become final and you will be required to pay the amount calculated. In the event of non-payment, recovery measures such as prosecution or, in extreme cases, seizure may be initiated.

Useful external links and sources to help you understand your tax return in more detail

Cantonal guides and instructions for the 2023 tax return

- General tax instructions for the canton of Vaud

- General tax instructions for the canton of Geneva

- General tax instructions for the canton of Valais

Software and application for completing your 2023 tax return

How can FBKConseils help you with your tax return in Switzerland?

At FBKConseils, unlike the vast majority of trustees, we specialise in financial services for individuals only, such as employees and the self-employed, focusing on tax, pensions and property. Here’s how we can help:

Handling your tax return

Whether you live in the canton of Valais, Geneva or Vaud, we can manage your entire tax return. Our expertise guarantees you an optimised return, including all the deductions to which you are entitled.

Tax return training

We also offer our customers the opportunity to come to our offices to learn how to complete their tax return correctly. During this session, we review all aspects of your tax situation and take the time to answer any questions you may have. This service also includes running simulations to show you the impact of different deduction options.

Simulation of subsequent ordinary taxation (TOU)

As you may have already realised, requesting Ordinary Further Taxation (UFT) without being obliged to do so can represent a significant financial risk, which may even be repeated year after year. Before taking such a decision, FBKConseils can help you to assess precisely whether it is worth taking this step. We can carry out detailed simulations to determine whether prior tax optimisation could make this option more advantageous for your financial situation. Our aim is to provide you with all the information you need to make an informed decision about the TOU.

Simulation of future changes

If you are contemplating major changes in your life such as moving house, buying property, getting married or having children, it is crucial to understand how these events could affect your tax burden. We offer simulations to assess the financial impact of these changes and help you plan accordingly.

At FBKConseils, our aim is to provide you with tailor-made support so that you can navigate the Swiss tax landscape with confidence and efficiency.